It began with a question. No, not the KYC question. But a deeper, more exasperated one whispered by compliance teams everywhere. ‘Why is something as routine as collecting KYC information still this painful?’ Forms arrived half-filled, signatures were missing, versions multiplied, and clients? They dreaded the process almost as much as the team chasing them did.

We saw teams trapped in an endless cycle: download, scan, resend, and repeat.

Some used documents. Others cobbled together email templates or retrofitted third-party tools never meant for due diligence. All of them had one thing in common: none of them really worked.

What if KYC wasn’t a form at all? What if it were an experience? Structured, secure, and human. No attachments. No copy-paste. Just the right questions, delivered and linked to the customer profile, and a team finally free to focus on risk, not reformatting.

The real challenge in compliance is meeting today’s regulations while staying ready for tomorrow. The KYC Questionnaire is a strategic framework. An unknown client becomes known, bringing clarity in risk assessment, AML/CFT compliance, and business relationship.

In an upgraded world, it was high time the humble KYC form got its glow-up. So, we took one of the most frustrating parts of onboarding and gave it a quiet reformation.

Traditional KYC practices aren’t just outdated. They are borderline tragic. And what should be a smooth onboarding experience turns into a slow-moving compliance opera.

You send over a long, intimidating PDF. The client opens it eventually. They squint, pause, get puzzled, and exit the stage without a word.

Compliance teams manually copy-paste responses from forms to systems. Emails fly. Versions collide. No one knows which document is the actual final version.

Updates fall. Old data lingers. Due diligence becomes due. And everyone prays an audit isn’t around the corner.

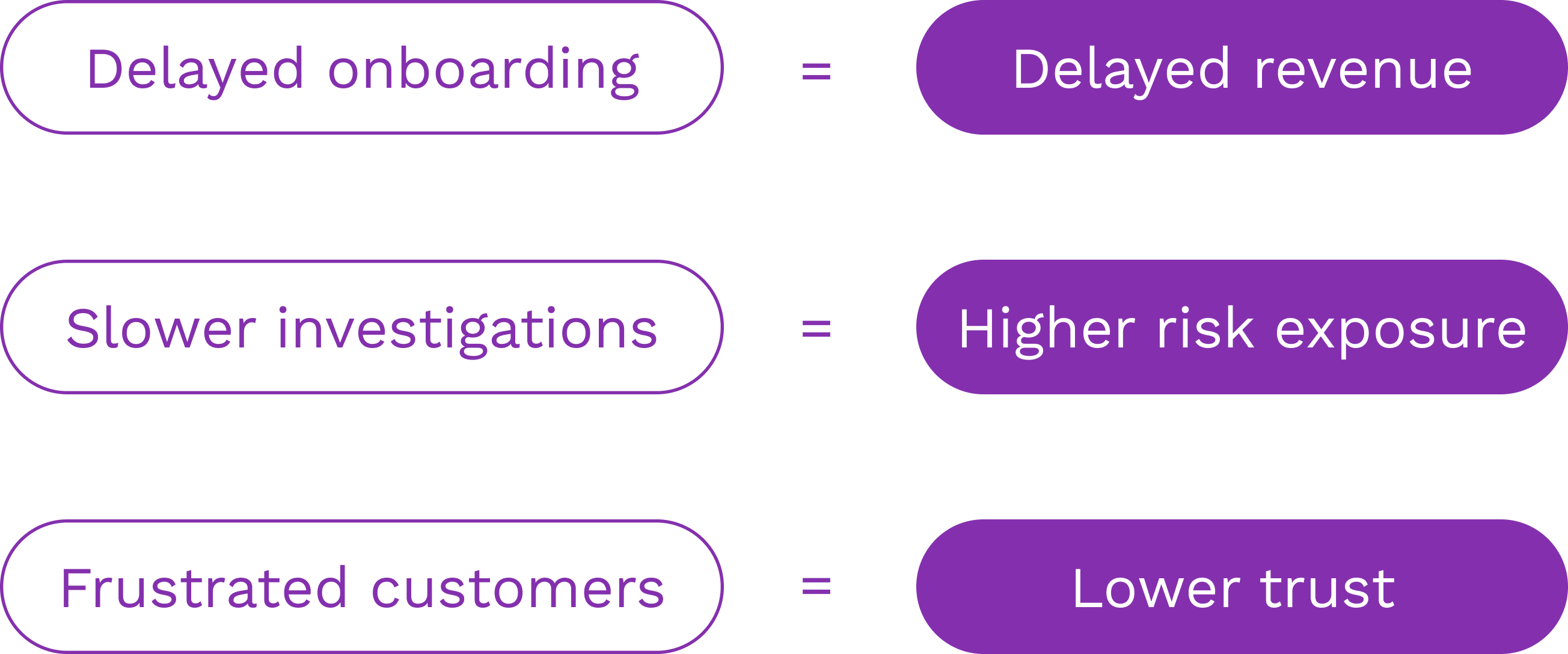

This isn’t just a paperwork problem. It’s a pipeline problem. A process problem. A risk problem. When your KYC questionnaire is old and manual, everything downstream suffers.

It’s not a death by a thousand cuts. It’s death by a thousand follow-up emails.

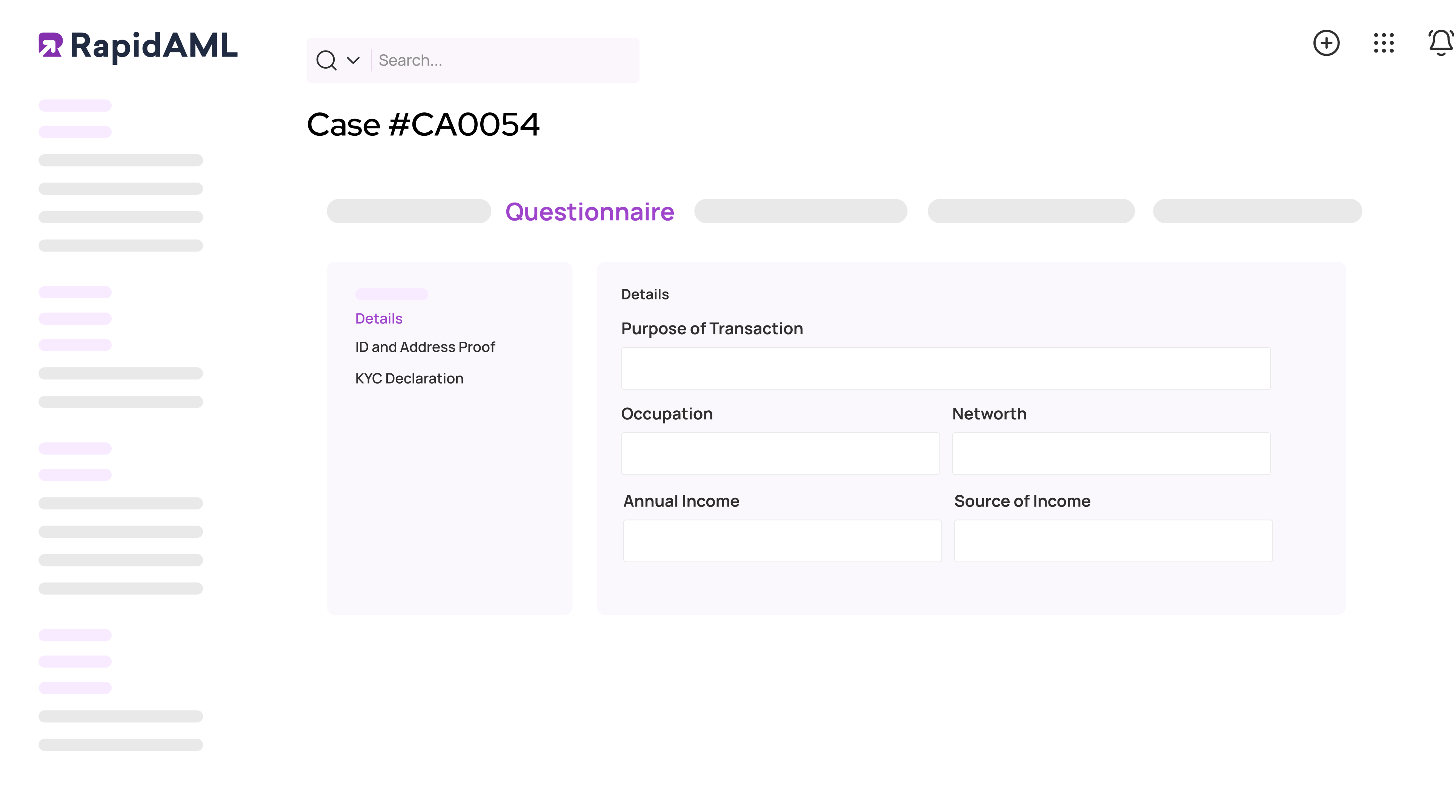

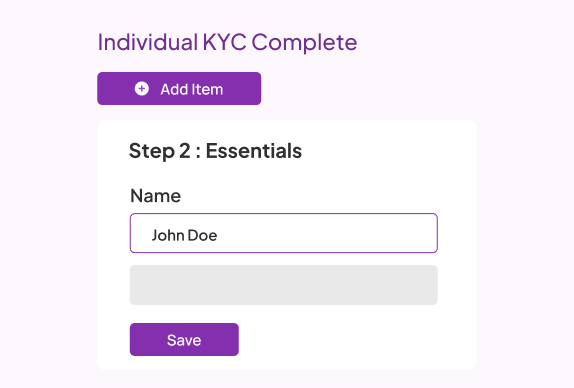

Well begun is half done, and nothing begins better than a form that actually makes sense. The latest upgrade to our KYC questionnaire is here, and it’s packing serious muscle. We’ve turned your humble KYC form into a fully configurable, context-aware, and organisation-savvy powerhouse.

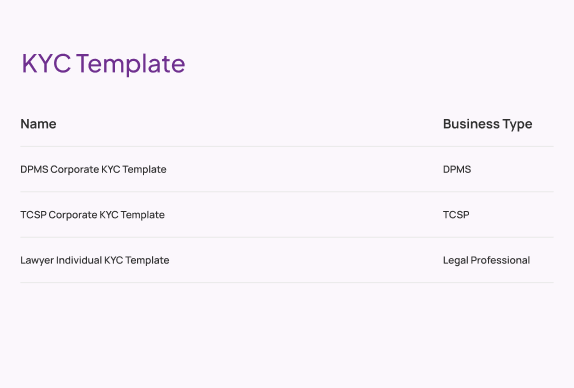

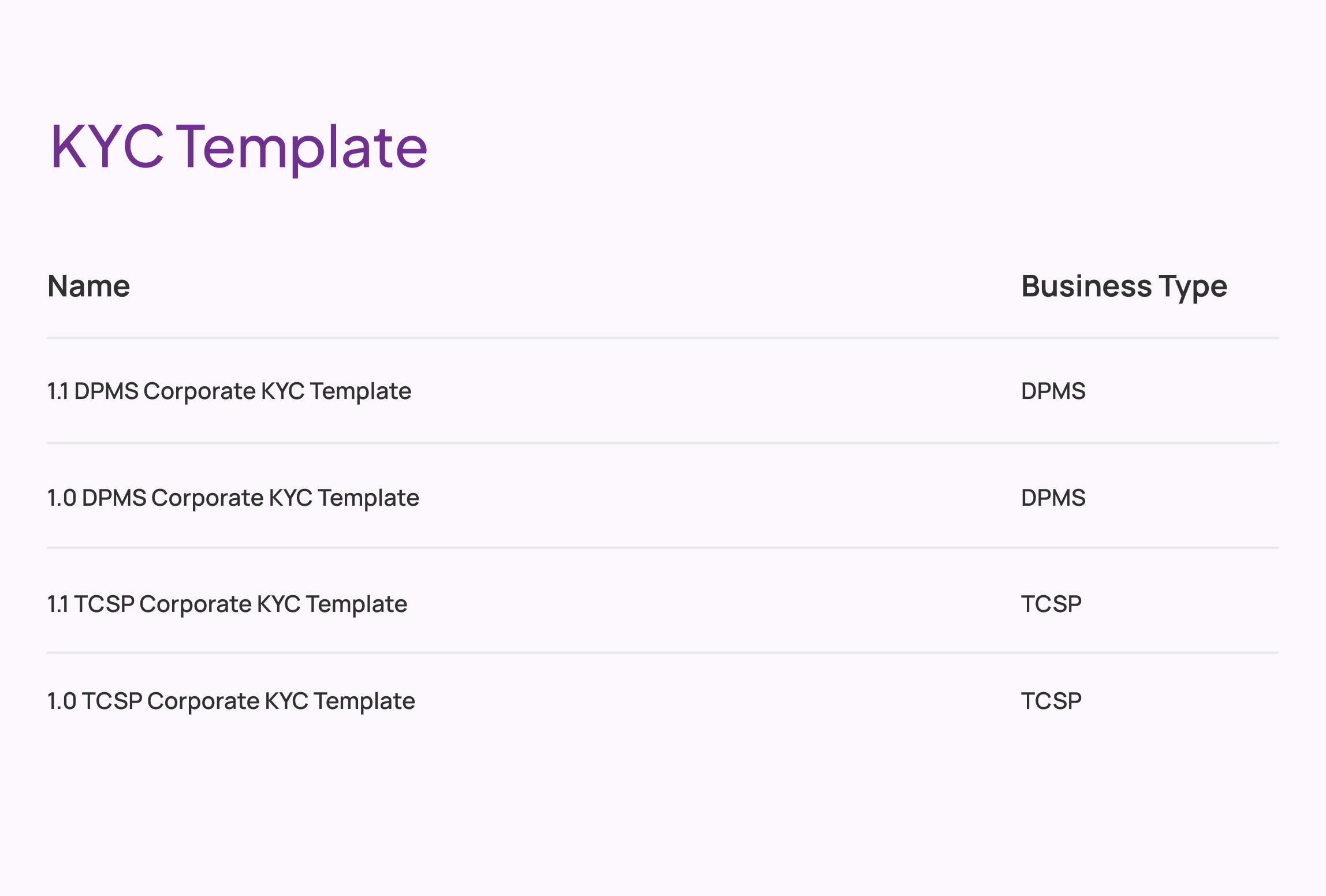

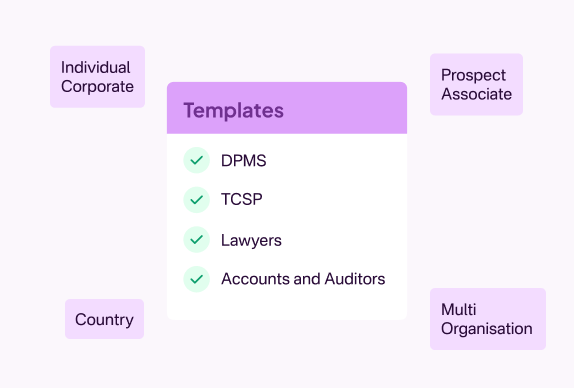

Blank-page syndrome? Get going instantly with pre-configurable questionnaire templates tailored to your business model.

Our KYC Template Builder puts you in full control, without sending you down a compliance rabbit hole.

Every template you customise or create is saved and version-controlled, so your team can iterate and improve without losing historical records or risking compliance. Because your policy will change and that’s okay. We planned for it.

If your organisation spans multiple business lines or jurisdictions, we’ve got you covered.

We didn’t redesign the form. We rethought how it should feel. We asked: What if KYC didn’t feel like an interrogation? What If it flowed, adapted, and respected the user’s time? Every question now has a reason to exist. A clean and intelligent experience makes compliance feel radical.

Reduce form fatigue

Improve accuracy

Cut completion time drastically

Not all matches are created equal. A name alone does not tell the full story, and a false match can lead to unnecessary detours. Screening Disambiguation is our next big leap forward.

We’re building intelligence that goes beyond surface-level similarities, refining results to separate true risks from mere coincidences.

Clarity is on the horizon!

Solutions

Services

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Solutions

Transaction Monitoring

Regulatory Reporting

Services

AML/CFT Health Check

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Contact Us