RapidAML Team

2025-09-18

Australia’s sanctions regime plays a central role in protecting national security and supporting international peace in the context of Sanctions and Proliferation Financing Risks in Australia. By restricting activities that could enable the development or spread of Weapons of Mass Destruction (WMD), sanctions help ensure that businesses, institutions, and individuals do not inadvertently contribute to threats against global stability arising from Sanctions and Proliferation Financing Risks in Australia.

Purpose of the ASO Advisory

The Australian Sanctions Office (ASO), part of the Department of Foreign Affairs (DFAT), has issued guidance on Sanctions and Proliferation Financing Risks in Australia to assist organisations in strengthening their compliance systems. The focus is on recognising and mitigating the risks of Proliferation Financing (PF), while encouraging Regulated Entities (REs) to adopt practices that align with both domestic obligations and international expectations.

Who Must Comply

These obligations apply to a wide group collectively described as REs that may be exposed to Sanctions and Proliferation Financing Risks in Australia. The category covers government agencies, private companies, professional service providers, and individuals whose activities fall within the scope of sanctions law. For each of these groups, compliance is more than just a formal requirement; it is a safeguard against exposure to unlawful or destabilising activities.

National and International Standards

Sanctions compliance reflects a blend of international standards and domestic law governing Sanctions and Proliferation Financing Risks in Australia.

International standards include:

Globally, FATF provides the benchmark for combating Money Laundering (ML), Terrorism Financing (TF), and PF. Recommendation 7 requires the use of Targeted Financial Sanctions (TFS) to counter PF, while the FATF “call to action” requires stronger measures against high-risk jurisdictions such as Iran and the Democratic People’s Republic of Korea (DPRK).

UNSC reinforces this framework through resolutions such as 1540 (2004), which obliges states to prohibit non-state actors from engaging in activities relating to WMD, and 2325 (2016), which calls for stronger enforcement and tighter export controls.

Domestically, Australia gives effect to these commitments through:

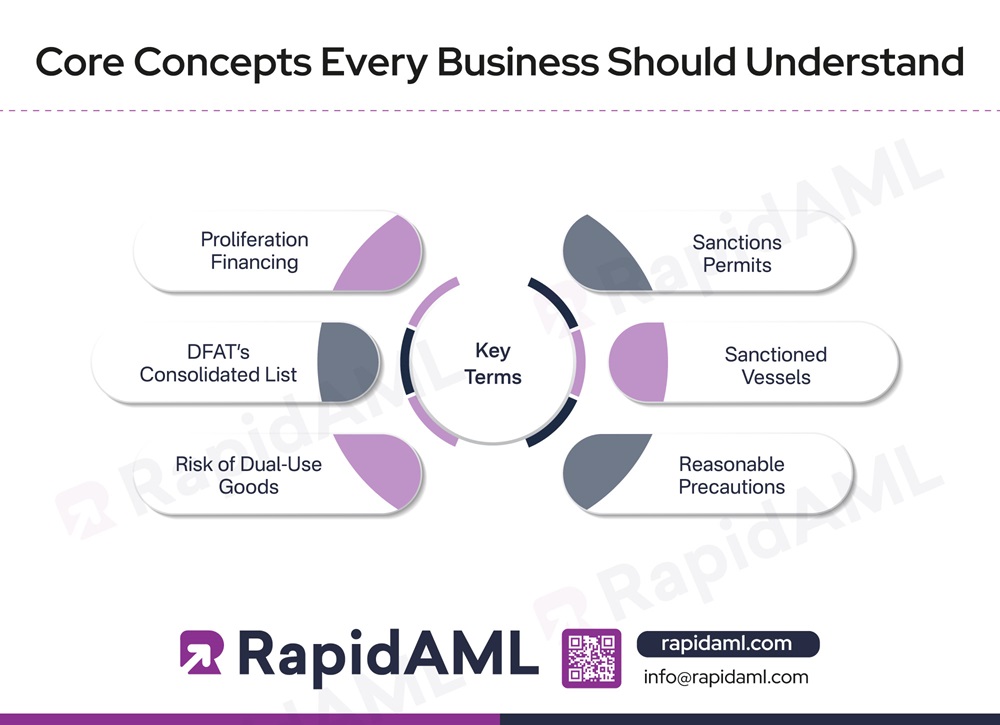

For organisations subject to Australian sanctions law, there are a few concepts that form the foundation of compliance.

Proliferation Financing

PF refers to the provision of funds or financial services that support the development, movement, or possession of nuclear, chemical, biological, or radiological weapons and their delivery systems, forming a key element of Sanctions and Proliferation Financing Risks in Australia. Such activities breach both national and international laws and present significant risks to global peace.

Preventing such financing is therefore critical not only for international security but also for maintaining the integrity of Australia’s financial system.

DFAT’s Consolidated List

A cornerstone of sanctions compliance is the Consolidated List maintained by the Department of Foreign Affairs and Trade (DFAT) to manage Sanctions and Proliferation Financing Risks in Australia. This list identifies designated persons and entities that are subject to TFS, and in some cases, travel bans.

In practice, organisations must screen transactions and parties against this list to ensure they are not engaging with prohibited actors. This measure forms part of the robust internal controls required under Australian sanctions law.

Risk of Dual-Use Goods

Dual-use goods are items designed for both civilian and military applications and are closely linked to Sanctions and Proliferation Financing Risks in Australia. They pose risks because proliferators often exploit legitimate supply chains to acquire them.

Warning signs include requests to route goods through unusual shipping hubs, resistance to providing end-user certificates, or unclear end-use information. Trade in dual-use goods without a transparent purpose is one of the strongest red flags for potential PF.

Sanctions Permits

In certain cases, the Minister for Foreign Affairs may issue a Sanctions Permit, authorising an otherwise prohibited activity. These permits are only granted where doing so serves Australia’s national interest.

Sanctioned Vessels

A vessel may be designated as sanctioned if:

Reasonable Precautions

REs are expected to take “reasonable precautions” to avoid involvement in sanctioned activities associated with Sanctions and Proliferation Financing Risks in Australia. This typically involves:

What counts as reasonable varies according to business size, transaction complexity, geography, and the sanctions regime involved, making it a flexible and content-dependent standard.

Strengthen Your Sanctions Compliance Framework

Learn how to screen, monitor, and apply EDD for high-risk clients and transactions

For REs, sanctions compliance cannot be an afterthought. A strong framework is essential to detect risks early, prevent violations, and protect the integrity of both financial and trading systems. Building such a framework requires a structured approach, one that considers customer behaviour, the nature of products and services offered, geographic exposure, and patterns of transactions linked to Sanctions and Proliferation Financing Risks in Australia.

Assessing Customer, Product and Geographic Risks

PF risks can emerge in different ways, so businesses must look beyond routine checks. Key risk factors include:

Certain industries face heightened exposure. These include Trust and Company Service Providers (TCSPs), Dealers in Precious Metals and Stones (DPMS), VASPs, maritime operators, and academic or research institutions. Each of these sectors has been misused to obscure ownership, transfer value across borders, or gain access to sensitive technologies.

Identification of Transaction Red Flags

Transactions linked to WMD often share warning signs with trade-based ML and Sanctions and Proliferation Financing Risks in Australia. Red flags concerning the same may include:

These indicators are not exhaustive, but together they provide important signals for closer scrutiny.

Screening and Monitoring

Effective compliance requires more than basic due diligence to address Sanctions and Proliferation Financing Risks in Australia. Businesses should integrate PF risks into their broader AML/CTF programs by:

Going Beyond AML/CTF Controls

Traditional AML/CTF systems, while essential, may not capture every PF risk associated with Sanctions and Proliferation Financing Risks in Australia. Recognising this, the AML/CTF Act imposes specific duties from 31 March 2026. Regulated Businesses will need to:

Sanctions Compliance is therefore not static. It demands continuous monitoring, regular reassessment, and, in complex cases, tailored legal advice. Businesses that embed these practices into their compliance culture are better placed to meet regulatory expectations and protect themselves from serious reputational and legal consequences.

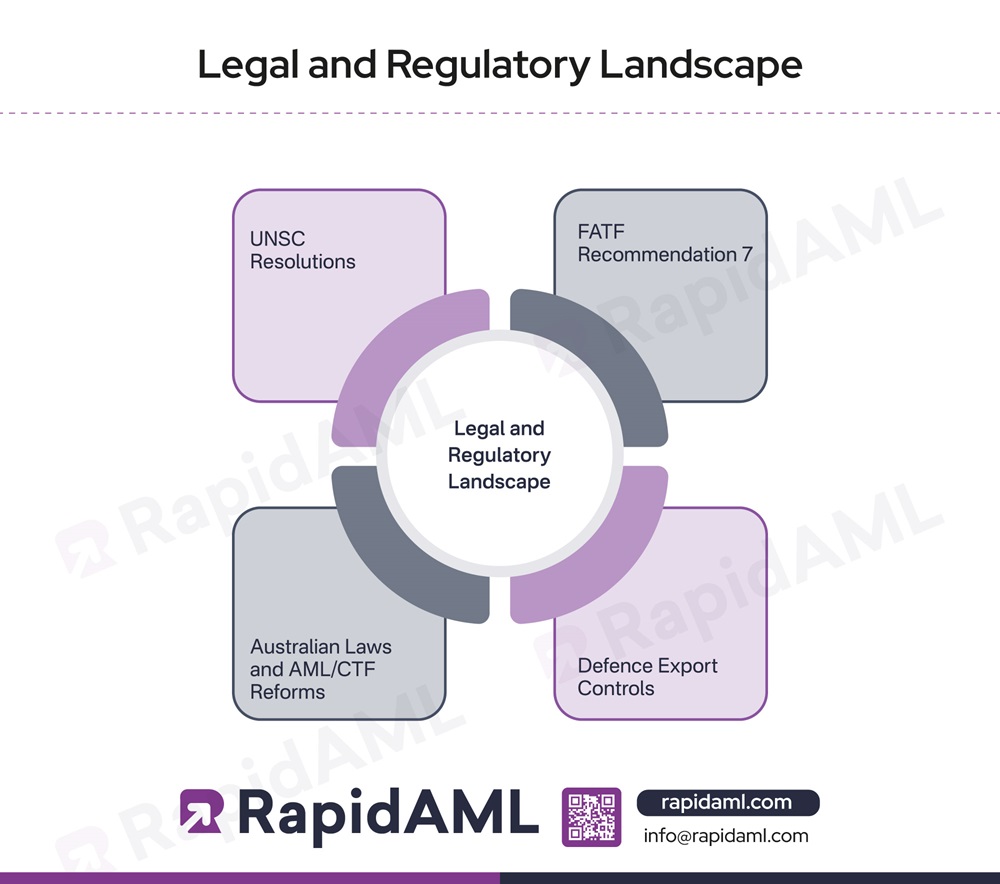

The framework governing PF is shaped by both international commitments and Australian domestic law. REs must be familiar with these obligations to strengthen compliance and ensure that financial and trade systems are not misused for the development of WMD.

United Nations Security Council Resolutions

United Nations Security Council Resolutions (UNSCRs) provide the foundation for international obligations and are central to the global fight against Sanctions and Proliferation Financing Risks in Australia.

FATF Recommendation 7

The FATF sets global standards for tackling ML, TF, and PF which includes and provides base for Sanctions and Proliferation Financing Risks in Australia. The following are a few ways adopted for the same:

Australian Laws and AML/CTF Reforms

Australia implements these international duties or obligations through its own legal system to control Sanctions and Proliferation Financing Risks in Australia.

Defence Export Controls

Defence Export Controls (DEC) regulates the transfer of defence and dual-use goods. DEC:

Together, UNSC obligations, FATF standards, Australian sanctions, AML/CTF reforms, and export controls operate like a layered defence system. Each element acts as a checkpoint to prevent resources from being diverted into PF.

Strengthen your Due Diligence and Countermeasures

Embed PF Risk in your Compliance

International sanctions target states whose activities threaten global peace and security, particularly those linked to the pursuit of nuclear, chemical, biological, or radiological weapons. Within Australia’s sanctions regime, two countries stand out as priority concerns: Iran and the DPRK. Both are subject to a mix of UNSC obligations, FATF requirements, and Australia’s autonomous measures.

Iran Sanctions and FATF Measures

Iran remains under scrutiny due to concerns about its nuclear program and its role in Sanctions and Proliferation Financing Risks in Australia. Sanctions are designed to limit access to materials, technology, and financial systems that could be diverted for weapons development.

The combined effect of these obligations is to isolate Iran from international financial systems and to ensure that businesses implement EDD before entering into any dealings that could create exposure.

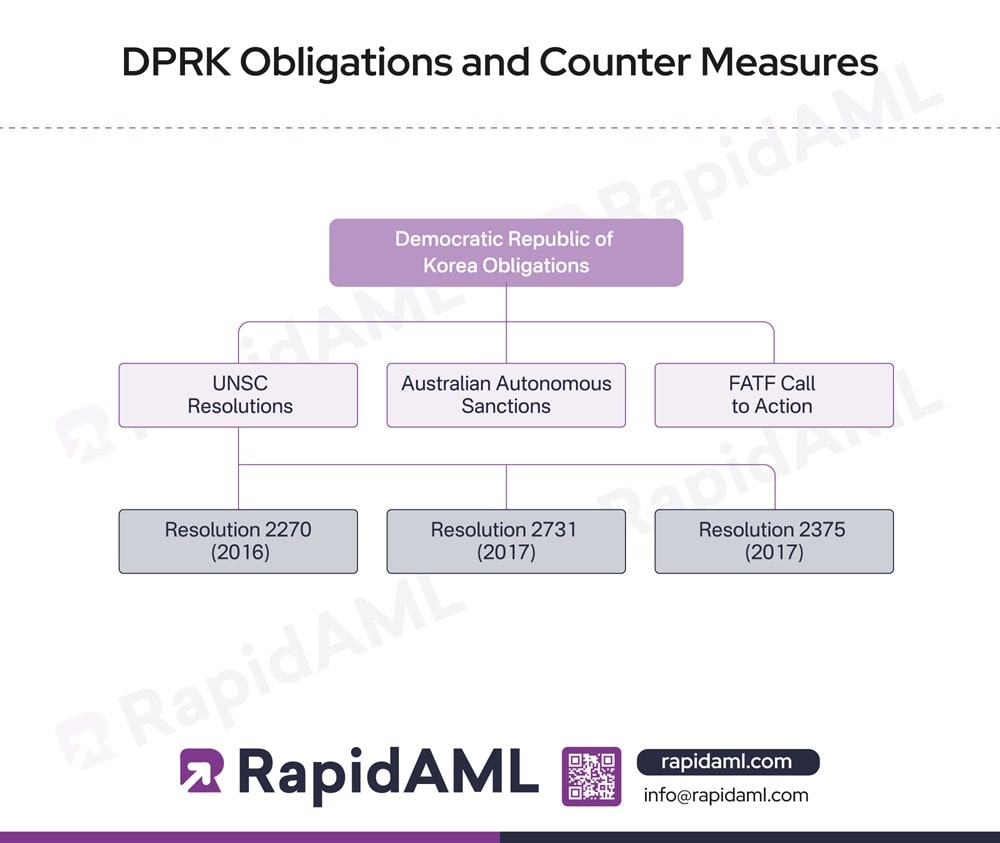

DPRK Obligations and Counter Measures

The DPRK is subject to one of the most stringent sanctions frameworks in existence due to extreme Sanctions and Proliferation Financing Risks in Australia, reflecting its continued pursuit of nuclear weapons and ballistic missile programs.

The risks extend beyond formal financial channels. The DPRK has been linked to cybercrime, fraudulent IT services, and deceptive business practices designed to generate revenue for its weapons programs. These activities are increasingly recognised as PF methodologies.

General Obligations for Businesses

From 31 March 2026, Australian businesses regulated under the AML/CTF Act must apply EDD to all customers connected to high-risk jurisdictions, including Iran and the DPRK. Indicators such as transactions involving parties located in or linked to these countries, unusual documentation, or opaque ownership structures should be treated as potential red flags. For REs, vigilance is not optional; it is the cornerstone of compliance in high-risk environments linked to Sanctions and Proliferation Financing Risks in Australia.

Some industries face higher exposure to PF than others, increasing Sanctions and Proliferation Financing Risks in Australia. These sectors are attractive to proliferators because they can be used to disguise financial flows, transfer goods, or acquire sensitive information. By understanding how each sector can be exploited, businesses are better placed to detect and disrupt suspicious activity.

Trust and Corporate Services

TCSPs offer legitimate support in setting up and managing business structures, yet they are vulnerable to misuse linked to Sanctions and Proliferation Financing Risks in Australia. Proliferators may create shell entities through law firms, accounting firms, or financial planners to obscure the real parties behind transactions. In many cases, intermediaries may not even realise they are being exploited, particularly when clients submit incomplete or inconsistent details that conceal links to sanctioned persons.

Precious Metals and Stones

The trade in gold, diamonds, and other high-value commodities is often less transparent than formal financial channels, increasing Sanctions and Proliferation Financing Risks in Australia. This makes DPMS attractive for those seeking to transfer value across borders without using banks. The physical nature of these assets, combined with cash-based transactions, provides a means of moving funds discreetly to support prohibited activities.

Virtual Assets and Fintech

Digital Assets and financial technology platforms present another avenue for exploitation related to Sanctions and Proliferation Financing Risks in Australia. VASPs, including currency exchanges and decentralised platforms, allow for rapid, cross-border transfers that can bypass traditional oversight. Proliferators have been known to exploit these systems by layering funds through correspondent accounts and converting them into cryptocurrency, thereby complicating detection.

Maritime Industry

The shipping sector is vital for global trade but equally attractive to proliferators involved in Sanctions and Proliferation Financing Risks in Australia. Vessels can be used to transport restricted materials, often under falsified documentation or through altered shipping routes. Some ships may deliberately switch flags, obscure ownership, or disable tracking systems. Such practices allow components for weapons programs to be moved covertly while also generating illicit revenue streams.

Academic Partnerships

Universities and research institutions play a central role in innovation but can also be targets for exploitation contributing to Sanctions and Proliferation Financing Risks in Australia. Foreign researchers or students engaged in legitimate collaborations may transfer sensitive knowledge or technology back to high-risk jurisdictions. This form of intellectual property theft poses significant challenges, as it often hides behind the appearance of academic cooperation.

Across these sectors, proliferators employ a range of techniques to conceal their activities linked to Sanctions and Proliferation Financing Risks in Australia. These include:

Potential warning signs include inconsistencies in customer profiles, unidentified end-users, unusual shipping patterns, and unclear end-use declarations for sensitive goods. These “red flags” are subtle but critical indicators that compliance teams must be alert to.

For REs, sanctions compliance is not a static obligation but a continuous process for managing Sanctions and Proliferation Financing Risks in Australia. A strong compliance framework is essential to guard against PF, helping protect the integrity of the financial system and contributing to wider international security.

AML/CTF Reporting Duties

Alongside stronger due diligence, Regulated Businesses will also face expanded reporting requirements under the AML/CTF Act. From March 2026, they must:

Together, these measures act as layers of protection. Embedding PF risk into compliance creates the foundation, EDD adds depth to investigations, and reporting duties ensure that potential breaches are escalated to authorities without delay.

Enhanced Due Diligence

“Reasonable precautions” and due diligence describe the steps a business must take to ensure it does not inadvertently engage in prohibited activities associated with Sanctions and Proliferation Financing Risks in Australia. What is considered reasonable depends on the size of the business, the complexity of its transactions, and the jurisdiction in which it operates.

EDD becomes essential when dealing with higher-risk customers or transactions. This includes obtaining information on:

From 31 March 2026, Regulated Businesses will have a legal obligation under the AML/CTF Act to apply EDD to clients in jurisdictions identified by FATF as high risk, including Iran and the DPRK.

Embedding PF Risk in Compliance

To effectively address PF, businesses must integrate these risks into their existing sanctions and AML/CTF frameworks. This involves several practical measures:

It is also important to recognise that while AML/CTF controls are essential, they may not fully capture PF risks. Some indicators fall outside traditional financial crime measures, requiring additional vigilance and sector-specific monitoring.

Conclusion

Proliferation Financing is not a remote or abstract threat but a pressing challenge that intersects with global security, financial integrity, and business resilience within Sanctions and Proliferation Financing Risks in Australia. The risks cut across industries, whether through misuse of corporate services, exploitation of virtual assets, or manipulation of maritime and academic networks. For this reason, compliance cannot be treated as a box-ticking exercise; it requires an embedded, risk-based culture that evolves with shifting threats.

True compliance goes beyond legal necessity; it is a contribution to safeguarding international peace and protecting Australia’s financial system. Continuous vigilance, proactive risk management, and reliance on credible guidance remain the most effective ways to counter PF.

Mitigate Sanctions & Proliferation Financing Risks in Australia

Build a framework aligned with DFAT & AML/CTF rules

Pathik is a Chartered Accountant with over 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise-Wide Risk Assessments to implementing robust AML compliance frameworks. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.

Pathik's expertise extends to guiding businesses in navigating complex regulatory landscapes, ensuring adherence to FATF and other international standards, and mitigating financial crime risks. He is a recognised thought leader in AML/CFT, frequently sharing insights on emerging compliance challenges on various platforms.

Get Started

Contact Us