RapidAML Team

2024-06-18

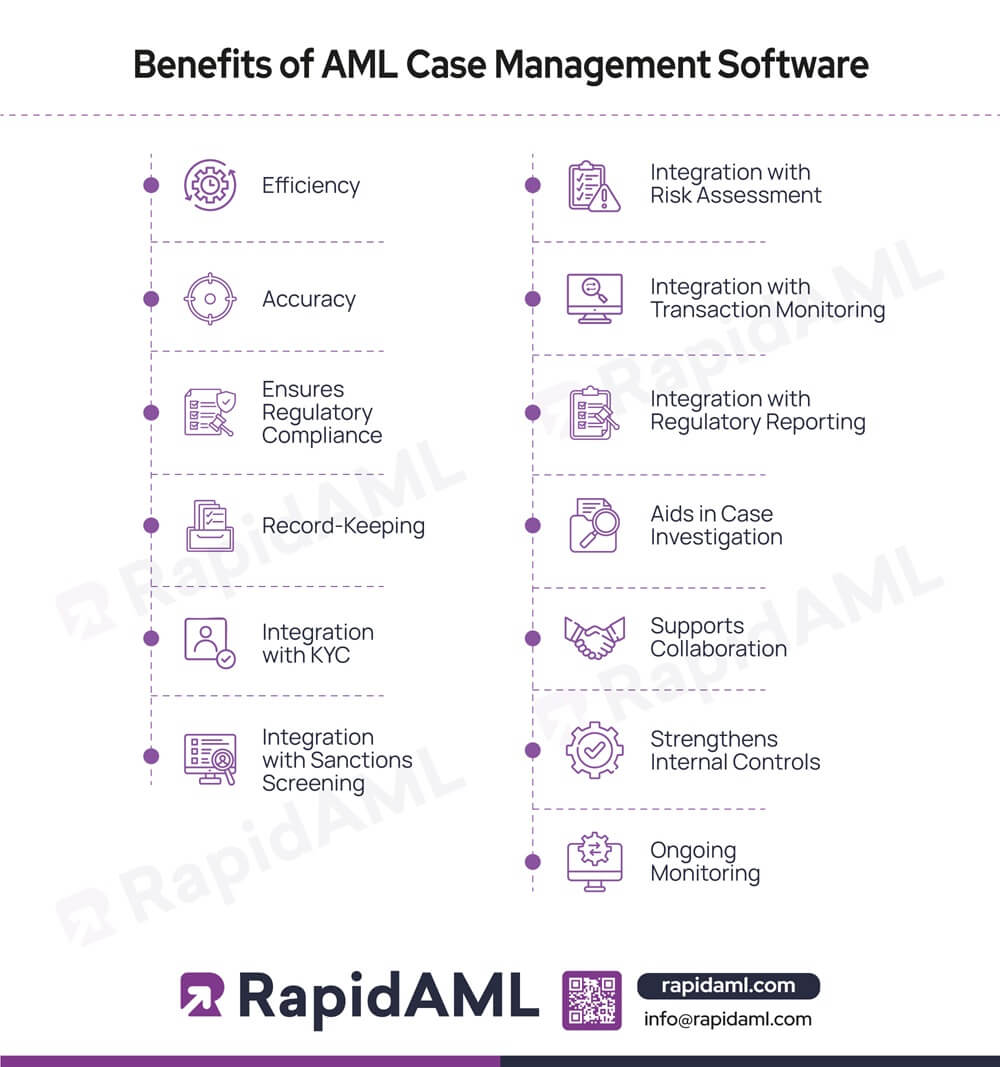

In this blog, we will explore how AML compliance is made more efficient, comprehensive, and optimised through AML Case Management Software. AML Case Management tool is one such solution that facilitates regulated entities to have a comprehensive overview of customer profile, AML compliance tasks, risk assessments, ML, TF, and PF alerts, case creation and investigation of alerts, etc., all in one place.

To protect their economies from threats of Money Laundering (ML), Terrorism Financing (TF), and Proliferation Financing (PF), countries have established their Anti-Money Laundering (AML), Combating the Financing of Terrorism (CFT), and Counter-Proliferation Financing (CPF) laws. These AML/CFT/CPF laws require regulated entities to adhere to strict compliance measures.

AML Software solutions are one of the most recommended tools for regulated entities to meet their AML compliance requirements and mitigate ML/TF and PF risks effectively.

AML Case Management helps track, investigate, and report potential breaches and financial crimes. Case management eases AML compliance by consolidating information related to the customer on a single screen.

AML Case Management Software also alerts the user if any red flags indicating ML/TF, and PF risks are found or if any tasks need to be completed or escalated. Powered with a customisable ML/TF and PF detection system and machine learning abilities, it continually tracks exceptions and provides alerts and notifications. It also enables collaboration and coordination among the staff members of the entity who have different AML compliance roles.

Such a comprehensive overview enables regulated entities to effectively manage their AML compliance requirements and customer lifecycle right from the customer onboarding stage to the completion of business and make informed decisions regarding business relationships with the customers.

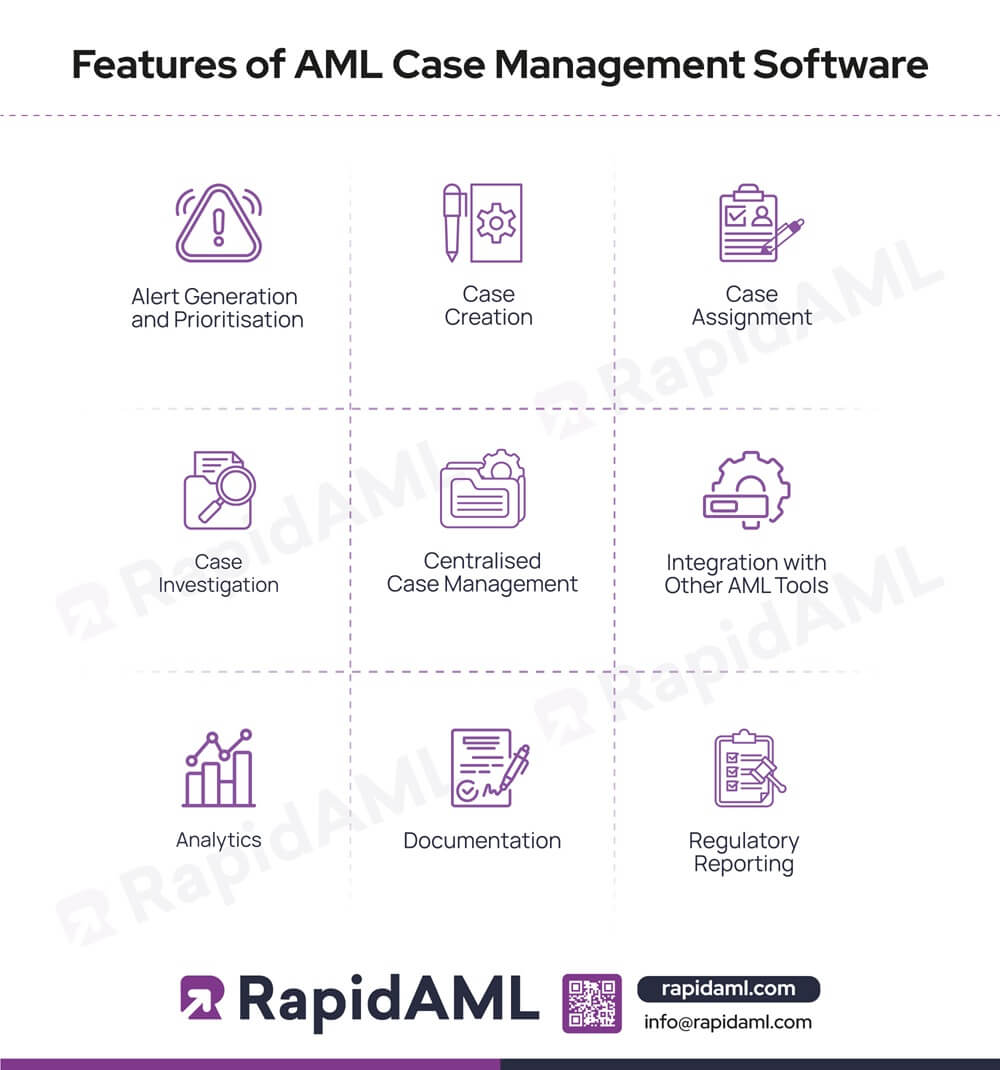

AML Case Management Software provides a range of features designed to optimise and streamline AML compliance processes. These features include the following:

Since AML Case Management Software consolidates all information related to the customer on a single screen, these alerts can be investigated with ease. AML Case Management Software also prioritises alerts based on urgency and shows the progress related to resolving the alerts. This helps create an AML audit trail for later review.

All alerts generated are visible through the customisable dashboard, with their priority or urgency indicated.

Centralise Your AML Compliance All Under One Roof

Track Alerts, Customer Risk, Investigations and Reporting from a Single Place

Refer to the table below, which explains how a “case file” moves from one personnel to another, from customer-facing staff to AML compliance officer or Money Laundering Reporting Officer (MLRO) to senior management, if needed.

|

Convergence of AML Case Management Software Features with AML Compliance Process |

|||

| Sr. No. | Case Management Software Features | Point of Intersection Where Case Management Software Features and Functionalities Meet and Fulfil AML Compliance Needs | Usual Sequence of AML Compliance Process |

| 1 | Alert Generation and Prioritisation | Scenario and Point of Convergence: Regulated entities can make use of case management software to track and prioritise alerts and cases. | Regulated Entities need to have clarity of its regulatory reporting and investigating requirements. It needs to configure case management software in such a way that high-priority alerts are brought to the attention of the compliance officer immediately. Medium and low priority alerts and notifications can be routed to other compliance team members to act upon and based on their investigation, they can further be routed to the compliance officer for his final decision. |

| 2 | Case Creation |

|

Red flags identification and internal Suspicious Activity Report (SAR) or Suspicious Transaction Report (STR). |

| 3 | Case Assignment | Scenario and Point of Convergence: Once case creation is complete, cases are assigned to various personnel enabling them to carry out their roles and responsibilities tailored around fulfilment of AML compliance process, such as:

|

Role-specific AML Compliance tasks are carried out to ensure regulatory compliance

|

| 4 | Case Investigation | Scenario: While carrying out CDD of prospective and existing customers during ongoing monitoring of business relationships several reports are generated such as follows:

|

The AML Compliance Officer or MLRO need to investigate or dig deeper whenever any element of suspicion is found regarding possible involvement of a customer with ML/FT and PF activities. |

| 5 | Centralised Case Management | Scenario and Point of Convergence: A regulated entity requires a solution where all its AML compliance workflows can be accessed and assigned according to requirement to specific personnel responsible for screening, CDD, investigation, reporting, etc. An AML case management software helps regulated entity to have a consolidated view of its AML controls and measures by providing a centralised dashboard from where all the AML compliance processes such as screening, CDD/KYC, transaction monitoring, regulatory reporting can be accessed. | Regulated Entities need to have in place streamlined AML compliance controls and measures so that relevant staff or personnel can fulfil their specific roles and responsibilities. |

| 6 | Integration with Other AML Tools | Scenario and Point of Convergence: AML Compliance software provides a consolidated view of the entity’s compliance effort. Creation and disposition of alerts and cases, audit trail, document management, workflow, etc., working in tandem with screening, KYC, and customer risk assessment modules helps entities remain compliance with legal obligations. | Ensuring overall AML Compliance encompassing all the AML processes. |

| 7 | Analytics | Scenario and Point of Convergence: The regulated entity using case management software can make use of the analytics function of the case management software that deploys machine learning to track, assign, and investigate suspicious cases and reduce time wastage and achieve a high-degree of performance. | Top management and compliance officer can know the average time taken to investigate and complete a case and decide on resource and budget allocation to mitigate ML/TF, and PF risks. |

| 8 | Documentation | Scenario and Point of Convergence: AML recordkeeping is regulatory compliance requirement that regulated entities are required to fulfil. AML case management software helps regulated entities store and access their AML compliance measures for time period agreed upon or decided upon in the contract with the case management software vendor. | Case management software generates an audit trail of compliance effort which helps entities showcase the amount of due diligence carried out by them to meet regulatory requirements. |

| 9 | Regulatory Reporting | Scenario and Point of Convergence: AML laws require regulated entities to fulfil reporting of designated transactions, suspicious activities and transactions, etc., which is made easy by having a place an AML case management software that provides consolidated view of reporting requirements or alerts which may need to be investigated to identify if such alert requires to be reported to the regulatory authority in that jurisdiction. | Filing reports according to the requirement such as:

|

Stop Drowning in Manual Compliance Tasks

Automation with RapidAML Eliminates Repetitive Work So Your Team Can Focus on Real Risk

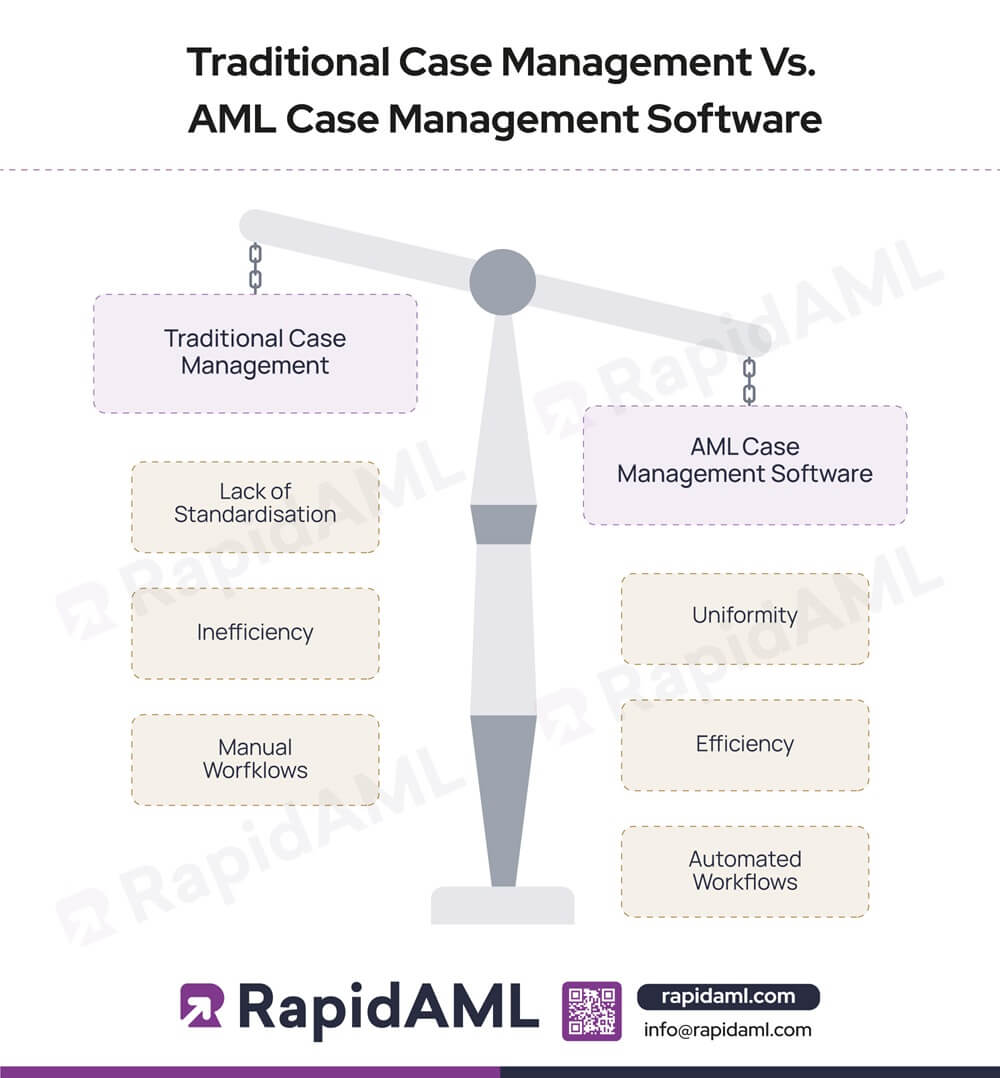

AML Case Management Software is a next-generation solution which offers many advantages compared to tradition case management.

|

Traditional Case Management Vs. AML Case Management Software |

||

| Parameter | Traditional Case Management | AML Case Management Software |

| Manual Workflows Versus Automated Workflows | Traditional Case Management involves manual workflows, leading to delay in tasks, non-transparency in completion of tasks, difficulties in coordination, lack of accountability, etc. | AML workflows if a series of procedures aimed at completing AML compliance tasks. AML Case Management Software provides a streamlined workflow from case creation to close, ensuring all steps in the case investigation process are completed, on time, smoothly, transparently and uniformly. Automated, digital workflows also ensure speed and accuracy in resolving cases, as well as escalation if required. It also enables collaboration between staff involved in AML compliance, ensuring coordination. It is adaptable to changes in AML regulatory regime and ML, TF, and PF typologies. |

| Inefficiency Versus Efficiency | Traditional Case Management requires a considerable amount of resources, time, and an experienced workforce. Due to huge amounts of data to process and many AML compliance tasks, there is a scope for human errors, delays, non-transparency, difficulties in coordination, etc., leading to the compliance process being inefficient. | AML Case Management software centralises all customer information and compliance tasks on one screen. It also enables the timely investigation of alerts. Therefore, AML Case Management Software facilitates efficient management of complex web of AML compliance tasks and lengthy investigation processes. |

| Lack of Standardisation Versus Uniformity | While there may be a set criterion for the AML compliance checklist on paper, traditional case management is done manually, and therefore, there is a lack of coordination and transparency. Because the case workflow cannot be verified, there is a lack of uniformity and standardisation in the process of completion of tasks. Tasks may not be done properly, comprehensively, or on time. | AML Case Management Software is customisable, and its detection systems and workflows can be set with criteria for completing AML compliance tasks. |

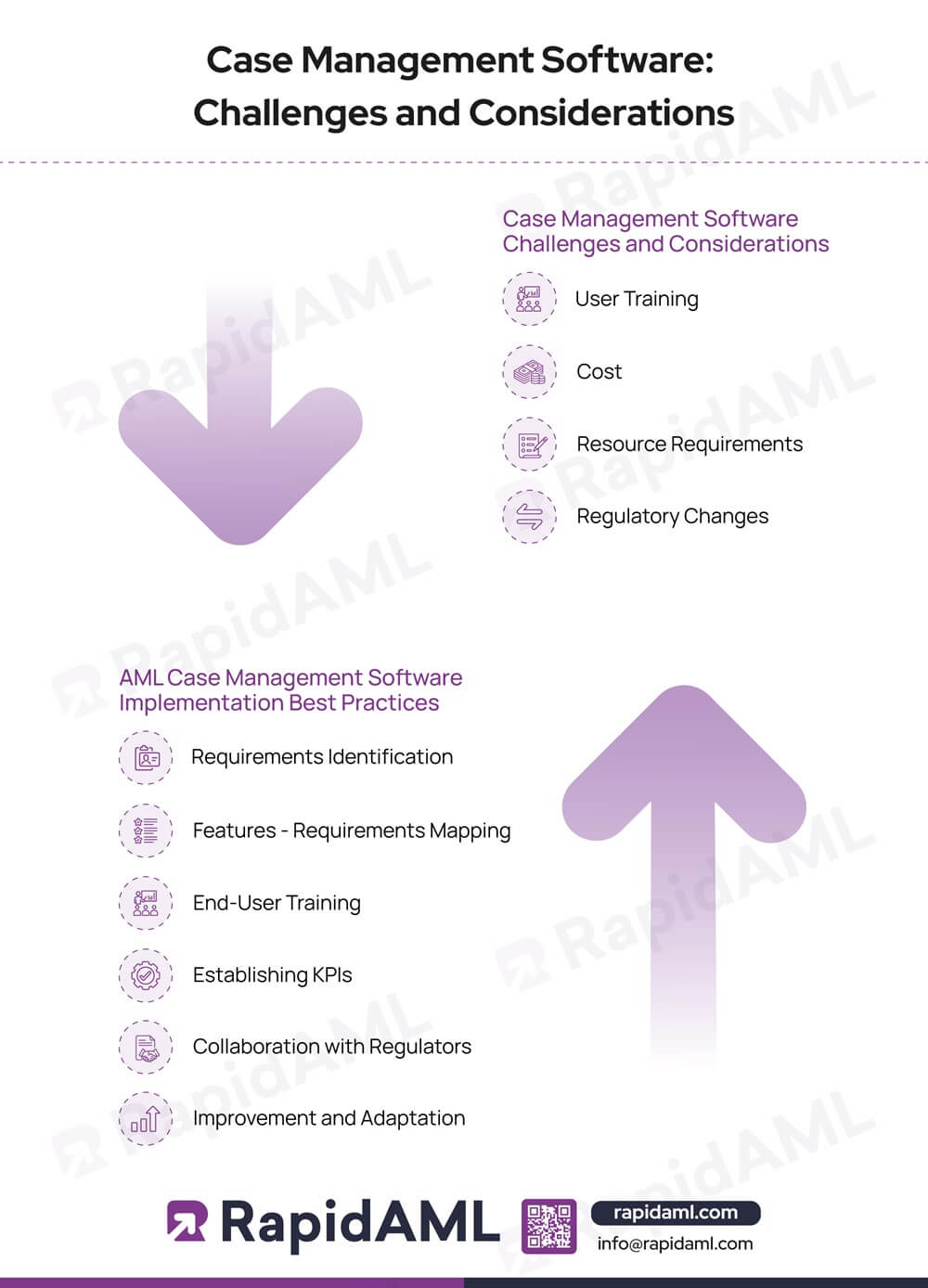

Users may come across the following challenges and considerations when adopting and utilising the AML Case Management Software:

Check out the infographic detailing Case Management Software Challenges and Considerations contrasting with AML Case Management Software Implementation Best Practices.

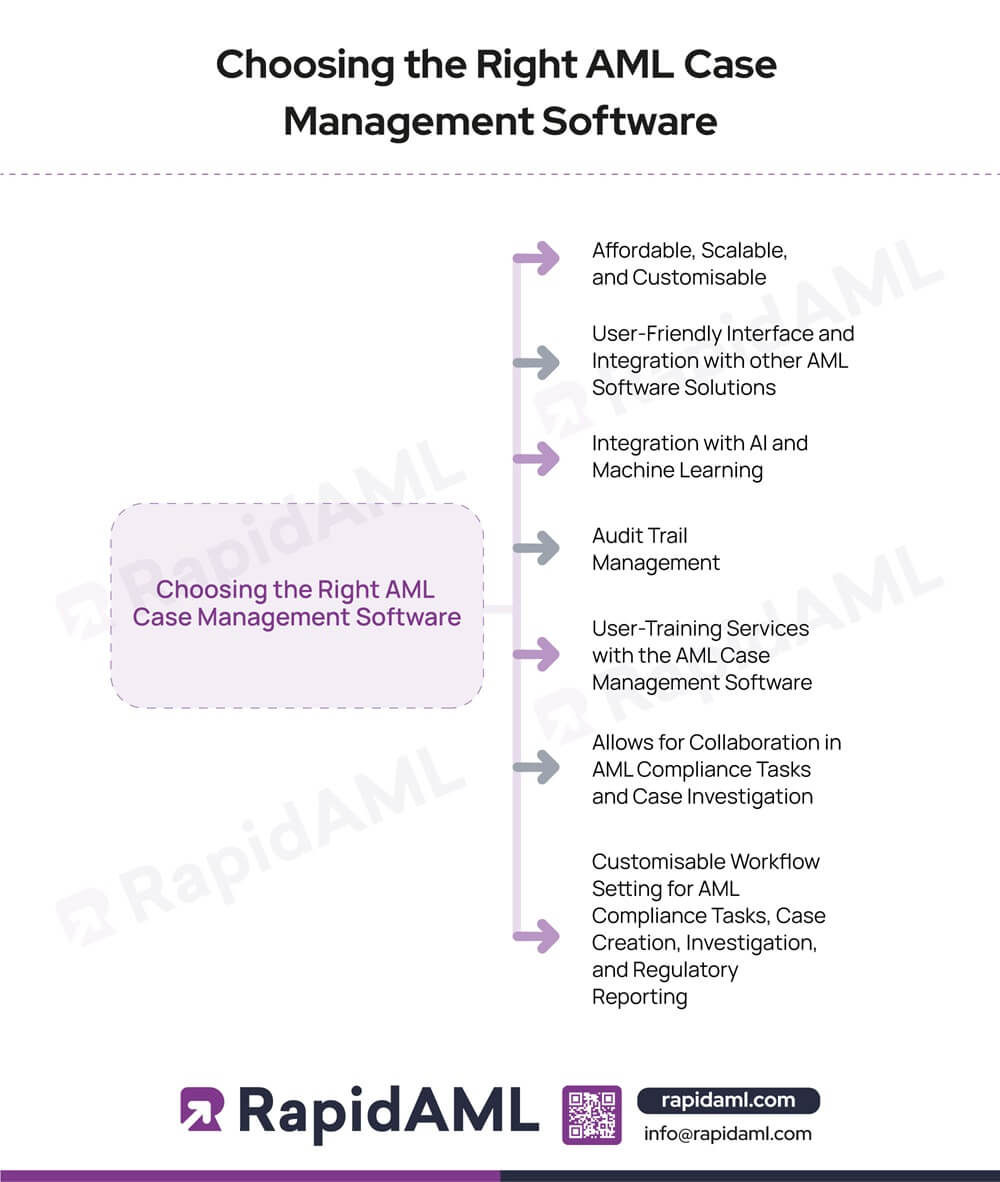

The above discussed challenges and considerations can be overcome through choosing the right AML Case Management Software. Here’s a guide of functionalities to look for while choosing an AML Case Management Software:

AML Case Management Software future-proofs AML/CFT/CPF compliance through its next-gen solutions, and updatable, customisable, and easy-to-use interface. Adopting this technology optimises AML/CFT/CPF compliance and makes it robust, and comprehensive.

Bring Alerts Under Control

One Dashboard. Zero Chaos

Dipali is an Associate member of ICSI and has a Bachelor’s in Commerce and a General Law degree.

She currently assists clients by advising and helping them navigate the legal and regulatory challenges of Anti-Money Laundering Law. She also helps companies develop, implement, and maintain effective AML/CFT and sanctions programs.

She knows Anti-money laundering rules and regulations prevailing in GCC countries and specializes in Enterprise-wide risk assessment, Customer Due-diligence, and Risk assessment.

Solutions

Services

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Solutions

Screening

KYC

Customer Risk Assessment

Case Management

Transaction Monitoring

Regulatory Reporting

Services

Enterprise-Wide Risk Assessment

AML/CFT Health Check

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Get Started

Contact Us