RapidAML Team

2024-06-18

Singapore, being a global business, trade and investment centre, is exposed to Money Laundering (ML), Terrorism Financing (TF), and Proliferation Financing (PF) risks. The regulatory framework in Singapore requires Designated Non-Financial Businesses and Professions (DNFBPs) to incorporate efficient and effective Anti-Money Laundering, Countering the Financing of Terrorism, And Counter-Proliferation Financing (AML/CTF/CPF) compliance measures. This article attempts to assist DNFBPs in harnessing the power of next generation AML Software for Singapore’s evolving needs in fighting ML, TF, and PF.

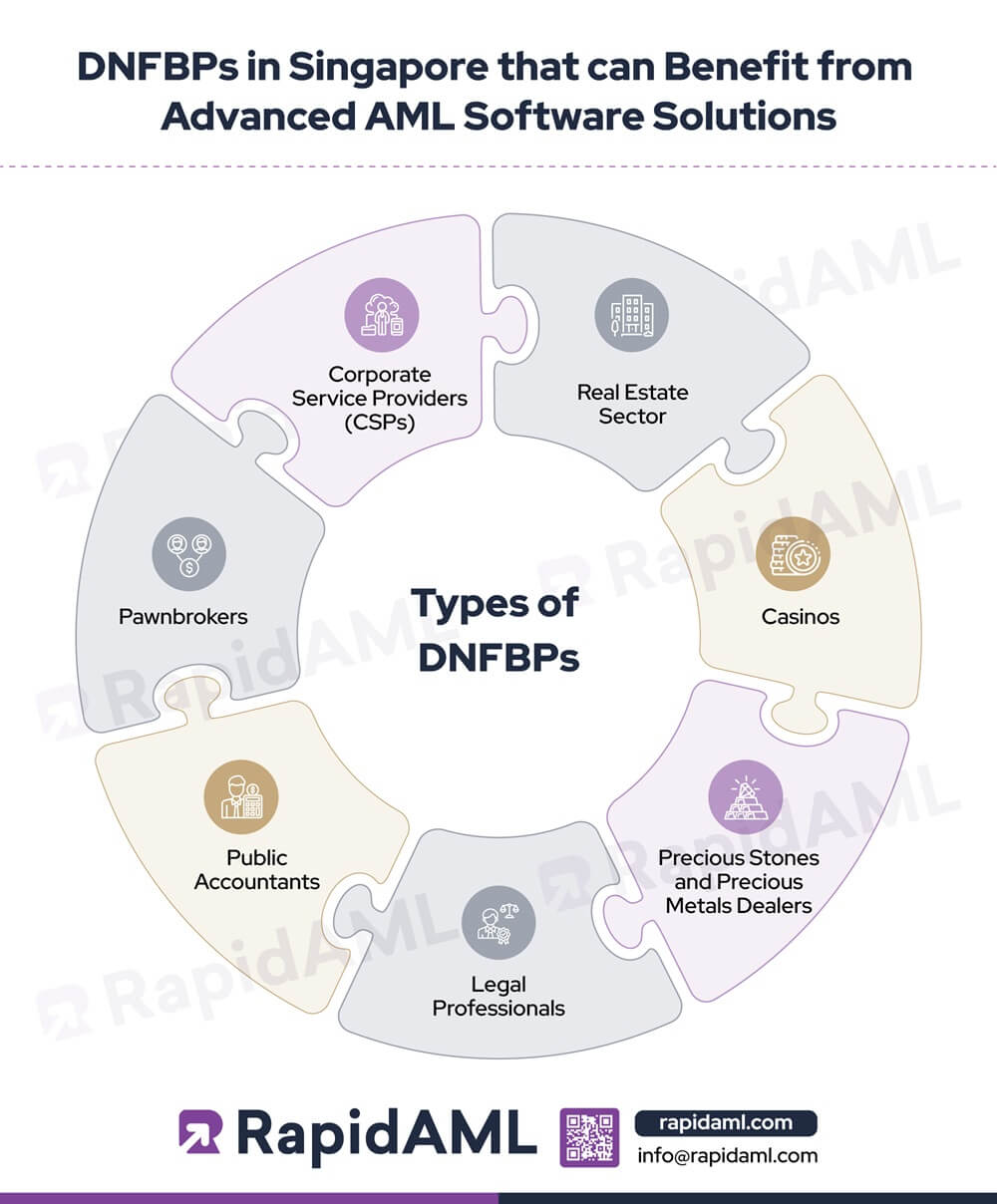

Businesses and professions that are required to adhere to AML compliance obligations under Singapore’s regulatory regime are termed DNFBPs. It includes:

CSPs are individuals and legal entities that provide services like corporate advisory, office hosting, corporate secretarial services, and filing statutory returns to businesses.

Real estate agents, salespersons, and property developers are participants in the real estate sector (residential and commercial segments).

Casinos in Singapore’s integrated resorts attract many customers. Most of the casino patrons are foreigners.

Regulated dealers engaged in manufacturing, importing, possessing for sale, selling, purchasing for resale of any precious stone, precious metal, or precious product, and selling or redeeming asset-backed tokens are referred to as PSMDs.

Singapore-qualified lawyers can act as advocates and solicitors. They can act on behalf of their clients and provide them with legal advice in conveyancing, litigation, and corporate advisory in cases of mergers and acquisitions and new ventures.

Foreign lawyers registered in Singapore can act as solicitors and practice counselling or offer legal services in matters of international commercial arbitration.

Public accountants and accounting entities, including accounting corporations, LLPs, partnerships, and proprietorships, provide services like auditing and reporting of financial statements and other acts stipulated in their governing regulations.

Pawnbrokers are businesses that provide money lending services against the pledging of securities or assets.

The abovementioned DNFBPs and other regulated entities can gain from advanced AML solutions to fulfil their compliance requirements and streamline existing AML processes at an efficient cost.

Corruption, Drug Trafficking, and Other Serious Crimes Act, 1992, is the primary legislation governing AML compliance in Singapore. However, there are sector-specific regulations guiding DNFBPs with effective implementation oversight by their respective regulatory authorities:

The Monetary Authority of Singapore (MAS) is Singapore’s central bank and integrated financial regulator. MAS sets out the regulatory requirements and statutory expectations for financial institutions by issuing a series of guidelines, notices and other AML/CFT guidance papers in pursuance of the Financial Services and Markets Act, 2022.

The Accounting and Corporate Regulatory Authority (ACRA) issues AML/CFT guidelines for Corporate Service Providers (CSPs), which comprise Registered Filing Agents (RFAs) and Registered Qualified Individuals (RQI), in consultation with professional .

ACRA also prescribes Accountants (Prevention of Money Laundering and Financing of Terrorism) Rules, 2023, for accounting entities that carry out transactions for specified client activities.

The Insolvency and Public Trustees Office (IPTO) oversees AML/CFT compliance measures undertaken by pawnbrokers in consonance with the Pawnbroker Act, 2015.

The Council of Estate Agencies (CEA) administers AML/CFT requirements imposed on real estate agencies and their salespersons by the Estate Agents Act, 2010.

The Controller of Housing (COH) supervises the fit and proper implementation of AML/CFT requirements by real estate developers as per the Developers (Anti-Money Laundering and Terrorism Financing) Act, 2018, which became effective in June 2023.

The Gambling Regulatory Authority (GRA) oversees AML/CFT measures taken by casinos in accordance with the Casinos Control Act, 2006.

The AML/CFT Division of the Ministry of Law (ACD) regulates PSMDs subjected to the Precious Stones and Precious Metals (Prevention of Money Laundering, Terrorism Financing, and Proliferation Financing) Act, 2019.

The Law Society of Singapore works closely with the Ministry of Law to provide practice guidance to Singapore-qualified lawyers on AML/CFT matters and regulate their conduct under the Legal Profession (Prevention of Money Laundering and Financing of Terrorism) Rules, 2015.

AML regulatory regime in Singapore requires DNFBPs to undertake the following compliance measures, which are streamlined using AML software:

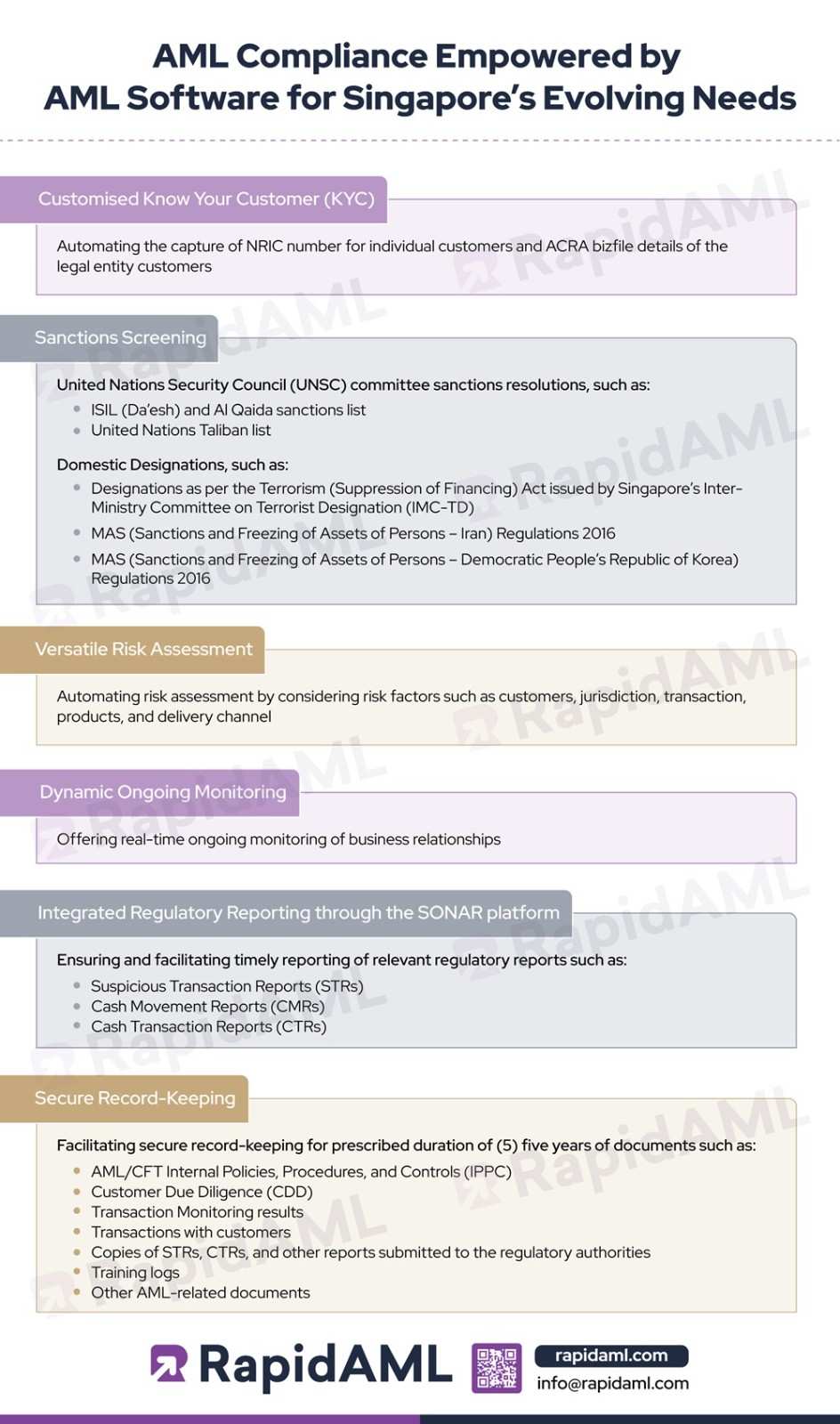

Customised Know Your Customer (KYC)

KYC is the first step in the journey of AML compliance. It is a meticulous process of collecting client information and verifying it against independent and reliable sources based on whether the client is an individual or corporate entity.

KYC requirements for individual

KYC requirements for a corporate entity

Conventionally, KYC is conducted by manually verifying the client’s information. Technological interventions such as RapidAML software can automate this process by:

Sanctions Screening

The AML laws and regulations in Singapore require DNFBPs to screen their customers against prescribed sanctions screening lists such as:

Sanctions screening requires businesses to assess the ML/TF/PF risks that businesses may counter from existing or potential customers. The screening process involves matching customer data against:

Screening clients against multiple sources can be a herculean task. Advanced technologies such as application programming interfaces (APIs) and related software conduct screening processes in real-time with exact results that can significantly reduce the instances of false positives or false negatives. AML software facilitates sanctions screening in line with

These built-in systems support DNFBPs in ensuring timely compliance by generating rapid alerts.

Versatile Risk Assessment

Enterprise-Wide Risk Assessment (EWRA) or Business Risk Assessment (BRA) is the process of identifying ML/TF and PF risk factors that may impact the business. DNFBPs must consider the following parameters when assessing a client’s risk profile:

Advanced technologies can streamline the risk assessment process based on inbuilt risk assessment parameters for their sector. AML software devises highly configurable risk profiling questions and assigns risk weightage suitable to sectoral needs.

Dynamic Ongoing Monitoring

Post-client onboarding, DNFBPs are required to conduct ongoing monitoring of business relationships with clients, monitor transactions, and scrutinise if any suspicious behaviour or transaction patterns emerge.

Technological advancements simplify ongoing monitoring requirements for DNFBPs by setting up sectoral typologies for easy identification of red flags. Specialised AML software offers real-time monitoring of customer profiles as per the monitoring rules configured to suit the business’s risk appetite to ensure the on-time disposition of the alerts.

Deciding transaction monitoring thresholds requires a nuanced approach that can be eased with automation tools that ensure consistency in client transactions and flag alerts in case of discrepancies.

Integrated Regulatory Reporting

DNFBPs, such as Regulated Dealers and Pawnbrokers, in Singapore are required to file Suspicious Transaction Reports (STRs), Cash Movement Reports (CMRs), and Cash Transaction Reports (CTRs) using the STRO Online Notices and Reporting (SONAR) platform if the transaction value exceeds the prescribed threshold value.

AML solutions categorise the data collected into reporting data fields and provide timely submissions of reports based on event triggers. Advanced AML software provide interactive compliance dashboards to meet reporting timelines so that DNFBPs can effectively manage their internal and external reporting workflows, leaving no gap for any possible delays or subversion of the business’s AML program.

Secure Record Keeping

The regulatory authorities in Singapore require DNFBPs to keep data and documents related to:

The record keeping requirements extends to at least five (5) years from the end of the business relationship or completion of the transactions, whichever is later.

Document management tools can be used for smart retention of records to maintain a comprehensive audit trail using an intuitive console to provide a holistic view of the customer profile in one place.

The FinTech sector is set to witness technological transformations led by automation tools that are based on:

Cognitive computing uses Artificial Intelligence (AI) and machine learning to understand user needs and make rational decisions with potential application in Risk Assessment procedures.

Graph Analytics utilises interconnected data points to detect common client attributes and allows DNFBPs to visualise complex networks of entities to uncover hidden relationships and detect transactional anomalies.

OSINT leverages openly available information to address specific queries by analysing digital footprints.

Biometric processes are in use today for KYC compliance. However, there is scope for multi-model biometric systems that can combine voice recognition and footprints with facial recognition for an integrated verification approach.

DNFBPs in Singapore must be aware of their AML/CFT/CPF obligation to avoid regulatory actions. As criminals resort to advanced tactics, it is important for DNFBPs to move away from time-consuming manual AML processes to easy, effective, and advanced AML software solutions.

Pathik is a Chartered Accountant with over 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise-Wide Risk Assessments to implementing robust AML compliance frameworks. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.

Pathik's expertise extends to guiding businesses in navigating complex regulatory landscapes, ensuring adherence to FATF and other international standards, and mitigating financial crime risks. He is a recognised thought leader in AML/CFT, frequently sharing insights on emerging compliance challenges on various platforms.

Solutions

Services

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Solutions

Transaction Monitoring

Regulatory Reporting

Services

AML/CFT Health Check

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Contact Us