Is your compliance in good health or flatlining?

If your business were a person, when was the last time it had a full-body check-up? Would you skip your annual doctor’s visit and just hope everything’s alright? So why let your compliance health hang by a thread? ML/FT risks are like silent but deadly illnesses, sneaking up when you least expect them. Identify compliance gaps with our AML/CFT health check services and fix them before they become costly violations. We are your AML/CFT financial physicians, diagnosing ML/FT risks, prescribing remedies, and keeping your business away from an ICU stay.

One’s AML/CFT compliance health, much like a balance sheet, must always be in order. Even the smallest discrepancy can tip the scales towards ML/FT risk.

Much like the hidden heart condition, ignoring the warning signs can lead to serious consequences. That’s where AML/CFT health check service steps in, our financial stethoscope, to diagnose, evaluate, and strengthen your compliance vitals before minor issues turn into a regulatory heart attack.

A Tangled Compliance Is Ineffective at Best, Disastrous at Worst

Fortunately, RapidAML's AML/CFT health check services offer the perfect cure

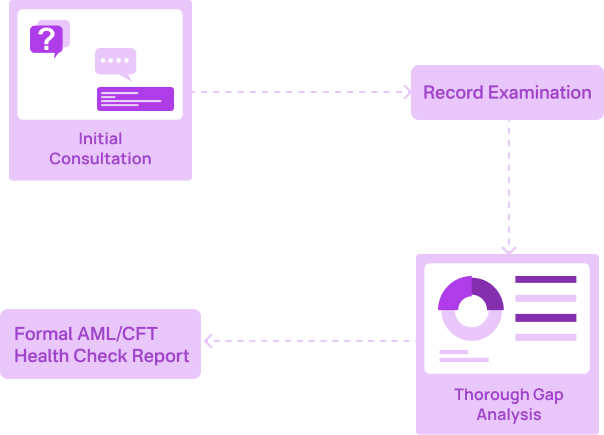

AML/CFT/CPF compliance is no place for the careless or the complacent. It is the place where fortunes are preserved and reputations guarded. Those who failed to uphold the highest standards found themselves cast out into the cold. Therefore, we present the AML/CFT Health Check service, a most rigorous diagnostic procedure designed to brace one’s financial constitution against the insidious ailments of ML/FT. Allow us to illuminate the stages of this most delicate yet essential examination.

Every skilled physician begins with the most vital inquiry. Before a physician may prescribe a remedy, one must first submit to an examination, must one not? So, too, in matters of compliance, where our assessment begins with a most thorough review of your institution’s risk. Through ML/FT/PF risk evaluation, analysis of the policies, procedures, and controls, and a discerning eye for telltale signs of weakness, our AML/CFT health check services seek out vulnerabilities that, if left unchecked, may fester into a full-blown ailment of non-compliance.

Records aren’t papers with ink but the lifeblood of honesty itself. From the humble annals of KYC, each document is dissected with the diligence of an apothecary preparing a most critical remedy. These documents serve as the patient’s medical history, revealing past illnesses, treatments attempted, and potential weaknesses that may yet be exploited. These records, much like the delicate constitution of a fragile debutante, reveal every past ailment affliction, dubious transactions, and the scars of financial impropriety. Some are treated, their symptoms suppressed, but others may yet fester, awaiting the eyes of our examiners.

Once done with the examination, we conduct a Gap Analysis. This is the moment where we determine whether the patient’s regulatory defences are sound or if, perhaps, dangerous vulnerabilities have gone unnoticed. This is more equivalent to a full-body MRI. This is where we roll up our sleeves, put on our metaphorical lab coats, and inspect every inch of your regulatory framework. Some gaps are mere scrapes easily treated with a quick procedural fix. Others? They’re more like ticking time bombs, waiting for an auditor’s knock to denote a full-blown regulatory emergency. Our job with AML/CFT health check services? To catch the fever before it turns into a full-blown compliance crisis.

With the examination complete and every regulatory ache and pain diagnosed, it’s time for the prescription. Your AML/CFT Health Check Report. This is your doctor’s final diagnosis, but instead of scribbled notes on a clipboard, you receive a detail-oriented compliance treatment plan. This is no vague prognosis. Symptoms of non-compliance are detailed, deficiencies are pinpointed without exception, and most importantly, a clear course of treatment is prescribed. If the compliance program is just a little under the weather, we recommend a simple regimen of strengthened internal controls and staff training. Is it showing signs of a chronic condition? Expect procedural interventions and enhanced monitoring to nurse back to health. Common compliance ailments include:

Your policies look good on paper but don’t meet the latest AML/CFT standards. Treatment? A compliance program overhaul with up-to-date guidelines.

Your monitoring stems aren’t detecting suspicious activities. Treatment? Enhanced transaction monitoring and staff training to build immunity.

Your KYC processes are weak, letting in high-risk clients without proper review. Treatment? A stricter due diligence program with automated risk-scoring.

Ignoring these symptoms? That’s like skipping antibiotics and hoping an infection goes away on its own.

The Remedy of Choice

To neglect the matters of compliance would be next to strolling through the social season with the most unfortunate case of consumption, unsightly, ill-advised, and certain to invite the inspection of those who exercise power. With our AML/CFT health check services, one may gracefully endure the season and scrutiny with confidence and undeniable distinction.

Defence Against Regulatory Plagues

Just as the human body fends off relentless waves of viruses and bacteria, our AML/CFT experts fend your institution against the ceaseless onslaught of regulatory demands and ML/FT crimes. Our AML audit services detect vulnerabilities before they fester, neutralise risks before they spread, and guard your compliance against even the most insidious financial plagues.

Without the Bitter Tonic

Would you prefer a remedy so arduous it drains the very lifeblood from your operations? Or rather, a treatment that is painless? Our AML/CFT professionals deliver solutions without the sting of cumbersome processes. A cure that does not demand sleepless nights nor labour, but grants peace of mind. A refined AML/CFT health check service, an effortless approach that makes AML compliance an elegant ballet rather than a wearying war.

The Royal Seal of Trust

Trust is the finest currency, more valuable than gold and rarer than a perfect AML/CFT compliance audit. And with us, your institution is adorned with the highest mark of distinction, a royal seal of compliance that commands respect from regulators and AML auditors alike. No raised brows, no furrowed foreheads, only nods of approval and quiet satisfaction.

The Alchemist’s Gold

Where inefficiencies exist, we offer not mere critique but cures. Like an apothecary refining his potions for greater efficacy, our AML auditors identify areas where your AML/CFT process may falter or cause undue strain. Be it cumbersome workflows, manual errors, or the weight of excessive documentation, our AML audit services offer remedies that transform compliance from an arduous chore to an efficient operation. Why settle for an outdated tonic when you can have a golden cure fit for kings and conquerors alike?

A Physician’s Highest Level of Examination

An astute physician discerns the faintest irregularity before it manifests as a full-blown ailment. Our anti-money laundering auditors chart the full anatomy of your compliance framework, detecting inefficiencies, prescribing remedies, and keeping your institution in optimal health. Identify weaknesses before they become liabilities with our AML/CFT health check services.

A Complete Suite of Services, Each More Refined Than the Last

The Prognosis

We find ourselves at the crossroads of fate. Should you choose the noble course, your compliance shall be like an oak tree in the storm, shielded from the nefarious ailments of ML/FT/PF crimes. But tarry too long. And alas! You may find yourself upon the examination table of the regulators, their quills poised to prescribe fines of a most grievous nature.

This author shall not speculate, but rest assured, our AML/CFT consultants will uncover the truth. And as history has shown, those who turn a blind eye to their compliance health often find themselves the subject of rather unflattering headlines.

Yours in whispered truths,

A Most Trusted AML Health Check Service Provider

Get Started

Contact Us