RapidAML Team

2024-05-17

Adverse Media is any negative information or news about a person or an entity. From an Anti-Money Laundering and Counter Financing of Terrorism (CFT) regulations perspective, adverse media means that there is materially important negative news about the customer of a business that is indicative of the potential involvement of such customer with Money Laundering, Financing of Terrorism, or Proliferation Financing of weapons of mass destruction (ML/FT/PF) or any other crimes. Such negative news or adverse media is generally available in the public domain or sources such as new items, blogs, reports, web articles, news bulletins, social media platforms, and so on.

From the Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) compliance perspective, adverse media screening refers to the research on reliable and independent public sources discussed above to identify whether any customer is involved in any ML/FT or PF activities. Such a customer can be a natural person, including the Ultimate Beneficial Owner (UBO) of a legal entity or a legal arrangement customer.

Types of Negative News/Adverse Media

The adverse news that can be found while digging through publicly available information can uncover the following types of adverse news:

Criminal Records

Criminal Records refers to information bringing to light, the involvement of a customer in any criminal proceedings or records. Such criminal records may include, but are not limited to, crimes such as fraud, bribery, money laundering, corruption, murder, and other gravely illegal behaviours.

Regulatory Enforcement

Another type of adverse media is regulatory enforcement, which shows violations done by a customer relating to any regulatory agencies’ rules, directives and regulations. For example, violation of directives, of the Central Bank of UAE (CBUAE).

Negative Press Coverage

Adverse media also consists of negative press coverage, such as news that portrays any individual or entity in a bad sense due to any piece of controversy, gossip material, or defamation.

Adverse Public Records

Adverse public records include negative information such as financial instability or bankruptcy news, involvement in lawsuits or scandalous events or being blacklisted for non-payment of government dues, etc.

Regulatory requirements around Negative News Screening

The Financial Action Task Force (FATF) recommends that DNFBPs and VASPs include adverse media screening in their Anti-Money Laundering (AML) and Counter Financing of Terrorism (CFT) measures, particularly the customer onboarding and ongoing monitoring of business relationships process.

The process or methodology of blending Adverse Media Screening into a business’s AML/CFT compliance framework requires ensuring that the following requirements are met:

Taking a Risk-Based Approach around adverse media

To determine the exact depth and detail-oriented results required to fulfil the needs of the business’s adverse media screening needs, the DNFBPs and VASPs need to rely on the Risk-Based Approach. The Risk-Based Approach (RBA) requires deploying ML/FT and PF risk mitigation measures based on and in proportion to the level of risk their business is exposed to. Having an RBA helps in determining the degree of implementation and type of adverse media screening required.

Procedures for Conducting Adverse Media Searches

Upon having relied on the RBA, the procedure for conducting adverse media searches can be determined and documented in the AML/CFT policies, procedures, and controls. These procedures may include the use of manual or software adverse media searches.

Selecting an adverse media screening software

Adverse media screening software can be used to conduct adverse media searches. The selection of software largely depends on the ML/FT and PF risk exposure and the RBA.

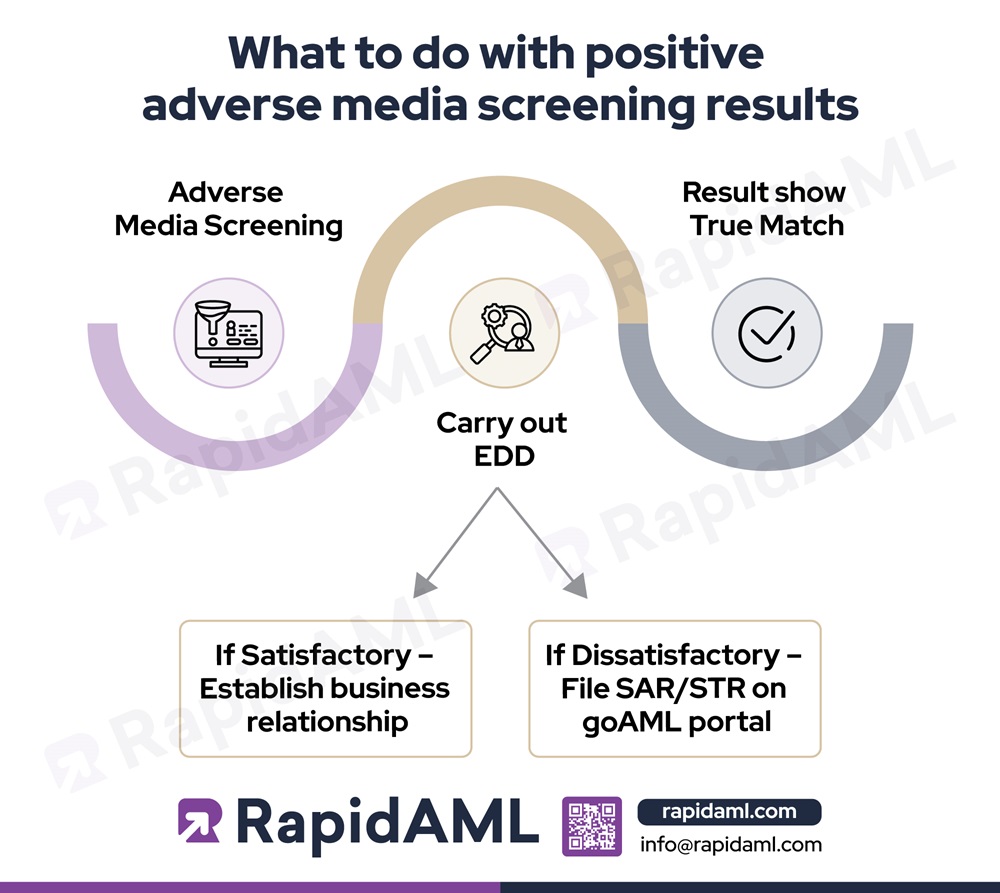

Performing EDD for adverse media matches

Further, the performance of EDD for positive matches must be made into a practice, and such a practice should be included in the AML/CFT policies, procedures, and controls. Having conducted EDD will help the business to identify the true nature of the business relationship by assessing the source of funds and source of wealth of the customer to make sure that the profile of the customer is consistent with the transaction proposed to be carried out.

Submitting SAR/STR for adverse media matches

The ultimate outcome of any positive match, after having a dissatisfactory EDD procedure where the suspicion on the customer cannot be averted, then such a positive match and dissatisfactory EDD procedure must be recorded, analysed and reported to the FIU by filing a Suspicious Activity Report (SAR) or Suspicious Transaction Report (STR), depending on the situation.

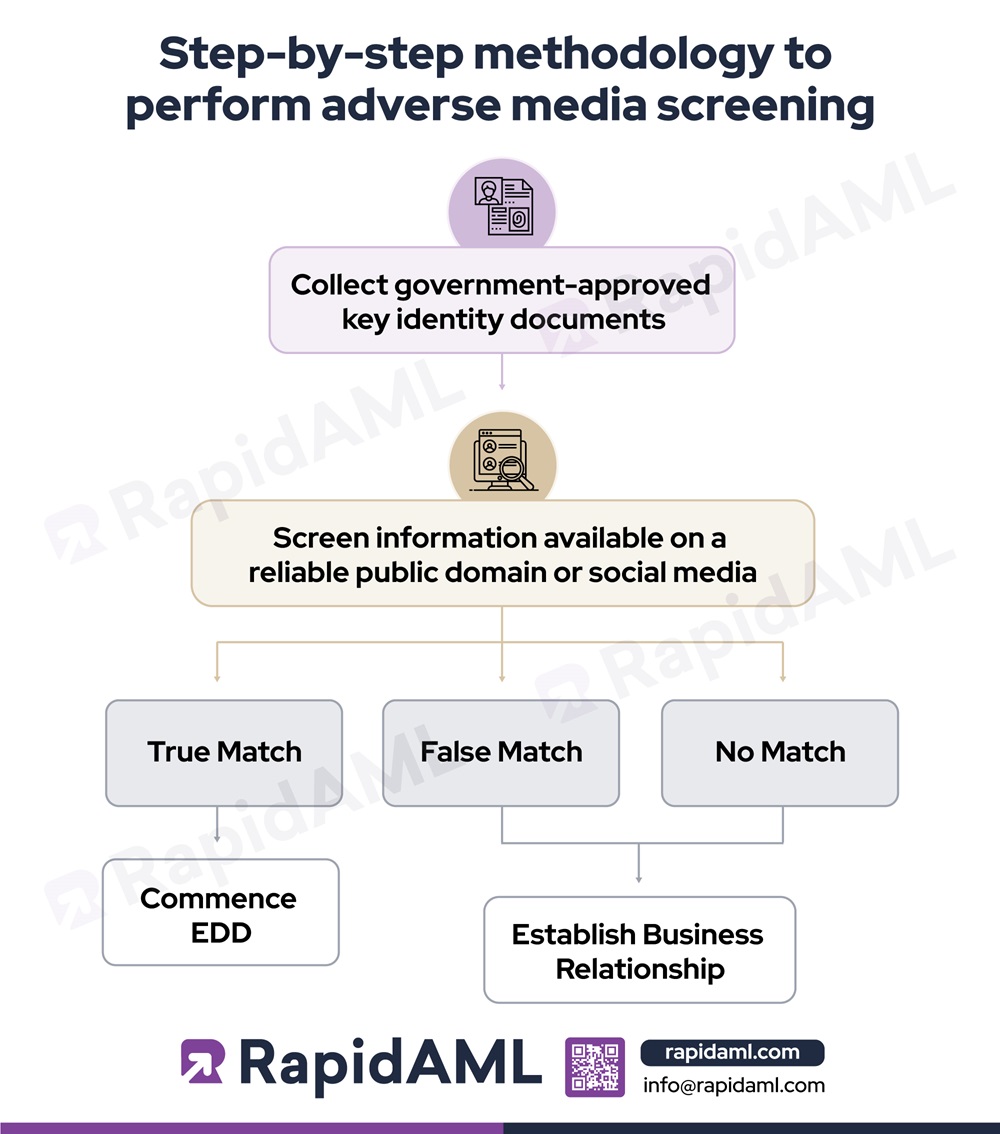

1. Collection of government-approved key identity documents such as passports or trade licenses to find out the official name of the customer.

2. Then, the name of the customer is screened through the information available on a reliable public domain or social media.

3. Check the adverse media screening results; there would be three possible outcomes:

When the Adverse media screening results turn out to be positive, then such positive results must be investigated to dig deeper into the involvement of the customer with the subject matter of adverse news, such as criminal charges. To do so, the customer-facing staff must escalate the positive adverse media screening results to the Compliance Officer. The Compliance Officer must investigate, analyse, and decide if such adverse news amounts to any potential ML/FT or PF red flag or seems abnormal and requires the filing of relevant mandatory reports such as SAR/STR on the goAML portal to report to the Financial Intelligence Unit (FIU).

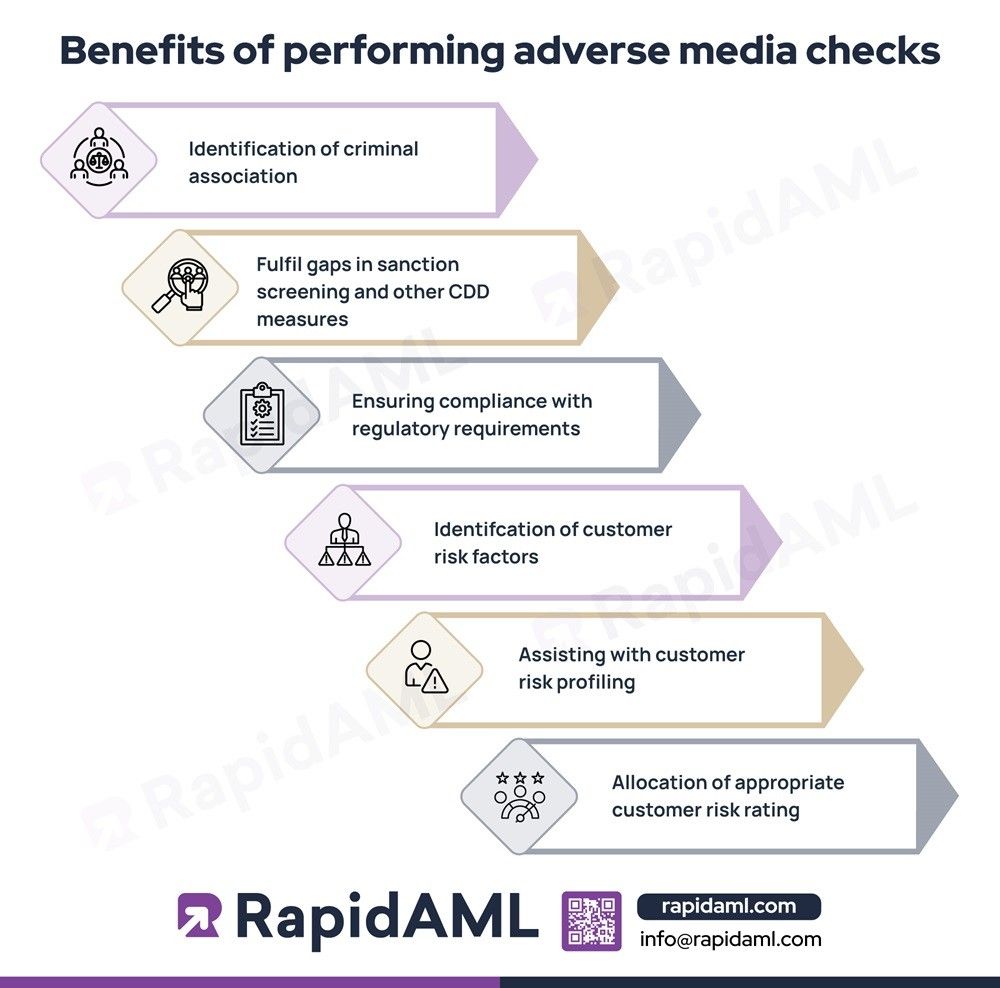

The immediate benefit of performing adverse media screening is the ability to identify if a customer or associations of a customer are involved in any criminal activity, which may have been missed during the usual identity verification process or sanction screening process. Such an oversight might lead to non-compliance with the regulatory requirement of reporting suspicious activities and transactions, leading to the imposition of fines, penalties, and/or imprisonment.

The adverse media check also helps the business to identify customer risk factors and assign appropriate customer risk ratings and customer risk assessment to determine if the customer should be treated as high, medium, or low risk.

Implementing Ongoing Adverse Media Screening

DNFBPs and VASPs must seriously consider deploying adverse media screening on an ongoing basis and not restricting the same to just prior customer onboarding. This shall help DNFBPs and VASPs to identify any negative news or adverse media as and when such negative news comes up during the lifespan of a business relationship.

Implementing Automated AML Solutions for Adverse Media Screening

With various AML/CFT software solutions available in the market, DNFBPs and VASPs can select appropriate automation solutions for carrying out adverse media screening for the business based on its RBA. Implementing an automation solution will help streamline processes and reduce costs as repetitive tasks of negative news screening and record keeping can be automated by such software solutions.

Conclusion

DNFBPs and VASPs operating in the UAE should seriously consider relying on AML solutions for carrying out adverse media screening as doing so will enable the DNFBPs and VASPs to identify on a real-time basis, any abnormal or suspicious pattern that emerges through the negative news that might come up about any customer or their associates and beneficial owners. DNFBPs and VASPs need to develop their understanding of the regulatory requirement of adverse media screening and fundamental steps to carry out the same to avoid regulatory lapses, leading to fines, penalties, and imprisonment.

Pathik is a Chartered Accountant with over 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise-Wide Risk Assessments to implementing robust AML compliance frameworks. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.

Pathik's expertise extends to guiding businesses in navigating complex regulatory landscapes, ensuring adherence to FATF and other international standards, and mitigating financial crime risks. He is a recognised thought leader in AML/CFT, frequently sharing insights on emerging compliance challenges on various platforms.

Solutions

Transaction Monitoring

Regulatory Reporting

Services

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Solutions

Transaction Monitoring

Regulatory Reporting

Services

AML/CFT Health Check

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Sign Up Form