RapidAML Team

2024-06-18

Chartered Accountants in Nigeria come under the purview of Anti-Money Laundering (AML) compliance as they are classified as Designated Non-Financial Businesses and Professions (DNFBPs) according to the Money Laundering (Prevention and Prohibition) Act, 2022, referred to as Nigeria’s MLA, 2022. This blog attempts to draw out the Anti-Money Laundering, Counter-Financing of Terrorism, and Counter-Proliferation Financing (AML, CFT, and CPF) compliance requirements for chartered accountants in Nigeria.

The MLA, 2022, requires chartered accountants in Nigeria to undertake AML measures, taking into account the AML/CFT legal framework in Nigeria. The Institute of Chartered Accountants of Nigeria (ICAN) is the governing body that controls the accounting profession in Nigeria.

The AML/CFT legal framework in Nigeria impacting chartered accountants consists of the following laws and regulations:

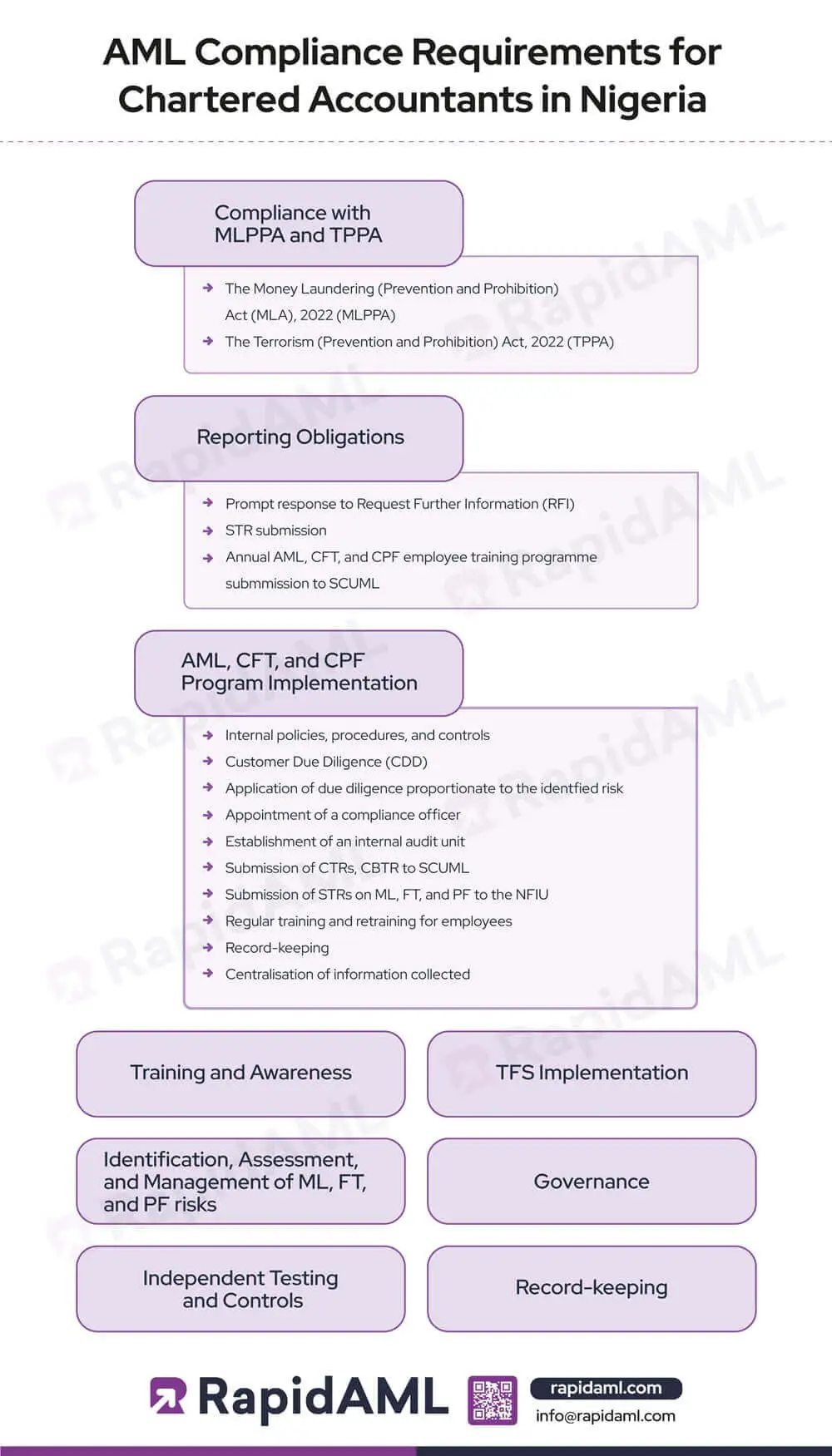

Chartered Accountants in Nigeria need to ensure compliance with the following AML, CFT, and CPF compliance requirements:

Compliance with MLPPA and TPPA

The provisions of MLPPA and TPPA need to be adhered to. Chartered Accountants must ensure compliance with AML and TFS compliance requirements provided for under these acts.

Reporting Obligations

AML, CFT and CPF Program Implementation

Chartered Accountants in Nigeria are required to ensure compliance with the AML/CFT and CPF laws and regulations. Discussed below are the AML compliance measures that chartered accountants in Nigeria need to implement, such as:

Record keeping

The records such as transaction records, cash transaction registers, and files, correspondences, and communications with clients must be stored for a duration of 5 (five) years.

Training and awareness

Chartered Accountants must train their employees regarding the implementation of AML/CFT and CPF compliance measures in accordance with their AML/CFT and CPF policies, procedures, and controls.

Chartered Accountants must retrain their employees as and when there is any regulatory or policy change.

Targeted financial sanctions implementation

The TPPA prescribes implementing TFS measures by DNFBPs, requiring chartered accountants to screen their customers across relevant and applicable sanctions lists to identify if any of their customer names come into any of the sanctions lists.

Identification, assessment and management of ML, FT, and PF risks

Chartered Accountants must take adequate measures to identify, assess, and manage the ML/FT and PF risks they are exposed to. This requires a risk-based approach while devising strategies to counter the ML, FT, and PF risks.

Governance

The governance structure of a chartered accountant’s practice must make way for having a person responsible for overseeing the compliance of AML/CFT and CPF regulations, a designated chief AML compliance officer must be appointed who acts as a point of contact between the employees and the senior management of a chartered accountant firm and ensures communication with regulatory bodies while ensuring timely filing of regulatory reports.

Independent testing and controls

The independent AML audit that tests the efficacy of AML control measures deployed by a chartered accountant firm and looks for any discrepancy or redundancy in the compliance process devised for the firm. The independent testing and controls help ensure that the findings of such AML audits are unbiased and fair, giving a clear picture of the AML/CFT and CPF measures.

Record-keeping

Chartered Accountants need to ensure compliance with the record-keeping requirements prescribed by the laws and regulations and ensure that such records of compliance measures taken are easily accessible for furnishing to any regulatory authority whenever needed.

Conclusion

The chartered accounting profession is governed by the AML/CFT and CPF laws in Nigeria. Chartered Accountants operating in Nigeria must have adequate and appropriate AML/CFT and CPF policies, procedures, and controls in place based on the requirements prescribed in the laws and regulations. The Institute of Chartered Accountants of Nigeria is the governing body that controls the accounting profession in Nigeria.

Pathik is a Chartered Accountant with over 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise-Wide Risk Assessments to implementing robust AML compliance frameworks. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.

Pathik's expertise extends to guiding businesses in navigating complex regulatory landscapes, ensuring adherence to FATF and other international standards, and mitigating financial crime risks. He is a recognised thought leader in AML/CFT, frequently sharing insights on emerging compliance challenges on various platforms.

Solutions

Transaction Monitoring

Regulatory Reporting

Services

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Solutions

Transaction Monitoring

Regulatory Reporting

Services

AML/CFT Health Check

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Sign Up Form