Regulated entities coming under the ambit of Anti-Money Laundering (AML), Counter Terrorism Financing (CFT), and Counter-Proliferation Financing (CPF) laws and regulations need to conduct transaction monitoring to safeguard their infrastructure from being misused by Money Laundering, Terrorism Financing, and Proliferation Financing (ML, FT, and PF) actors. A Transaction Monitoring Analyst plays a pivotal role in monitoring transactions of a regulated entity to identify, investigate, and report such suspicious transactions to the relevant regulatory body. This blog discusses what a transaction monitoring analyst is from an AML, CFT, and CPF perspective, along with their requisite skills and qualifications, roles and responsibilities, and involvement in ensuring AML compliance.

What Is a Transaction Monitoring Analyst?

A transaction monitoring analyst is responsible for carrying out the task of monitoring the transactions of the regulated entity (particularly money service businesses, fintechs, brokerage firms, firms facilitating cross-border transactions, e-commerce portals, etc.). He or she identifies suspicious transactions that are indicative of red flags, typologies, or anomalies associated with money laundering, terrorism financing, proliferation financing (ML, FT, and PF) and any other financial crime. His primary duty is to safeguard the regulated entity against financial crimes by taking timely action to mitigate and report suspicious transactions with the respective regulatory authorities.

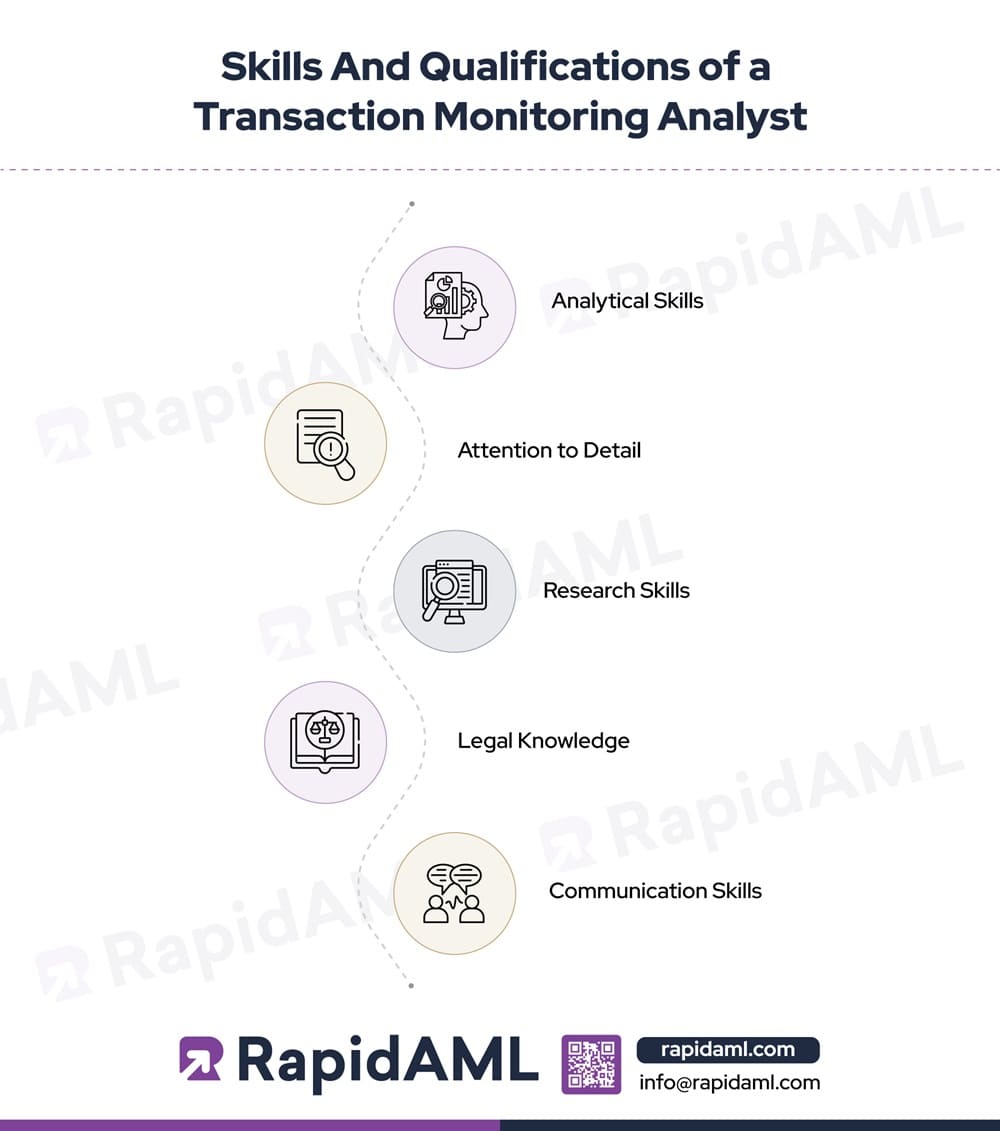

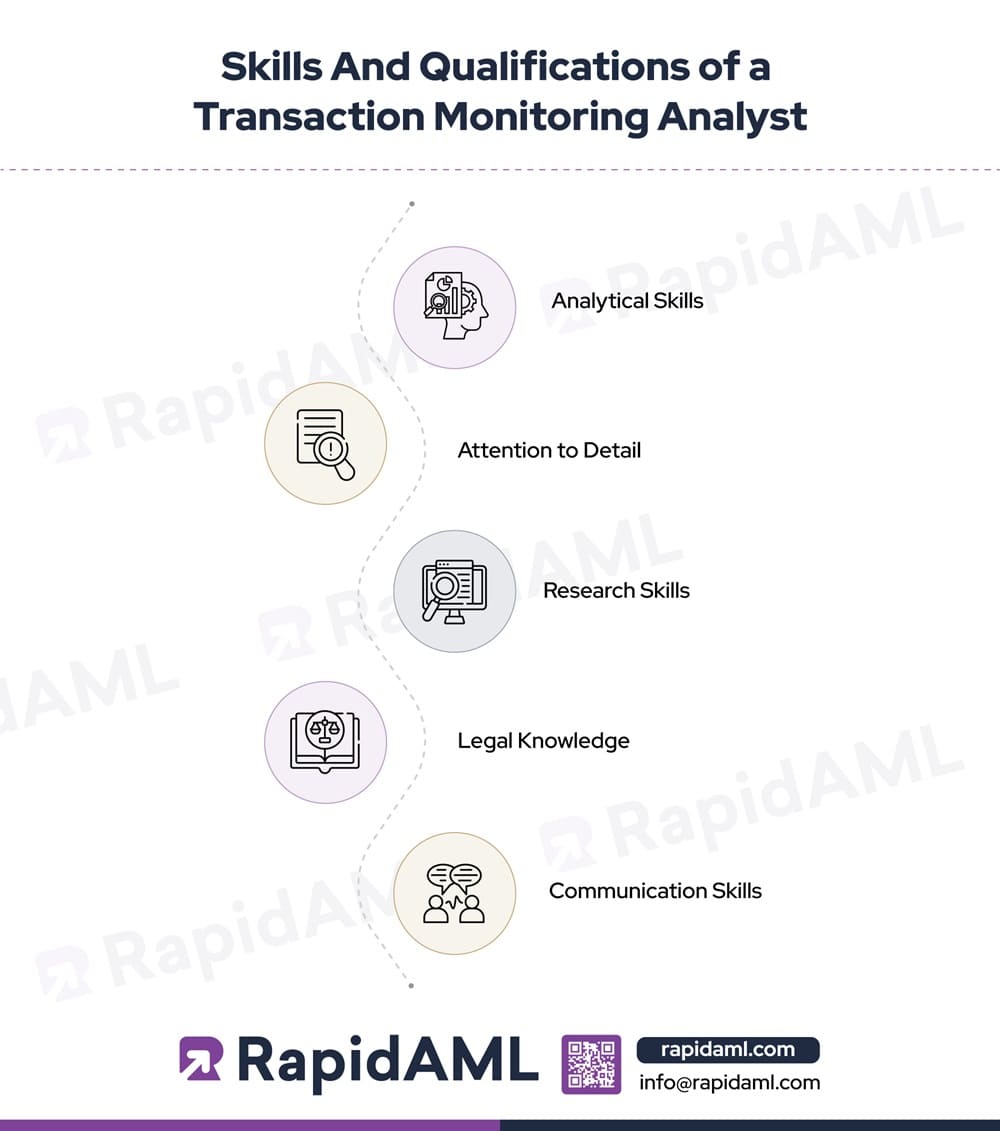

Skills and Qualifications of a Transaction Monitoring Analyst

A transaction monitoring analyst needs to have qualifications that equip them with the competencies and abilities necessary to carry out their roles and responsibilities adequately. Such qualifications are usually qualitative ones, such as professional certifications from recognised bodies and relevant experience in the AML field over and above basic education in any of the fields such as business, statistics, mathematics, finance, economics, financial services, accounting, etc. A transaction monitoring analyst is required to be well-equipped with the following skills:

- Analytical Skills: Analytical skills are those skills that enable a person to gather information, organise, or categorise information into that which requires immediate attention and that which can be reviewed at a later point in time. Analytical or critical thinking skills are essential in a transaction monitoring analyst as they are required to identify and assess information of customer’s transaction details and analyse it across known red flags and typologies of ML, FT, and PF risks to determine whether the transaction is suspicious or merely an unusual transaction without any ML, FT and PF risks to the regulated entity.

Analytical skills play an important role as the transaction monitoring analyst needs to compare customer due diligence (CDD) details collected during customer onboarding and the nature of the transaction conducted, to understand whether the transaction conducted is in alignment with the purpose of the business relationship or not. And if the transaction is beyond economic rationale or has a legally justifiable purpose, then whether grounds for suspicion are there or not.

These analytical skills are very helpful while writing suspicious transaction report (STR) narratives or descriptions as to why a particular transaction is considered suspicious and the reasonable grounds behind considering such a transaction as suspicious.

- Attention to Detail: To be able to analyse complex transactions and identify if those transactions need to be reported to the regulatory authorities, a transaction monitoring analyst needs to be detail-oriented and should be able to tune out noise as they need to be able to dig deep and study every detail contained within the transaction history and identify if any patterns emerge that might be indicative of potentially illegal elements such as structuring, layering, or misuse of a customer account by money mules.

A transaction monitoring analyst must be able to identify details around a transaction, such as shipping details, financial records, invoice numbers, quantitative, and qualitative descriptions of products or services, the date of invoices, etc., to identify if any invoice manipulation is taking place on part of the customer or business associate of the regulated entity that might be indicative of trade-based money laundering (TBML) through over-invoicing, under-invoicing, or multiple invoicing.

A transaction monitoring analyst must have an eye for detail while going through transaction records and details to identify if any transaction deviates from usual transactions through changes in its frequency, timing, countries to and from or through where the transaction is routed through, which might be indicative of potentially suspicious transaction indicating ML, FT, or PF element.

The skill of attention to detail goes a long way in helping a transaction monitoring analyst spot the difference between routine business transactions and suspicious business transactions.

Attention to detail helps the transaction monitoring analyst separate normal customer behaviour by monitoring transaction patterns without ever having to personally meet the customer and instantly spot any inexplicable change in customer behaviour by analysing their transactions.

A transaction monitoring analyst needs to be attentive to small details, particularly those of high-risk clients such as politically exposed persons (PEPs), to be able to establish a nexus or link between their sources of funds and sources of wealth to make sure that the funds utilised for the transaction are legitimate and not proceeds of crime and there is a logical reason behind the transaction.

- Research Skills: A transaction monitoring analyst must possess the skills for conducting research. For instance, a transaction monitoring analyst must be able to investigate any transaction deeply by understanding the purpose, timing, location, and nature of the transaction.

Research skills in the context of transaction monitoring analyst require them to be curious in nature. This curiosity of the transaction monitoring analyst helps them understand the why, when, how much, etc., of any transaction and helps them compare the same with customer profile details.

For instance, the research skills of transaction monitoring analysts help them navigate situations like sudden activity observed in a dormant account, erratic cash withdrawals from multiple locations in small denominations, etc.

When presented with such situations, the research skills of a transaction monitoring analyst are truly tested.

- Legal Knowledge: A transaction monitoring analyst must possess legal knowledge in their area of work. They must be aware and updated with the latest guidelines, laws and regulations pertaining to suspicious transaction reporting requirements in their country as well as countries where their regulated conducts most business with. Other relevant knowledge that transaction monitoring analysts must possess is as follows:

- Knowledge of FATF Recommendations, particularly those about transaction monitoring, and relevant guidelines on transaction monitoring.

- Knowledge of local AML laws and of those countries with whom the regulated entity frequently transacts with.

- Basic knowledge about data privacy laws such as EU GDPR and other relevant and widely used data privacy and protection laws, to ensure that their investigation does not lead to violation of customer right to privacy.

- AML/CFT compliance requirements surrounding topics like:

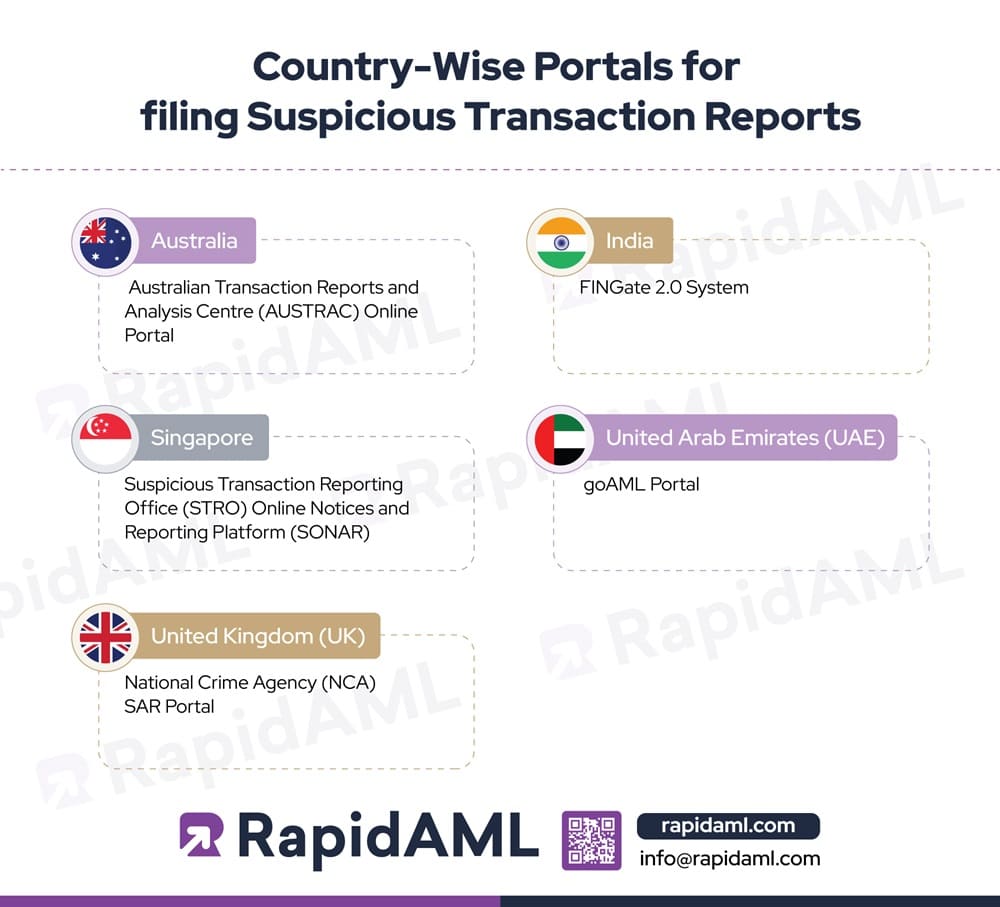

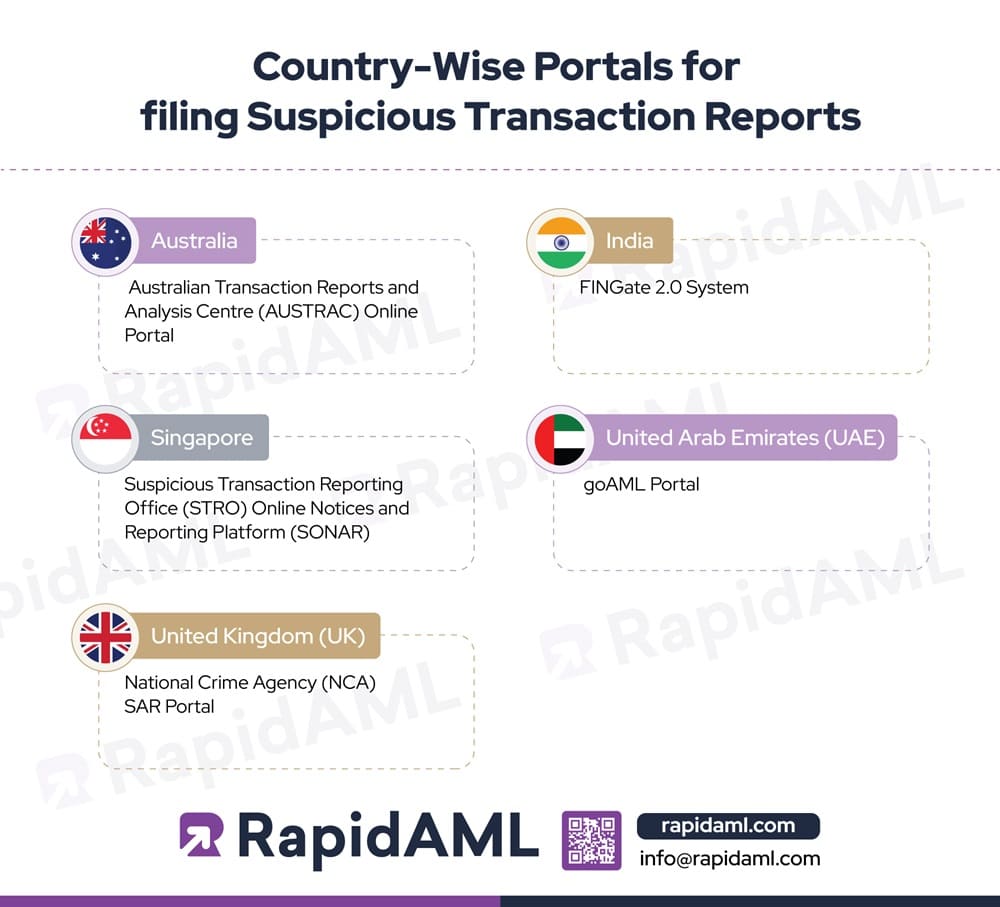

- Knowledge of suspicious transaction reporting processes on relevant FIU of different countries through applicable platform such as follows:

- Communication Skills: All the skills of the transaction monitoring analyst are incomplete without the ability to communicate with the internal AML compliance team, the AML compliance officers, and the senior management, including communicating abilities in written format with the relevant authorities and internal communication.

- Written Communication: A transaction monitoring analyst must be able to articulate their grounds for suspicion while writing internal STR narratives as well as STR narratives for regulatory reporting to the relevant financial intelligence unit (FIU). This articulation of the when, how, where, whom, how much, etc., of suspicious transaction details are necessary to ensure that STR contains actionable information for the FIU to investigate. Therefore, analytical skills combined with report-writing capabilities help transaction monitoring analyst execute their duties adequately.

A transaction monitoring analyst must be able to communicate with the members of the AML compliance team, such as:

- Sanctions Screening Analyst: To make sure if the suspicious transaction belongs to any individual or entity that is sanctioned.

- KYC Analyst: To obtain data for comparing customer transaction activity with customer information to assess whether their transaction pattern is aligned with their details or if there is any deviation indicative of suspicious transactions.

- Risk Analyst: To ensure that the transaction pattern of customers is consistent with the risk rating or risk classification assigned to them, also to notify the risk analyst whenever the transaction monitoring analyst finds transaction patterns which require the customer’s risk rating to be re-classified or changed according to their transaction pattern.

- AML Compliance Officer: To coordinate and assist in the escalation and investigation of internal STR and STR to be filed with the relevant FIU.

- Senior Management: To coordinate the business relationship approval status of newly assigned high-risk business relationships.

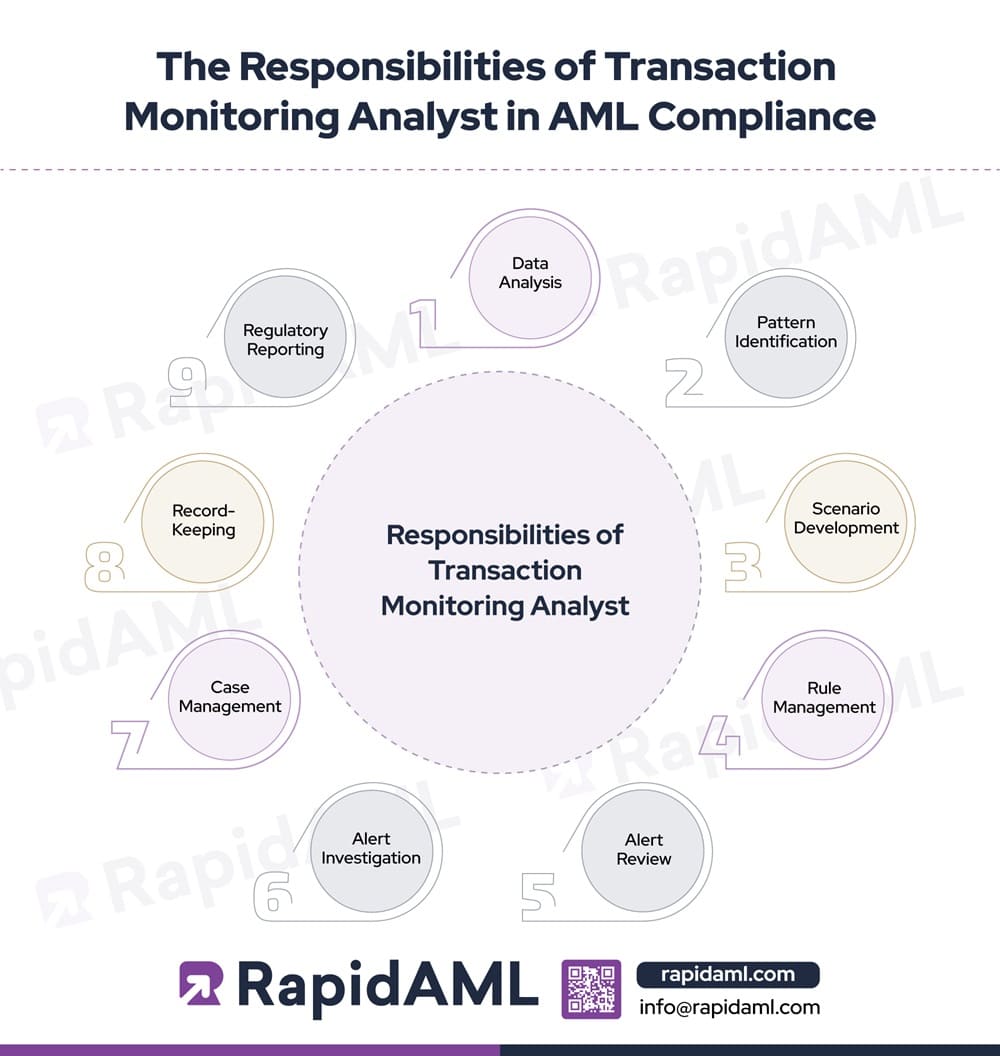

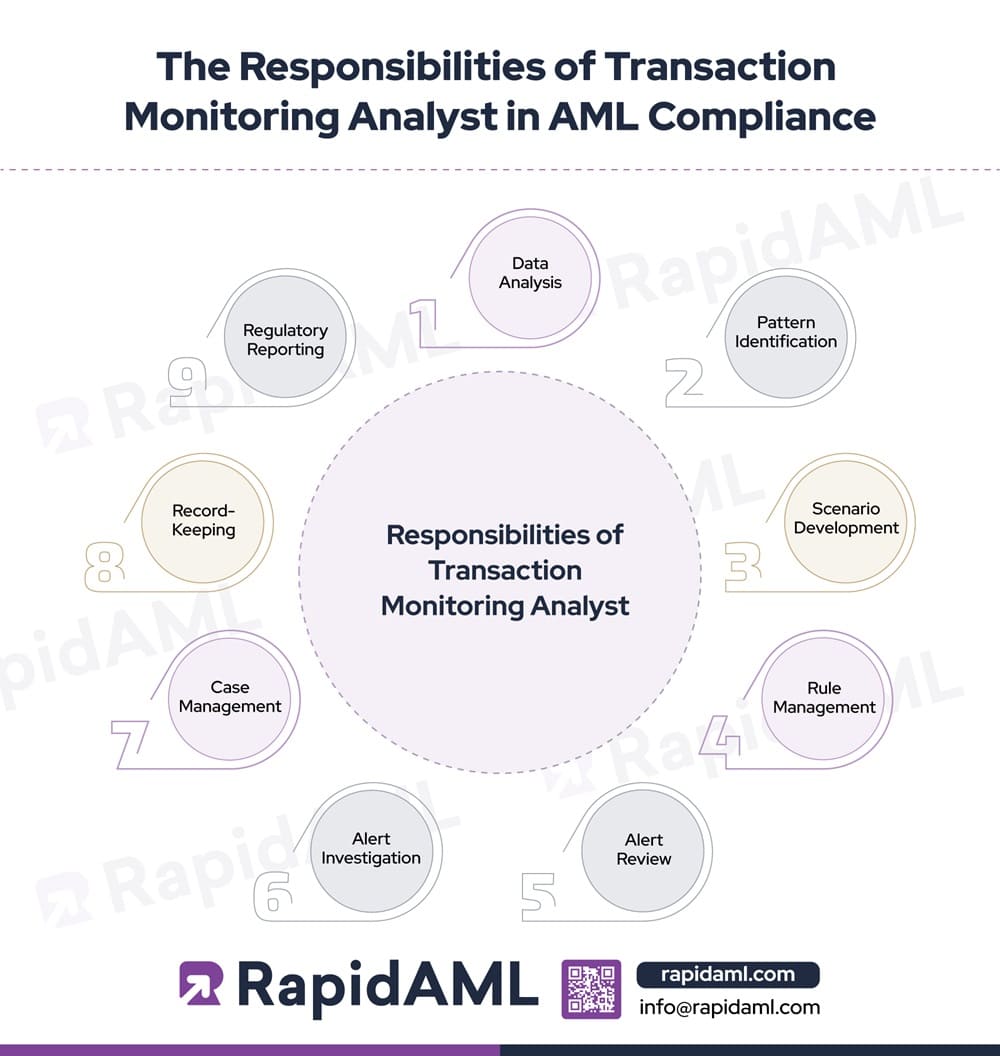

The Responsibilities of Transaction Monitoring Analyst in AML Compliance

- Data Analysis: A transaction monitoring analyst must be able to conduct an in-depth analysis of large volumes of transaction data so that they can identify potential ML, FT, and PF threats. Data analysis requires the transaction monitoring analyst to go through transaction registers, investigate the transaction history of a customer, organise the transaction data, and segregate the data available into potentially suspicious requiring further review and non-suspicious ones that don’t require any analysis, also known as disambiguation.

Once the transaction data requiring further review is identified, the transaction monitoring analyst can dedicate time and efforts to analyse data of potentially suspicious transactions to decide whether to internally escalate the same to the AML compliance officer for their input, whether the transaction is indeed a suspicious one necessitating filing of suspicious transaction report (STRs) or whether it’s a false alert. A transaction monitoring analyst must be able to analyse transaction data using and relying on various software tools designed to help with transaction monitoring.

Data analysis enables a transaction monitoring analyst with tasks such as follows:

-

- Establishing Nexus: Connecting dots between transactions of seemingly unrelated customers to identify if a money mule or smurfing network is operating behind the disguise of apparently reasonable transactions.

- Considering Geographical Factors: Taking into consideration whether there is any change or fluctuation in usual locations from where the customer generally conducts their transactions helps identify unusual patterns.

- Assess Data Quality: While analysing data, transaction monitoring can also assess the quality of customer data they are presented with, assessing data quality helps with streamlining the management and record-keeping of customer data as prescribed by the relevant regulator.

- Red Flag Gap Analysis: Any regulated entity’s suspicious transaction identification capabilities are only as good as how well-updated they are with existing and emerging ML, FT, and PF red flags and typologies. Regulated entities must conduct red flag gap analysis from time to time, and a transaction monitoring analyst can help with identifying whether the regulated entity’s internal policies and procedures are updated with the latest transaction-related red flags and typologies to ensure that internal alerts are generated whenever any transaction is found to be like the red flags updated in the internal transaction monitoring systems.

- Pattern Identification: A transaction monitoring analyst should be able to identify patterns and help the regulated entity with the configuration of pattern recognition rules into the transaction monitoring software or internal system to detect suspicious transactions. This linking of pattern recognition rules with known typologies of suspicious transactions helps regulated entities to identify and report suspicious transactions to the regulatory authorities in a timely manner. These known typology patterns could be transactional as well as behavioural patterns that help identify suspicious transactions.

- Scenario Development: In the context of AML screening and monitoring, regulated entities are required to develop scenarios to set up or configure parameters through which their monitoring and screening tools or systems would “learn” to identify suspicious patterns emerging from transactions and behaviour scenario development helps with setting a benchmark for acceptable transactions, separating them from suspicious ones. Scenario development closely aligns with the concept of machine learning, where the system “learns” from the data and scenarios fed into it to identify suspicious transactions and activity, as well as rule-based monitoring systems where the “rules”, in terms of scenario-based trigger points are configured into the system. A transaction monitoring analyst can contribute to the scenario development process for improved AML monitoring by developing, testing, and scenario logic validation for identifying various types of suspicious transactions and ML, FT, and PF typologies such as:

-

- Structuring

- Unusual and excessive cash deposits or withdrawals

- Unusual remote location activity

- Round-tripping

- Transactions indicating underlying trade-based money laundering

- Transactions with high-risk individuals such as peps

- Transaction with entities which have complex ownership structures

- Transactions with individuals and entities which are sanctioned

- Rule Management: A transaction monitoring analyst must be able to successfully conduct their responsibilities through widely used transaction monitoring systems. They should be able to take charge of the rule management component, where they can set parameters, thresholds, and configure known red flags into systems such as:

- Rule-Based Monitoring Systems

- Threshold-Based Monitoring Systems

- Automated/ Machine Learning-Based Monitoring Systems

- Behavioural And Transactional Analysis-Based Monitoring Systems

- This Includes Threshold Tuning and Validation of Configured Rules

- Alert Review: A transaction monitoring analyst should be able to disambiguate alerts of first instance, which means that initial alerts received by the transactions monitoring analyst from other analysts and ones that are identified by self should be first disambiguated into whether they are valid alerts or false alerts.

- Alert Investigation: A transaction monitoring analyst needs to investigate valid alerts further and decide whether to file internal STR for the AML compliance officer’s investigation or seek the compliance officer’s help.

- Case Management: A transaction monitoring analyst must be able to manage cases created for the customers containing their KYC/CDD details and transaction details, which would ultimately help them identify, investigate, and report suspicious transactions.

- Record-Keeping: A transaction monitoring analyst must maintain records of their observations and findings related to transactions along with all the documents, correspondences with the internal compliance team, communications with regulatory bodies, and data they come across while carrying out their responsibilities as transaction monitoring analyst for the duration specified by the AML laws and regulations applicable to their regulated entity.

- Regulatory Reporting: Lastly, a transaction monitoring analyst should be able to assist the AML compliance officer, if not fully execute themselves, with the responsibility of regulatory reporting of suspicious transactions through applicable and accepted mediums to the FIU.

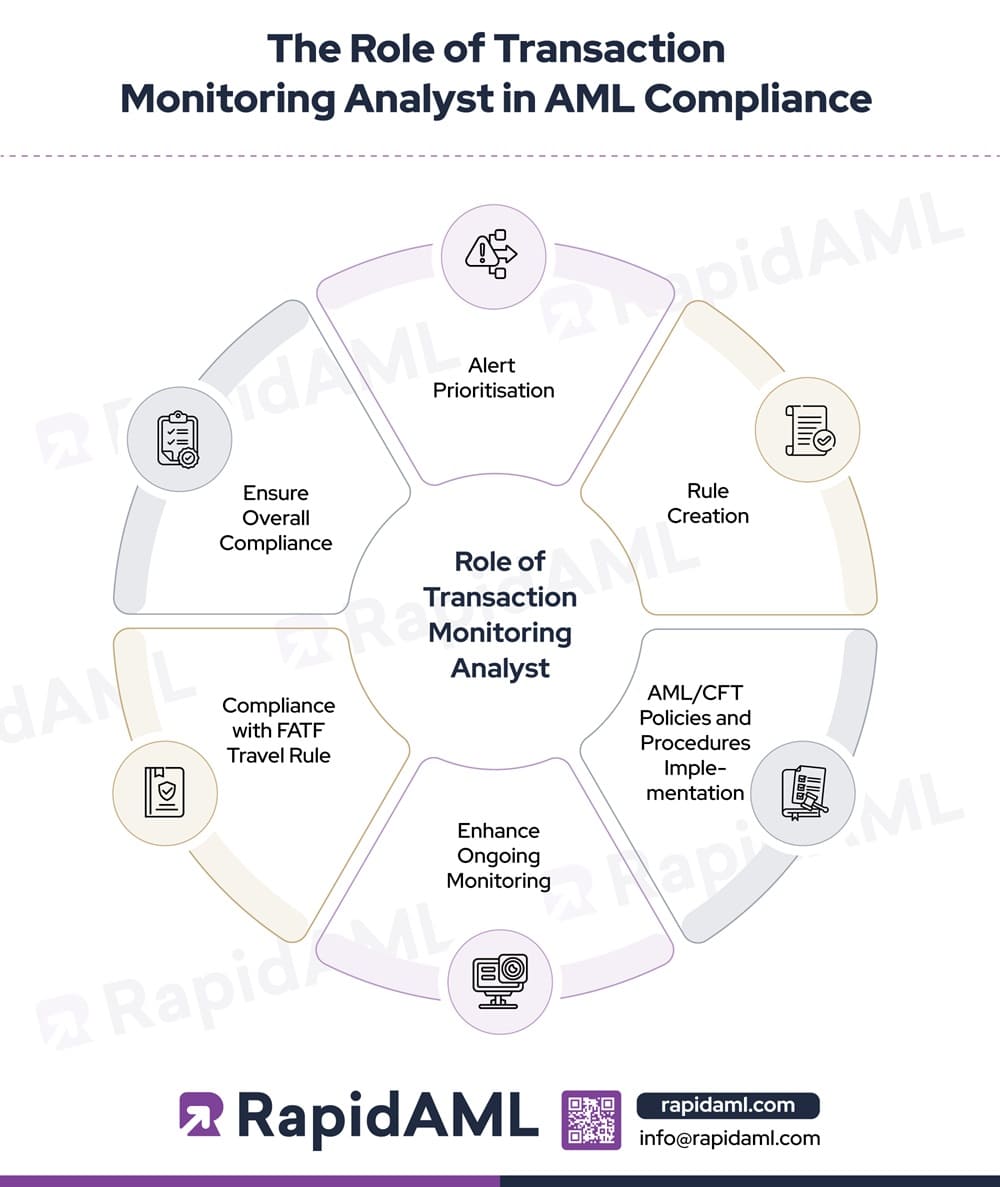

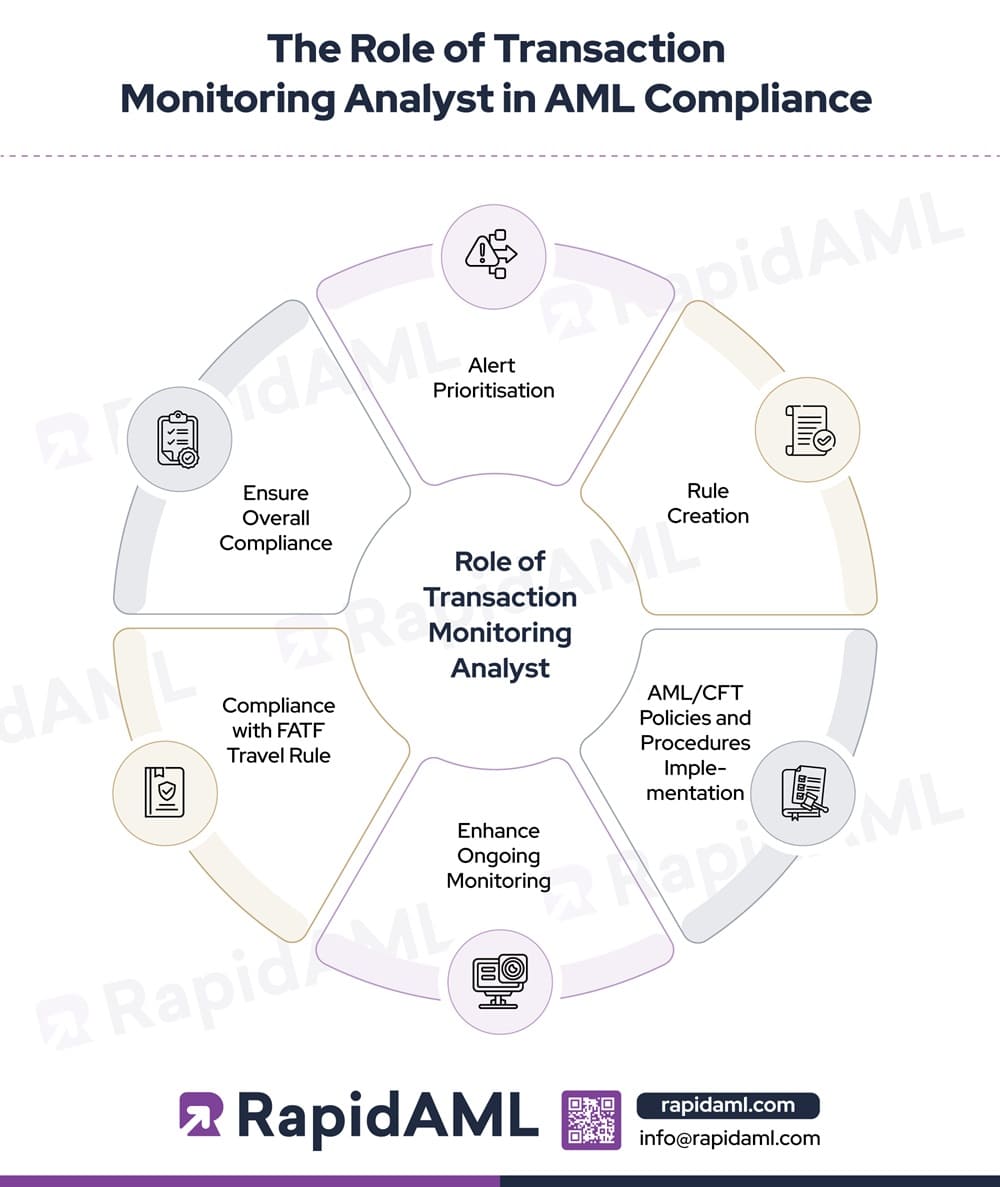

The Role of Transaction Monitoring Analyst in AML Compliance

The role of a transaction monitoring analyst in AML compliance is an extremely essential one as a transaction monitoring analyst is the first person who comes across illegal funds laundered through the regulated entity for furthering motives of ML, FT, and PF actors.

A transaction monitoring analyst plays a proactive role in protecting the regulated entity from ML, FT, and PF risks by participating in conducting the following tasks:

- Alert Prioritisation: Organising alerts and notifications into following categories for efficiency:

- Level 1 alerts: to disambiguate alerts as whether valid alert or false alerts.

- Level 2 alerts: to create case, if not created by screening analyst or KYC analyst earlier to understand the nature of suspicious transactions, decide whether to escalate or assign to AML compliance officer for STR filing or close the case if no reasonable grounds found for filing STR.

- Level 3 alerts: to review L2 alerts, and validate their results, and observations. Assist with AML compliance to file reports and documentation to meet regulatory requirements.

- Rule Creation: To set or configure parameters to suit specific needs of the regulated entity based on the risk-based approach, requiring the regulated entity to deploy risk mitigation commensurate with the ML, FT, and PF risks faced by it.

- AML/CFT Policies and Procedures Implementation: Understand and contribute to the AML/CFT policies and procedures by helping with determining how to conduct transaction monitoring, inculcate best practices for transaction monitoring, and understand software through which the regulated entity intends to identify suspicious activities and transactions.

- Enhance Ongoing Monitoring: By re-tuning and re-configuring screening and monitoring rules with the latest amendments to legal requirements and emerging typologies and red flags pertaining to ML, FT, and PF to ensure that ongoing monitoring of business relationships is effective and is not redundant or obsolete due to non-updating or constant re-evaluation.

- Compliance with FATF travel rule: Help regulated entities with ensuring compliance regarding details required for monitoring virtual assets transactions such as originator and beneficiary account details.

- Ensure overall AML Compliance: Through adherence to rules, transaction monitoring analyst helps with effective compliance software, systems, and controls.

Key Takeaways on the Role of a Transaction Monitoring Analyst

A Transaction Monitoring Analyst’s role is extremely critical when it comes to safeguarding a regulated entity’s infrastructure from being misused by ML, FT, and PF actors. A transaction monitoring analyst tasked with transaction monitoring responsibilities of a regulated entity must be adequately skilled, qualified, and experienced enough to navigate through various factors such as identification, investigation, escalation, communication, and regulatory reporting of suspicious transactions. With the help of internal alert systems, be it manual or software-based, by enhancing their efficiency through scenario development, scenario logic validation, re-tuning and testing of alert systems, which could either be rule-based, threshold-based, or a combination of both or be based on machine learning capabilities.

The human intervention of transaction monitoring analysts is essential to derive optimum output from automated transaction monitoring systems as the critical thinking capabilities of human element are necessary to ensure the accuracy as well as relevance of alerts generated.