- SolutionsScreening

Your compliance checklist where sanctions, PEPs, and adverse media subjects get the right level of scrutiny.

Case ManagementEvery task documented, every red flag addressed. No unsolved mysteries in your compliance workflow.

KYCVerifying identities to make sure you’re not accidentally welcoming a financial criminal.

Transaction MonitoringA surveillance system detecting unusual patterns and flagging suspicious transactions in real time.

Customer Risk AssessmentFair is foul, and foul is fair unless your risk scores separate high and low-risk customers.

Regulatory ReportingSubmit accurate and flawless reports to help authorities track financial criminals effectively.

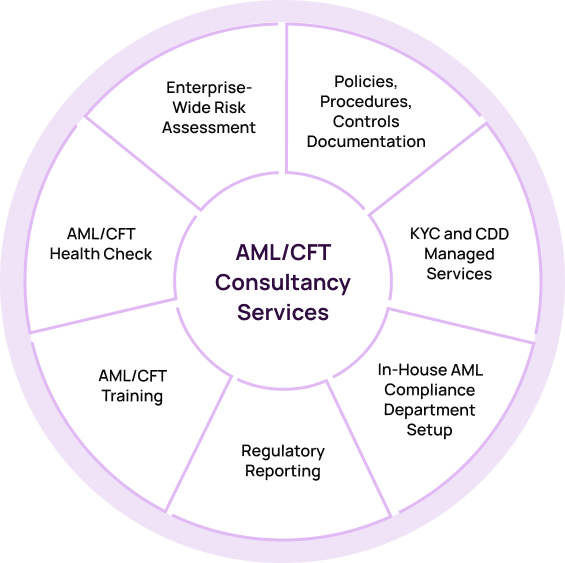

- ServicesEnterprise-Wide Risk Assessment

A most strategic matter, no hidden ML/FT risks crawl behind the velvet curtains of your palace.

Regulatory ReportingA pristine declaration of accuracy empowering FIUs to take appropriate actions against financial crime with ease.

AML/CFT Policies, Procedures, and Controls DocumentationThe rules of high society for those who fail to observe them risk financial disgrace.

AML/CFT TrainingA proper education in ML/FT risks, lest one unwittingly aid a money launderer’s grand deception.

KYC & CDD Managed ServicesOne must always know who they’re dealing with, lest they unknowingly dance with ML/FT risks.

AML/CFT Health CheckA third eye that not only pinpoints irregularities but also prescribes the right remedy.

Assembling a trusted inner circle, only the most astute shall guard your reputation from ML/FT crimes.

- ResourcesArticles

Detailed explorations, best practices and sharp perspectives on AML compliance.

eBooksIn-depth and engaging guides packed with strategies and compliance wisdom to help you master key topics.

VideosAML explained in motion. Quick, clear and easy to grasp.

Product UpdatesFresh features and enhancements for smoother, smarter, and more efficient compliance.

InfographicsComplex AML concepts simplified and visualised for quick understanding.

EventsStay in the loop with sessions that talk about compliance and connect the community

- About

- Contact Us