RapidAML Team

2024-05-17

Customer Due Diligence (CDD) is an important regulatory requirement in the UAE. The DNFBPs and VASPs must conduct Customer Due Diligence before onboarding customers. This article provides insights into the best practices for conducting AML customer due diligence.

Customer Due Diligence, shortly called CDD, is the process of identifying, assessing, and verifying who your customers are. The logic of carrying out CDD is to understand the nature and volume of transactions expected from the customer and what might be the potential risk factors associated with the business relationship.

At its basic level, the CDD procedure involves collecting information such as a customer’s name, address, work site details, and intentions with respect to the utilisation of his account with the organisation. Other information, such as official documents, which include driving license, passport, and incorporation documents, is collected to ensure that the customer is being truthful and has no malicious intentions.

Customer Due Diligence is based on the idea that it is better for an institution to know about its clients to effectively money laundering (ML), terrorism financing (TF), or proliferation financing (PF) activities.

The Financial Action Task Force (FATF) Recommendation No. 10 states that financial institutions should carry out CDD procedures under the following circumstances:

However, regulated entities such as financial institutions, banks, insurance companies, Designated Non-Financial Businesses and Professions (DNFBPs)

Such as:

and Virtual Asset Services Providers (VASPs) in the UAE are required to conduct Customer Due Diligence in situations such as:

Conducting Customer Due Diligence helps ensure compliance with AML/CFT regulations, namely:

To determine the type of CDD that needs to be conducted upon a customer, the regulated entity, such as a DNFBP or a VASP, is required to collect customer details through the Know Your Customer (KYC) process, following which name screening across applicable sanctions lists, adverse media, and Politically Exposed Person (PEP) lists must be carried out using appropriate AML solutions. Based on the outcome of name screening, a Customer Risk Assessment (CRA) must be conducted to determine the level of risk posed by the customer to the business. ML, FT, or PF risk at this stage is categorised as high, medium, low, medium-high, or low-medium.

On the basis of CRA categorisation, a regulated entity, by relying on RBA must conduct CDD that is either Simplified, Standard or Enhanced.

If while carrying out the Due Diligence process, the customer seems high-risk then regulated entities have to undertake a more extensive CDD procedure. Customer Due Diligence takes place in three different yet correlated ways, namely – Simplified, Standard, and Enhanced.

1. Simplified Due Diligence

Simplified Due Diligence is a streamlined procedure to conduct customer due diligence on customers who pose low risk to the DNFBP or VASP.

It is a basic level of investigation to verify essential information, such as the identity of parties involved.

In the case of Simplified Due Diligence, the regulated entity generally relies on readily available information to make informed decisions while ensuring compliance with relevant regulations and standards without seeking detailed information.

2. Standard Due Diligence (SDD)

Standard Due Diligence involves thoroughly examining all aspects of a customer’s identification documents.

The regulated entity undertakes in-depth verification of identity documents across reliable sources.

The Standard Due Diligence process involves a detailed review of the customer’s profile.

3. Enhanced Due Diligence (EDD)

There are certain factors about the customer that hint at a higher risk of Money Laundering or Terrorist Financing, for example, clients who are named Sanctions list or are classified as Politically Exposed Persons (PEP).

In such cases, it becomes mandatory for regulated entities to take Enhanced Due Diligence (EDD).

In the case of EDD, the following factors may be evident when identifying a high-risk client. In these cases, the regulated entity is obliged to conduct EDD measures:

There are other factors, such as Geographic Risk factors and Transaction Risk Factors, where undertaking Enhanced Due Diligence (EDD) becomes crucial.

These factors are:

| Geographic Risk Factors: | Transaction Risk Factors: |

| Countries that represent a high risk are indicated by the following:

a. Inadequate Anti-Money Laundering system b. Funding or supporting Terrorist motives c. High rate of financial crime and corruption |

Transactions indicating risk factors are:

a. Non-face-to-face dealings b. Receiving payments from unidentified third parties c. Anonymous transactions |

Don’t Let Your Business Be the Weakest Link

Strengthen Your AML/CFT Framework to Stay Ahead of Risk

Customer Due Diligence procedures have these measures as their key components:

1. Customer Identification and Verification

DNFBPS and VASPs in UAE are required to identify customers.

Here is a step-by-step guide to identifying customers who want to open an account. The committee has further divided it into two lists. The first list is for natural persons, and the second one is for legal entities.

The list of details that need to be obtained from the client in the case of natural persons is as follows:

For legal persons:

2. Sanctions Screening

Sanctions screening involves checking individuals and entities against the list of sanctioned parties to prevent interaction with prohibited parties (UAE Local Terrorist List, UN Consolidated List).

It is crucial for compliance with respect to international regulations and local laws. This procedure utilises specialised sanctions screening software to compare data against the sanctions list produced by the regulatory authorities.

If a match is found, a Confirmed Name Match Report (CNMR) or Partial Name Match Report (PNMR) is submitted to the FIU. In the case of suspicion as to ML/TF, a Suspicious Transactions Report (STR) or Suspicious Activity Report (SAR) is submitted with the goAML portal.

3. Customer Profile Management

The regulated entity gathers all the relevant information about the customer, including his business, occupation, income level, value, and volume of transactions, and develops a comprehensive customer profile.

4. Customer Risk Assessment

Customer Risk Assessment under Anti-Money Laundering regulations involves evaluating the potential risk posed by a customer. The regulated entity takes into consideration various risk factors like geography, product, service, transaction, delivery channel, customer, technology, etc., to assess the risks associated with the customer.

5. Customer Acceptance

As per the customer acceptance policy, the customer is onboarded, and if the risks associated with a customer are unacceptable, the business relationship with the customer is not established.

6. Ongoing Monitoring

What we mean by “Ongoing Monitoring” is the ongoing assessment of business relationships. This step is crucial because, while certain transactions might not initially seem suspicious, they could, over time, hint at a pattern of irregular behaviour that necessitates changing a customer’s risk profile.

The following are included in continuous monitoring:

All business engagements should follow the best practice of continuous monitoring, but like other Customer Due Diligence measures, it can be tailored to the customer’s risk profile.

7. Investigation

If a customer enters into suspicious transactions or conducts suspicious activities, the investigation is conducted, and STR or SAR is filed with the FIU.

8. Documentation

As per the Federal AML/CFT Laws, regulated entities are required to maintain AML/CFT documentation and records for a period not less than 5 years in UAE Mainland. Documentation of the CDD procedures and related records play a huge role in fulfilling this obligation. The duration for maintaining records varies from one supervisory body to another, which regulated entities must keep in mind. For instance, refer to the table below to understand AML/CFT record-keeping duration requirements under various supervisory bodies in UAE.

| Sr. No | Area of Operation | Applicable to | Supervisory Body | Prescribed Data Retention Period |

| 1 | UAE Mainland and Free Zones | DNFBPs | Ministry of Economy | Five [5] years |

| 2 | Abu Dhabi Global Market | DNFBPs & VASPs | Financial Services Regulatory Authority | Six [6] years |

| 3 | Dubai International Financial Centre | DNFBPs & VASPs | Dubai Financial Services Authority | Six [6] years |

| 4 | Dubai (Except DIFC) | VASPs | Virtual Assets Regulatory Authority | Eight [8] years |

| 5 | UAE (Except DIFC, VARA) | VASPs | Securities & Commodities Authority (SCA) | Ten [10] years |

9. Staff Training

Employee training and awareness around CDD requirements is a must to fulfil the legal obligations around customer onboarding.

Why is Customer Due Diligence Required?

Legal Obligations of DNFBPs to Carry Out Customer Due Diligence

DNFBPs stands for Designated Non-Financial Businesses and Professions. DNFBPs are entities that are not financial institutions but are still vulnerable to being used for Money Laundering purposes (e.g., real estate agents involved in the sale and purchase of real estate, dealers in precious metals, companies providing accounting and auditing services, lawyers, notaries, etc.)

Keeping the scope of DNFBP practices and its exposure to several risk areas relating to money laundering and terrorist financing (ML/FT), the following legal obligations arise:

Failure to abide by these regulations results in administrative and financial penalties for DNFBPs, which could be as grave as the institution’s license being cancelled.

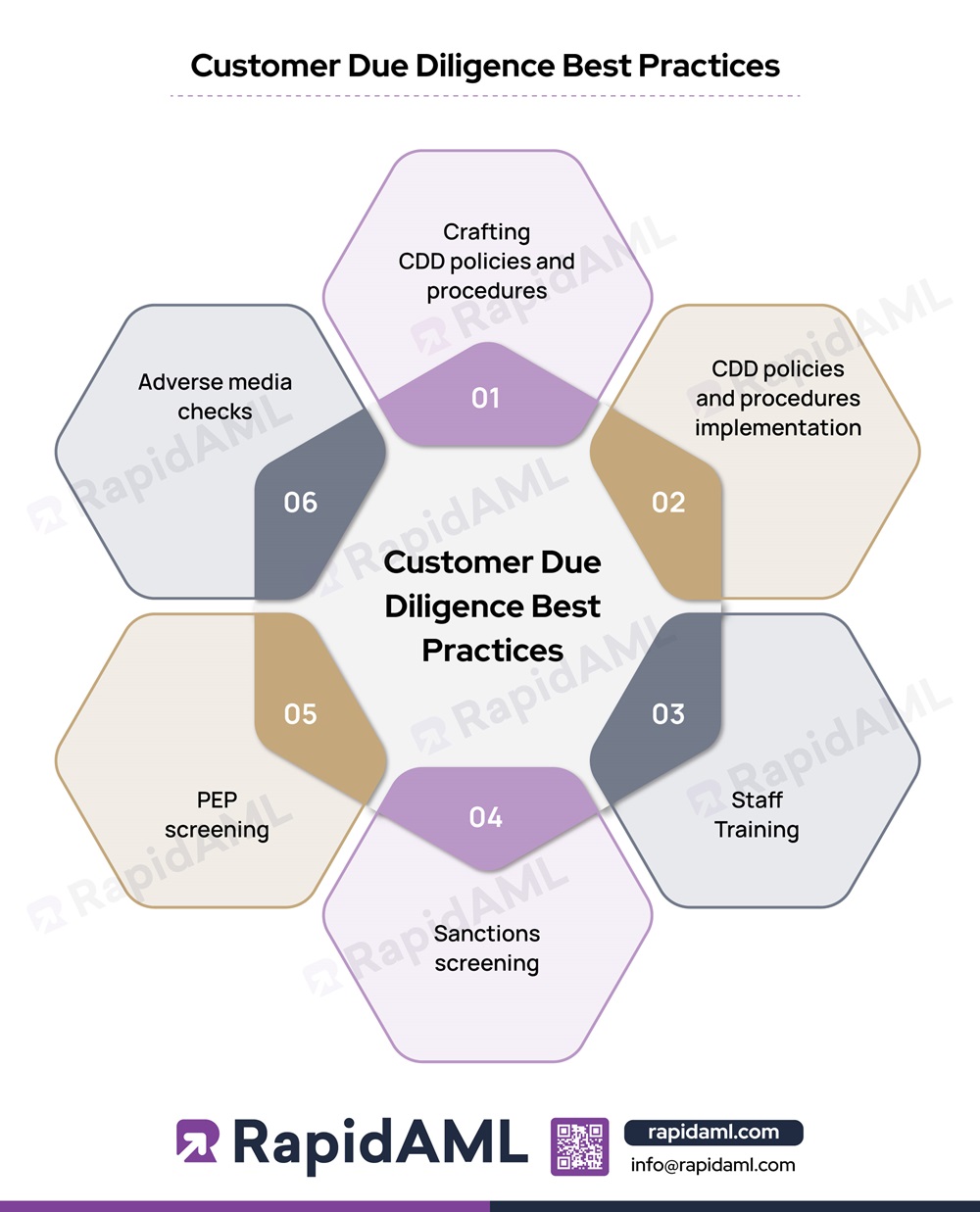

The best Customer Due Diligence practice involves a systematic and thorough approach to assessing and managing risks associated with clients. Key aspects include:

1. Crafting CDD Policies and Procedures:

Developing a clear CDD policy outlining criteria for assessing risks, customer identification and verification process, and other protocols.

2. CDD Policies and Procedures Implementation

Assigning responsibility for effectively implementing CDD procedures to designated personnel. Deploy appropriate KYC software, Screening Software, Customer Risk Assessment Software, and Case Management Software to support CDD processes effectively.

3. Staff Training

Educating staff on CDD policies, procedures, and regulatory requirements. Providing necessary training on recognising suspicious activities and unusual customer behaviour.

4. Sanctions Screening

Integrate the name-screening software into customer onboarding processes for real-time screening. The AML software helps in efficient and accurate sanctions screening, further aiding in reduced onboarding time and increased automated flow, leading to straight-through processing.

5. PEP Screening

Under the Customer Due Diligence process, PEP screening identifies any prominent political personality, either domestic or international. It helps determine if a customer is a PEP or a relative or close associate of a PEP and whether there is any risk associated with that person with respect to carrying out transactions.

6. Adverse Media Checks

Adverse media checks, or, say, Negative News Screening, is a crucial step in identifying any negative information associated with customers. Open sources can be utilised to monitor relevant news and events.

Conclusion

AML Customer Due Diligence serves as a robust mechanism in safeguarding DNFBPs against money laundering and terrorist financing activities. Be it simplified, standard, or enhanced, CDD plays a crucial role in combating financial fraud including ML,FT and PF. It aids in catching red flags at an early stage and prevents regulated entities from engaging in illegal transactions.

Let’s Make AML Compliance a Team Sport

Spot the Red Flag. We’ll Handle the Report

Jyoti is a Chartered Accountant and Certified Anti-Money Laundering Specialist (CAMS), having around 7 years of hands-on experience in regulatory compliance, legal advisory, policy-making, tax consultation, and technology project implementation.

Jyoti holds experience with Anti-Money Laundering regulations prevalent across various countries. She helps companies with risk assessment, designing and deploying adequate mitigation measures, and implementing the best international practices to combat money laundering and other financial crimes.

Get Started

Contact Us