RapidAML Team

2024-05-17

What is a suspicious activity?

Any unusual, irregular or unnatural customer behaviour which can be interpreted as Money Laundering, the Financing of Terrorist activity, Proliferation Financing of weapons of mass destruction (ML/FT/PF), or any other criminal offence is termed as a “Suspicious Activity”. Suspicious Activity also refers to any unusual or abnormal pattern emerging from customer behaviour, conduct or activity that occurs during the course of a business relationship with a customer.

What is a Suspicious Activity Report (SAR)?

In the context of the UAE Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) regulations, the Designated Non-Financial Businesses and Professions (DNFBPs) and Virtual Asset Service Providers (VASPs) need to report promptly the events of any suspicious activity by their customers, suppliers or business partners to the Financial Intelligence Unit (FIU). A Suspicious Activity Report (SAR) can be filed by using the goAML portal.

DNFBPs and VASPs are exposed to the risk of Money Laundering (ML), Financing of Terrorism (FT) and Proliferation Financing (PF) of weapons of mass destruction due to the inherently risky nature of their goods, services, geographies and delivery as well as transaction channels they are involved with.

Therefore, the customer-facing staff of the DNFBPs and VASPs need to be aware of indicators or signals of potentially suspicious behaviour that they may encounter while dealing with a large number of customers on a day-to-day basis. These indicators or signals are also known as red flags of ML/FT and PF. These signals should ideally form a part of the internal AML/CFT policy and procedure documentation and the AML/CFT training programs that are specifically designed for customer-facing personnel of DNFBPs and VASPs.

Red Flags Indicating ML/TF for DNFBPs and VASPs

Red flag indicators are warning signs that indicate the potential involvement of ML/FT or PF-related activities and crimes. The ML/FT and PF red-flag indicators help the customer-facing personnel of DNFBPs and VASPs identify potentially suspicious customers engaged in ML/FT and PF.

The red-flag indicators help the customer-facing staff of the DNFBPs and VASPs to become aware of the circumstances that would require the filing of an SAR.

Various situations in the day-to-day business of DNFBPs and VASPs require the filing of a SAR, such as the following:

1. Customer’s reluctance or refusal to provide KYC details

When a customer deliberately avoids or does not cooperate with the DNFBP or VASP to complete their KYC formalities, which include sharing key identifier information and verifying the same, then such a situation requires the customer-facing staff of the DNFBPs and VASPs to report such abnormal behaviour or pattern to the Compliance Officer, who upon further investigation, decides whether or not to file SAR on the goAML portal.

2. Proposed business on behalf of unknown person/entity

When a customer presents themselves as:

then such a situation is required to be reported by DNFBPs and VASPs through the filing of a SAR on the goAML portal, as the inability to trace or identify the person behind the transaction or the Ultimate Beneficial Owner (UBO) through the complex business structures by using shell companies poses a significant ML/FT and PF risk, which needs to be investigated and the attention of the authorities needs to brought to a situation where a customer is attempting to conduct business on behalf of a person or an entity whose identity cannot be found and verified.

3. Multiple intermediaries

Intermediaries are persons or entities that act as go-between or middlemen among parties to transactions. Intermediaries include financial institutions, banks, retailers, distributors, agents and brokers, among many others. The involvement of multiple intermediaries to execute or carry out a transaction or channelling of funds for the purpose of transaction through multiple intermediaries is a cause for concern requiring the attention of authorities through the filing of SAR because such transactions could probably mean that there is an element of ML/FT or PF associated with such transactions and involvement of multiple intermediaries could denote that they are being used to layer illicit proceeds into the financial system by creating a trail of transactions.

4. Association with sanctioned individual

Sanction lists are lists of individuals and entities published on the national and international levels containing names of individuals and entities with whom business should not be conducting because of their involvement with criminal or prohibited activities. The Customer Due Diligence (CDD) process of any DNFBP and VASPs operating in the UAE requires that the prospective and existing customers are continuously screened against UAE local terrorist lists and UNSC consolidated lists to prohibit business with entities and individuals whose names appear in such lists. When during such screening and monitoring process during CDD and ongoing monitoring, it is found that the existing or the prospective customer’s name is appearing in sanctioned lists or that they are associated with persons or entities whose names are appearing in sanctioned lists, then such a finding requires for reporting to the authorities by filing of Fund Freeze Report (FFR) when the DNFBP or VASP have already received any payment or funds from the sanctioned individual or file a Partial Name Match Report (PNMR) if the the DNFBP or VASP are not entirely sure that the name of their customer matches accurately or partially with those given in the sanction lists.

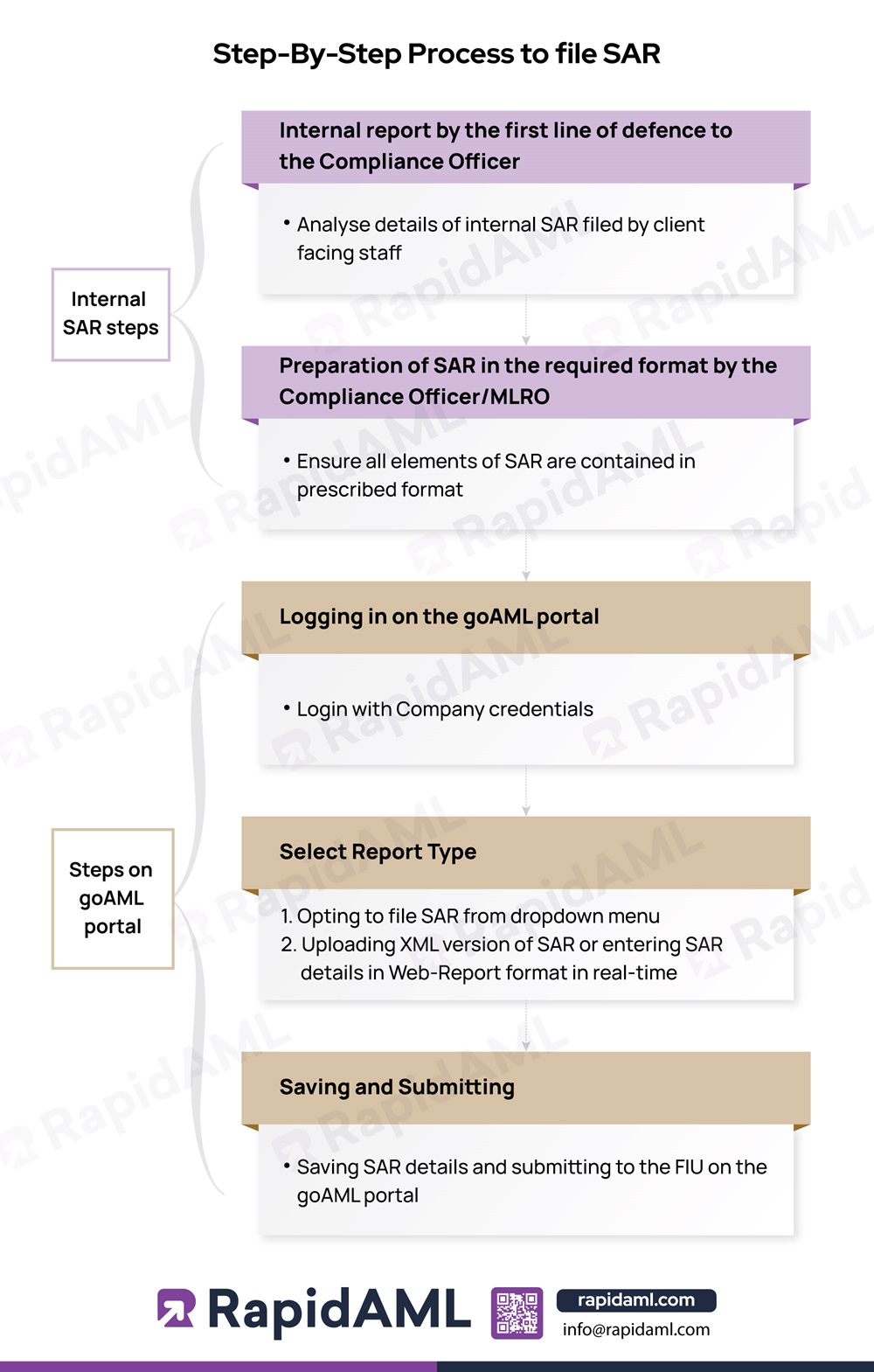

The Step-by-step process to file the SAR involves a blend of internal procedures to be followed within the organisation and steps for filing the SAR on the goAML portal.

The registration of DNFBPs and VASPs on the goAML portal is a mandatory obligation, enabling them to fulfil their regulatory reporting requirements, such as SAR, STR, and other such reports. Needless to say, the DNFBP or VASP have to maintain their status as “active” on the goAML portal.

As the Compliance Officer of a DNFBP or VASP gets notified of the potentially suspicious activity by receiving the internal SAR from the client-facing staff, then the Compliance Officer needs to investigate the internal SAR and decide if suspicious activity mentioned in such a report needs to be reported to the Financial Intelligence Unit (FIU) through the goAML portal by following the steps discussed below:

1. Internal report by the first line of defence to the Compliance Officer

The customer-facing staff has to file an internal SAR to escalate the case of a potentially suspicious customer to the Compliance Officer. The Compliance Officer needs to investigate and analyse the internal SAR received concerning the potentially suspicious activity and decide whether to file a SAR on the goAML portal.

2. Preparation of SAR in the required format by the Compliance Officer/MLRO

Once the Compliance Officer is clear that the filing of the SAR would be required, they must start preparing the SAR in a manner and format prescribed, which is acceptable on the goAML portal, along with the necessary details for SAR submission, such as date, time, location of the alleged suspicious activity, parties involved, business purpose, and other relevant information.

3. Logging in on the goAML portal

As the details of SAR are ready, the Compliance Officer must log into their DNFBPs or VASPs goAML portal account using company credentials.

4. Select report type

The Compliance Officer or MLRO must select the type of report they intend to file (SAR in this case) from the list given in the dropdown menu on the goAML portal, after selecting the SAR as the report type. The Compliance Officer or MLRO may either upload the SAR in XML format or fill in the details pertaining to suspicious activity in real-time by selecting the web-report option.

5. Saving and submitting

The last step while filing SAR on the goAML portal is to save the SAR details and submit the same.

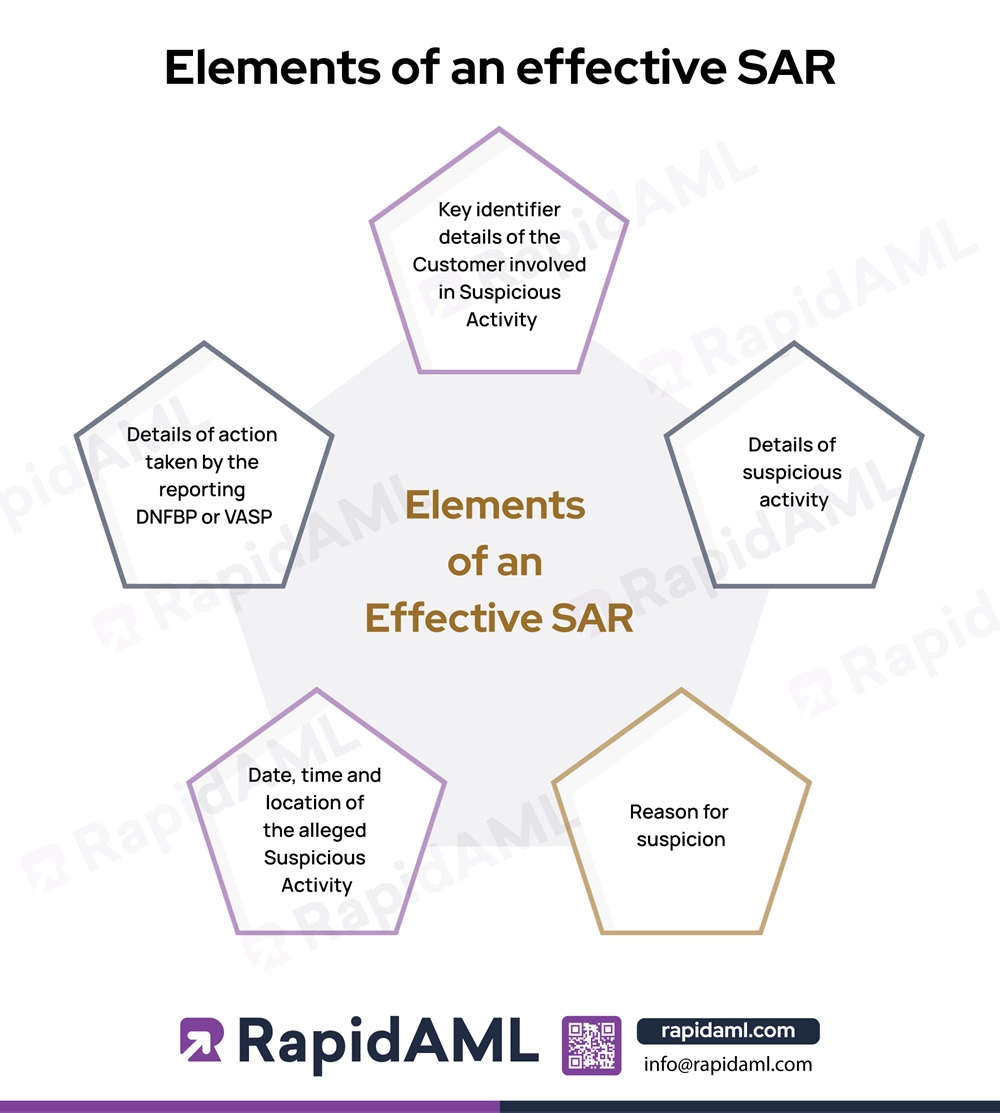

The responsibility of the Compliance Officer to file SAR on the goAML portal cannot be treated with a tickbox approach. The Compliance Officer needs to ensure that the SAR contains necessary actionable details regarding the alleged suspicious activity so that the FIU can investigate the SAR thoroughly. The essential elements of an effective SAR would ideally contain the following details:

– Key identifier details of the Customer involved

The SAR must clearly describe its subject of SAR, which is the details of individuals or entities that the DNFBPs or VASPs find suspicious, resulting in the need to file the SAR. The SAR must also include the identifying information of beneficiaries, accountholders, originators, or any other party involved in the allegedly suspicious activity. These details must also contain information about every individual’s role and involvement in such alleged suspicious activity.

– Details of suspicious activity

The SAR needs to contain details regarding the means and methods used for carrying out the alleged suspicious activity.

– Reason for suspicion

The SAR must also contain reasons behind why the customer-facing staff and compliance officer of the DNFBPs or VASPs found the subject of the SAR to be suspicious, or what red flag was observed, or what caused them to file the SAR. Such reason for SAR must be included in the SAR.

– Date, time and location of the alleged suspicious activity

The SAR also needs to contain details of the date, time, and location of the alleged suspicious activity, and the DNFBPs and VASPs need to be mindful of mentioning this important element in the SAR.

– Details of action taken by the reporting DNFBP or VASP

Lastly, the SAR needs to contain the details of mitigating measures taken by the DNFBP or VASP, such as suspending the business relationship and filing an internal SAR to escalate the suspicion to the Compliance Officer /MLRO.

Once the SAR is filed, the customer-facing staff of the DNFBPs and VASPs need to navigate carefully through the business relationship with the prospective or existing customer,- whose name has been included in the SAR.

An abrupt or sudden break in communication or a distant approach while dealing with such a customer may cause the customer to sense that the DNFBP or VASP has become suspicious of them.

The DNFBPs and VASPs can rely on delaying tactics such as technical issues, internal approval processes, or operational issues as an excuse to wait for FIU’s instructions while keeping the customer engaged.

The FIU may not respond or may give instructions as to what needs to be done with the subject matter of SAR. However, the DNBPs and VASPs need to follow FIU’s instructions whenever they are sent. They should also classify such a customer as a high-risk customer and treat such a customer with Enhanced Due Diligence (EDD) and ongoing monitoring procedures as they would for any high-risk customer to mitigate and eliminate the possibility of ML/FT or PF.

Conclusion

The DNFBPs and VASPs in UAE need to be alert about the regulatory requirement of filing SAR if they come across any suspicious or abnormal patterns which may point towards potential ML/FT or PF. They should have appropriate methods and tools to identify suspicious activity by imparting adequate and suitable training regarding red flags and typologies of ML/FT and PF relevant to their business and the customer-facing staff. They should also have a systematic workflow in place where the identification of suspicious activity is escalated through relevant staff to the compliance officer, enabling them to report the suspicious activity by filing SAR on the goAML portal.

Pathik is a Chartered Accountant with over 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise-Wide Risk Assessments to implementing robust AML compliance frameworks. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.

Pathik's expertise extends to guiding businesses in navigating complex regulatory landscapes, ensuring adherence to FATF and other international standards, and mitigating financial crime risks. He is a recognised thought leader in AML/CFT, frequently sharing insights on emerging compliance challenges on various platforms.

Solutions

Transaction Monitoring

Regulatory Reporting

Services

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Solutions

Transaction Monitoring

Regulatory Reporting

Services

AML/CFT Health Check

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Sign Up Form