RapidAML Team

2024-06-18

Money laundering and terrorist financing are the global concerns. Due to the widespread use of technology and the global economy, it has become easier for criminals to set up shell companies and run their ill-motives. The article, ‘What is a shell company and how does it operate?’ throws light on the associated money laundering and terrorist financing risks and the modus operandi.

According to the meaning interpreted from the Cambridge English dictionary, a shell company is a legal entity that does not have any operations or own any assets but is used to hide a natural or legal person’s activities. In plain words, Shell Companies are those companies formed only to exist on paper but not have any real business operation to serve several legal as well as illegal purposes discussed further in this article.

Key Characteristics of a Shell Company

Shell Companies are often characterised by having a legal existence, but such an existence is not alive with the hustling bustling business with any real product or service, supply chains, real employees, and operational business with assets, liabilities, contracts, suppliers, and consumers. However, shell companies do have a bank account, often in a secrecy haven, complex layers of ownership, nominee accounts, and dummy employees or business transactions that exist only on paper to create an illusion of legitimacy.

Functions of a Shell Company

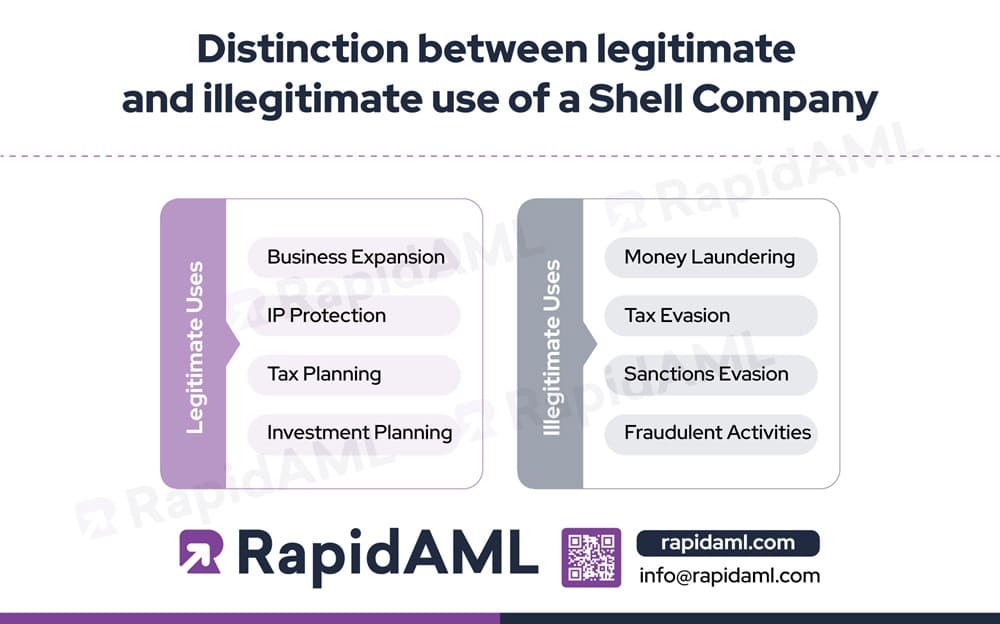

Every Shell Company’s function can be broadly divided into two categories, it may serve legitimate functions like:

Or illegitimate functions like:

Not Every White Shirt Is Crisp Clean, The Dirt Might Be Hiding in the Collar

Just Because a Company Looks Legitimate Doesn’t Mean It’s Free from Hidden Risks, Check Beneath the Surface.

Shell companies serve legal as well as illegal purposes due to their nature of being an entity that exists on paper but does not have operations or assets. The legally permissible and non-permissible uses of shell companies are expanded below.

Legitimate Uses:

Illegitimate Uses:

A Shell Company’s corporate structure is not very different from a usual company’s corporate structure. What differentiates the structure of shell companies from usual companies with legitimate and real business operations, assets, and liabilities is the extensive use of nominees to mask the identities of UBOs. Also, the structure of shell companies is often characterised by offshore bank accounts, payable through accounts, complex ownership structures with inter-se ownerships between holdings and several subsidiaries to confuse the scrutinisers.

Don’t Become Collateral in Someone Else’s Shell Game

Avoid Becoming Unknowingly Connected to Shell Companies Used for Illicit Transactions.

Shell Companies have no business operations. However, their formation and use are done by following steps:

Quick and easy formation in secrecy jurisdictions

Many tax and compliance neutral or tax haven jurisdictions or jurisdictions that foster secrecy offer quick and easy company formation channels to legitimate investors and criminals alike. These jurisdictions are often preferred by financial criminals due to the secrecy element that facilitates disguising beneficial ownership.

Bank account opening for financial transactions

Once the shell entity is formed, it must have a bank account to resemble a real company that conducts transactions. This bank account of the shell company is then either used or misused by its user for legitimate or illegitimate uses of shell companies discussed earlier.

Complex ownership structure

Once the shell company and its bank account are formed, its beneficial owner usually creates holdings, subsidiaries, and sister concerns to create a complex ownership structure that they may use for conducting illegal activities.

The Regulatory Framework for shell companies differs from country to country. Some countries strictly prohibit the formation of shell companies, while others only prohibit their misuse for illicit purposes such as tax evasion, ML, FT, PF, sanctions evasion, fraud, etc., while permitting the formation and use of shell companies for legitimate uses such as IP protection.

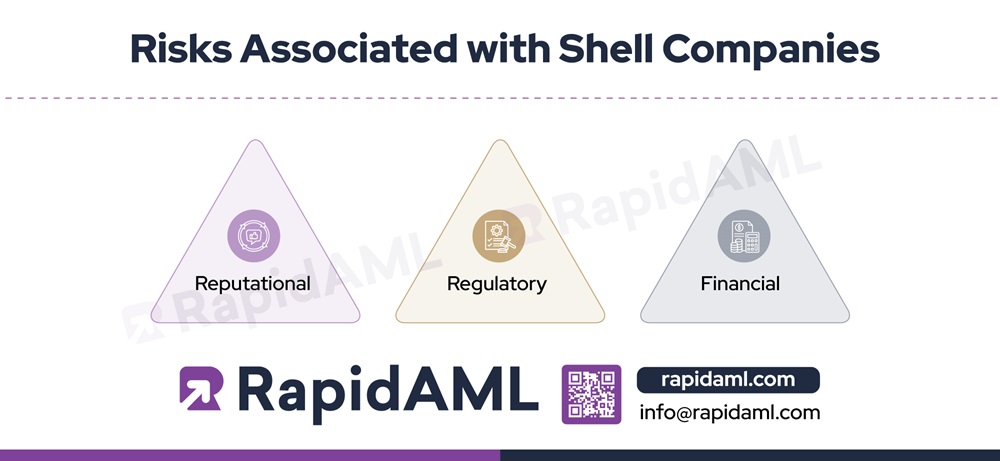

Regulated Entities such as Designated Non-Financial Businesses and Professions (DNFBPs), Virtual Assets Service Providers (VASPs), and Financial Institutions (FIs) must exercise caution while conducting business with Shell Companies as it come with its own set of risk factors, such as:

The identification and investigation of Shell Companies must be integral to every regulated entity’s compliance framework. For instance, every regulated entity’s AML, CFT, and CPF Compliance policies, procedures, systems, and controls should include the steps, tools, workflow, personnel responsibilities, escalation, and alert mechanisms to identify and investigate the element of shell companies while establishing and continuing business relationships with shell companies. All the relevant personnel of the AML Compliance team, such as KYC Analysts, Screening Analysts, Risk Analysts, Transaction Monitoring Analysts, AML Compliance Officer (AML CO) must take active measures to identify the UBOs behind the shell companies and report them if found involved in ML, FT, PF or any other predicate offences to the relevant regulator. The AML Compliance Officer and Senior Management must take the call on whether or not to establish business relationships with shell companies posing high ML, FT, and PF risk to the business and record their decision-making and supporting documentation for the same.

Regulated Entities such as DNFBPs, VASPs, and FIs need to be mindful of the legalities and true nature of corporate entity customers, which might be shell companies. In order to successfully identify and mitigate the ML, FT, and PF risks arising out of establishing business relationships with shell companies, RE’s senior management, and relevant client-facing and compliance employees should strive to understand what shell companies are and their modus operandi and leverage AML Software and solutions to enhance detection, monitoring, and risk assessment processes.

Clean On Paper, Risky in Real

RapidAML Helps in Spotting Legal Entities Without Operations That May Be Used for Money Laundering

Pathik is a Chartered Accountant with over 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise-Wide Risk Assessments to implementing robust AML compliance frameworks. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.

Pathik's expertise extends to guiding businesses in navigating complex regulatory landscapes, ensuring adherence to FATF and other international standards, and mitigating financial crime risks. He is a recognised thought leader in AML/CFT, frequently sharing insights on emerging compliance challenges on various platforms.

Get Started

Contact Us