RapidAML Team

2024-05-10

Sanctions checks have been a regulatory requirement for Designated Non-Financial Businesses and Professions (DNFBPs), Virtual Asset Service Providers (VASPs), and Financial Institutions (FIs) in the UAE. Anti-Money Laundering (AML) compliance is impossible without reliable sanctions screening software. Let us explore how regulated entities can elevate their AML compliance with name-screening software.

The exercise of matching a list containing names of customers, suppliers, or business partners against the sanction lists, watchlists, or databases issued by regulatory authorities of various countries or international organisations is known as name screening.

AML Name screening can be carried out either using software, APIs, automated screening tools, or manually searching names across sanction lists.

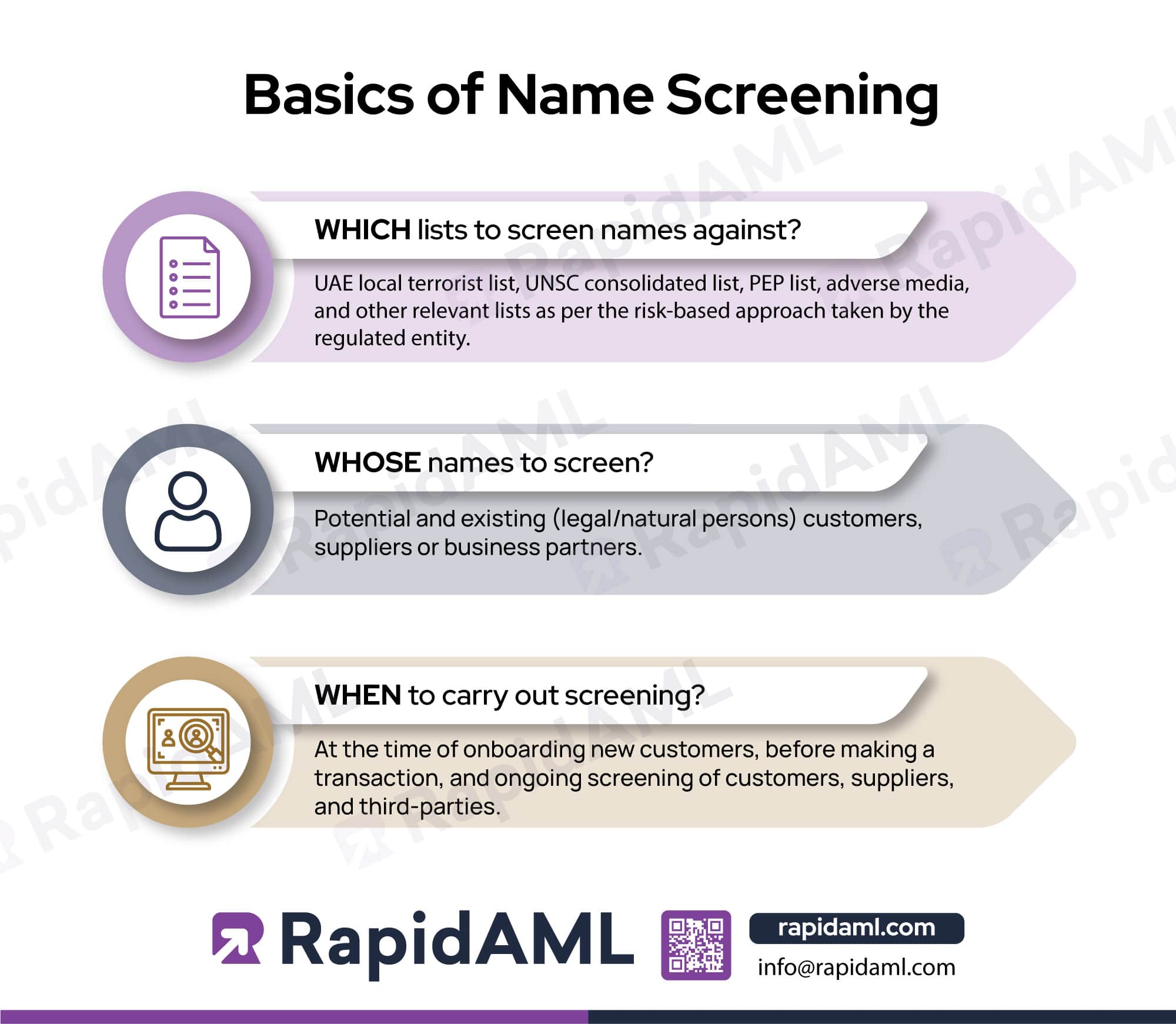

To understand how name screening works and helps in fighting Money Laundering (ML), Terrorism Financing (TF), and proliferation financing of weapons of mass destruction (PF), it is important to know which “lists” and whose “names” require screening and when.

Which Sanction Lists to screen names against?

As per UAE AML/CFT laws and regulations, regulated entities are required to consider the UAE local terrorist list and UNSC consolidated list to comply with their legal obligations. However, DNFBPs, VASPs, and FIs dealing with foreign customers should take into account other relevant lists as per the risk-based approach taken by them.

Whose names to screen across the aforesaid Sanctions List?

Potential and existing customers (legal or natural persons), suppliers or business partners and their directors, Ultimate Beneficial Owners (UBOs), authorised signatories, and representatives through the power of attorney. In the case of a minor as a customer/supplier or business partner, their parents or legal guardian need to be screened.

When to screen?

At the time of onboarding, i.e., establishing a business relationship or while continuing a business relationship, before making a transaction, and ongoing screening of customers, suppliers, and third parties. Re-screening existing customers when there is a change in their Know Your Customer (KYC) information.

Name screening is carried out for various purposes, particularly to identify sanctioned or politically exposed individuals or entities while carrying out regular business activities to prevent onboarding such individuals or entities as their customers, suppliers, or business partners.

The need to avoid onboarding such individuals or entities arises from the requirement to stop or restrict such individuals or entities from entering or establishing their foothold in the legitimate financial system.

The process of carrying out name-screening exercises helps businesses to stay compliant with Anti-Money Laundering (AML), Counter-Financing of Terrorism (CFT), and Counter-Proliferation Financing (CPF) of weapons of mass destruction laws and regulations around the world and directives, recommendations, findings, and interpretive notes of international organisations such as the Financial Action Task Force (FATF), United Nations Security Council Resolutions (UNSCRs) related to the sanction regimes as UAE is a member of United Nations; thus, compliance with UNSCRs and various local UAE laws is required.

The Role of Sanctions Check in Financial Crime Prevention

Sanctions are restrictive or prohibitory measures taken by countries either single-handedly or jointly with the primary goal of requiring deterrent or non-compliant individuals, organisations, or countries to change their status of non-compliance with AML laws towards compliance.

The UAE laws and various international sanctions regimes are enacted with the intention of safeguarding economies being used as channels to circulate illicit proceeds and fund terrorist activities. To enable businesses to steer clear of criminals and organisations that are suspected, blacklisted, and found responsible for ML, FT, and PF, the UAE government and various international bodies have come up with lists containing names of individuals and organisations to be avoided and reported to the Financial Intelligence Unit (FIU).

Some of the popularly used sanctions lists are:

Further, UAE laws and international resolutions require businesses to adopt sanctions compliance programs. These programs usually require businesses to cross-verify the names of their existing and potential customers, suppliers, and business partners across names in such lists applicable to the business.

The prevention of ML, FT, and PF becomes possible when businesses cross-verify their existing and potential customers, suppliers, and business partners across such lists and report matches to the FIU. When businesses find a complete match or a partial match, they are required to terminate or suspend transactions, freeze funds, and submit a Funds Freeze Report or a Partial Name Match Report as the case requires with such individuals or organisations, thus breaking the chain or stopping them from entering legitimate financial systems.

Know Every Name Before You Onboard

Sanctions Screening, PEP Checks, Adverse Media Watch and Ongoing Monitoring, Everything at One Stop

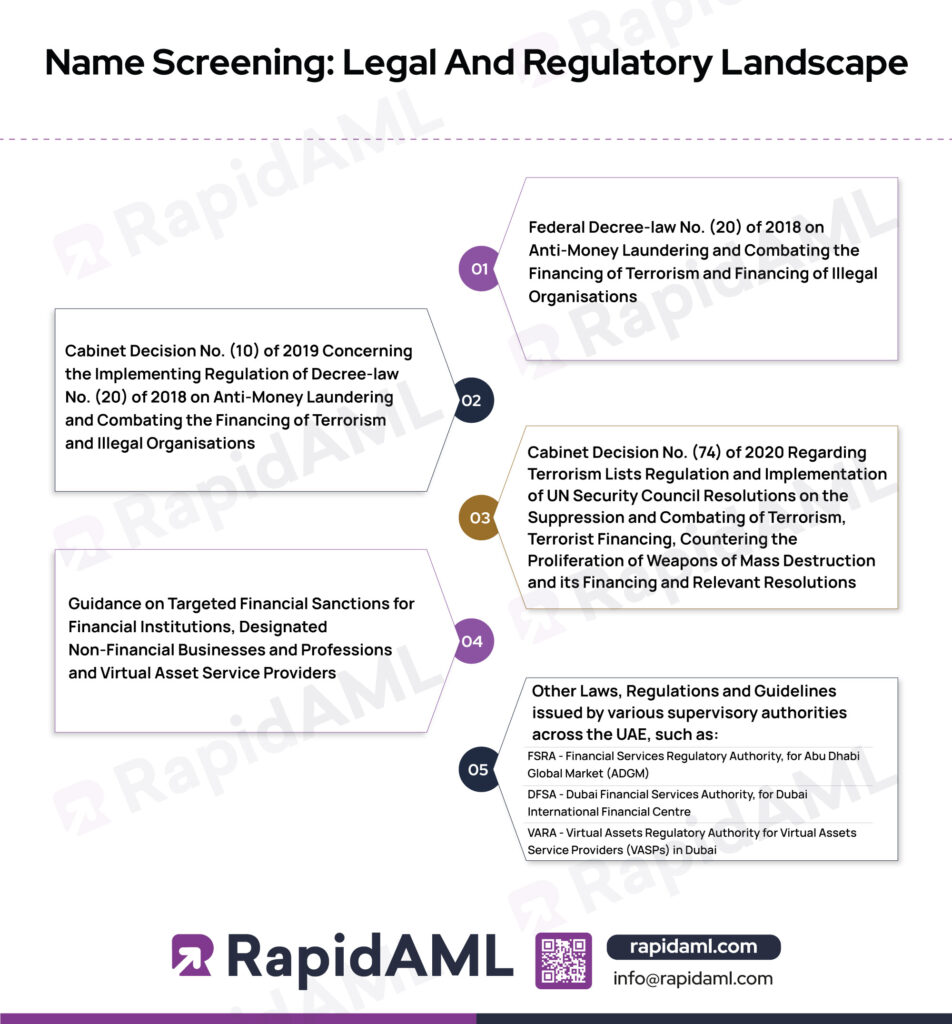

When it comes to the regulatory landscape in the UAE, the UAE government has enacted the following laws to prevent money laundering, terrorism financing, and the proliferation of weapons of mass destruction.

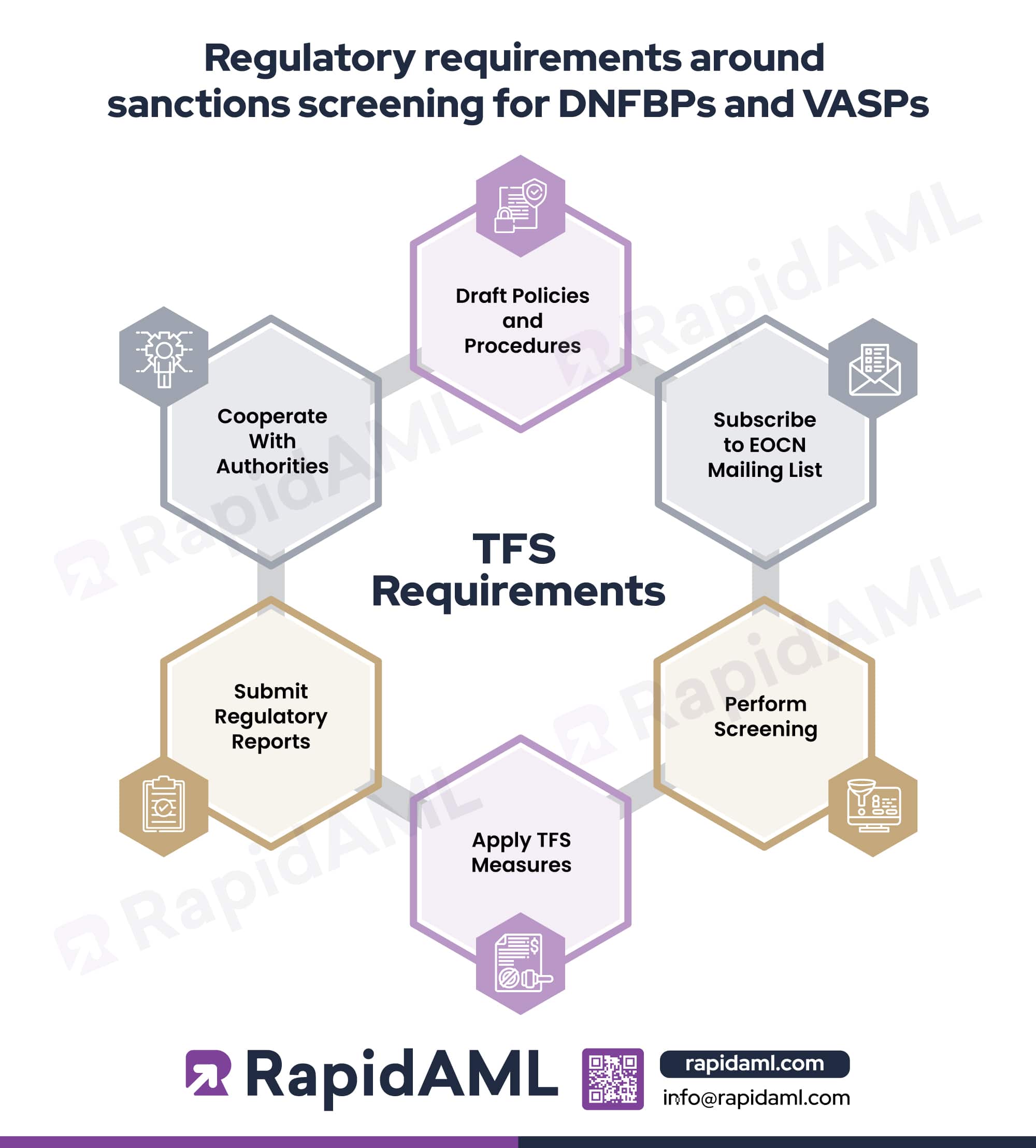

Regulatory Requirements Around Sanctions Screening for DNFBPs and VASPs:

Broadly speaking, the aforementioned laws in UAE and the Guidance on Targeted Financial Sanctions for Financial Institutions, Designated Non-Financial Businesses and Professions, and Virtual Asset Service Providers cover the major obligations of DNFBPs and VASPs. Some of these obligations revolve around ensuring that a proper process is followed to carry out sanctions screening. The following steps are suggested by the guidance for DNFBPs and VASPs:

International Standards: FATF Recommendations

The FATF is a global AML, CFT, and CPF watchdog that makes suggestive recommendations to prevent ML, FT, and PF acts.

FATF Recommendation 6

FATF Recommendation 6 deals with the Targeted Financial Sanctions related to terrorism and terrorist financing. It requires each country to implement TFS measures to comply with the UNSC resolutions that require countries to freeze, without delay, the funds or other assets and to ensure that no funds and other assets are made available to or for the benefit of designated person or entity by the UNSC under Chapter VII of the Charter of the UN, as required by the Security Council resolution 1267 (1999) and its successor resolutions; or any person or entity designated by that country pursuant to Security Council resolution 1373 (2001).

FATF Recommendation 7

FATF Recommendation 7 deals with Targeted Financial Sanctions related to Proliferation. It requires countries to implement TFS measures and freeze, without delay, the funds or other assets of, and to ensure that no funds or other assets are made available to, and for the benefit of, designated individuals and entities by the UNSC under chapter VII of the Charter of the United Nations, pursuant to Security Council resolutions that relate to the prevention and disruption of the financing of proliferation of weapons of mass destruction.

Businesses operating in the UAE are required to carry out AML Know Your Customer (KYC). The KYC process forms part of RBA, where customer identification and verification are carried out.

As a part of finding risk associated with customers, it is essential to screen customers prior to onboarding them across applicable and relevant sanctions lists, watchlists, and PEP lists and screen them across media to find if any negative or adverse finding connects them to larger crimes like ML, FT, and PF.

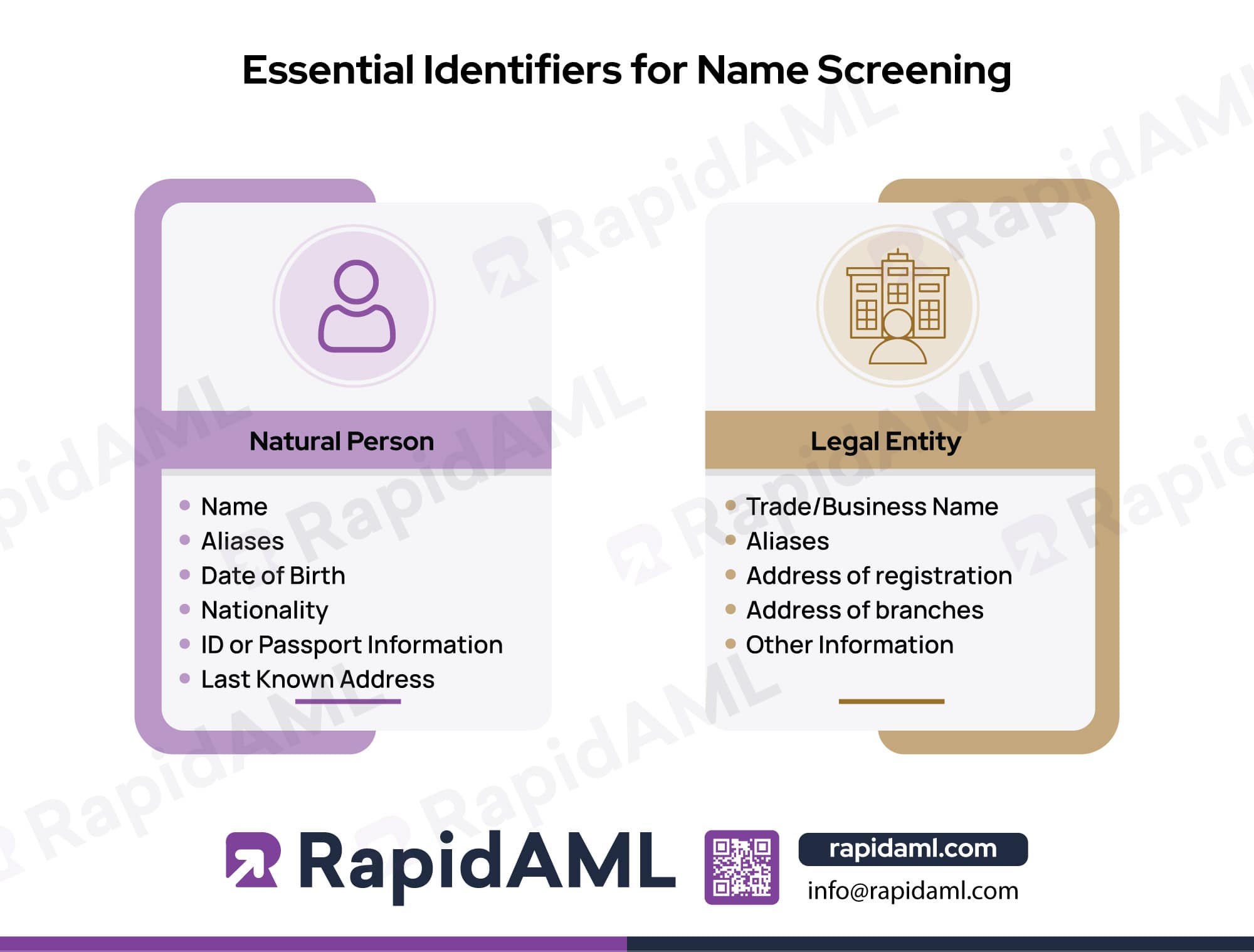

The Name Screening process is carried out by entering key identifiers of a natural or legal person, such as name, date of birth, aliases, nationality, ID or passport information, and last known address for a natural person and business name, aliases, address of registration, address of branches, and other relevant information for a legal person into the sanctions screening tool when relying on technology for name screening or manually cross-verifying these identifiers across the sanctions list or watchlists applicable to the regulated business carrying out name screening.

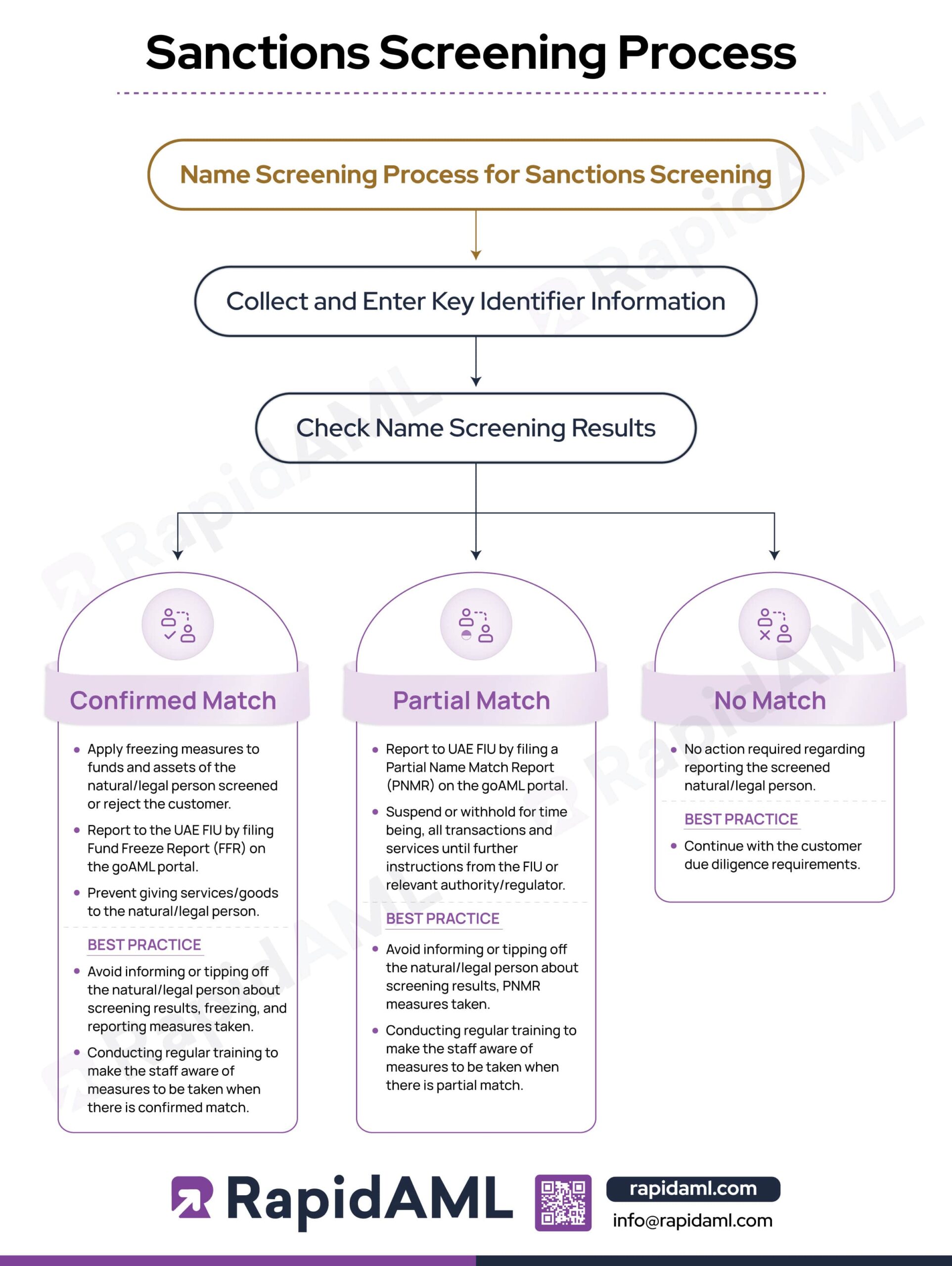

Sanctions Screening Process

The sanctions screening process is generally carried out by taking the following steps:

The result of name screening would show the following results, with interpretations of each one explained below:

Confirmed Match:

Partial Match:

No Match:

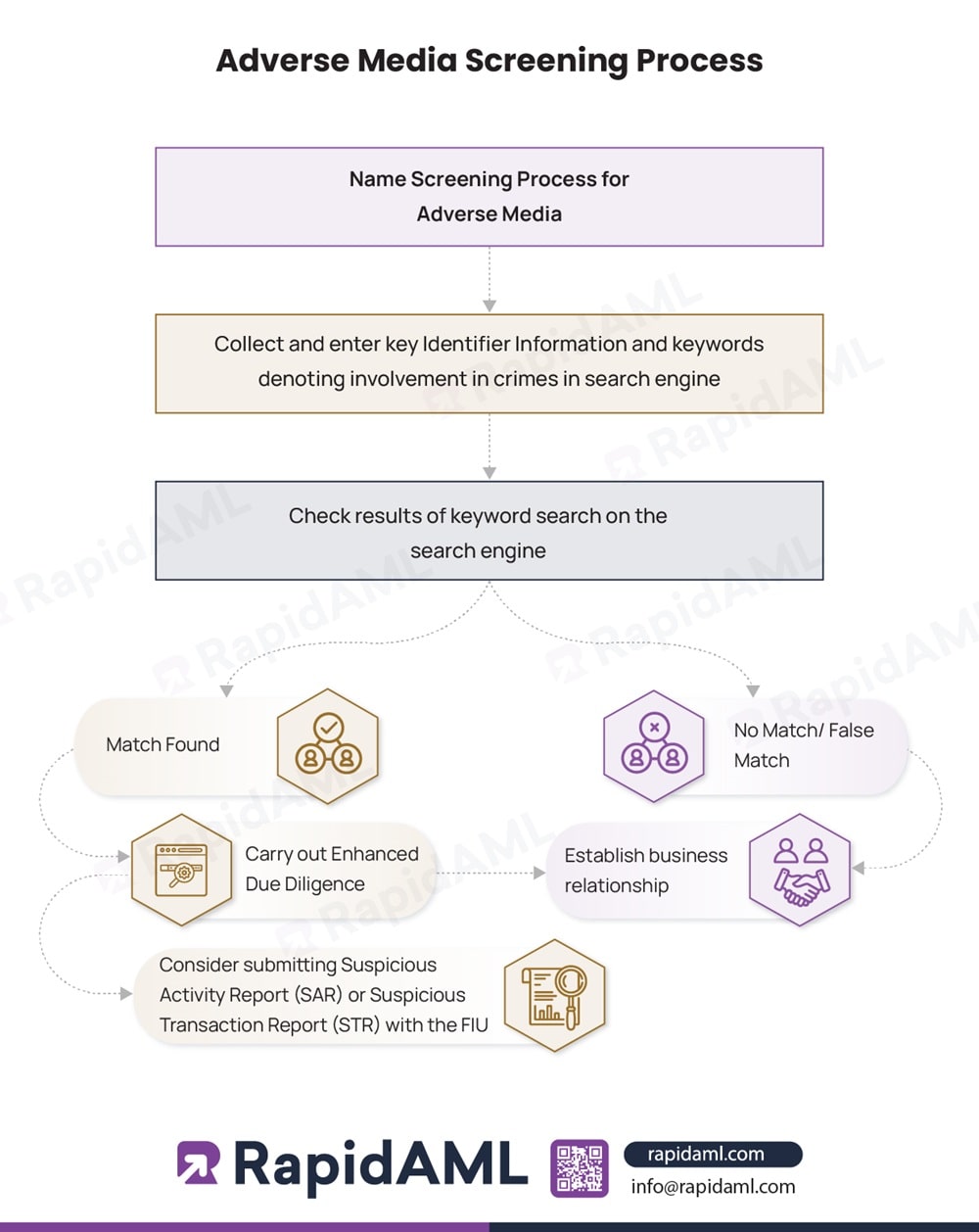

Adverse Media Screening Process

The Adverse Media Screening Process is generally carried out by taking the following steps:

The result of name screening for adverse media would show the following results, with interpretations of each one explained below:

Match Found:

When screening results show a match found, it means that the natural/legal person who is being screened has their name associated with financial crimes and predicate offences. Then, enhanced due diligence measures need to be implemented to ascertain the true extent of risk they pose to the business. The regulated entity can also submit a Suspicious Activity Report (SAR) or Suspicious Transaction Report (STR) in case of suspicion as to Money Laundering or Terrorist Financing.

No Match/False Match:

When the result of screening shows a ‘No Match’ or a ‘False Match’ as a result, it means that the natural/legal person that was screened for negative news does not appear to have their name associated with keywords that denote involvement with financial crimes and predicate offences and is safe to conduct business as usual.

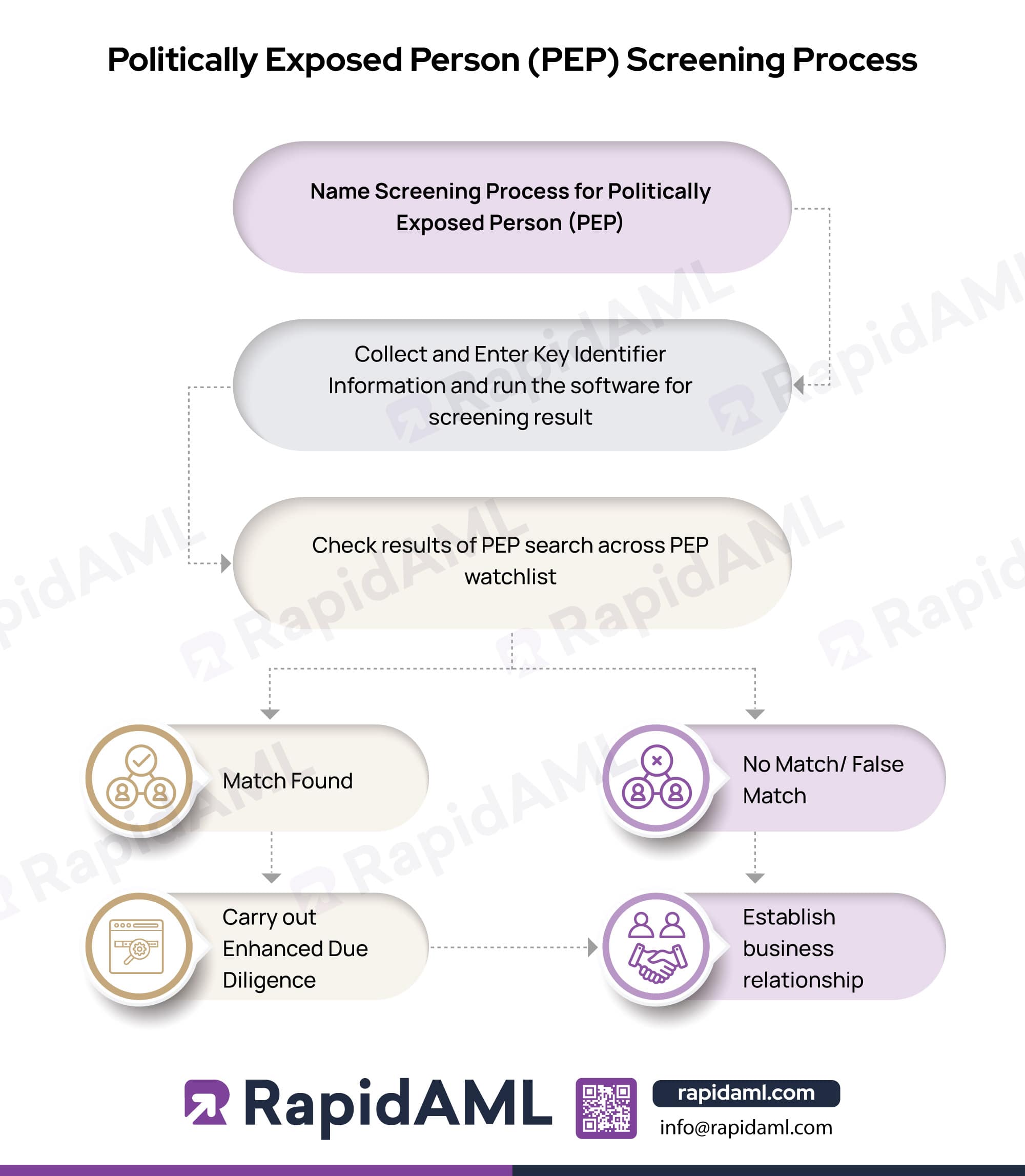

Politically Exposed Person (PEP) Screening Process

PEP screening is required to identify if a potential customer, supplier, or business partner is a Politically Exposed Person (PEP), meaning that such a person holds political influence. PEPs are generally categorised as high-risk due to their reach and influence. When a customer is identified as a PEP, enhanced diligence measures need to be applied.

The process of PEP screening entails entering key identifier data into screening software or across a PEP watchlist. The screening result determines whether a customer is PEP.

Stop The Risk Before It Costs You

RapidAML Makes Sure That No Risk Slips Through with Intelligent Screening

Best practices around the name screening process include the following measures that a business can undertake.

1. Applying a Risk-based Approach

The FATF recommendations and UAE local laws require businesses operating in the UAE to implement a risk-based approach, where the business shall apply measures to prevent ML, FT, and PF in proportion to the risks identified.

While implementing such RBA measures, risk factors pertaining to the customer need to be carefully considered. Appropriate policies, particularly sanction compliance programs, must be drawn up to adequately identify customer risk and implement commensurate mitigation measures. Such a sanctions compliance program must contain the stepwise procedure to be followed by the business’s personnel while carrying out the name screening to identify sanctioned, politically exposed individuals and organisations.

The Sanctions Compliance Program must also specify the sanctions list the business will adhere to and mention the frequency of updating such lists.

2. Designing and Implementing Appropriate Policies and Procedures

The FATF recommendations, UAE federal laws, and various supervisory authorities across UAE, such as the FSRA, DFSA, and VARA, strongly recommend businesses have in place appropriate policies and procedures in place that clearly state and direct the steps to be taken to ensure compliance with screening requirements, including sanctions compliance program as discussed above and use of technology, reliance on third parties for carrying out screening, etc. to maintain clarity and compliance at the same time.

It is important to have a clearly drafted client exit policy in place that helps the business’s employees understand how and when to reject, terminate or suspend transactions and services, particularly due to name screening results with potential and existing customers, suppliers, and business partners to ensure that the business stays within its risk appetite while conducting business.

3. Use of Technology

Various supervisory authorities across the UAE now recommend relying on technology, i.e. software and APIs, to carry out sanctions screening, PEP screening, and Adverse Media screening. Implementing the correct technological tool is highly advisable as it reduces the occurrence of errors while carrying out manual screening and saves cost and time to a great extent.

4. Exploring and Applying Third-Party Services

Various supervisory authorities across the UAE also mention in their guidelines that businesses can depend on third-party solutions for getting their customer due diligence measures carried out on their behalf to meet regulatory requirements and reduce the burden of hiring staff just for meeting CDD requirements. Businesses need to be mindful that the third-party entity is following AML compliance measures up to the standards of those prescribed by the FATF and the relevant supervisory authority, and in the event of ambiguity, the stricter law shall prevail.

5. Exploring and Using Suitable APIs

APIs are application programming interfaces. In simple words, APIs are software intermediaries that enable two applications/software to communicate with one another seamlessly using protocols. For example, the share market app on your mobile phone communicates with the systems of the stock exchanges and gives out immediate, accurate, and exact information about changes in share prices instantly on your phone.

The API for screening shall help businesses keep the sanctions database updated. Selecting a suitable API depends on a business’s individual needs.

6. Staying Updated with Regulatory Changes

The businesses operating in UAE, to ensure continuous and non-redundant compliance with sanctions and screening requirements, need to stay updated with the latest and frequent regulatory changes to ensure compliance with the ever-evolving legislative landscape. The compliance officer and senior management must remain mindful of such updates.

7. Ongoing Screening

Needless to mention, name screening in AML Compliance is not a one-time exercise; the purpose of name screening would instantly get defeated when an individual or organisation screened and onboarded today with simple due diligence becomes politically exposed or ends up having their name appear on the local terrorist list tomorrow without being subject to enhanced due diligence or freezing and reporting measures. To avoid such a lapse, it is important to screen existing customers, suppliers, and business partners daily by way of ongoing monitoring across relevant sanctions lists.

8. Language Variation Consideration

Generally, international sanctions lists contain names of Arabic, Cyrillic, and Russian origin, and the language difference leads to complications when trying to match names in such lists with names in English script. The accuracy of results suffers. To remove the issues arising due to language variation, the best practice can be adopted by relying on software that uses fuzzy matching algorithms so that matching names with sanctions lists becomes possible without missing names due to language variation and leaving less room for errors in match results.

9. Testing and Auditing Screening Measures Applied

The responsibility of regulated entities does not end by subscribing to EOCN notifications or buying screening software. Businesses need to test the efficacy of screening systems and mechanisms chosen for their organisation and make sure that the measures applied are commensurate and optimum for their needs. Auditing of measures in place is essential to ensure ongoing compliance with applicable laws.

10. Selecting Suitable Screening Software

There are many tools available in the market to aid businesses in implementing name screening. However, businesses need to be mindful that the software they select for this purpose actually suits their individual business and ensures regulatory compliance. Finding software that is a good match, affordable, and compliant with the needs of the business is essential best practice; otherwise, implementing software would be a futile exercise.

11. Regular Training

Employees, compliance officers, and senior management need to be trained on a regular basis to ensure that they are aware of best practices regarding name screening and its regulatory and compliance requirements to avoid criminal and administrative fines and penalties.

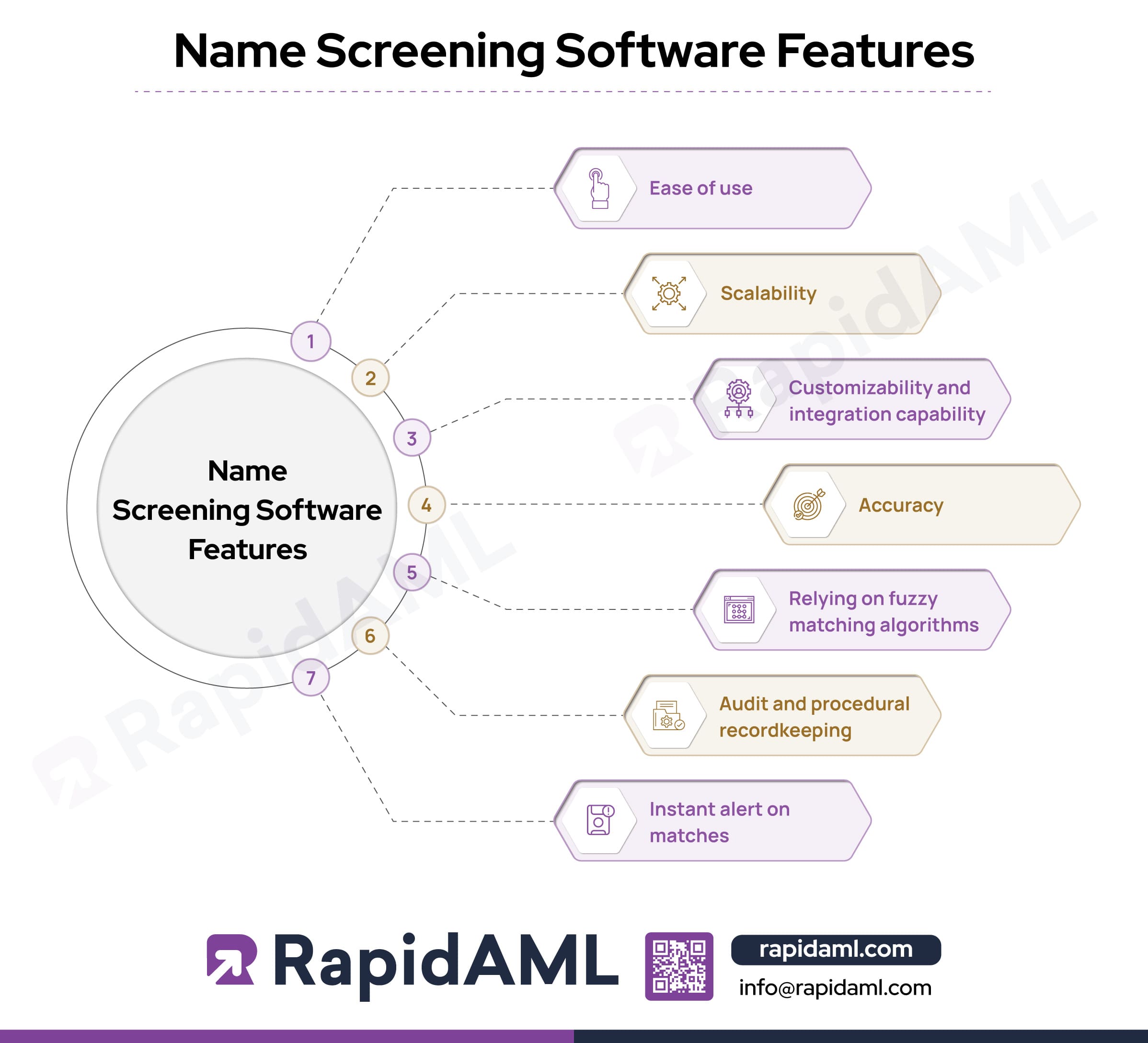

Name-screening software is generally considered a one-stop solution for fulfilling name-screening needs (sanctions, adverse media, PEP and terrorist name screening) and related regulatory compliance. The features that make name screening software a preferred screening solution are:

1. Ease of Use

Relying on any software is intended to achieve convenience and ease while carrying out tedious, repetitive, and monotonous tasks. Name-screening software solves the pain of the manual name-screening process for businesses by providing features such as bulk screening or batch screening, where hundreds of customers can be screened across various watchlists in a matter of minutes.

2. Scalability

Any good name-screening software would allow businesses to increase screening volumes, helping them achieve scalability with growing businesses.

3. Customisability and Integration Capability

Many good name-screening software providers offer the feature of customising or tailoring the software to suit the needs of an individual business in accordance with its risk-based approach (RBA). Further, name screening software also provides allied AML compliance solutions such as KYC, CDD, and Transaction Monitoring, which can be integrated according to requirements with the screening software.

Some software also provides the option of integrating screening software with other POS, ERP, and CRM software to help businesses have a one-stop solution.

4. Accuracy

The degree of accuracy in name screening results derived by using name screening software is tremendous as room for human error gets instantly mitigated. Further, this accuracy helps avoid false results, leading to timely implementation of freezing measures and compliance with reporting requirements on the goAML portal.

5. Relying on Fuzzy Matching Algorithms

Fuzzy matching algorithms aid businesses in achieving accurate screening results by removing confusion arising from language variation and phonetic differences. Fuzzy matching features in name screening software help get better results by allowing businesses to alter match percentages according to their screening policy.

6. Audit and Procedural Record-keeping

Name Screening software helps businesses by creating a record of screenings carried out and ongoing screenings that are continuously monitored, which helps build documentary records necessary for audits and record-keeping requirements.

7. Instant Alerts on Matches

Name screening software has a feature of sending immediate notifications to businesses over emails whenever there is a match found while conducting ongoing monitoring or ongoing screening of customers, suppliers, or business partners, resulting in the ability of businesses to apply enhanced due diligence mechanisms and fulfilling freezing and record-keeping requirements in a timely manner.

A name-screening exercise will only be as successful and accurate as the selection of appropriate watchlists that help in achieving regulatory compliance applicable to the business. There are various types of watchlists used to carry out name screening. Some of these are discussed here as follows:

Watchlists for AML/CFT and CPF Compliance

Sanctions Screening APIs

The use of Sanctions Screening APIs, to a great extent, simplify the process of the watchlist screening process. Simply put, sanctions screening APIs can be integrated with the existing POS, ERP, and CRM systems, and the benefits of having a unified compliance software can be availed.

Name Screening Software is important due to its inherent nature of being updated on a real-time basis when it comes to additions, deletions and modifications carried out by regulators in their respective watchlists across the globe.

Name Screening software gives immediate alerts of matches across ongoing screenings, leading to timely implementation of freezing or transaction suspension measures for compliance with freezing and reporting requirements.

Name screening software helps get more accurate screening results compared to manual screening, leading to ease of conducting screening. Its fuzzy matching feature considers language, spelling, and aliases while generating results.

The automated batch screening feature helps businesses to scale and carry out their bulk screening requirements in the background while issuing notifications or alerts on prompt detection of sanctioned individuals or entities.

Non-compliance with screening requirements, whether intentional or unintentional, when caused by human error of missing out a name or mistake in name screening, be it sanctions, PEP, adverse media, or any other watchlists, leads to fines and penalties, damage to the reputation of the business, loss of trust in the business, bans or restrictions getting imposed on the business for carrying out certain or all business activities and even imprisonment in severe cases.

The use of name screening software helps to mitigate the occurrence of human errors, whether intentional or unintentional, increasing the chances of businesses remaining compliant with screening requirements.

1. Frequent Updates in Regulations

The regulatory landscape is ever-evolving. It’s important to stay updated with regulatory changes to avoid noncompliance, which can lead to fines and penalties. Policies, procedures, systems, and controls must be updated and modified to ensure continuous compliance with TFS requirements.

2. Data Quality and Accuracy

Implementation of an effective sanction screening process is only possible when the database used for screening is updated and accurate, language variations are considered, and discrepancies are removed to eliminate the possibility of errors.

3. Scalability

Initial implementation of a suitable sanction screening process is usually accurately achieved. However, issues arise with the flexibility of the sanctions screening program as business volume increases beyond the scope of the existing sanctions screening system, which results in difficulty in handling large volumes of customer data across multiple sanctions lists.

4. Data Privacy and Protection

It is important to conduct sanctions screening to fulfil regulatory compliance requirements, but businesses must be mindful that their data privacy notice, which is publicly available, mentions that they use identifiers of their customers, suppliers, and business partners key identifier information for carrying out sanctions screening, failing which could result in non-compliance with data privacy and protection laws such as:

5. Ever-updating Sanctions Lists

The sanctions lists, PEP lists, and other watchlists are updated on a real-time basis by the regulatory authorities responsible for issuing them. However, the challenge arises when businesses are unable to keep up with updated sanctions lists. If they carry out screening across lists that are outdated, the results of such screening would not be accurate. Businesses must be mindful of keeping their database updated to ensure compliance.

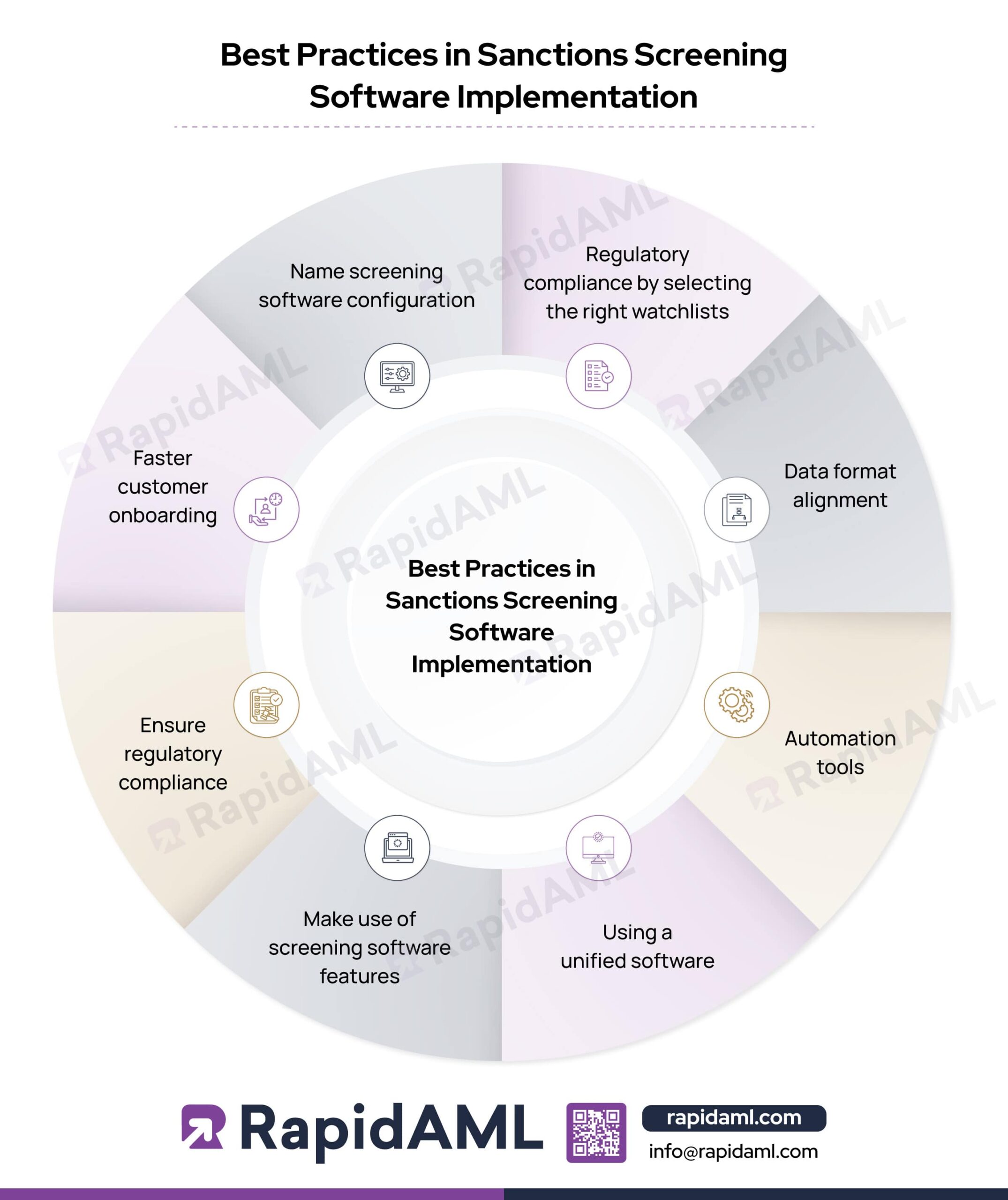

The best practices that a business can implement by relying on sanctions screening software are discussed as follows:

1. Regulatory Compliance by Selecting the Right Watchlists

Make sure to select, subscribe, and run name screening against all relevant and applicable sanctions watchlist; sanctions compliance screening software will help to screen across multiple lists in one go.

2. Data Format Alignment

Businesses need to be mindful of aligning or arranging their database of customers, suppliers, and business partners according to the requirements of sanctions screening software and screening lists within, particularly when batch screening needs to be carried out, to reduce inaccurate results from screening.

3. Automation Tools

While using sanctions screening software, businesses should aim to use automation tools to conduct ongoing screening for bulk screening to avoid manually running single scans. Artificial intelligence and machine learning algorithms can be used to go through a large bulk of databases to save time and ensure accuracy.

4. Using a Unified Software

Businesses should focus on finding software that helps them fulfil all their AML/CFT and CPF compliance needs of name screening (sanctions, PEP, Adverse Media, etc.) in one software. Businesses may also consider relying on software that has integrated KYC and CDD conducting features to avoid complications and confusion arising out of using more than one platform.

5. Make Use of Screening Software Features

Making use of software features such as bulk screening, ongoing monitoring of existing customers, suppliers, and business partners, creation of whitelists and blacklists, setting fuzzy match percentages, etc., to optimise the use of the software.

6. Ensure Regulatory Compliance

Businesses can try to ensure that screening software provides the sanctions list needed by the business to ensure compliance with the laws of the jurisdictions in which it operates.

7. Faster Customer Onboarding

When businesses use comprehensive software that carries out multiple AML/CFT and CPF tasks such as KYC, CDD, and Name Screening, the process and timeline of the customer onboarding cycle reduce drastically, enabling businesses to increase their turnover.

8. Name Screening Software Configuration

Name-screening software enables businesses to configure and set up name-matching rules, where every match identified by the software has a match percentage score associated with it. Based on the closeness of the match, the matching rule will give out the match score.

Name screening is an indispensable requirement of AML, CFT, and CPF compliance. It forms part of the Customer Due Diligence procedure set out for the business based on the risk assessment carried out for it.

The name-screening process, when carried out by using software or an API, elevates the AML compliance of an organisation in several ways as it makes way for customisation and integration of name-screening software to suit the individual needs of an organisation accurately.

Name Screening Software and API provide tailor-made name screening services where the organisation can decide which screening lists it needs to subscribe to and whether name screening should include PEP detection and adverse media search for names screened.

Further, the key takeaway of name screening software is its versatility in aiding organisations in complying with their regulatory obligations by generating reports using automation and still involving human intervention while ultimately deriving the final screening report.

This helps ensure that screening analysts, compliance officers, or any personnel of similar skill, competence, or authority can review, assess, and generate conclusive reports using name-screening software.

Below is an example of such an interplay between name screening software and the role of human input in generating the final name screening reports.

| Illustrative Name Screening Batch Report | ||||||

| Software Generated Outcome | Human Input and Evaluation | |||||

| Sr. No. | Customer Name | Watchlist Name | Screening Result | Result Evaluation/ Review | Review/ Evaluation done by: | Conclusive Screening Finding |

| 1 | Chris Ronaldo | Cristiano Ronaldo | Positive | Only the Surname Matches with the customer’s surname, and the First Name Partial Matches. | Screening Analyst | Partial Name Match (File PNMR) |

| 2 | Taylor Swift | Taylor Smith | Positive | Only the first name matches, and considering the date of birth and other available data points, it’s a different person.

(cross-verified with KYC documents) |

Screening Analyst | False Match (Continue business) |

| 3 | Harry Porter | Harry Potter | Positive | Spelling variation

(Same person, cross-verified with KYC documents) |

Screening Analyst | Positive Match (File CNMR) |

Compliance Without the Headache

From Sanctions Lists to PEPs, Handles It All Without Missing a Beat

1. What is a Name Screening tool?

Name Screening is an essential practice that ensures compliance with AML, CFT, and CPF regulations by comparing names of potential and existing customers, suppliers and business partners against databases and watchlists. Name Screening tool is usually an AML screening software or an API that carries out name screening using automated systems supported by AI and ML.

2. What is an example of Name Screening?

An example of name screening refers to searching the names of natural/legal persons in databases, watch lists, sanctions lists, PEP lists, most wanted criminal lists, etc.

3. What are screening tools used for?

Screening tools are used to identify individuals and businesses included in any of the sanctions lists, watch lists, PEP lists, and most wanted criminal lists to carry out necessary regulatory compliances such as applying freezing measures and reporting transactions to the FIU through the goAML portal.

4. How to do AML screening?

AML screening can be carried out by collecting key identifier details of natural and legal persons, such as full name and date of birth, entering such details into screening software, and checking results to ascertain whether a match is confirmed against any of the names in watchlists or no match is found.

5. What is fuzzy logic name screening?

Fuzzy logic is a method that simplifies screening processes by taking into consideration the extent of accuracy. In the context of name screening, fuzzy logic is relied upon to factor in phonetic, script, pronunciation, spelling variations, and other differences in names and errors.

6. How do you screen PEPs?

PEP can be screened by entering details as follows:

and checking the screening result to find out if any match is found or not.

7. What are AML Sanctions Screening?

AML sanctions screening is a process where names are scanned against sanctions lists issued by various authorities to break the chain of financial crimes by detecting and preventing the entry of criminals into legitimate financial systems. Sanctions screening prohibits business with certain individuals, entities, groups, industries, and countries, to name a few.

8. How are screening tools selected?

Factors to be considered by businesses before selecting a screening tool are as follows:

9. How is screening different from assessment tools?

Screening generally leads to a result that is either:

However, assessment tools give results diagnostic and elaborate results that cannot be categorised distinctly as results differ from case to case, considering factors such as missing data, recommendations of enhanced due diligence etc.

10. Is name screening a sanction control?

Name screening covers various types of screening processes under its umbrella, such as sanctions screening, PEP screening and Adverse media checks.

11. Is screening part of the KYC and CDD process?

Screening is a part of KYC as it helps businesses reduce the incidences of financial crime such as ML, FT and PF by screening such customers against sanctions, PEP and various AML-related watchlists to prevent them from entering the economy.

12. Why is screening important in the AML KYC and CDD process?

Screening is important because it ensures:

13. What is PEP and sanction screening?

PEPs and sanctions screening are part of AML compliance requiring the identification of politically exposed persons and sanctioned legal entities and natural individuals and screening them against the sanction list to comply with legal obligations.

14. How do you conduct a PEP screening?

PEP screening is conducted by using the following steps:

15. What is screening in AML KYC?

Screening in AML KYC includes screening potential and existing customers across various AML checklists to prevent conducting business with individuals and entities named in the watchlists.

16. What are the types of screening in AML?

Common screening types in AML are

17. How to do screening in the KYC and CDD process?

Screening during KYC involves collecting customer information, verifying their identity and scanning them against the relevant sanctions list.

18. What is the difference between monitoring and screening in AML?

Monitoring is an ongoing process where business relationships are monitored during the course of business, and screening is matching names of customers across lists issued by regulators.

19. What is the screening process in banking?

The practice of collecting and verifying customer information, such as name, date of birth, address, and other relevant details, and cross-referencing it against various watchlists, sanctions lists, and relevant databases.

Pathik is a Chartered Accountant with over 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise-Wide Risk Assessments to implementing robust AML compliance frameworks. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.

Pathik's expertise extends to guiding businesses in navigating complex regulatory landscapes, ensuring adherence to FATF and other international standards, and mitigating financial crime risks. He is a recognised thought leader in AML/CFT, frequently sharing insights on emerging compliance challenges on various platforms.

Solutions

Services

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Solutions

Screening

KYC

Customer Risk Assessment

Case Management

Transaction Monitoring

Regulatory Reporting

Services

Enterprise-Wide Risk Assessment

AML/CFT Health Check

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Get Started

Contact Us