RapidAML Team

2024-06-18

It’s important for businesses to provide a smooth onboarding as customers want convenience and a world-class customer experience. Due to widespread money laundering and terrorist financing risks, the DNFBPs and VASPs are obliged to comply with KYC and customer due diligence requirements. It is important to strike a proper balance between customer experience and compliance requirements to maintain customer expectations and fight ML/TF effectively. Here is the definitive guide on remote customer onboarding and ML/TF risk mitigation to help you balance the compliance requirements and customer experience.

In today’s world, technology has made life easy and trouble-free. Technology has now been used in every sphere of life. Development in technology post–COVID has been increased. This development in technology has resulted in remote customer onboarding. The regulated entities that are subject to Anti-Money Laundering (AML) compliance must conduct customer due diligence, which includes customer identification and verification. This KYC process can be conducted remotely through KYC software, which is referred to as remote customer onboarding or non-face-to-face customer onboarding.

Remote Customer Onboarding negates the physical presence of customers. It makes the customer onboarding process less time–consuming, accurate, easy and efficient. This even helps with customer retention as customers do not have to be physically present with all the documents for verification.

Remote Onboarding and AML/CFT Compliance

The regulated entity can conduct AML/CFT compliance in cases of remote customer onboarding by verifying the identity of customers without their physical presence. In remote customer onboarding, the customers can be identified by live video along with some other identity proof with photo. The AML/CFT compliance in remote customer onboarding includes identification and verification of customers’ documents, liveness check, and behavioural analysis. The regulated entities use a risk-based approach in remote customer onboarding.

Although remote customer onboarding makes the process seamless, the threat of data breach is always there. The entity should make robust policies and procedures to combat the threat of money laundering and data breaches. Moreover, the policies related to AML/CFT compliance should also be strong in cases of remote customer onboarding to prevent the chances of any fraud.

Digital Onboarding being a crucial element of remote customer onboarding, has become the new normal as businesses have customers beyond geographical boundaries. Digital Onboarding has made it easy for an entity to onboard the customer without face-to-face interaction. The trend of video calling can be equated with the physical presence of customers. There are certain steps that an entity should take to onboard its customers digitally. Let us discuss these in detail:

Know Your Customer is the process that regulated entities follow to verify the identity of their potential customer. When the KYC process is done manually, then it is called KYC, but when the KYC process is carried out electronically, it is known as eKYC. It is the digitised version of conventional KYC. There are certain differences between KYC and eKYC. Let us discuss these in detail:

Is Your Onboarding Future-Ready?

Take the First Step Towards a Secure and Efficient Customer Onboarding Journey

AML/CFT regulatory requirements for KYC and Customer Due Diligence (CDD) help in combating instances of money laundering. A well-defined KYC and CDD procedure provides a clear structure that needs to be followed to prevent cases of money laundering. Let us discuss AML/CFT regulatory requirements for KYC and CDD in detail:

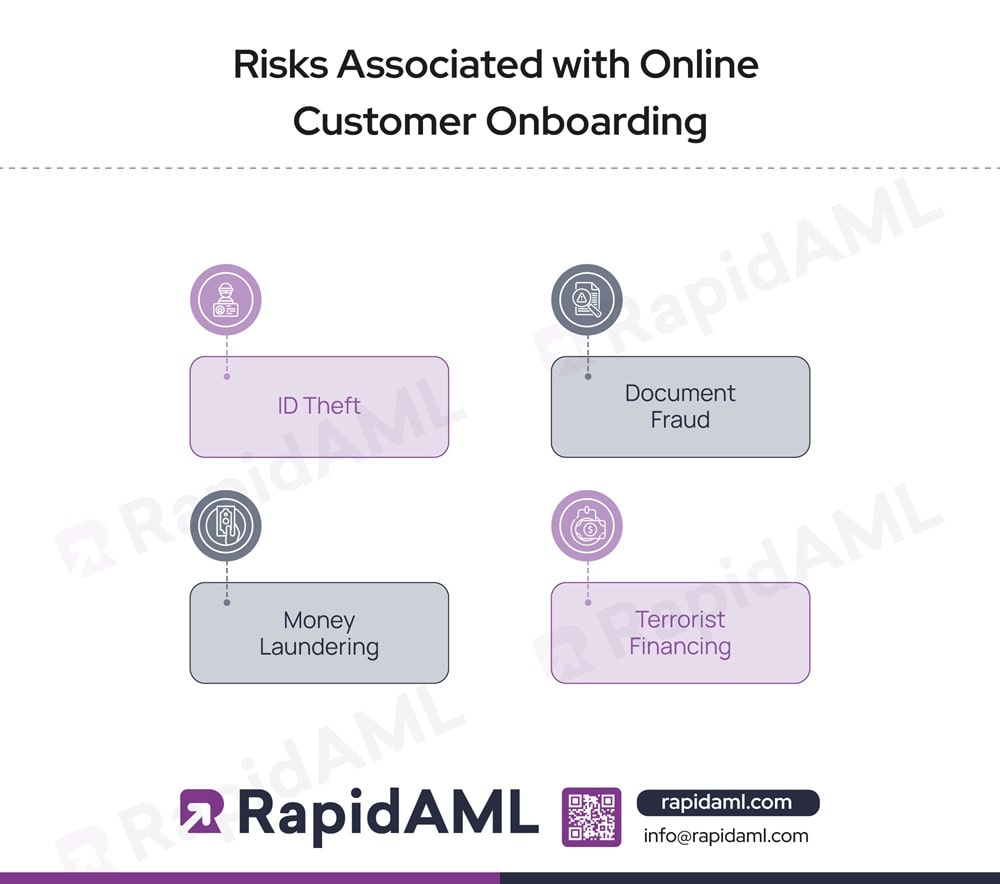

Online customer onboarding has made the process of onboarding hassle-free, but there are certain pros and cons. Likewise, there are certain cons of online customer onboarding. As an entity cannot assess the customer face to face, there are certain risks associated with online customer onboarding. Let us discuss these risks in detail:

ID theft is the most common risk associated with online customer onboarding. The customer can fake their identity and open an account with the entity for making the transactions. As this is online Onboarding, it becomes difficult to identify the offender. This, in turn, increases the entity’s chances of ML/TF risk.

In the cases of remote onboarding of customers, there is a high chance of document fraud. The customer might submit forged documents like a forged ID card or utility bill, which misrepresents their identity. This will ultimately lead to high chances of ML/TF risk for the entity as providing forged documents is suspicious conduct.

The chances of ID theft and document fraud result in high chances of money laundering in cases of remote Onboarding of customers. Criminals can open accounts with stolen identities that look like genuine identities, and hence, it becomes difficult to catch such criminals at the time of identity verification. The suspicious and malicious identity increases the chances of money laundering for an entity.

In the cases of remote Onboarding of customers, it becomes difficult to understand the behaviour and demeanour of customers, which makes it difficult for an entity to understand their actions or any suspicious activity, leading to high chances of ML/TF risk. Moreover, in the cases of non-face-to-face customer onboarding, the probability of data breaches is high as the genuine customers’ accounts may be taken over by criminals to perform their illegal activities, which might lead to ML/TF risk for an entity.

Know Your Customers, Protect Your Business

Onboarding the Delights and Protects Simultaneously

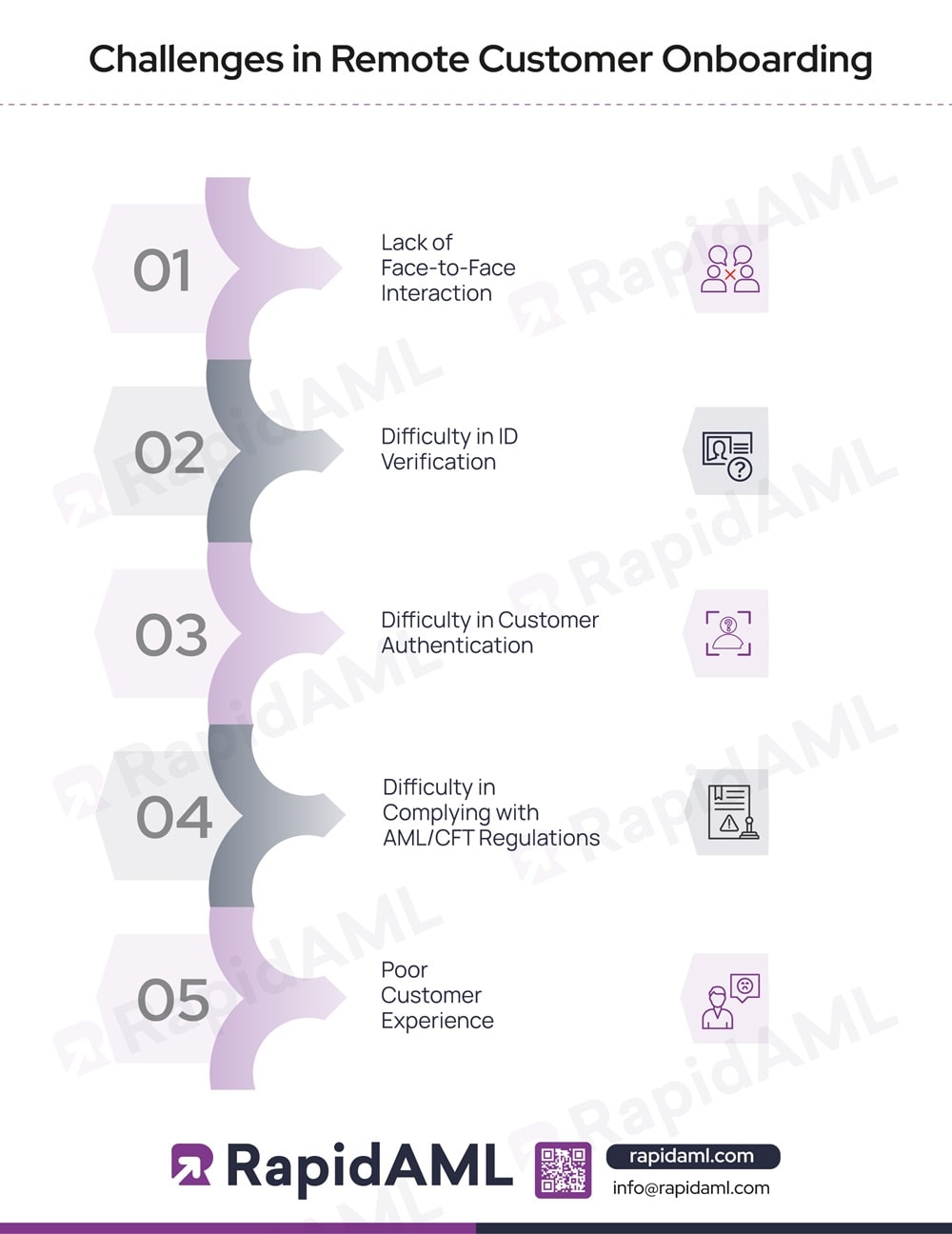

Remote Customer Onboarding has many challenges like lack of face–to–face interaction, difficulty in ID verification, etc. Knowing the challenges will help in developing ways to overcome them. Let us discuss these challenges in detail:

Lack of Face-to-Face Interaction:

The remote customer onboarding might be done using a software or app, it becomes difficult to have a face–to–face interaction. The face–to–face interaction helps in analysing the person better. It becomes easier to understand the customer’s behaviour and demeanour.

Difficulty in ID Verification:

The chances of ID fraud are high in cases of remote customer onboarding. Criminals use fake IDs to open an account, and if remote customer onboarding is performed, it is difficult to spot fake IDs.

Difficulty in Customer Authentication:

Customer authentication in cases of remote customer onboarding can be done through software or app. In the cases of forged ID, it becomes difficult to verify the customer’s ID, which in turn poses difficulty in customer authentication.

Difficulty in Complying with AML/CFT Regulations:

Difficulty in ID verification or customer authentication automatically contributed to non-compliance with AML/CFT regulations. The regulations require the identification and verification of ID. If the ID is forged, the verification cannot be done properly. Moreover, it would also affect the screening of customers against sanctioned lists, as the forged ID might not be able to match the sanctioned list.

Poor Customer Experience:

The remote Onboarding of customers might be done using a software or app. There is a chance that customers will have to submit one document multiple times due to technical issues. The customer can get irritated by the blurred photos as he might have to upload the clear photo again. There are many other problems that customers have to face that contribute to poor customer experience overall.

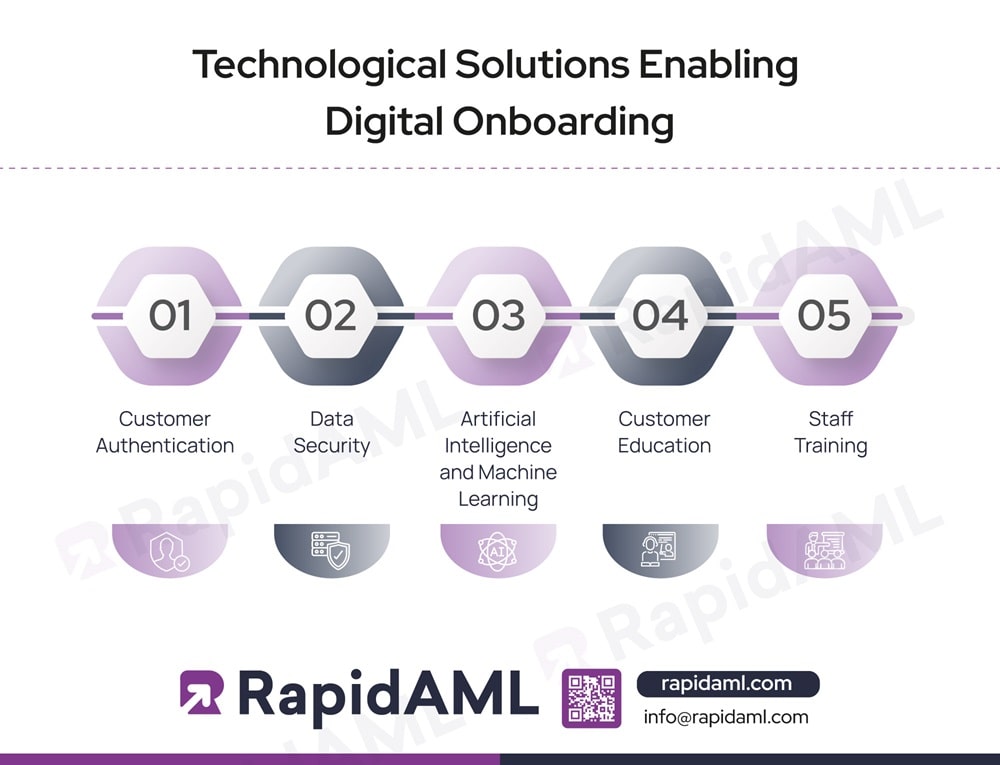

Digital Onboarding of customers can become hassle-free with technological advancement. The use of technology makes the process of digital onboarding error-free. Let us discuss some technological solutions related to digital Onboarding in detail:

Digital ID Verification:

Digital ID verification includes the verification of customers’ IDs through ID Verification Software (IDV). The digital ID verification also involves the choice of a video call with the customer. The entity can video call the customer to match the customer’s face with the photo on the government-approved ID card.

Electronic Signatures and Consent:

Electronic Signatures provide the client with an opportunity to sign the document without their physical presence. The electronic signature is legally valid and binding. The electronic signature saves the client’s time and speeds up the document processing.

Risk Assessment:

In the case of digital onboarding, an entity can use customer risk assessment tools to analyse the risks associated with customers. The tool analyses the risk based on the geography, product/service, delivery channel, transaction history, etc. of the customer.

Secure Communication Channels:

It is important for an entity to have secure communication channels in case of digital Onboarding. Customer data should be preserved, and privacy should be maintained. The overall KYC process should comply with data privacy laws.

Blockchain and Distributed Technology:

Blockchain technology is used to preserve customer data. It helps with securing the customer’s data in blocks which cannot be hacked, making it secure and safe. This technology saves data from the offence of data breach.

Remote onboarding of customers lacks face–to–face interaction between the entity and the customer. The entity is not able to analyse the customer’s behaviour. The chances of fraud are high; hence, it is preferred to conduct Enhanced Due Diligence (EDD) in remote customer onboarding. Enhanced due diligence includes certain additional steps than standard due diligence, such as increased verification of documents, the reason behind establishing a business relationship, the customer’s source of funds, etc. Let us discuss these factors in detail below:

In the case of remote customer onboarding, it is important to monitor the business relationship with the customer regularly. Regular monitoring helps track the activities of customers and prevents an entity from being at risk of ML/TF. Now, the question that comes up is, what activities of the customer should be regularly monitored? Let us discuss this in detail:

The purpose of monitoring business relationships is to identify any out-of-pattern behaviour of customer transactions to spot suspicious activities and transactions and reduce the risk of ML and TF.

Building a secure remote onboarding process is essential for an entity as well as for a customer. Secure remote customer onboarding prevents the entity from ML/TF risk. It boosts the confidence of customers as their data is protected. There are some steps which an entity should take to build a secure remote onboarding of customers. Let us discuss these in detail:

Customer authentication and verification are important steps in securing remote customer onboarding. The entity should use an extra level of security to prevent identity fraud. Moreover, an entity can use AML Software to check the genuineness of the customer’s ID.

The data provided by the customer should be safely stored. For this, an entity should comply with the data security rules and regulations. Moreover, important information should be shared via secure media. Data security boosts the confidence of the customer in an entity and protects the entity from breaches related to privacy laws.

The use of technology makes human life easy. Technologies like artificial intelligence and machine learning can be used in AML measures. AI can help confirm the authenticity of ID proof, facial recognition, etc. Machine learning helps with screening, risk scoring, identification of suspicious patterns and transactions, etc.

Educating customers about the tools used in remote customer onboarding is important. This reduces the chance of any error during the onboarding process. Moreover, educating customers about security measures helps them boost their confidence in an entity.

Staff training is important for making the staff aware of customer onboarding policies and procedures. It even helps the staff identify any red flags, which in turn helps curb the offences of money laundering. It even makes the staff aware of their individual responsibilities.

Training the staff makes the remote onboarding process trouble-free. The trained staff is well aware of their responsibilities and fulfills them to the fullest. It removes the room for any confusion. Regularly training the staff makes them aware of the latest updates in rules and regulations as well. Let us discuss the importance of training the staff in remote Onboarding in detail:

Technological developments in every sphere of work have been growing rapidly. It has changed the way of working in various ways. The development of technology has added many benefits to the process of remote Onboarding. As it is still growing, there will be some future advancements in remote onboarding that will make the remote onboarding process much easier and error-free. Let us discuss these future trends in detail:

Conclusion

Remote Customer Onboarding makes the onboarding process easy and quick, as customers do not need to be physically present for the Onboarding. Apart from being easy, there are certain cons associated with non-face-to-face customer onboarding. Privacy concerns play a major role in digital Onboarding. As customers’ data are preserved online, there is a high chance of data breaches. However, with the improved rules, regulations and technology, the lacunas in remote Onboarding can be eliminated.

Onboard Confidently, Comply Effortlessly

KYC that Works behind the Scenes So You Can Focus on Growth

Pathik is a Chartered Accountant with over 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise-Wide Risk Assessments to implementing robust AML compliance frameworks. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.

Pathik's expertise extends to guiding businesses in navigating complex regulatory landscapes, ensuring adherence to FATF and other international standards, and mitigating financial crime risks. He is a recognised thought leader in AML/CFT, frequently sharing insights on emerging compliance challenges on various platforms.

Get Started

Contact Us