RapidAML Team

2024-05-13

The Role of AML Software in UAE is crucial for Designated Non-Financial Businesses and Professions (DNFBPs) and Virtual Asset Service Providers (VASPs) to comply with Anti-Money Laundering and Counter-Terrorism Financing (AML/CFT) laws and regulations. They must fulfil various regulatory obligations related to Sanctions Screening, KYC, Transaction Monitoring, and Record-keeping. Depending on the nature and size of these entities, they can employ manual processes or AML software to fulfil these obligations. In this article, we have highlighted the role of AML software in the UAE’s evolving regulatory landscape.

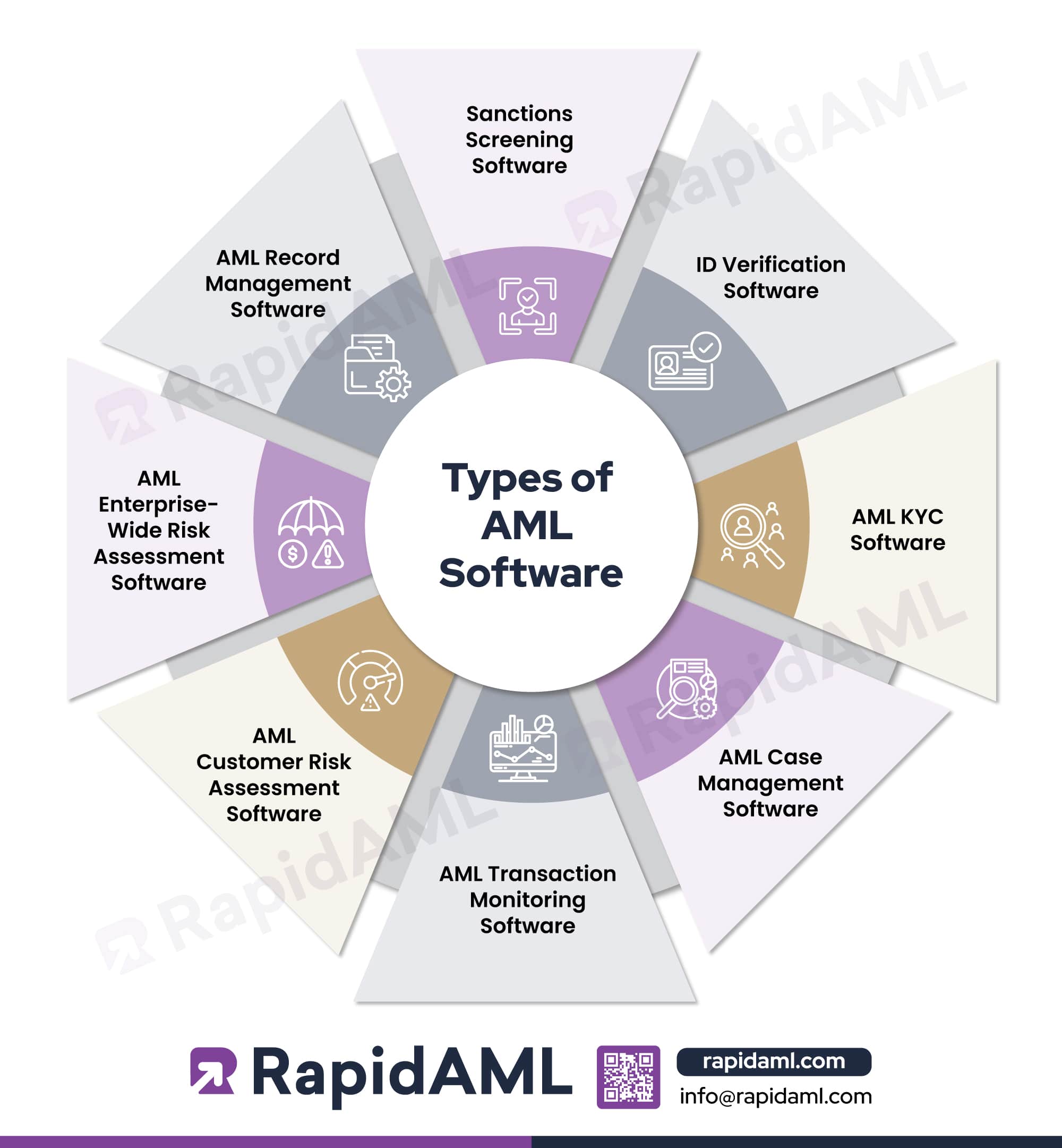

Anti-Money Laundering (AML) Software carries out various tasks to fulfil AML compliance-related processes such as KYC, name screening, Customer Due Diligence, transaction monitoring, risk assessment, etc.

Software, in general, contains a bundle of built-in programs and information that communicate with one another, as well as the computer, mobile or any device from which they are being accessed, to perform or carry out tasks or steps for which the software has been developed. Many businesses now prefer AML Software in the UAE to simplify these operations.

Definition and purpose of AML Software in UAE

AML software is a package of instructions, programs, and data used to operate on computers and other devices to carry out specific AML compliance tasks. Most entities rely heavily on AML Software in the UAE for these functions.

AML software helps businesses identify, assess, prevent, and report suspicious activities and transactions that may indicate money laundering (ML), terrorism financing (TF), or the proliferation of weapons of mass destruction (PF) while ensuring AML compliance as prescribed by UAE Federal law and related regulations.

The implementation of AML software in the UAE helps businesses automate and streamline their AML compliance tasks, such as screening and improving their customer onboarding processes. RapidAML is one of the best AML & KYC software solutions in UAE, helping regulated entities to comply with regulatory requirements.

Gaining information on the types of AML software and tools available in the market while understanding the technology aspect of such software, tools, and APIs discussed further in this article can help one better understand its purpose.

The AML software in the UAE analyses the user’s data and follows the steps and procedures it has been programmed to follow.

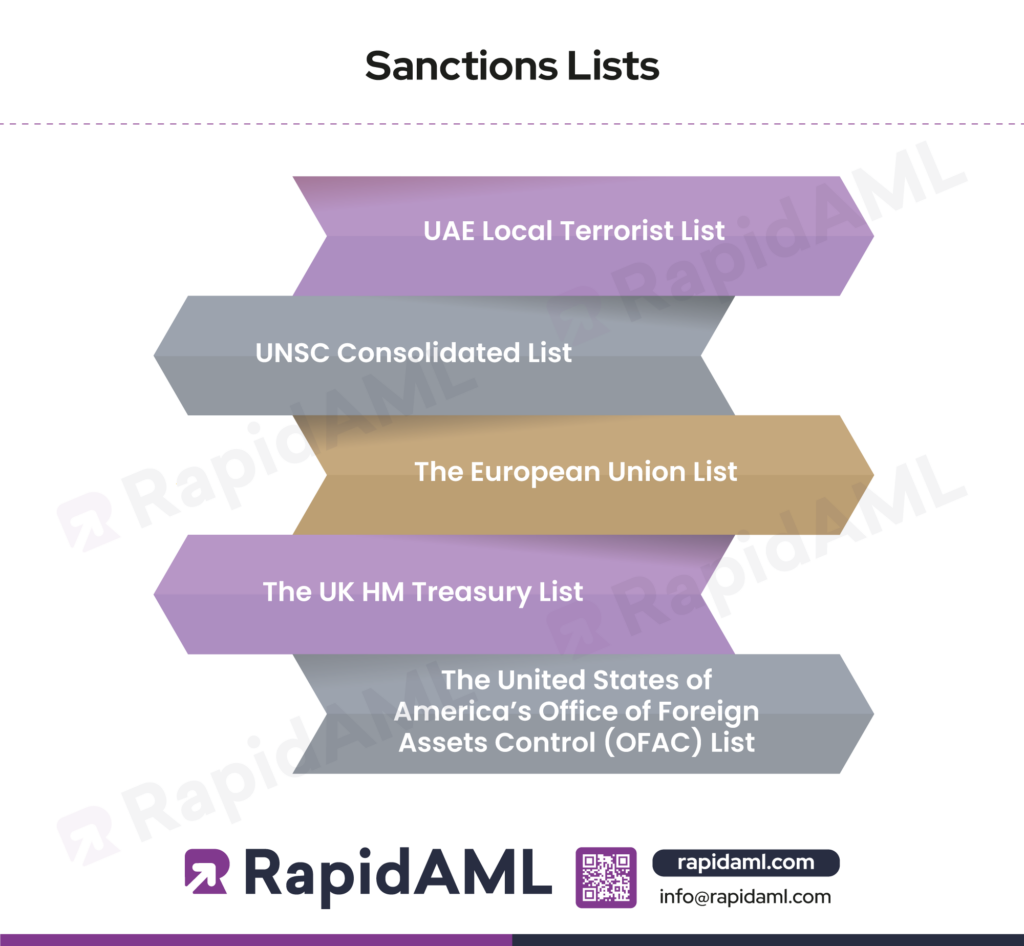

As the name suggests, sanctions screening software is responsible for ensuring compliance with the sanctions screening requirement. Usually, sanctions screening software offers a one-stop solution for complying with multiple jurisdictions’ different sanctions compliance requirements wherever the business operates. AML screening solution provides subscriptions to various sanctions lists across the globe and UAE, as listed below:

Sanctions Screening software helps generate prompt alerts whenever any name is found to match names in the sanctions list to ensure timely action, such as filing Confirmed Name Match Report (CNMR) and Partial Name Match Reports (PNMR), applying freezing measures, and reporting to the Financial Intelligence Unit (FIU) through the goAML portal.

ID Verification Software

ID verification software and APIs are technologically driven. They aim to enhance customer experience and expedite the AML compliance process for fulfilling Customer Due Diligence (CDD) requirements. Using APIs or apps, businesses can rely on ID verification software for document collection and ID document verification, either online or offline.

ID verification software helps with security enhancement, fraud prevention, compliance with AML regulations, and providing cost efficiency.

ID verification lowers customer abandonment by improving customer experience. It is a mandatory AML requirement used across all sectors, such as Financial Institutions, Designated Non-Financial Businesses and Professions (DNFBPs), Virtual Asset Services Providers (VASPs), and age-restrictive sectors.

AML KYC Software

AML KYC software collects, stores, and analyses customer information to carry out functions like Know Your Customer (KYC), Customer Due Diligence (CDD), and Enhanced Customer Due Diligence (EDD).

The KYC software is responsible for obtaining and verifying customer information and obtaining information such as source funds and source of wealth for EDD. Thus, relying on a top anti-money laundering software in the UAE that provides a one-stop KYC solution simplifies AML KYC Compliance.

AML Case Management Software

An AML case management software is responsible for generating and tracking various alerts concerning suspicious activities or transactions requiring the attention of the AML/CFT compliance officer and senior management.

It flags various events and transactions and then alerts the senior authorities to take appropriate action.

Usually, AML case management software provides a dashboard where all cases can be accessed, such as cases related to screening results, KYC results, ongoing monitoring, risk profiling, risk rating, etc.

AML Transaction Monitoring Software

AML transaction monitoring software usually monitors customers’ transactions, such as sales, purchases, deposits, withdrawals, and cryptocurrency transactions.

It is designed to identify suspicious behaviour that could indicate money laundering or terrorism financing.

Transaction monitoring systems rely on a data monitoring algorithm-based approach, enhanced by AI, graph analysis, etc., to notice changes in transaction patterns and detect unusual transactions.

AML Customer Risk Assessment Software

AML customer risk assessment tools help businesses identify their inherent risk of being used as a vehicle for money laundering activities by criminals while operating.

Upon identifying inherent risks, the risk assessment software considers factors such as the businesses’ diversity, complexity, nature, and scale. The risk assessment tool is responsible for carrying out risk assessments of its customers based on the abovementioned factors and assigning them risk ratings.

AML Enterprise-Wide Risk Assessment (EWRA) Software

AML Enterprise-Wide Risk Assessment Software helps identify ML/TF risks at the regulated entity level. It provides due consideration to the ML/TF risk factors like customers, geographies, products, services, transactions, delivery channels, and technology and helps identify the inherent and residual risks.

The EWRA software dynamically tracks and monitors risk factors to ensure that the control measures are relevant and stringent enough to curtail money laundering events.

AML Record Management Software

AML record-keeping software maintains records and databases of AML exercises in acceptable formats for conducting AML audits and ensuring compliance with record-keeping requirements according to the Federal Decree Law No (20) of 2018.

Don’t Risk Fines Upgrade Your AML Compliance Now

Cut Errors, Save Time, And Reduce Operational Risk with Advanced Software

How does AML Software work?

The Anti-Money Laundering software analyses the user’s data and follows the steps and procedures it has been programmed to follow.

Businesses such as DNFBPs and VASPs can elevate their AML compliance by using technology-driven AML software. However, before migrating from manual AML compliance processes to software-driven processes or even from one AML software to another, a business must evaluate its potential effect on AML compliance and update and align its AML/CFT policy and procedures.

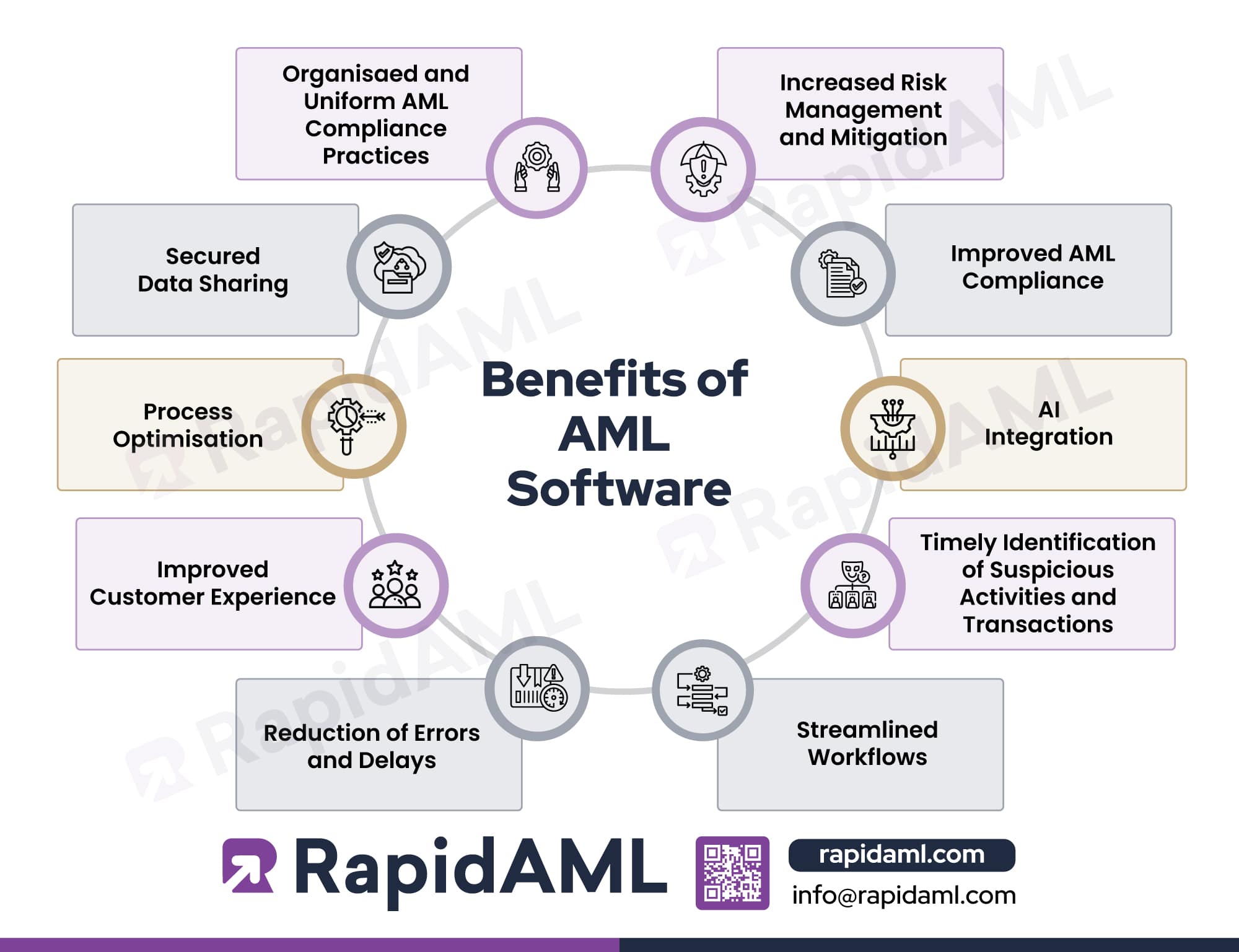

The benefits of transitioning from manual AML compliance processes to the best anti-money laundering compliance software in UAE are listed below:

Organised and uniform AML Compliance Practices

Introducing AML compliance software into an AML compliance framework helps streamline or converge all AML-related efforts into a single platform.

AML software in the UAE simplifies all AML-related efforts by automating various manual tasks, thus saving the organisation’s resources.

Further, it ensures uniform AML compliance practices across the organisation, resulting in quick and continued adaptation.

Increased Risk Management and Mitigation

AML Software helps identify, assess, and evaluate ML/FT risks. Regulated entities can take appropriate risk-based measures and mitigate money laundering and terrorist financing risks. The way to deal with various types of risks is configured in the system.

Thus, seamless customer onboarding is ensured, with a reduced ratio of customers losing due to delays while ensuring onboarding compliance. Also, the ongoing monitoring of transactions and business relationships helps safeguard the business from risk factors.

Improved AML Compliance

AML Software ensures improved AML compliance. Usually, the AML software in the UAE is configured to suit the compliance requirements of the regulated business. Such an AML solution helps businesses improve their AML risk management like never before, removing oversight, if any, during the software testing phase.

AI integration

AI-enabled AML software increases the accuracy and efficiency of AML compliance practices.

It can identify suspicious activities and transactions and reduce false or erroneous outcomes due to its ability to automate manual processes like transaction monitoring and Customer Due Diligence. The AI can imbibe new learning and findings into the AML software, which is an added advantage.

Timely identification of Suspicious Activities and Transactions

AML software in the UAE helps identify suspicious activities and transactions. It can recognise patterns in transactions and generate alerts for the compliance team to take appropriate risk mitigation measures. This results in increased efficiency in handling red flags and identifying and reporting suspicious transactions and activities.

Streamlined Workflows

There is an element of certainty when AML software is used. Various processes require input from the screening analyst, KYC analyst, or compliance officer. AML software streamlines the communication between these teams, resulting in a faster turn-around.

Further, ongoing monitoring of a business relationship happens in the background without adding additional tasks for the compliance team.

Reduction of Errors and Delays

The AML Software in the UAE automates various compliance tasks. It uses machine learning and RPA, resulting in a shorter time for generating results and reports. Also, cognitive computing systems lead to fewer errors when using cognitive computing-backed AML software compared to manual AML compliance practices.

Improved Customer Experience

ID Verification, liveness checks, and KYC self-service features available in AML software help reduce onboarding time, resulting in an improved customer experience.

Also, the ability of AML ID verification software to enable onboarding and verification by using cell phones and 2-factor verification of customer information with the central data registry leads to ease of onboarding.

Process optimisation

A direct advantage of relying on AML software solutions is the optimisation of lengthy and often repetitive AML compliance tasks such as name screening and sanctions screening for many customers. AML software relies on RPA, machine learning, AI, and cognitive computing to shorten the time required for tedious manual processes.

Secure data sharing

Another immediate advantage of shifting to AML software in the UAE is enhanced data security. This allows for more secure data sharing across group organisations, third parties, and relevant data registries in compliance with the current data protection regime in the UAE and globally. Such data sharing is possible only through explicit consent received from the customer during their onboarding.

The role of AML Software in the UAE’s evolving regulatory landscape for DNFBPs and VASPs can not be understated. Here are the top reasons why implementing AML software is essential to remain compliant with the UAE AML/CFT laws and regulations.

Avoidance of Fines and Penalties

The core motivation behind any DNFBPs and VASPs in the UAE to transition to AML software solutions is to avoid non-compliance with AML laws, resulting in punitive payment of fines and penalties. The Federal Decree-Law No. 20 of 2018 provides administrative penalties ranging from AED 50,000 to AED 5,000,000 for each violation by the DNFBPs and VASPs for contravention of any AML/CFT regulations. Thus, implementing AML software in the UAE and solutions directly helps the business ensure AML compliance.

Keeping pace with Regulatory Requirements

The regulatory landscape in the UAE is ever-evolving. Appropriate AML software can easily help match global AML standards and FATF Recommendations and keep pace with such a fast-paced regulatory environment.

Cost and Outcome Efficiency

Implementing AML software leads to fewer erroneous decisions and judgments in suspicious activity and transaction reporting (SAR/STR) than human decisions and interpretation. AML software solutions optimise organisations’ time and resources, resulting in greater efficiency and outcomes.

The importance of AML Compliance for DNFBPs and VASPs

AML compliance is essential to DNFBPs and VASPs not only to avoid paying fines due to non-compliance but also to ensure that there is no question as to the integrity of the DNFBPs and VASPs when it comes to their involvement with any criminal activities.

Compliance with the AML/CFT laws and regulations helps create brand value and customer loyalty. Compliance is helpful in small but unusual ways, as attaching AML documentation and records while seeking business licenses overseas in highly regulated regimes helps build and create an image of a trustworthy and compliant entity, as well as during mergers and acquisitions and valuation of the entity for the same.

How much does AML Software in the UAE cost?

AML software comes with various modules, which can be purchased depending on the business requirements. The pricing of AML software depends on the modules, features and functionalities, number of users, scale of operations, and licensing model provided by the vendor. SAAS-based solutions entail less upfront payment than perpetual solutions.

Before subscribing to AML software, one must perform a thorough requirement analysis, research available software solutions, and conduct a cost-benefit analysis.

Protect Your Business from Fines and Penalties

Ensure Complete AML Compliance with One Integrated Software Solution

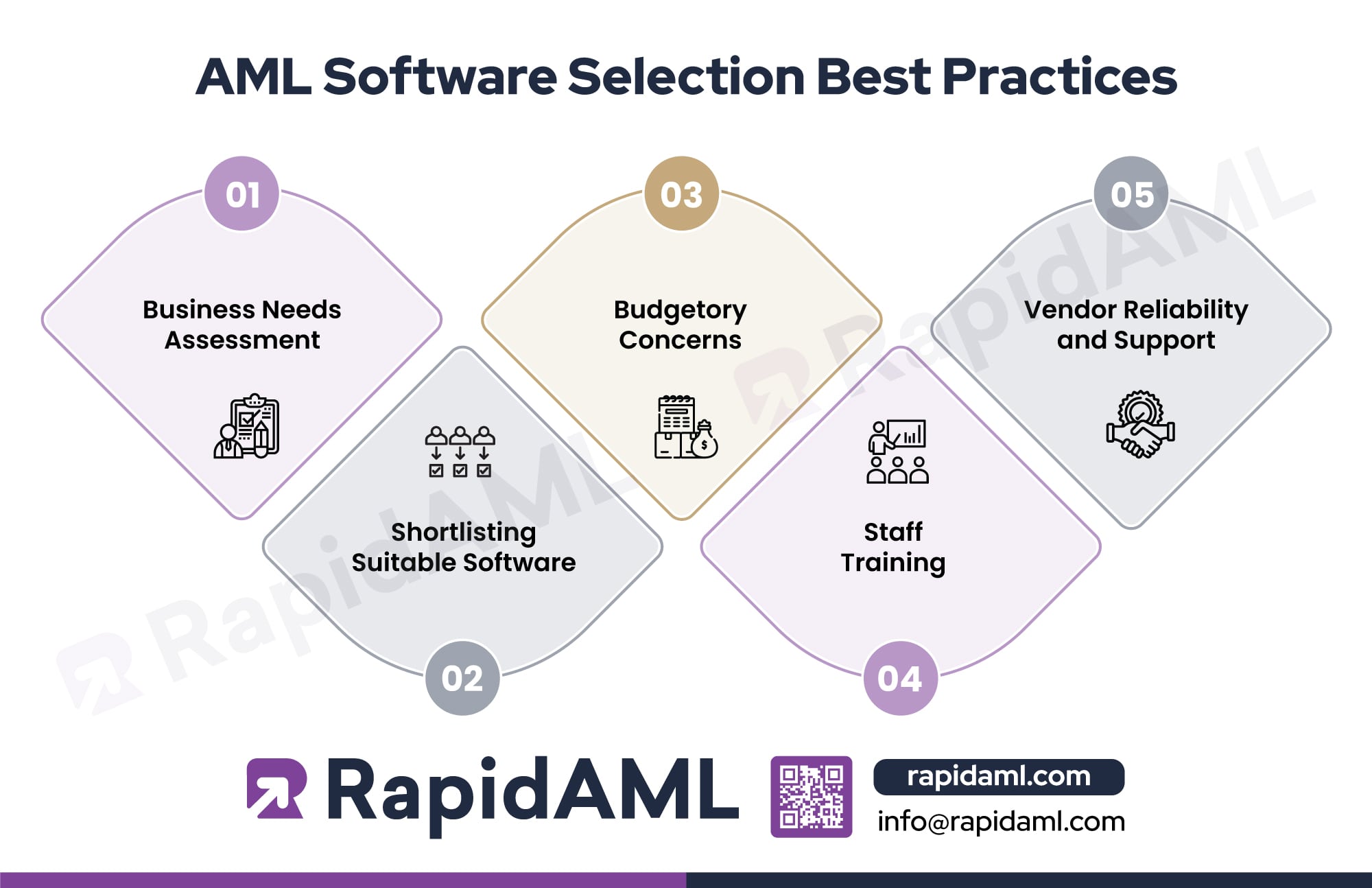

A business in UAE which does not already have AML Compliance software in place or who isn’t completely satisfied with its current AML compliance solution needs to consider the following pointers while selecting an appropriate AML software for meeting its AML compliance requirements:

1. Business needs assessment

The business must assess the factors that pose money laundering risks in compliance with the risk-based approach recommended by FATF and Federal law, such as the type of customers, their associated geographies, delivery channels, mode of payment, etc.

As a result of this risk-based assessment, the business could adequately identify the areas where appropriate AML solutions would be required. For example, suppose the business identifies that it faces a high risk from its customers and geographies. In that case, the business must consider selecting an appropriate name screening, sanctions screening, and PEP screening AML solution that also checks for adverse media, further selecting which watch lists it needs to comply with and selecting suitable screening software accordingly.

2. Shortlisting suitable software

The RegTech market presents businesses with several AML compliance software, APIs and solutions. However, selecting a suitable AML Software in the UAE requires shortlisting available solutions based on the following factors:

Regulatory reporting needs

The AML Software in the UAE must be selected based on the software’s ability to ensure compliance with various regulations applicable to the business across various jurisdictions where the business has its operations, group entities, or representative offices. Businesses must be mindful of selecting AML software in the UAE that suits their business size and needs and whose cost aligns with the business’s affordability.

Scalability

AML compliance software is only as good as its ability to scale and offer flexibility to suit a business’s unique growing and expansion needs. Businesses must ensure that the AML compliance software offers scalability to ensure continuous AML compliance without any disruptions.

Ability to integrate with existing systems

AML software solutions must offer versatility and integrate or operate seamlessly with existing software/technologies or mechanisms for any business use. The Name Screening software must integrate with a retail business’s Point-of-Sale System. A business must be mindful that the AML compliance software of its choosing offers the versatility to integrate and conduct AML compliance functions with existing mechanisms.

API adaptability

AML solutions aid in automating AML compliance processes such as screening, KYC or CDD. The API integration with various data publishing authorities ensures ongoing, updated screening processes. API handles processes in the background much faster, such as ensuring subscription to the latest watchlists and sanction or designated person lists issued by various regulatory or supervisory authorities.

Advanced search algorithms

The businesses, particularly those dealing with Arabic, Russian or Chinese clients, whose original script names are challenging to understand, pronounce, or prone to misspelling must consider investing in an AML solution that makes use of “fuzzy matching”, wherein factors such as accuracy with name match, degree of spelling closeness, etc. can be altered and customised to filter out matches more accurately.

3. Budgetary concerns

The AML solution deployed must be carefully selected, considering its cost efficiency. Businesses must be mindful of selecting AML software that suits their business size and needs and whose cost aligns with the business’s affordability.

4. Staff training

Training and familiarising the staff with operating or using the newly introduced AML solution is necessary. This will help transition from manual compliance processes and practices to new technology. After training and familiarisation, the staff will gain confidence in using the software interface seamlessly to carry out daily compliance processes.

5. Vendor reliability and support

However feature-rich AML Software in the UAE is, if the vendor is not reliable, it’s not going to help the regulated entity. Vendor reliability is an important factor to consider when finalising software. The regulated entity must ask for customer references and perform due diligence on the vendor.

The normal support hours of the vendor and TAT must be checked to ensure that the software is available to use when it is needed the most.

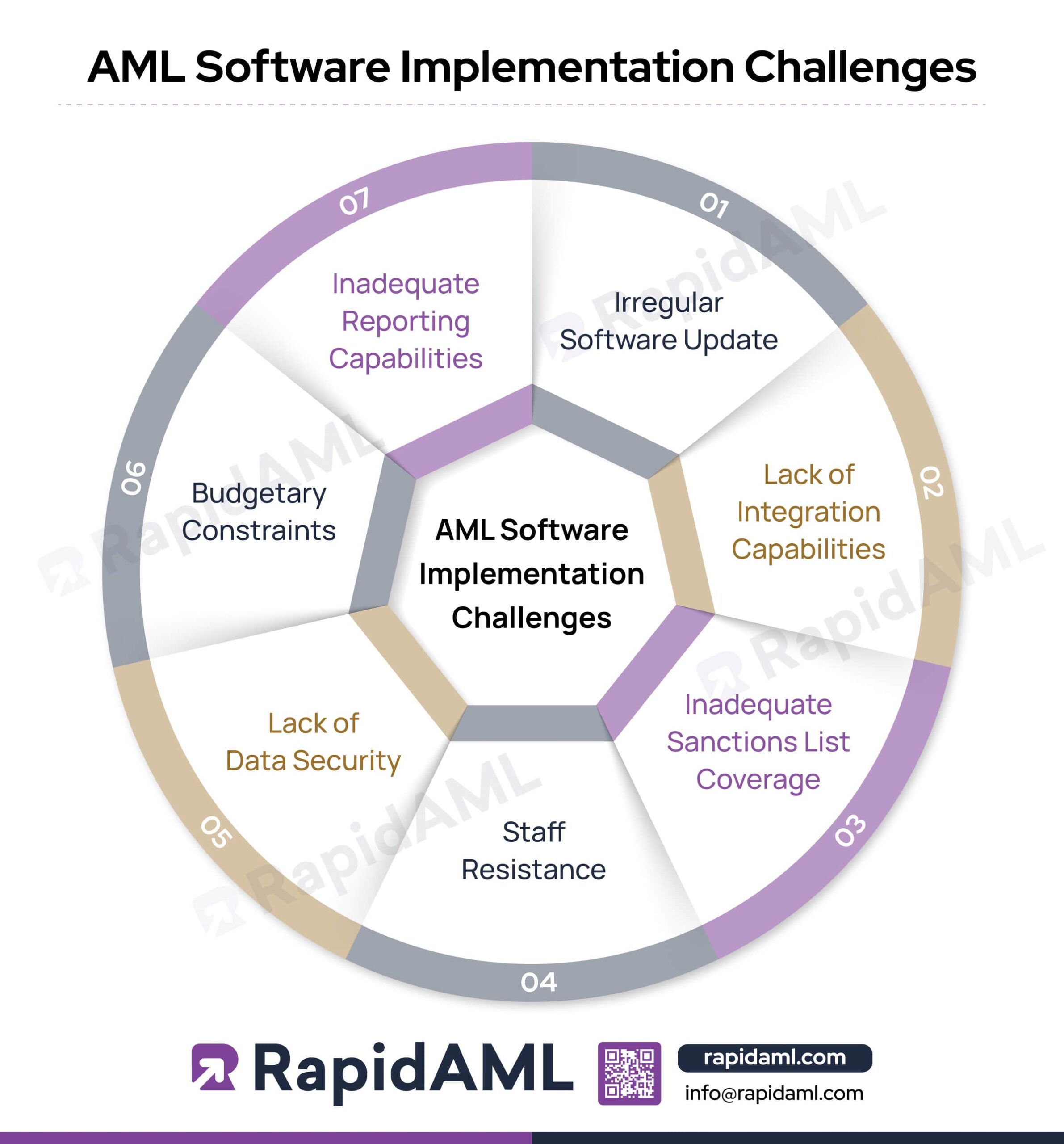

No matter whether one is implementing ERP, CRM, or AML software, software implementations have always been tricky and full of challenges. Here is the list of common challenges in AML software implementation.

1. Irregular software update

Sanction Lists are dynamic, and the AML software in the UAE must update its database as soon as there’s a change. If the software updates are irregular, it poses several regulatory challenges for the organisation, and the regulated entity may fail to comply with the TFS requirements.

2. Lack of integration capabilities

Some AML software in the UAE does not provide an API interface for easy integration with a point-of-sale or ERP system. Lack of integration capabilities is a major bottleneck resulting in duplication of efforts.

3. Inadequate Sanctions List coverage

The AML Screening Software in UAE must support the required sanctions lists. The regulatory requirements for a global business are unique, and if the software does not support the global watchlists, the regulated entity may fail to fulfil its legal obligations.

4. Staff resistance

Change management is always tricky, and if the staff isn’t provided with proper training on the software, the entire objective behind implementing AML software will fail. At the same time, the software must be easy to use and provide necessary help, user manuals, and videos for its enterprise-wide adoption.

5. Lack of data security

It’s ultimately business data. Customer databases, supplier information, and third-party data security are of utmost importance to businesses. If the AML software in the UAE is not secure enough to protect the data, there could be a loss of reputation and regulatory breaches as well.

6. Budgetary constraints

Resources are scarce, and businesses do not have the luxury to invest in AML Compliance Software. There could be budgetary constraint, and that acts as a major challenge for acquiring and implementing AML software in the UAE.

7. Inadequate reporting capabilities

AML software should provide reports for screening, case management, KYC, CDD, EDD, and transaction monitoring. Further, the data needs to be maintained in the software for record-keeping purposes. If the software does not provide proper reports for auditing, record-keeping, and regulatory reporting purposes, the entire effort will fail.

AML software integration with other business processes

Integration of AML Software in the UAE with existing business processes is highly recommended as it helps improve the efficiency of employees and the effectiveness of AML compliance policies for the business. To maximise the benefits of switching to AML software solutions, integrating usual business processes with AML software is required.

Integration with Point-of-Sale, ERP, CRM, payment platforms, and supply chain processes helps minimise manual data entry errors and saves time by reducing dual efforts. Integration with various APIs, such as sanction list APIs, is also highly beneficial as it helps streamline AML compliance efforts.

AML software integration, particularly with CRM or supply chain systems, can help keep up with sanctions screening requirements and fulfil CRM or supply chain functions regarding the same customers.

For example, integrating AML solutions such as name screening, ID verification, and KYC software with CRM software would help quicker customer onboarding and identify high-risk, sanctioned, or designated individuals. This would help in the overall risk management of the business.

AML software solutions, by their inherent nature, when integrated with business processes, can help extract customer information and provide it for use for other processes, such as automating payment links and verifying sanctions watchlists during supply chain management; this ensures that AML compliance with the business is less prone to risk elements.

Automated AML software solutions further help businesses reduce manual, repetitive tasks. This helps businesses optimise the use of business resources, increase operational efficiency and meet timelines.

Conquer Compliance Challenges with

Cuting-Edge AML Software

Singup for our beta waitlist and stay compliant

with evolving UAE regulations.

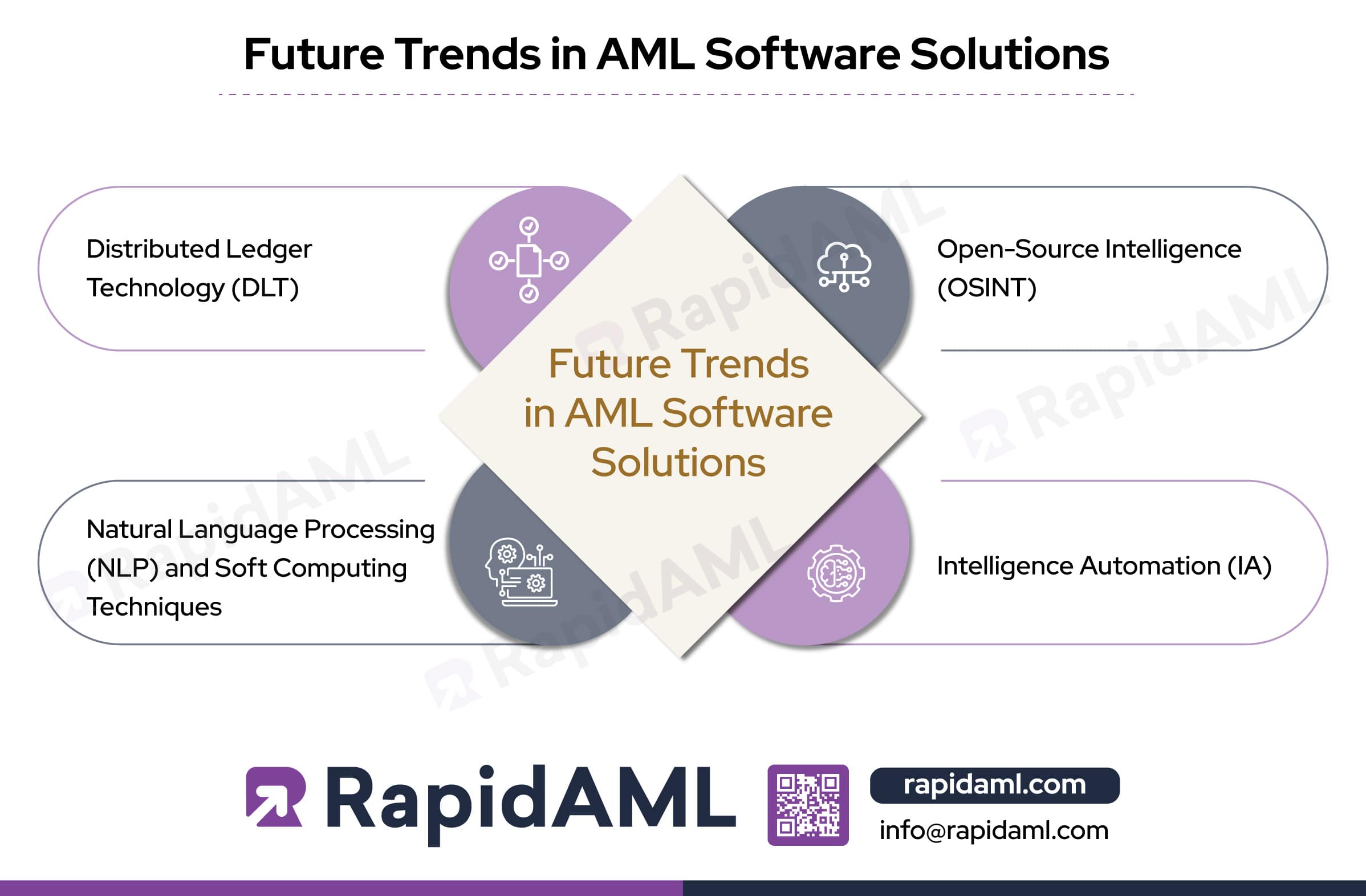

Relying on outdated and less efficient manual compliance practices cannot fulfil the constantly changing and upgrading AML compliance landscape.

Current and future AML compliance requirements dictate the use of technology to filter through high volumes of publicly available data sources and use trend and predictive analysis to safeguard against upcoming risk threats.

The use of technology in this regard is recommended by supervisory authorities and federal law in the UAE, emphasising the need for better compliance through technological advancements.

Open-Source Intelligence (OSINT)

OSINT is a database of analysis conducted from open sources to produce actionable intelligence. It can be used for AML compliance, such as gathering social media intelligence for adverse media screening for customers by observing them online and devising results from such observation.

OSINT also helps businesses analyse links between complex business structures. It helps in customer onboarding by assessing and assigning risk ratings and identifying high-risk customers. OSINT tools can help with proactive AML risk management.

Intelligence Automation (IA)

IA, commonly known as cognitive automation, combines concepts such as AI, ML, and RPA to help AML solutions replicate human intelligence while performing AML compliance functions and decision-making. Often, IA uses technologies like NLP, generative AI, and optical character recognition (OCR) to streamline operational processes.

IA has the potential to enable businesses to conduct AML activities much faster than existing technologies, help with data retrieval from various sources, and generate accurate results.

Natural Language Processing (NLP) and Soft Computing Techniques

NLP is an AI that understands, interprets and modifies human language. Fuzzy Logic systems are an example of NLP where improper or ambiguous language inputs (such as names in various scripts such as Arabic or Russian) can be simplified into logical outcomes.

Fuzzy logic is used in name screening and has the potential to be used for various software solutions where simplifying ambiguous data is required. Soft computing and NLP can replicate human decision-making processes for risk analysis and high-risk customers, resulting in well-informed decisions.

Distributed Ledger Technology (DLT)

DLT is a system for recording transactions in which transaction details are recorded simultaneously at multiple places. It does not have a central data registry.

DLT technology can help manage CDD and transaction monitoring processes better by improving the traceability of cross-border transactions and making ID verification much more accessible. DLT can also share watchlists and pool data among group entities.

Conclusion

Businesses in the UAE must upgrade their AML compliance process by relying on AML software, tools, or APIs designed to suit their specific and sector-centric business needs.

The FATF, UAE Federal Laws, and Supervisory guidelines issued by bodies such as the Dubai Financial Services Authority (DFSA) and Financial Services Regulatory Authority (FSRA) for the Abu Dhabi Global Market (ADGM) recommend relying on technology tools and solutions to ensure AML/CFT compliance.

Transitioning from traditional AML processes to new software solutions and advancements requires staff familiarisation and training.

The future of AML compliance technology, or the commonly used buzzword “RegTech”, considers various technological advancements that businesses need to be on the lookout for prompt implementation.

RapidAML is the best AML software in the UAE designed to support the various compliance tasks of DNFBPs and VASPs, from smooth customer onboarding to determining customer risk profiling and accurately submitting various regulatory reports.

Don’t Let Regulatory Changes Catch You Off Guard

RapidAML Ensures Sanctions Screening, Transaction Monitoring, And Reporting Stay Up-To-Date

Pathik is a Chartered Accountant with over 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise-Wide Risk Assessments to implementing robust AML compliance frameworks. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.

Pathik's expertise extends to guiding businesses in navigating complex regulatory landscapes, ensuring adherence to FATF and other international standards, and mitigating financial crime risks. He is a recognised thought leader in AML/CFT, frequently sharing insights on emerging compliance challenges on various platforms.

Get Started

Contact Us