Uncover and tame unruly ML/FT/PF risks with foresight and meticulous scrutiny

You wouldn’t speed up the highway without a seatbelt, airbags, or brakes. It isn’t common sense or smart; it is a regulatory requirement to protect you from the unexpected. In the same way, businesses must identify and assess risks to avoid the dangers on the road and study the nature of these risks. Risk control puts safety measures in place in accordance with the level of risk you’re exposed to, and risk monitoring keeps you prepared for sudden detours. Regulatory bodies demand that organisations conduct a periodic, enterprise-wide risk assessment to evaluate risk factors in customer profiles, geography, products and services offered, delivery channels, and the march of new technologies.

If history has ever taught us anything, it’s that the greatest downfall, whether in Shakespearean tragedies or corporate collapses, often stems from risks no one bothered to assess.

Call it what you want- Enterprise-Wide Risk Assessment (EWRA), Firm-Wide Risk Assessment (FWRA), ML/FT Risk Assessment, Entity-Wide Risk Assessment, or even the ‘Sorting Hat of Compliance.’ But without it, you might drift aimlessly or, worse, crash into an iceberg of regulatory trouble. This brings us to the point that partnering with top-tier ML/FT Business Risk Assessment experts is your winning gambit.

To Assess Is to Address

May Your Name Be Spoken Only in Admiration, Never in Inquiry

The noblest of enterprises are not built on a coin alone but on wisdom, foresight, and impeccable compliance. With our Business Risk Assessment, you shan’t stumble blindly into treachery nor find yourself the subject of whispers in the corridors of regulations.

Who is involved? What are the risks? Where could vulnerabilities arise? We don’t just blindly start. We break down every risk scenario. Starting with a meeting, we hear your story and gather intel over a questionnaire, making sure we understand you from every angle. Now that we have a plot, we ask questions and build a complete picture. Only then will we draft your EWRA because no detective worth their salt will start without evidence.

Not all risks are created equal, much like not all suitors are worthy of one’s attention. Some are but fleeting concerns, easily managed with a simple adjustment, while others require careful strategy and refinement. Every business has vulnerabilities. We assess risk that could turn into a full-blown storm.

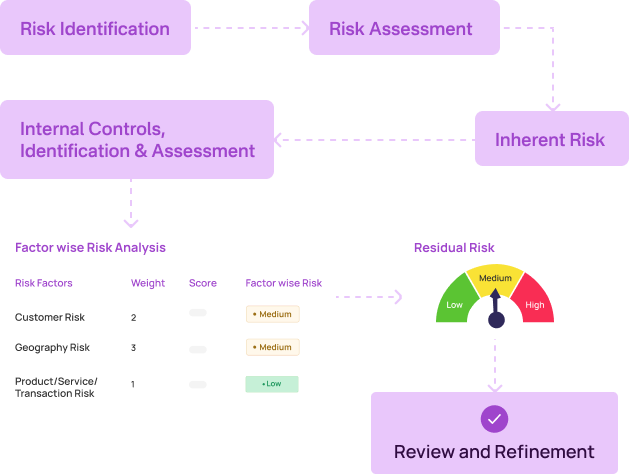

Many financial institutions may find themselves entangled in the most delicate of predicaments. An ML/FT risk assessment is most grave yet necessary to maintain its standing in high society. We speak, of course, of the ML/FT Gross Risk or, as some may say, Inherent Risk Assessment. Only after a grand assessment may one introduce the season’s most eligible controls to transform an unchaperoned danger into a well-mannered compliance regime.

Let it be known that true mastery lies not merely in the possession of controls but in their most dutiful execution. We meticulously compare inherent risks with your control measures, balancing the scales for your business to stand firm. A grand symphony sounds harmonious only when every instrument plays its part. For a business to stand resolute, its defences must neither be too lax nor too rigid but in perfect harmony with its risk appetite.

Despite the best-laid controls, some ML/FT/PF risks remain, and a few whispers of risk linger in the air. We turn our keen eye to the strength of thy controls assessing their true effectiveness and the measure of their success. And where gaps remain, we implement additional controls. A well-heeled institution, much like an esteemed household, must decide whether its residual risk remains within acceptable bounds or requires further fortification.

Alas, a single assessment shall not suffice. Much like society’s ever-changing whims, the business landscape is in constant motion. What was once a distant concern may suddenly become the talk of the town. Thus, continuous monitoring and review is imperative. Through continuous monitoring and strategic refinements, one merely doesn’t survive but survives with excellence, influence, and enduring prosperity.

If ML/TF/PF were a movie villain, it’d be the kind that never quits. Sneaky, relentless, always plotting in the shadows. But guess what? You don’t have to be the unsuspecting protagonist walking straight into the trap. With RapidAML, you’re in control of the narrative.

Our team doesn’t just do AML compliance, we live it. With years of experience cultivating Business Risk Assessment, we know exactly where the ML/TF/PF risks are hiding. Whether it’s a subtle risk exposure or a flashing neon sign screaming ‘compliance disaster,’ we’ve got the expertise to shut it down before it becomes a problem. We make sure your business thrives without compliance worries under your bed like a financial boogeyman. We don’t just do AML/CFT/CPF compliance. We embody it.

Some risk assessments are like reading the first page of a mystery novel and thinking you’ve cracked the case. Not us. We don’t skim, we investigate. We dig deep. Our accurately framed EWRA leaves no technicality unchecked and no vulnerability overlooked. It’s like giving your compliance framework a full-body scan. The difference between ‘almost caught it’ and ‘caught it before it became a crisis’ is everything.

A flimsy compliance framework? That’s like bringing a knife to a gunfight. And we don’t do that here. Risk isn’t just about what you see. It goes deep under the surface. That’s why we don’t settle for smoke and mirrors. We build compliance structures so strong that even Houdini himself couldn’t wriggle out. It’s not just about plugging leaks, it’s about strengthening the entire ship so no cracks appear in the first place.

There’s a fine line between protecting your business and drowning in over-compliance. Crackdown too little, and risks creep in, crack down a little too hard, and you’re slowing down innovation and growth. At the airport security check, you need strong measures to keep threats out, but if you strip-search every passenger, delay every flight, and interrogate every traveller, you’re grounding the entire system. That’s where we come in. The takeaway? Building a business that’s too smart to be exploited.

There are two types of players. The dreamers and the schemers. The dreamers are old, visionary and building empires. The schemers, on the other hand, are hidden in the shadows, looking for loopholes to exploit. You are the dreamer. You’ve got the vision, the ambition, the drive. The twist is that the schemers are watching, too. Schemers aren’t loud. They don’t announce themselves. They whisper, hide in the fine print, and blend into the background like a master illusionist. Lucky for you, we don’t fall for tricks. While you build, we guard. While you innovate, we eliminate risks.

Let it be known that Business Risk Assessment is not a tedious formality but a competitive advantage. A refined skill possessed by those who do not merely operate within the business world but command it with effortless charm.

Yours in strategy and sophistication,

A Most Trusted Service Provider

Solutions

Transaction Monitoring

Regulatory Reporting

Services

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Solutions

Transaction Monitoring

Regulatory Reporting

Services

AML/CFT Health Check

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Sign Up Form