The FATF Blacklist is a list of countries that either do not have any anti-money laundering and counter-terrorist financing (AML/CFT) legislation or have inefficient ones due to which they have failed to make sufficient progress in addressing these ML/FT concerns.

The Financial Action Task Force (FATF) is a global watchdog for activities involving Money Laundering, Terrorism Financing, and Proliferation Financing of weapons of mass destruction (ML/TF/PF). It was founded to research and analyse global trends in ML, FT, and PF and give recommendations to its signatories, enabling them to combat these illicit activities. As of 27 October 2023, the FATF had 40 members, and over 200 countries are signatories to its recommendations.

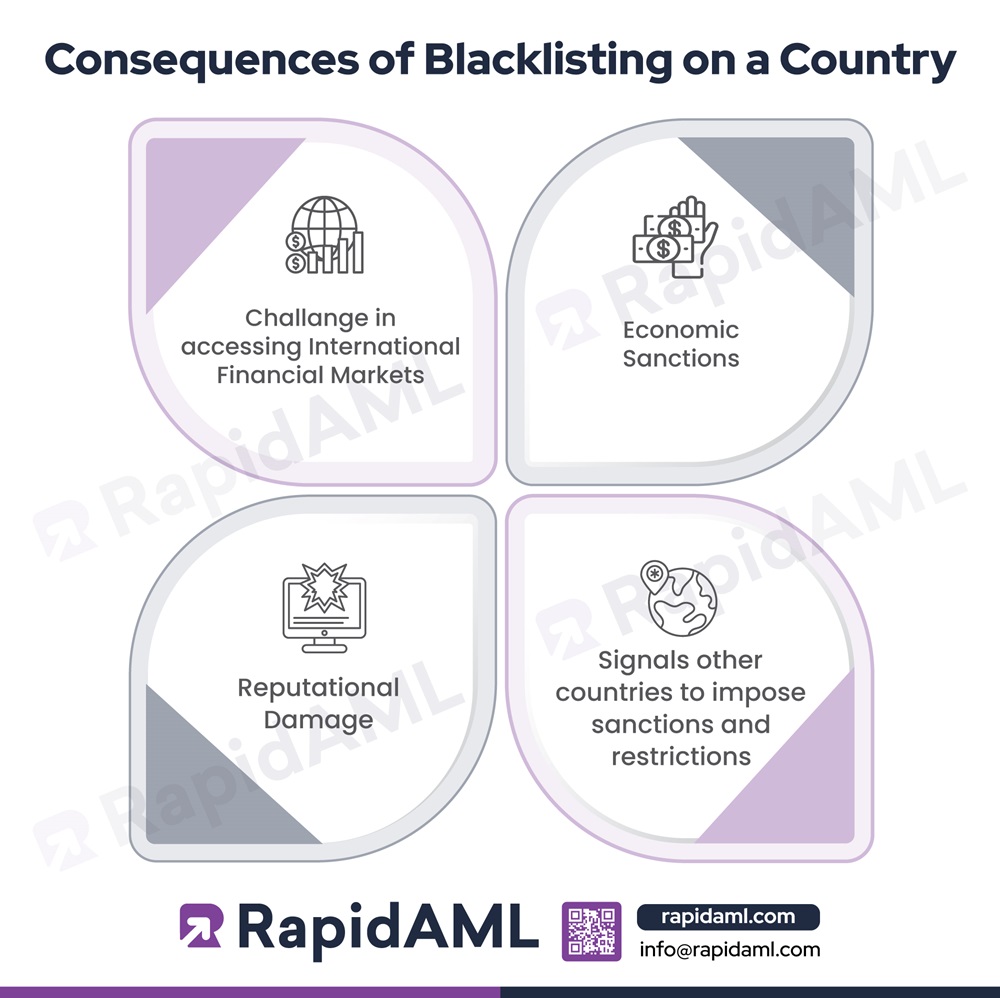

A blacklisted country is subject to a call for action by the FATF, which means that other countries are informed by the FATF that blacklisted countries should not be entertained for conducting business until their AML framework is at par with the requirements of the FATF.

FATF is a global AML watchdog and does not have the power to enforce a complete ban on blacklisted countries. However, the issuance of blacklist signals that businesses and countries must avoid conducting business with such a country.

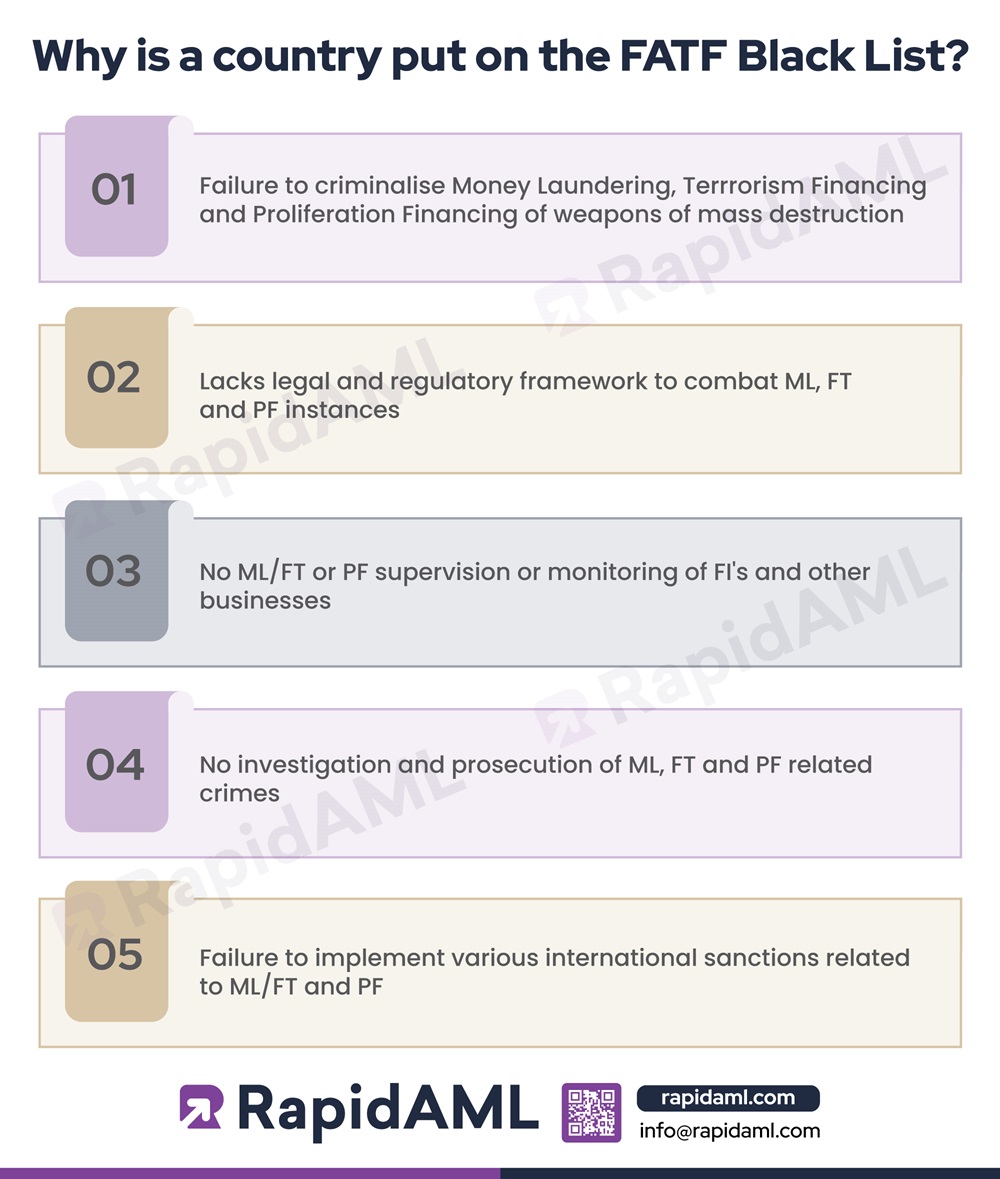

A country or jurisdiction is placed on the FATF Blacklist when:

In order to ensure compliance, the FATF conducts regular assessments of countries’ AML and CFT status through its mutual evaluation process. If a country is found to have deficiencies or if it fails to make sufficient progress in addressing the deficiencies, the FATF can place them on the Blacklist after warnings.

The FATF frequently updates their blacklist; if a blacklisted country appears to have addressed their deficiencies in curbing ML/FT and PF, the FATF evaluates whether the country can be de-listed or should its listing in the ‘blacklist’ continue.

A country which is placed on the FATF Blacklist can have severe consequences, which include:

The Designated Non-Financial Businesses and Professions (DNFBPs), such as Dealers in Precious Metals and Stones (DPMS), real estate agents, and professionals such as lawyers, accountants, and Virtual Asset Service Providers (VASPs) involved in Virtual Assets (VA) activities operating in the UAE need to be vigilant about having due diligence measures in place while dealing with customers (also suppliers, business partners, or third parties) from the blacklisted countries.

Ideally, DNFBPs and VASPs should not conduct business with a FATF-blacklisted country. However, FATF recommendations are only suggestive in nature and cannot be enforced, but since UAE is a signatory to FATF, it is important that DNFBPs and VASPs in UAE follow certain measures as follows:

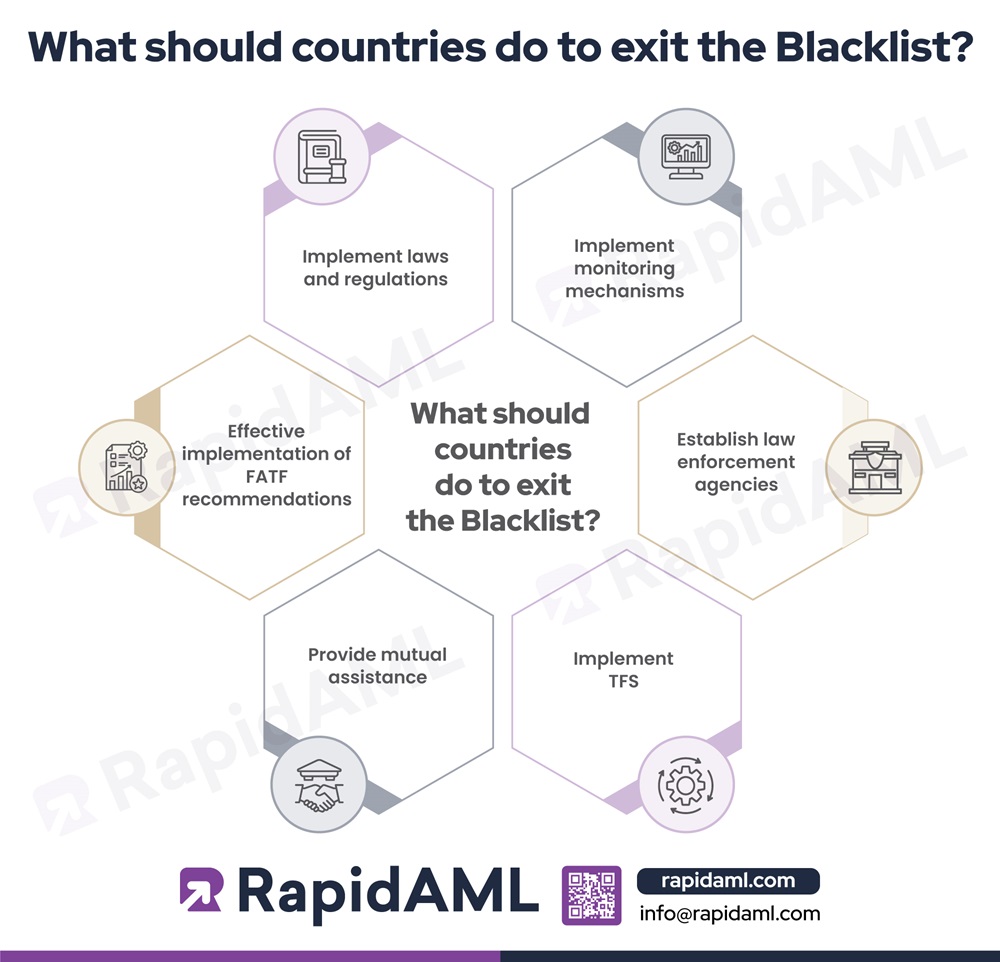

To exit the FATF Blacklist, countries must address the deficiencies in their regulatory framework identified by the FATF and implement an action plan to strengthen their AML/CFT regimes. This involves:

Laws and Regulations:

Blacklisted countries must improve their legal and regulatory frameworks to ensure compliance with the FATF’s recommendations for combating money laundering and terrorist financing. The countries should adequately criminalise ML, FT and PF activities.

Monitoring Mechanisms:

Blacklisted countries must establish an effective monitoring system and customer due diligence regime enabling their businesses to detect money laundering and terrorist financing activities.

Enforcement Agencies:

Blacklisted countries must ensure that law enforcement agencies like judiciary, tribunals and police are equipped with the necessary resources, training, and tools to effectively investigate and prosecute cases related to money laundering and terrorist financing.

Targeted Financial Sanctions:

The FATF recommends financial sanctions to comply with the resolutions of the United Nations Security Council (UNSC). The UNSC regulations require member states to freeze the funds and assets of the listed individuals and groups and ensure that no further funds or assets are made available to them in the future.

Mutual Assistance:

Backlisted countries must ratify international conventions on the prevention of TF, such as the Palermo Convention, clarifying that they shall provide mutual legal assistance.

Regular Reporting and On-Site Assessments:

The FATF and its regional bodies conduct regular assessments and on-site visits to evaluate a country’s progress in implementing the FATF’s recommendations and addressing deficiencies identified by the FATF. Countries must ensure effective implementation of the recommendations from time to time to be considered for removal from the Blacklist.

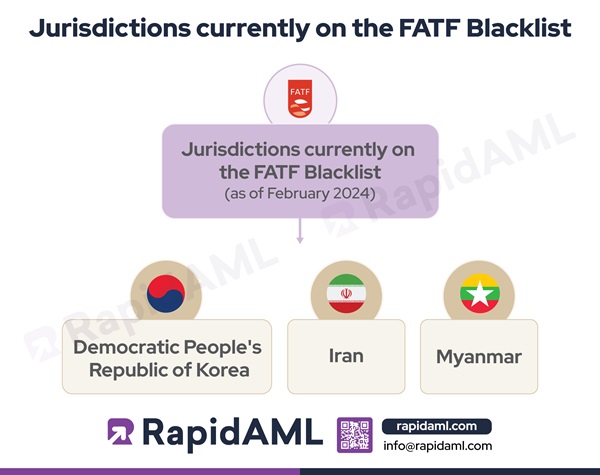

As of February 2024, the following jurisdictions are on the FATF Blacklist:

Democratic People’s Republic of Korea

The FATF has blacklisted North Korea as it poses a threat to the proliferation of weapons of mass destruction, and it has failed to address these concerns.

Iran

Iran is on the blacklist as it has failed to enforce the Palermo and Terrorist Financing conventions in accordance with FATF standards. Iran will be out of the blacklist or be delisted when the full ‘Action Plan’ is completed.

Myanmar

Myanmar is on the blacklist due to not renewing or updating its action plan and not addressing the supervision of money value transfers. Myanmar will be out of the blacklist when its full action plan is completed.

The DNFBPs and VASPs operating in the UAE need to consider the FATF blacklist when making a customer onboarding or offboarding decision, and their internal policies, procedures, and controls must be formulated on the basis of a risk-based approach.

Whether or not to conduct business with blacklisted countries depends on the risk appetite of the DNFBPs and VASPs, as blacklisting is suggestive in nature, signalling that such a country should be avoided while conducting business due to their nature of being associated with criminal activities such as money laundering, terrorism financing, and proliferation of weapons of mass destruction and conducting business with them would mean exposing one’s own business with high risk emanating from conducting business with such blacklist countries.

DNFBPs and VASPs in UAE need to educate themselves on the reasons why certain countries are blacklisted and the reasons why these countries are unable to remove themselves from the blacklist. Having information about this shall help DNFPs and VASPs in UAE to formulate and implement AML/CFT and CPF measures that are compliant with UAE federal laws and FATF recommendations and rely on AML solutions specifically designed to address high-risk customers, high-risk countries, and enhanced due diligence measures required.

Purva is a Certified Anti-Money Laundering Specialist (CAMS) and a Lawyer with 5+ years of experience.

She has substantial knowledge of Anti-Money Laundering Laws, Rules, Regulations, and AML Compliance Processes. Purva has been instrumental in drafting RegTech processes, corporate policymaking, and fulfilling various legal research and drafting requirements arising from AML laws and regulatory technology.

Solutions

Services

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Solutions

Transaction Monitoring

Regulatory Reporting

Services

AML/CFT Health Check

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Contact Us