One of many mechanisms of the Financial Action Task Force (FATF) to combat Money Laundering and Terrorist Activities is the Grey List, officially known as “Jurisdictions Under Increased Monitoring.” Grey List countries are considered to have strategic deficiencies in their Anti-Money Laundering framework. Being on the Grey List means that a country has not implemented sufficient measures to combat ML/TF, as per FATF standards. In this article, we will look at what the FATF Grey List is and its implications on DFNBPs and VASPs.

The Grey List is a list of countries having strategic deficiencies in their existing AML/CFT regulatory framework and its enforcement. These countries are put under increased monitoring, and more frequent reviews by the FATF until they acknowledge these deficiencies and work on it. Being on the Grey List implies that a country is expected to resolve the deficiencies and is subject to FATF’s scrutiny until it shows some sufficient improvements.

Grey List is like a charge on a country stating its inability to counter Money Laundering and Terrorist Financing. FATF’s Grey List acts like a message to global financial system to remain cautious while dealing with Jursidictions Under Increased Monitoring.

The FATF publishes the Grey List three times a year, and it is possible that these lists can change, and jurisdictions are added or removed from the list based on FATF’s scrutiny.

By placing a country on the Grey List, the FATF offers an opportunity to that country to make its AML/CFT framework sturdy and robust, and thereby, it aims to strengthen the fight against money laundering and terrorist financing.

The Grey List is not something any country desires to be on. FATF regularly assesses countries to gauge their efforts in combating money laundering and terrorist financing. After proper evaluation, it chooses to put a country on the Grey List, which signals a country’s efforts and current policies to combat money laundering and terrorist financing lack the required standards as set by the FATF.

A country gets grey-listed when it performs poorly in the Mutual Evaluation Report (MER).

There are two key parameters to analyse a country’s AML/CFT framework: Technical and Effectiveness.

Technical parameters check the adequacy of regulatory frameworks, preventive measures, detection and reporting mechanisms, and international cooperation to counter money laundering and terrorist financing. For each of these criteria, a country is then given ratings like compliant, partially compliant, largely compliant, or non-compliant.

The Effectiveness parameter is a judgement factor that helps to assess how well AML/CFT measures are implemented to address the risk of ML/TF, and whether it meets the FATF’s aims.

Being on the Grey List can have serious repercussions. The first and most significant of all is the reputational and credibility damage. A well-developed nation is hit the most by the grey listing. This can make a country lose out on its investors and deter foreign investments.

Being on the grey list brings increased global scrutiny, and a country might face enhanced due diligence, which can lead to increased transaction costs and administrative burdens. Moreover, a grey-listed company may not benefit from the global financial system, which increases the difficulties in cross-border dealings, negatively affecting international trade.

Grey listing may be assumed by other countries as a caution in terms of high ML/TF risks, and thus it can affect the country’s financial sector. This affects low-income nations the most.

In addition to economic and reputational damage, being grey-listed can also have political consequences. International pressure to comply with AML/CFT can lead to tensions between trade partners. The most severe of all could be the continuous non-compliance of a Grey-listed country. It might become blacklisted by the FATF, which means more serious economic damage.

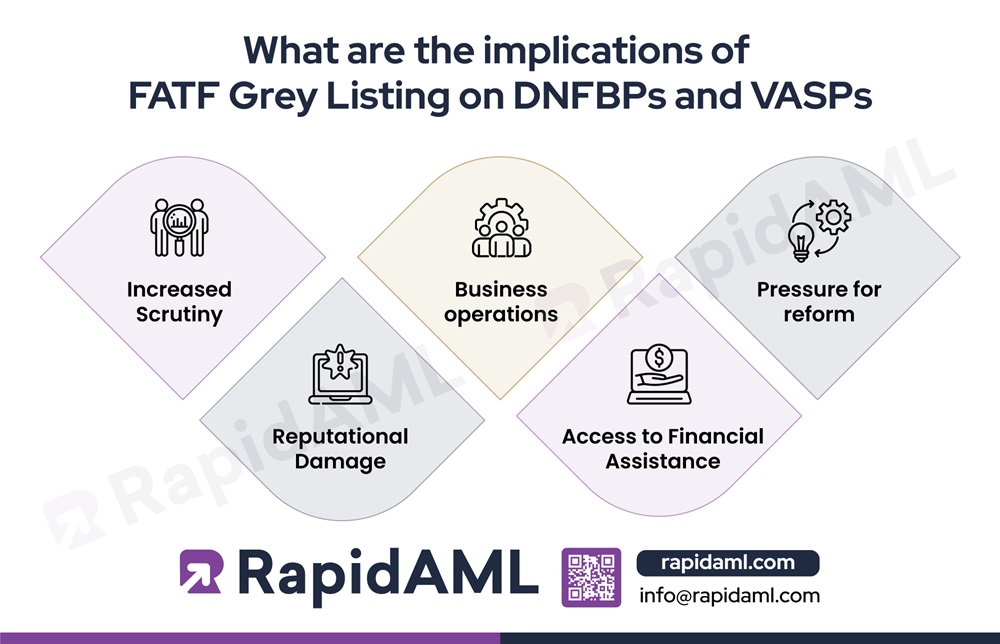

Implications of FATF Grey listing can affect DNFBPs and VASPs in two ways:

Increased Scrutiny:

DNFBPs and VASPs operating in grey-listed countries might face increased scrutiny from international organisations, local regulatory bodies, and business partners. This could involve more frequent assessments, or reporting requirements to ensure AML/CFT compliance.

Reputational Damage:

DNFBPs and VASPs have to face reputational damage and loss of trust as counterparties perceive increased risks in associating with them for any financial dealings.

Business Operations:

For DNBFPs and VASPs, the costs associated with carrying out the due diligence process increase as compliance requirements heighten when a country gets grey-listed. This also affects cross-border business operations negatively.

Access to Financial Assistance:

Grey listing is a warning to other countries before indulging in any financial transactions. As a result, organisations may be hesitant to engage in establishing any relations. Therefore, it becomes difficult for grey-listed countries to access global financial services.

Pressure for Reform:

Greylisting serves as a wake-up call for countries to acknowledge their deficiencies and improve their AML/CFT regimes. Though it acts as a catalyst to build a robust AML/CFT framework, the onus to reform and get it whitelisted is a collective effort, and it is applicable to DNFBPs and VASPs, too.

Generally, it takes one to three years for countries to reform and get off the grey list. This only happens after both the FATF and the relevant country agree to a point where they believe all areas of deficiencies have been addressed and fully reformed.

There are a total of 40 recommendations on Money Laundering and 9 Special Recommendations on Terrorist financing that serve as a benchmark for AML/CFT. These recommendations are key indicators of the quality of AML/CFT frameworks. On the basis of these recommendations, a country is given one of these titles: i.e. compliant, partially compliant, largely compliant, or non-compliant. While in a practical scenario, no country is fully compliant, a grey-listed country has too many weaknesses in its AML/CFT framework.

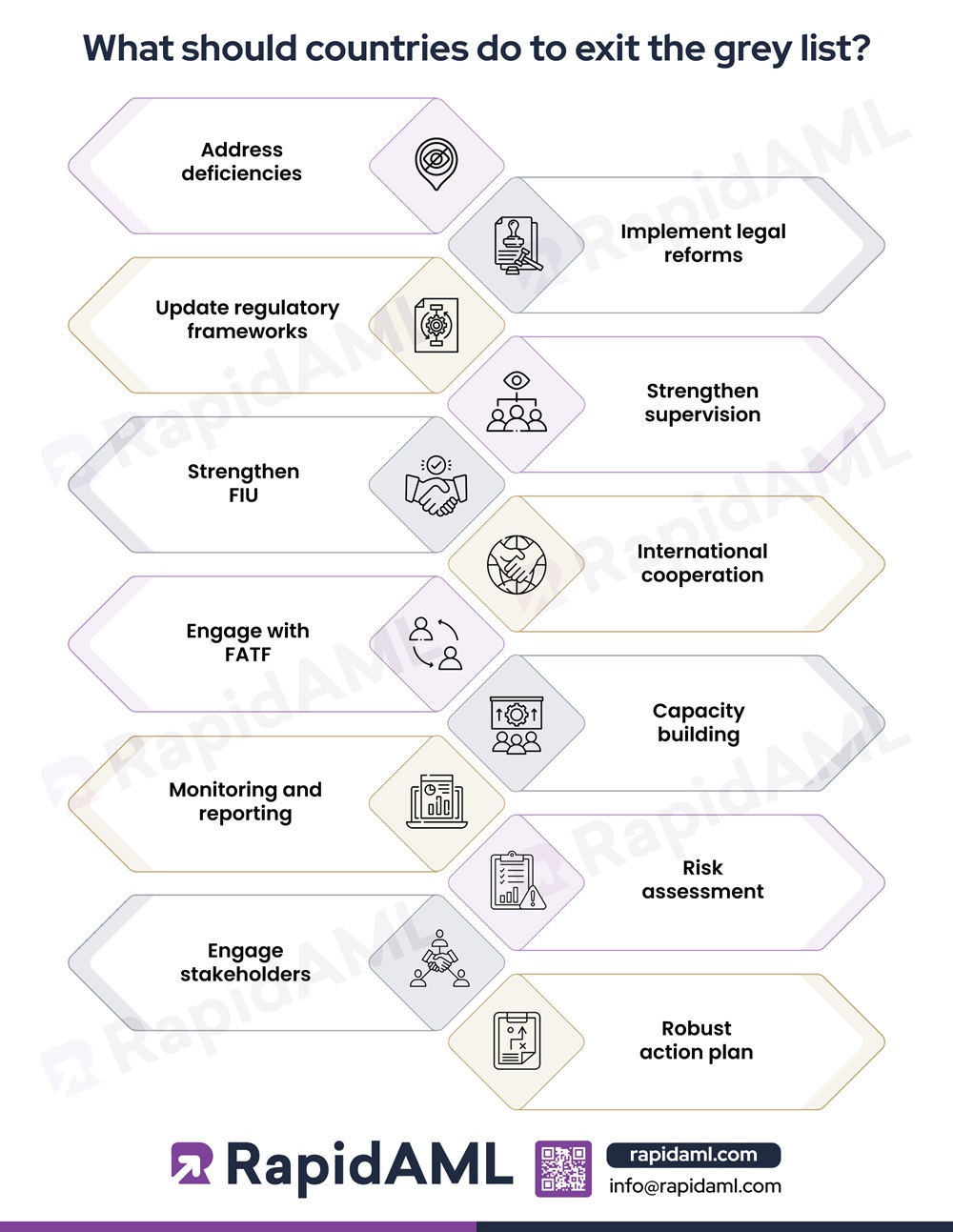

A grey-listed country must rigidly follow these steps to get off the list:

Address Deficiencies: Strategic deficiencies are the main reason a country ends up on the grey list. Therefore, it is mandatory to address deficiencies in the current AML/CFT framework and work on improving them by adopting powerful AML/CFT strategies as per international standards.

Implement Legal Reforms: Demonstrate a firm commitment to enforcing laws that comply with FATF standards. This should involve updated laws that cover emerging threats of ML/TF.

Updating Regulatory Frameworks: Implement robust CDD and KYC procedures and strengthen regulatory bodies such as banks and other financial services businesses to effectively carry out AML/CFT processes.

Strengthen Supervision: Regulatory bodies overseeing financial organisations should be powerful enough to provide correct guidance. Therefore, they need to be provided with adequate resources and authority to administer compliance.

Strengthen FIUs: Strengthen FIUs to enhance analysing and reporting financial intel for better detection and investigation of suspicious transactions.

International Cooperation: Solidify ties with other countries and international organisations by cooperating with them to combat cross-border ML/TF. This includes the sharing of information, mutual legal assistance, providing smooth cross-border onboarding, etc.

Engage with FATF: Engage with the FATF by addressing concerns raised by it, demonstrating progress through tangible actions, transparent reporting, and so on.

Capacity Building: Invest in training all relevant stakeholders to improve their understanding of AML/CFT measures so they can work efficiently.

Monitoring and Reporting: Enhance mechanisms for ongoing monitoring to address any emerging risks or gaps. Regularly report to FATF and other concerned regulatory bodies.

Risk Assessment: Conduct regular risk assessments to identify any gaps and promptly resolve them to mitigate any potential risks.

Engage Stakeholders: Work on raising public awareness about the risks of ML/TF by leveraging stakeholder engagement, including the private sector and civilians.

Robust Action Plan: It is mandatory to have an effective and dynamic action plan to resolve the deficiencies and meet the timeline as given by the FATF.

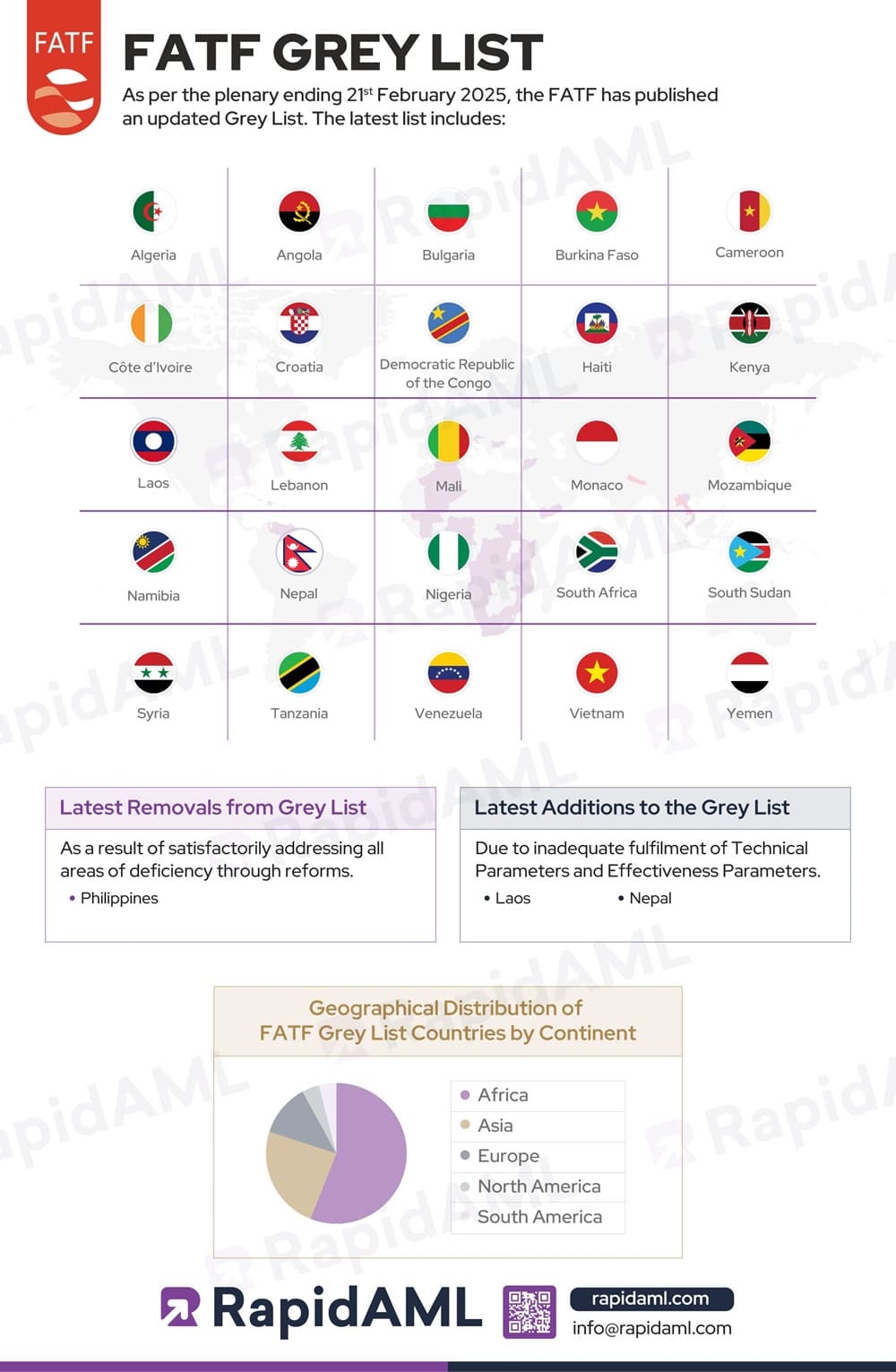

As per the plenary ending 21st February 2025, the FATF has published an updated Grey List. The latest list includes:

|

FATF Greylist as of 21st February 2025 |

||||

| 1. Algeria | 2. Côte D’Ivoire | 3. + Laos (Added to the Greylist on 21st February 2025) | 4. Namibia | 5. Syria |

| 6. Angola | 7. Croatia | 8. Lebanon | 9. + Nepal (Added to the Greylist on 21st February 2025) | 10. Tanzania |

| 11. Bulgaria | 12. Democratic Republic of Congo | 13. Mali | 14. Nigeria | 15. Venezuela |

| 16. Burkina Faso | 17. Haiti | 18. Monaco | 19. South Africa | 20. Vietnam |

| 21. Cameroon | 22. Kenya | 23. Mozambique | 24. South Sudan | 25. Yemen |

Conclusion

Conclusion

The FATF is the key organisation fighting money laundering and terrorist financing. Greylisting acts as a deterrent and requires a jurisdiction to make reforms in its judiciary. Further, when a country is placed on the grey list, it hampers its economic growth. This forces the jurisdiction to cooperate with FATF and strengthen the fight against ML/TF. The FATF’s grey list is a tool that encourages accountability and promotes transparency and integrity in the global financial system.

Pathik is a Chartered Accountant with over 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise-Wide Risk Assessments to implementing robust AML compliance frameworks. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.

Pathik's expertise extends to guiding businesses in navigating complex regulatory landscapes, ensuring adherence to FATF and other international standards, and mitigating financial crime risks. He is a recognised thought leader in AML/CFT, frequently sharing insights on emerging compliance challenges on various platforms.

Solutions

Transaction Monitoring

Regulatory Reporting

Services

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Solutions

Transaction Monitoring

Regulatory Reporting

Services

AML/CFT Health Check

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Sign Up Form