RapidAML Team

2024-06-18

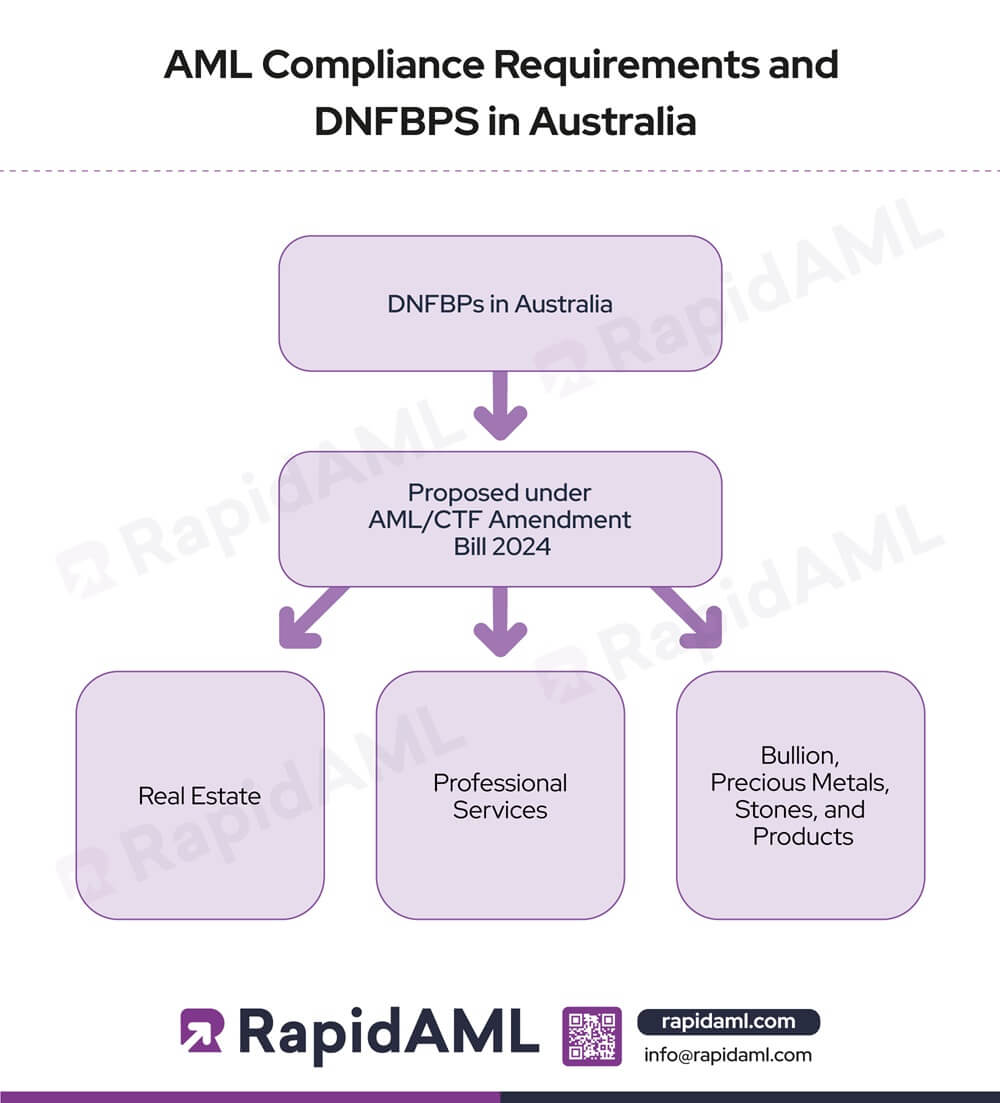

Anti-Money Laundering and Counter-Terrorism Financing Amendment Bill 2024, once passed, will extend the AML regime to ‘tranche 2’ service provider entities, including accountants, lawyers, corporate service providers, real estate agents, precious commodities traders, etc. These ‘tranche 2’ entities are also known as Designated Non-Financial Businesses and Professions (DNFBPs).

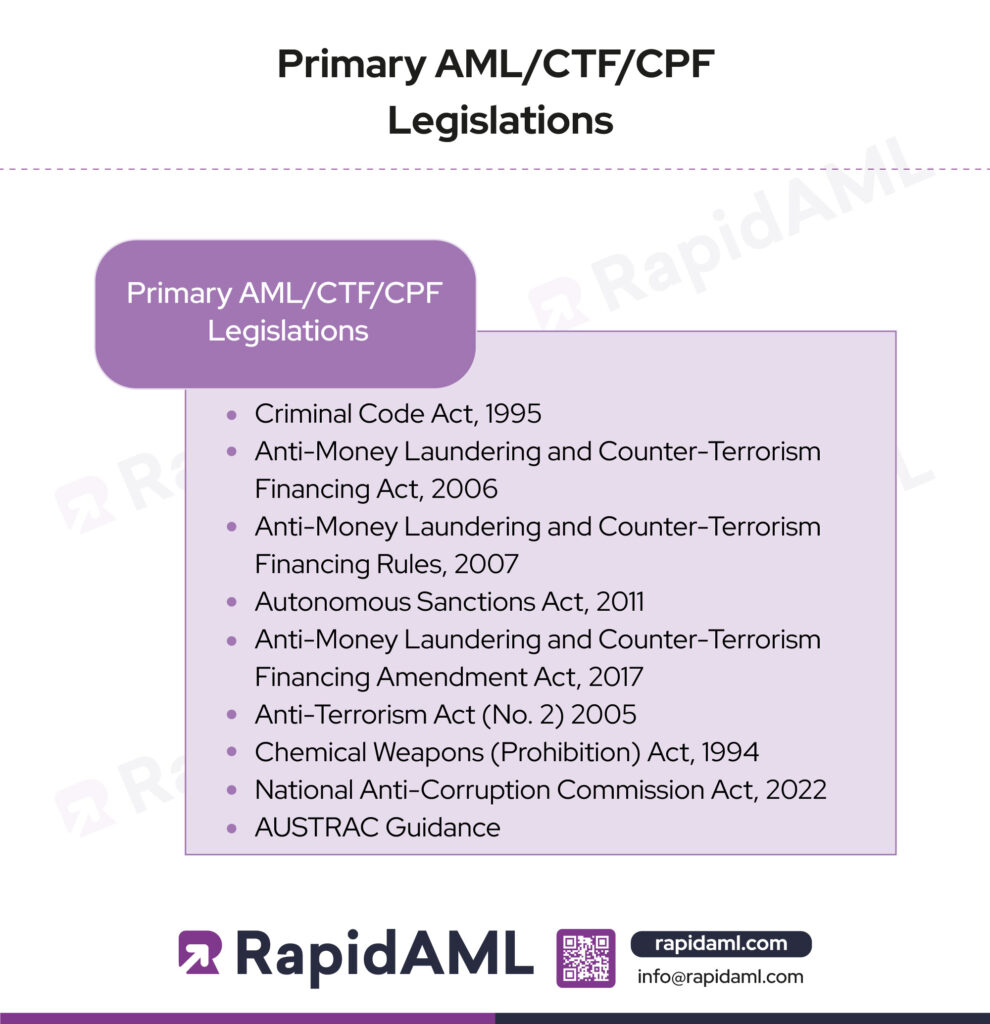

The Anti-Money Laundering (AML), Counter-Terrorism Financing (CTF), and Counter-Proliferation Financing (CPF) regulatory framework will make it necessary for reporting entities, including Designated Non-Financial Businesses and Professionals (DNFBPs) that engage in designated services, to implement effective and efficient AML/CTF programs. These programs must include core compliance measures to ensure adherence to AML/CTF laws.

This blog intends to provide insights into the core AML/CTF compliance requirements for DNFBPs in Australia and explores how the use of technology and AML software have shifted the burden imposed by manual processes for DNFBPs. The blog covers areas such as the definition of DNFBPs, key AML/CTF/CPF regulations and regulatory authorities and highlights how the transition from manual AML compliance processes to automated AML software simplifies and streamlines the AML compliance obligations for DNFBPs in Australia.

Australia’s AML/CTF regulations mandate reporting entities to comply with AML requirements. These reporting entities include both the financial sector and other businesses providing designated services, which include DNFBPs. Designated services are those services that require reporting entities to adhere to AML/CTF regulations in Australia.

While the AML/CTF regulatory framework in Australia does not define the term DNFBPs, the term with respect to Australia was coined by the Financial Action Task Force in the country’s evaluation report. Currently, the AML/CTF regulatory framework in Australia only includes three DNFBPS sectors, the Casinos, Solicitors, and Bullion sectors, with all other DNFBPs exempted from AML/CTF obligations.

However, with the evolving nature of money laundering (ML), terrorist financing (TF), and proliferation financing (PF), it was the need of the hour to make high-risk businesses subject to the AML/CTF/CPF regulations. In response, the Government of Australia has proposed an amendment to the Anti-Money Laundering and Counter-Terrorism Financing Act, 2006, through the introduction of the Anti-Money Laundering and Counter-Terrorism Financing Amendment Bill, 2024. This bill seeks to expand the scope of designated services to include additional professionals and businesses, thereby requiring them to comply with AML/CTF laws. The proposed entities include:

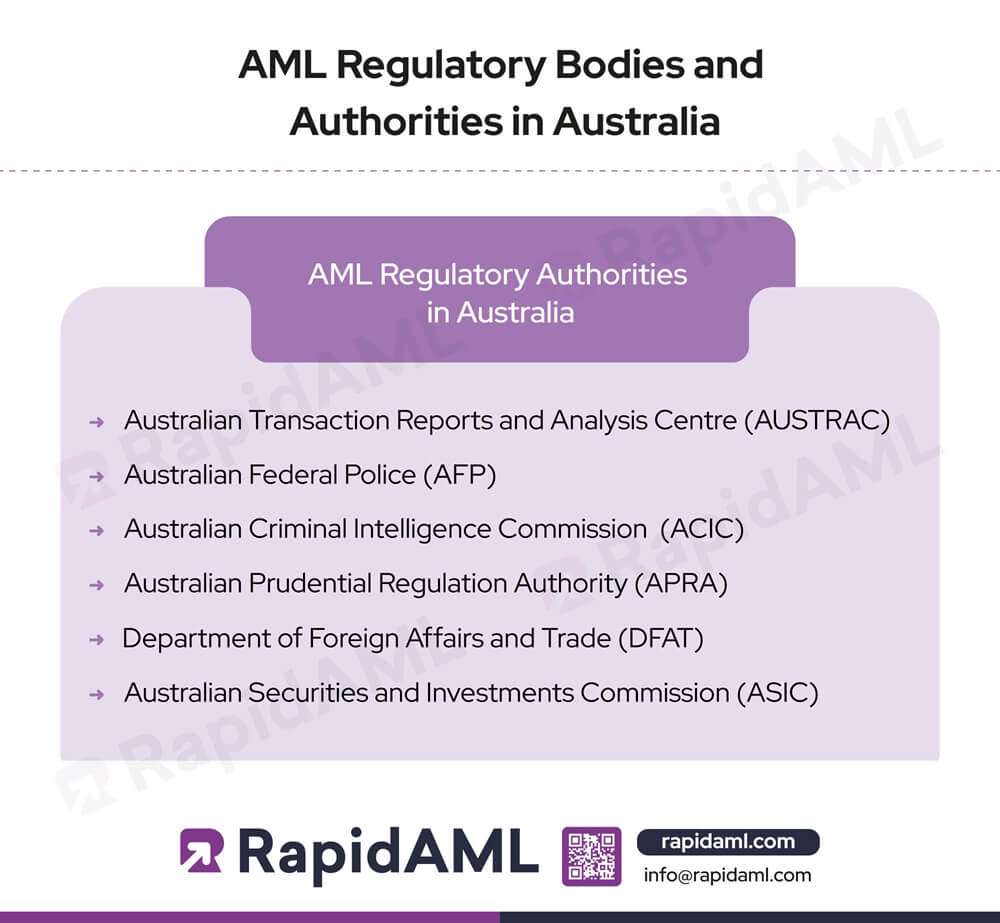

The AML regulatory framework for DNFBPs in Australia includes AML/CTF regulations and regulatory authorities.

The government of Australia has proposed an amendment to the AML CTF Act, 2006, which aims to widen the meaning of designated services and professions under the AML CTF Act, 2006, for the purpose of compliance with AML/CTF laws in Australia.

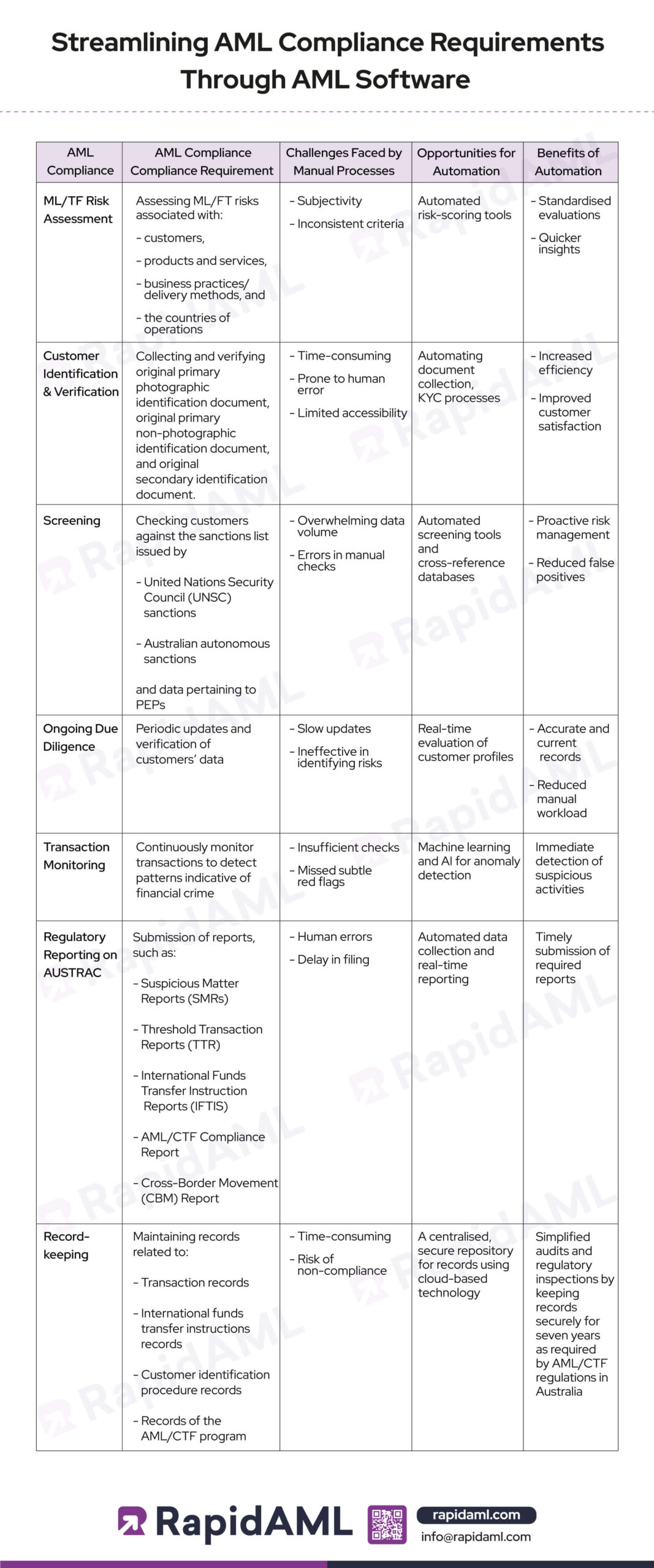

The AML/CTF regulatory framework in Australia requires reporting entities to implement an AML/CTF program to detect and deter money laundering and terrorism financing. As part of the program, they are required to comply with various requirements. The following are compliance requirements and how, with the shift from manual processes to AML software, DNFBPs can achieve more efficiency in implementing their AML/CTF program.

| AML Compliance | Compliance Requirement | Challenges Faced by Manual Processes | Opportunities for Automation | Benefits of Automation |

| ML/TF Risk Assessment | Assessing ML/FT risks associated with: – customers, – products and services, – business practices/delivery methods, and – the countries of operations |

– Subjectivity – Inconsistent criteria |

Automated risk-scoring tools | – Standardised evaluations – Quicker insights |

| Customer Identification & Verification | Collecting and verifying original primary photographic identification document, original primary non-photographic identification document, and original secondary identification document. | – Time-consuming – Prone to human error – Limited accessibility |

Automating document collection, KYC processes |

|

| Screening | Checking customers against the sanctions list issued by – United Nations Security Council (UNSC) sanctions – Australian autonomous sanctions and data pertaining to PEPs |

– Overwhelming data volume – Errors in manual checks |

Automated screening tools and cross-reference databases | – Proactive risk management – Reduced false positives |

| Ongoing Due Diligence | Periodic updates and verification of customers’ data | – Slow updates – Ineffective in identifying risks |

Real-time evaluation of customer profiles | – Accurate and current records – Reduced manual workload |

| Transaction Monitoring | Continuously monitor transactions to detect patterns indicative of financial crime | – Insufficient checks – Missed subtle red flags |

Machine learning and AI for anomaly detection | – Immediate detection of suspicious activities |

| Regulatory Reporting on AUSTRAC | Submission of reports, such as: – Suspicious Matter Reports (SMRs) – Threshold Transaction Reports (TTR) – International Funds Transfer Instruction Reports (IFTIS) – AML/CTF Compliance Report Cross-Border Movement (CBM) Report |

– Human errors – Delay in filing |

Automated data collection and real-time reporting | – Timely submission of required reports |

| Record-Keeping | Maintaining records related to: – Transaction records – International funds transfer instructions records – Customer identification procedure records Records of the AML/CTF program |

– Time-consuming – Risk of non-compliance |

A centralised, secure repository for records using cloud-based technology | – Simplified audits and regulatory inspections by keeping records securely for seven years as required by AML/CTF regulations in Australia |

ML/TF Risk Assessment

Customer Identification and Verification

Ongoing Due Diligence

Transaction Monitoring

Regulatory Reporting

Record-Keeping

DNFBPs in Australia must comply with AML regulations. With the advancement of technology, DNFBPs are opting for technology integration. The transition from manual processes to AML software enhances compliance with AML regulatory requirements and significantly reduces operational risks. By leveraging technology, organisations can ensure they meet their AML/CTF obligations effectively and efficiently, reducing the risk of exposure to ML/TF risks.

Pathik is a Chartered Accountant with over 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise-Wide Risk Assessments to implementing robust AML compliance frameworks. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.

Pathik's expertise extends to guiding businesses in navigating complex regulatory landscapes, ensuring adherence to FATF and other international standards, and mitigating financial crime risks. He is a recognised thought leader in AML/CFT, frequently sharing insights on emerging compliance challenges on various platforms.

Solutions

Services

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Solutions

Transaction Monitoring

Regulatory Reporting

Services

AML/CFT Health Check

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Contact Us