RapidAML Team

2025-02-18

Regulated entities under UAE’s Anti-Money Laundering (AML) regulatory regime are required to comply with obligations such as reporting financial crimes, adopting AML Policies, Procedures, and Controls, etc. AML non-compliance can lead to heavy penalties. In this blog, we will discuss the consequences of AML non-compliance and highlight the importance of ensuring adherence to AML regulations of UAE.

Let us first discuss the AML regime in UAE, and the penalties for non-compliance provided under the same.

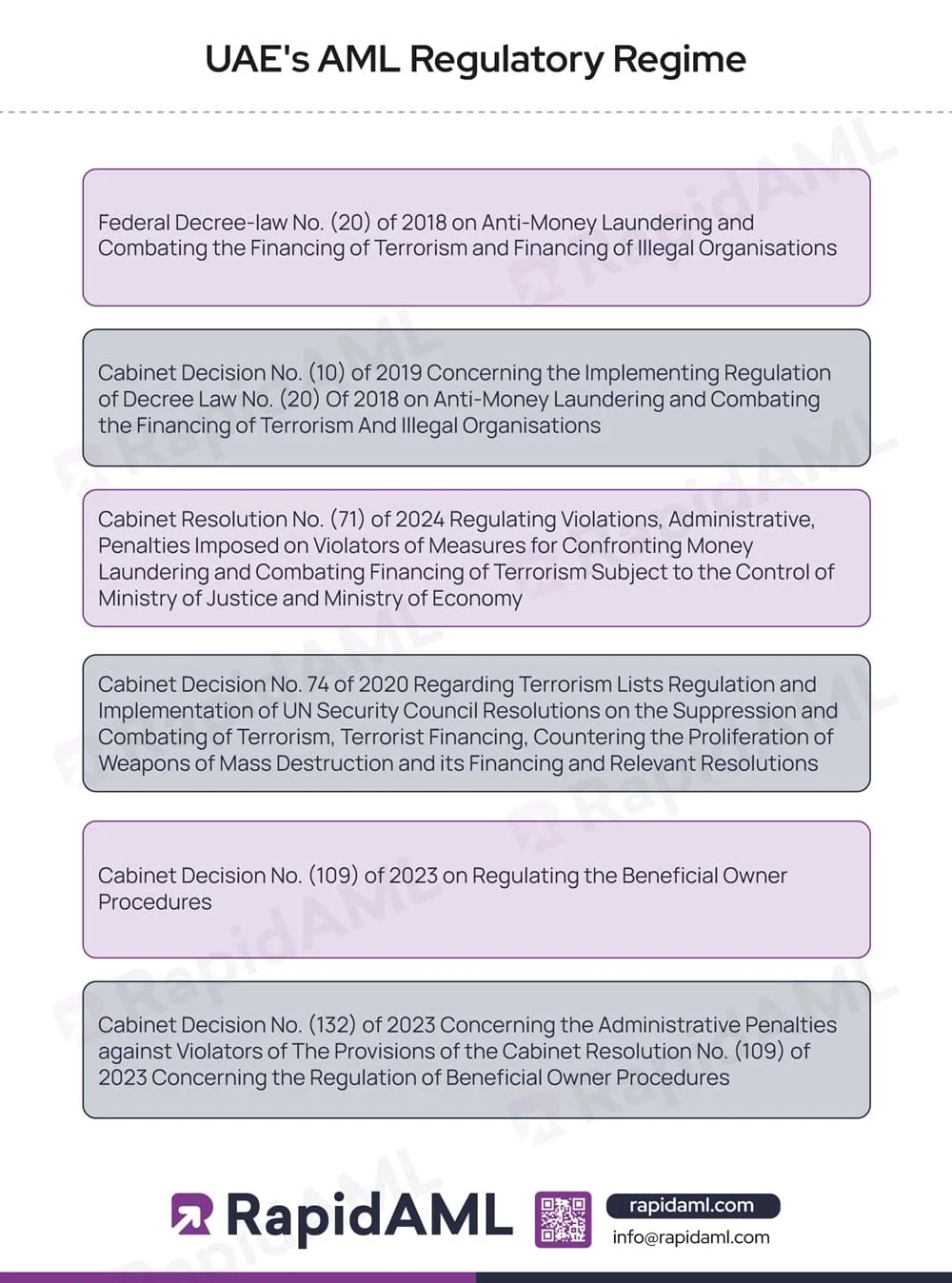

UAE has established a strong system of AML laws and regulations to combat the menace of Money Laundering and protect the integrity of its financial system. UAE’s AML regime includes the following laws and regulations:

These AML laws provide for the obligations regulated entities have to follow as well as the penalties for non-compliance with the obligations. The types of punishments include the following:

Administrative Fines and Penalties

The cost of AML non-compliance is heavy and may even lead to the shutting down of businesses. These fines range from AED 50,000 to AED 5,000,000 depending on the severity of the type of crime involved . For example, failure to frame and implement AML Policies, Procedures, and Controls may result in an administrative fine of minimum AED 100,000 and maximum AED 200,000 for a Designated Non-Financial Business and Profession (DNFBP) in UAE.

Criminal Proceedings

The financial crime of Money Laundering (ML), Terrorism Financing (TF), and Proliferation Financing (PF) may result in criminal prosecution and imprisonment in UAE. Under Federal Decree-law No. (20) of 2018, criminal proceedings can be commenced by the Public Prosecutor or his delegate against perpetrators of financial crimes. Under the same law, a person guilty of committing or attempting to commit the crime of Money Laundering can be sentenced for a period of maximum 10 years and/or to a fine ranging from AED 100,000 to AED 5,000,000.

Let us now discuss the reasons regulated entities may remain non-compliant with their AML obligations.

Penalties Are Real, So Should Be Your Compliance

From Licensing Revocation to Criminal Charges, Non-Compliance Can Cost You Beyond Your Thinking

AML compliance requires highly trained professionals who understand financial crime risks and regulatory obligations. However, a shortage of skilled AML/CFT/CPF experts make it difficult for regulated entities to implement and maintain strong AML/CFT/CPF Programs.

Many Regulated Entities, especially smaller businesses, may not be aware of or understand the extent of their AML obligations. AML regulations may be complicated to implement. Without proper training and awareness programs, employees of the regulated entity may fail to identify and play their role in the AML compliance processes, leading to inadvertent violations.

AML compliance can be costly, especially for regulated entities that are small businesses. It may require investments in technology, skilled employees, and training. Some Regulated Entities may struggle to allocate sufficient funds for their AML Program, increasing the risk of AML non-compliance.

Senior management of a regulated entity is responsible for setting the tone of AML compliance culture from the top. When senior management does not prioritise AML compliance, employees of the regulated entity may not take their responsibilities with the seriousness they deserve, leading to risks of non-compliance.

AML laws and requirements are constantly changing to mitigate the dynamic financial crime typologies. It can be complicated to understand and keep up with these evolving AML obligations. This may lead to confusion which increases the likelihood of AML non-compliance.

Due to lack of awareness or resources, regulated entities may rely on manual, outdated or inadequate systems in their AML program. This may lead to human errors or delays, leading to risks of AML/CFT/CFT non-compliance.

In many cases, regulated entities may prioritise business goals over AML compliance. AML measures can be seen as burdensome or time-consuming. This may result in inadequate resources being allocated to the AML program of the regulated entity, leading to risks of non-compliance.

Stringent AML controls such as Enhanced Due Diligence can create friction with the customers because of the need for additional information. When this leads to delays and customer dissatisfaction, regulated entities may choose to loosen ML/TF and PF controls to provide a smoother customer experience. This may result in AML non-compliance.

As discussed in the blog, the violation of AML/CFT/CPF regulations can lead to heavy financial penalties in UAE. These fines can range from AED 50,000 and may go up to AED 5,000,000. This results in a severe financial burden for regulated entities, hampering their normal functioning.

As discussed in this blog, in extreme cases, Supervisory Authorities may revoke the licences of regulated entities for their AML/CFT/CPF violations, resulting to the close-down of their business.

Non-compliance with AML/CFT/CPF regulations can severely damage a regulated entity’s reputation. Customers, investors, and stakeholders may lose trust, leading to reduced business opportunities and a decline in market value. Negative publicity can have long-lasting effects, making it difficult to regain credibility.

Regulated entities found to be non-compliant with their AML/CFT/CPF obligations often face heightened scrutiny. This results in frequent audits, investigations, and monitoring.

Regulated entities that fail to comply with AML/CFT/CPF regulations may lose access to financial markets, banking services, and potential investors, partnerships, etc. Many organisations may refuse to work with regulated entities due to loss of reputation. This limits their growth opportunities in the industry.

AML/CFT/CPF non-compliance can leads to prosecution and court cases, where regulated entities may be embroiled in lawsuits and court cases. Legal fees, fines, and associated costs can further burden the regulated entities financial health, affecting their normal functioning.

In severe cases, AML/CFT/CPF violations can result in criminal charges against the board of members, management members, owners, etc., of the regulated entity. Convictions may lead to arrest, imprisonment and hefty fines.

Formulating and implementing a strong AML/CFT/CPF Program may seem cost-heavy and complicated. However, with the right strategy, help, and guidance, AML compliance becomes a cost-effective strategy, protecting the regulated entity from both the risks of AML non-compliance and financial crimes. By investing in comprehensive AML measures, regulated entities can avoid hefty fines, legal battles, and reputational damage. Compliance ensures smoother operations and enhances customer trust.

For guidance on AML strategies, please refer to our eBook “Crafting Effective AML/CFT Policies: Best Practices for UAE DNFBPs and VASPs.”

As discussed in the blog, non-compliance with AML obligations can lead to severe repercussions that go beyond just financial penalties. On the other hand, AML compliance provides various benefits such as improved customer trust, prevention of financial crime risks, promotion of ethical practices, and enhanced efficiency through AML Software and solutions. Therefore, investing in AML compliance is a strategic decision, leading to long-term growth and positive results.

Avoid The Penalty Spiral

One Violation Leads to Many, RapidAML Catches Risks Before They Escalate

Jyoti is a Chartered Accountant and Certified Anti-Money Laundering Specialist (CAMS), having around 7 years of hands-on experience in regulatory compliance, legal advisory, policy-making, tax consultation, and technology project implementation.

Jyoti holds experience with Anti-Money Laundering regulations prevalent across various countries. She helps companies with risk assessment, designing and deploying adequate mitigation measures, and implementing the best international practices to combat money laundering and other financial crimes.

Get Started

Contact Us