With the RapidAML’s screening specifications ready, it’s time to breathe life into our sanctions compliance solution.

Encountering false negatives is a serious compliance challenge that businesses face, and RapidAML is here to solve it, making their time and efforts worth the compliance. Similarly, false positives result in unnecessary delays and higher costs.

When we scrutinise how we could make compliance easier, we found that an intuitive, easy-to-use interface is one of the major missing pieces.

“We seek sanctions-screening software where automation goes hand in hand with an easy-to-use interface.”

“I’ll go for a tool that has a straightforward screening process so that my customers also save their valuable time.”

With our user-friendly interface, compliance stays front and centre

Our aim is to reduce the learning curve to its minimum. By hitting this spot, we’ll reduce the time and resources spent. Thus, compliance becomes speedy without costing accuracy.

Interface that Guides You on “What’s Next?”

How about everyone, including the front office employees and screening analysts, know what’s to be done without being told?

How about you know what the bottleneck is and how to unclog it?

RapidAML’s UI solves this as well by: Empowering the compliance team to work independently Empowering management to check the work status

We must have the UI/UX and sanctions screening at the peak of perfection, enabling users to move forward flawlessly in the process, making compliance smooth, intuitive, and risk-aware.

Overall, RapidAML wants businesses to get value out of its Seamless User Interfaces, Exceptional User Experience

RapidAML’s ease of use doesn’t only come with how it appears. It’s way more than that.

Dedicated Screening Process

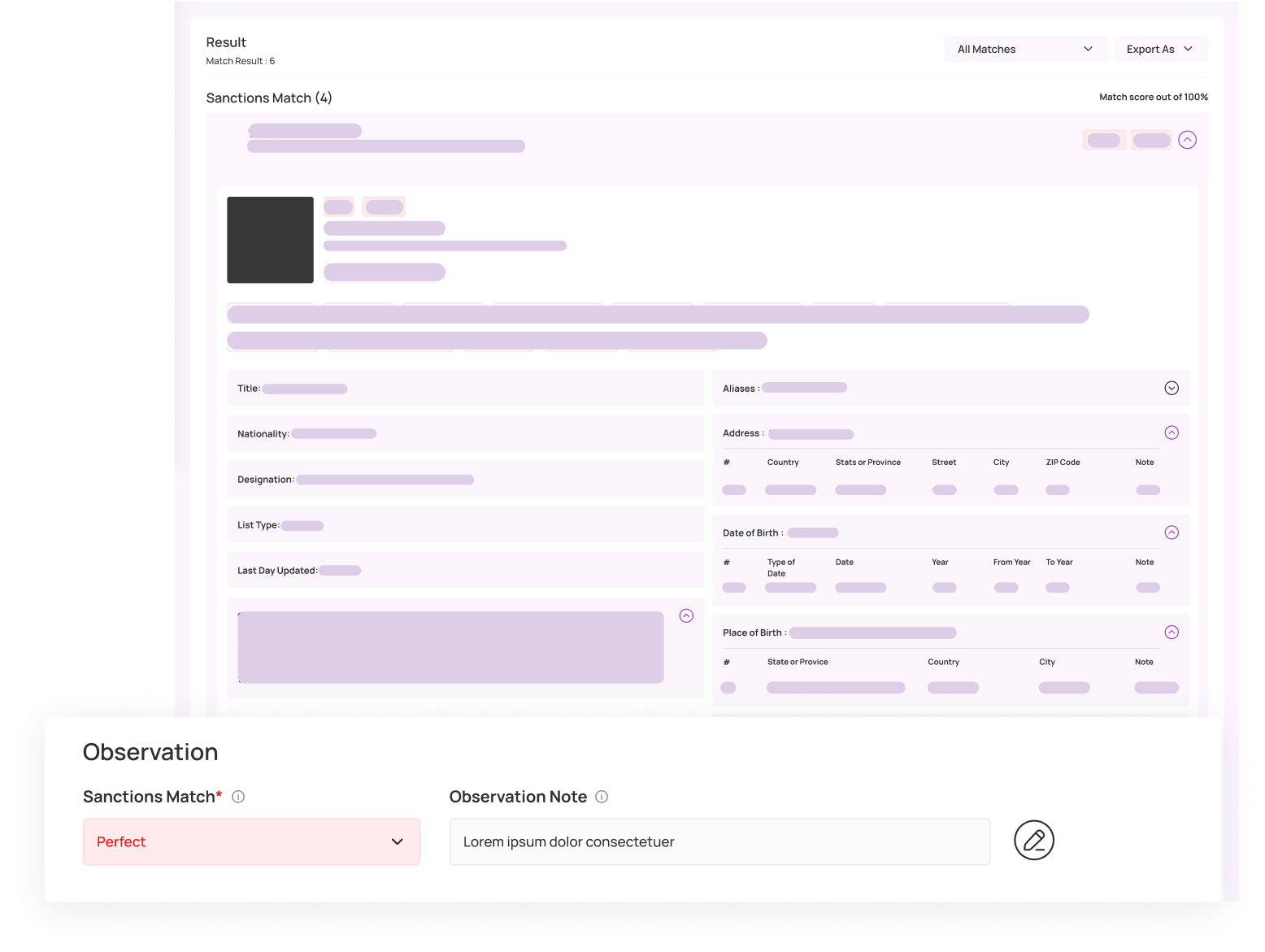

Well-thought placement of elements

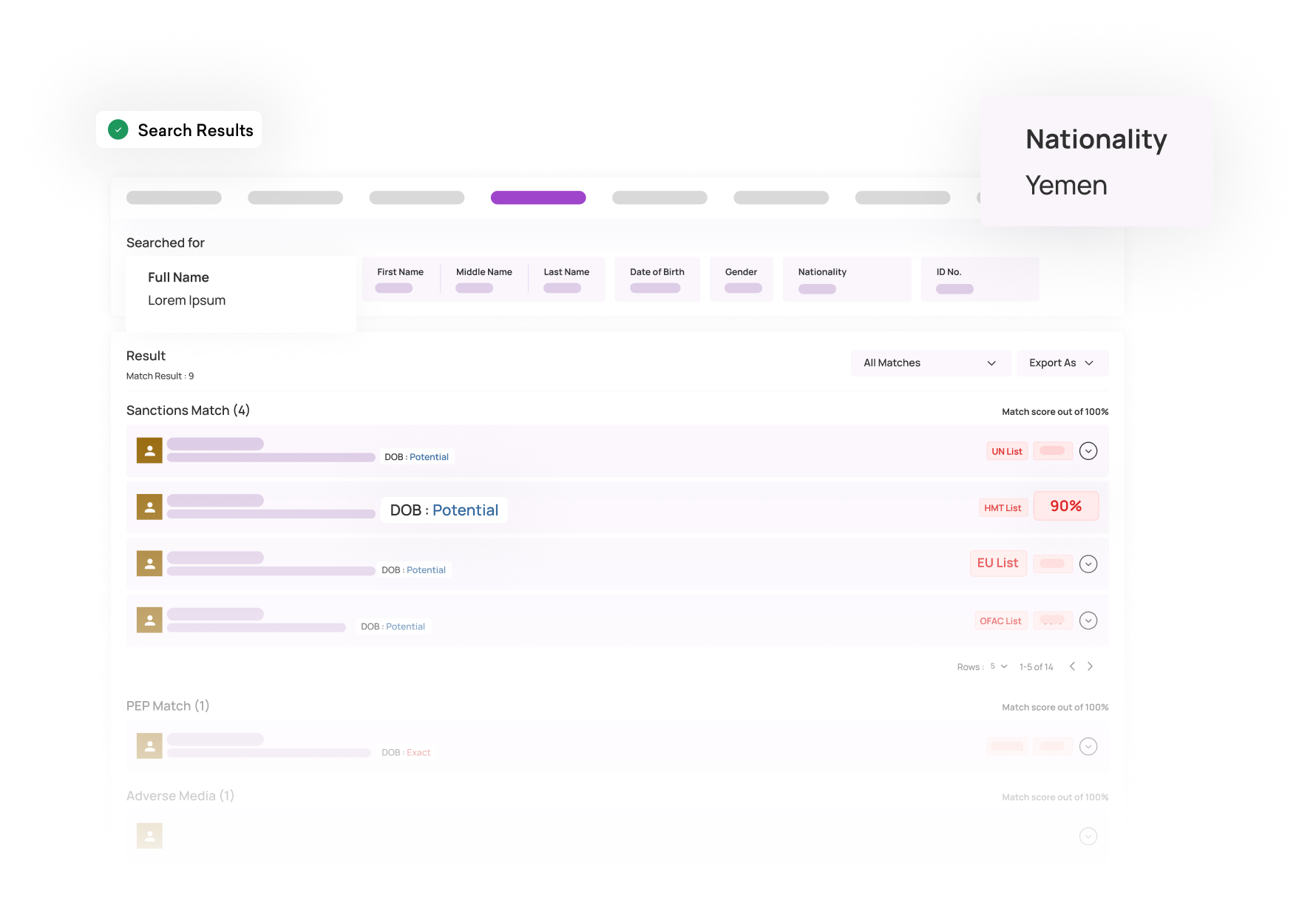

Unambiguous Presentation of the information

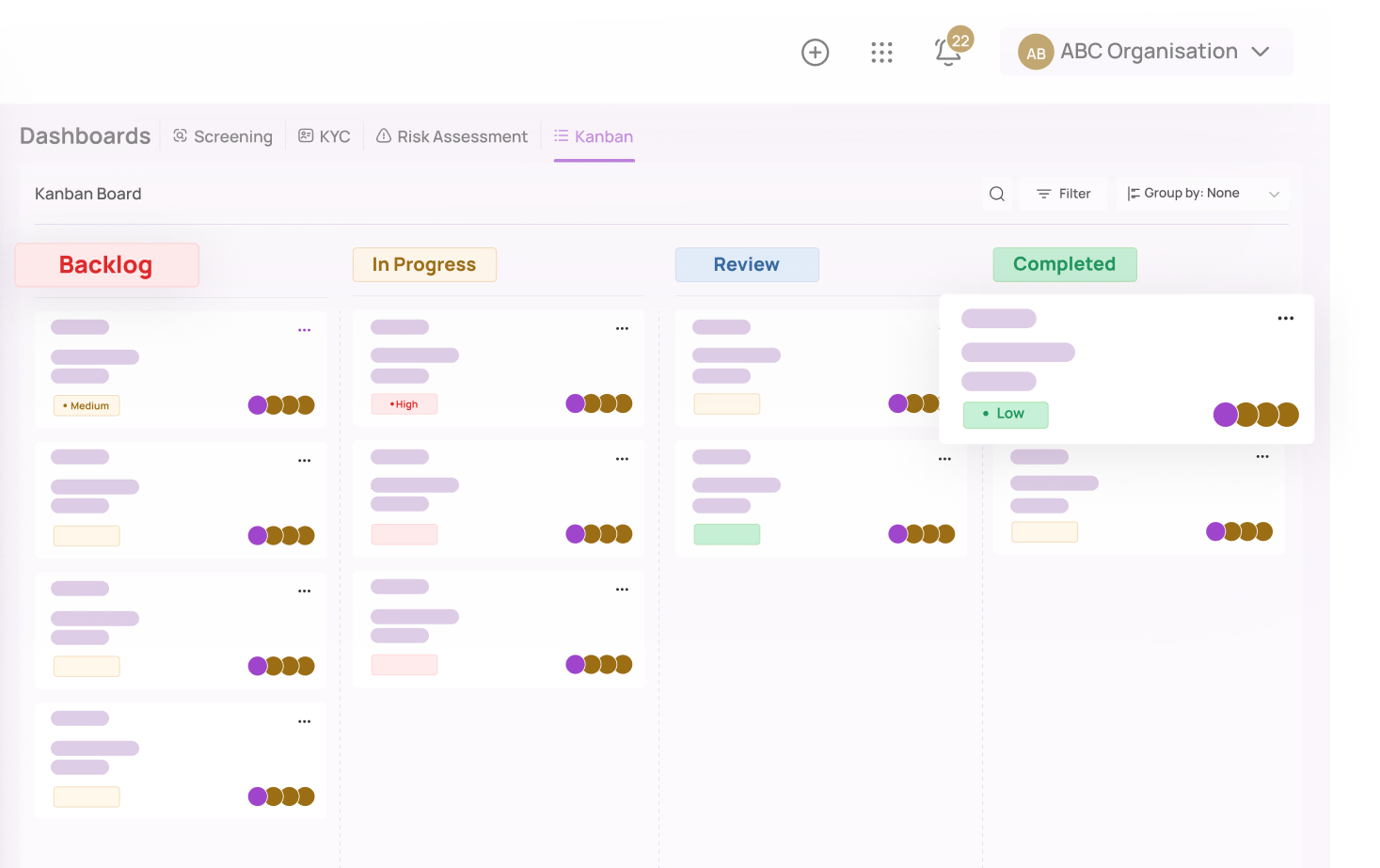

Big picture of screening tasks

We segmented the entire process, specifying the focus for each screen and outlining the optimal flow.

Our exceptional UI/UX team placed the elements thoughtfully, making it easy for users to navigate and take the required actions.

Whether it’s the attributes about a customer one must collect, screening results or observations thereon, everything is presented clearly.

We introduced the Kanban board, covering the entire screening process so you know who does what and what the progress of customer onboarding is.

How We Achieved Your Goal for You?

The expert AML consultants from our knowledge partner, NIYEAHMA, collaborated with the UI/UX specialist team to help them achieve this uniqueness.

Before getting started with the UI/UX designing, well-defined screening process documentation was provided to the designers.

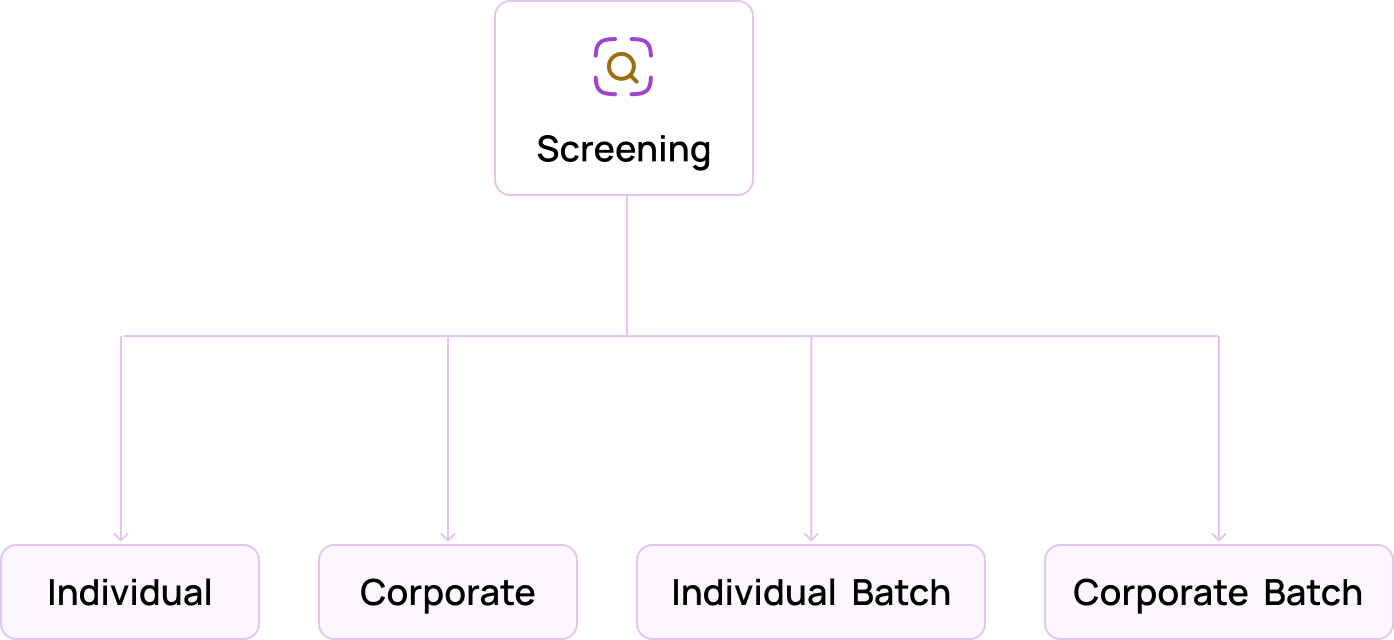

There are different processes for individual screening and corporate screening. Accordingly, different screens were crafted.

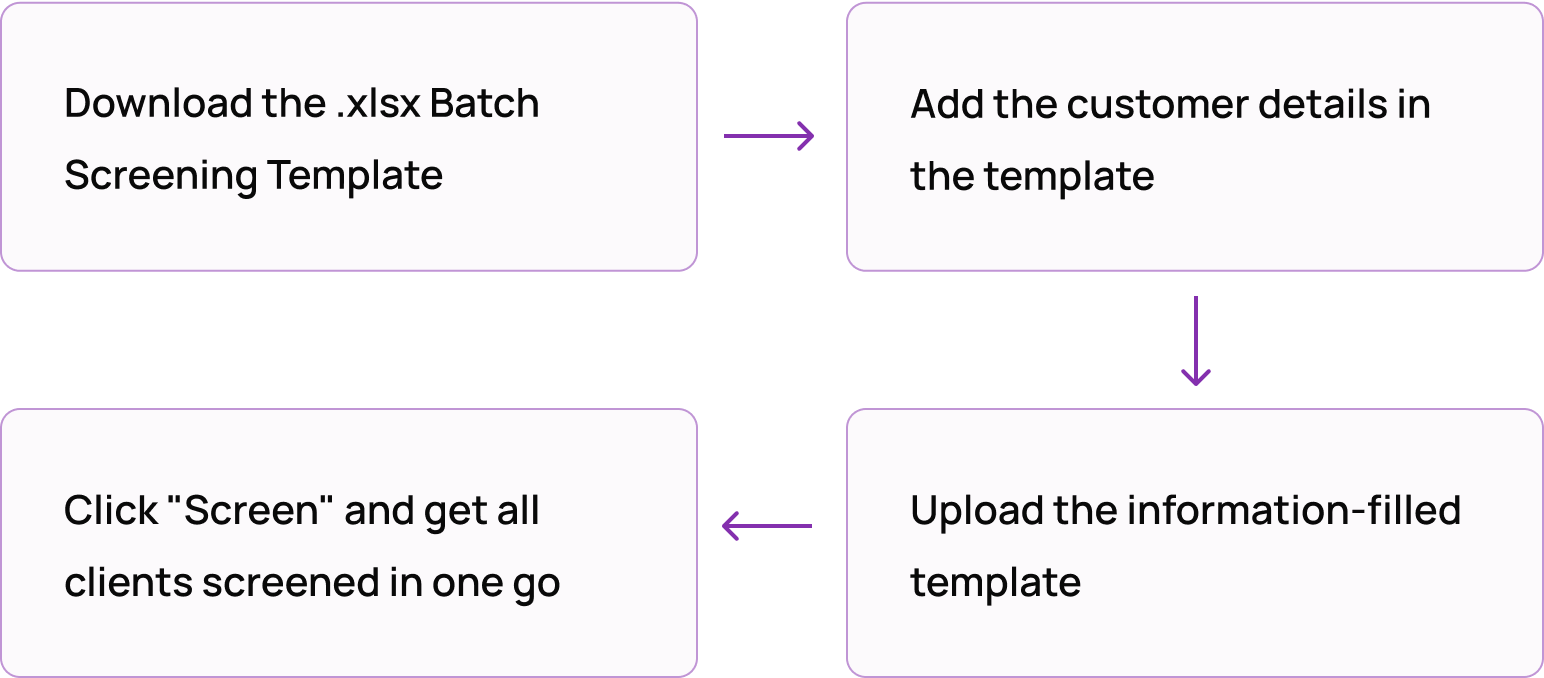

To make things easier, we introduced batch screening.

Whether it’s individual screening or corporate screening, you’ll be able to screen multiple clients in one go in a couple of steps.

This final user interface went under scrutiny several times to deliver what’s the best. After climbing one cloud over another, we have reached the sky beyond the horizon.

RapidAML won’t just be a tool; it will be your guide as well.

Now that the UI/UX is ready, it’s time to get the fingers moving and steer through the coding path.

RapidAML’s UI/UX will revolutionise your compliance experience

Get Started

Contact Us