Lawyers, Notaries, and Other Legal Professionals in the UAE are strongly advised to rely on a well-calibrated name screening software as part of their AML/CFT compliance framework. In doing so, it is imperative to develop and implement a comprehensive name screening methodology to vet prospective and existing clients against a range of applicable lists. These include the UAE’s Local Terrorist List, the UN Security Council Consolidated List, as well as other internationally recognised sanctions lists and watchlists. Additionally, lawyers, notaries, and other legal professionals must ensure that their screening process extends beyond formal lists to include checks for Politically Exposed Persons (PEPs) and adverse media mentions across online sources and social platforms. This holistic approach helps identify individuals or entities potentially involved in Money Laundering (ML), Terrorism Financing (FT), or Proliferation Financing (PF), thereby safeguarding the integrity of legal practices and maintaining compliant and secure client relationships.

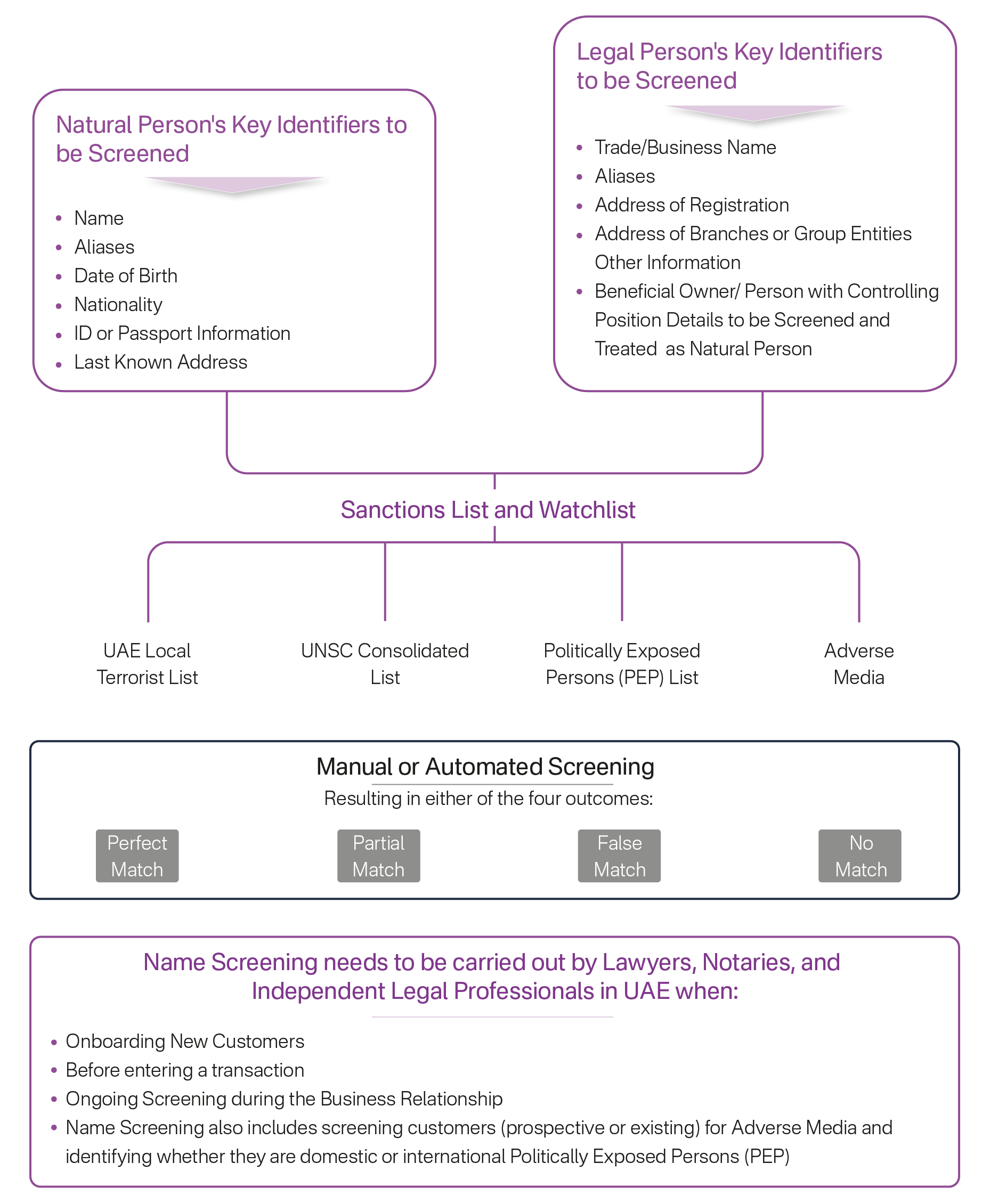

For Lawyers, Notaries, and Other Legal Professionals in the UAE, the process of name screening involves systematically checking the names and key identifying attributes of prospective or existing clients, counterparties, or associated individuals, whether natural persons or legal entities, against the relevant sanctions lists.

These lists are mandated under the UAE’s primary legislation on Anti-Money Laundering (AML), Countering the Financing of Terrorism (CFT), Targeted Financial Sanctions (TFS), and the implementation of UN Security Council (UNSC) Resolutions. Normally, name screening software supports global lists, helping lawyers with AML/CFT compliance. This sanctions screening is a critical compliance measure to ensure that lawyers, notaries, and other legal professionals do not engage, either directly or indirectly, with sanctioned parties and that they uphold their legal obligations under national and international AML/CFT and TFS frameworks.

Name Screening needs to be carried out by lawyers, notaries, and other legal professionals in the UAE when:

Since sanctions, PEP, and adverse media data keep changing, it’s important for lawyers to rely on a name screening tool to keep financial crimes at bay.

Add Name Screening to Your Legal Checklist

Compliance Starts with Who’s Who

Name Screening can be broadly classified into three categories: sanctions screening, PEP screening, and adverse media screening. Let’s delve into each type for greater clarity.

Refer to our YouTube Video: Introduction to Name Screening: The UAE Standpoint | RapidAML

Purpose: Sanctions Screening serves the following purposes:

Lawyers and Legal Professionals operating in the UAE are required to conduct adequate and proportionate Customer Due Diligence (CDD) on both prospective and existing clients. An essential part of fulfilling this CDD obligation is screening clients against the relevant and prescribed sanctions lists. This process when implemented efficiently with the help of name screening software ensures that legal practitioners are not facilitating services for individuals or entities listed under sanctions and are complying with the UAE's regulatory requirements on Anti-Money Laundering (AML), Countering the Financing of Terrorism (CFT), and Targeted Financial Sanctions (TFS).

TFS Compliance: Cabinet Decision No. 74 of 2020 provides for TFS Compliance by subscribing to the mailing list maintained on the UAE Executive Office for Control and Non-Proliferation (EOCN) website and screening the prospective or existing customers, suppliers, employees, or business associates.

For more insights into Sanctions and TFS Compliance Requirements in UAE, refer to Sanctions Compliance Best Practices for DNFBPs and VASPs.

Process: This section illustrates the process for sanctions screening using name screening software for lawyers, notaries, and other legal professionals.

Refer to our YouTube Video: The orderly process of customer screening to ensure AML compliance | RapidAML

Purpose

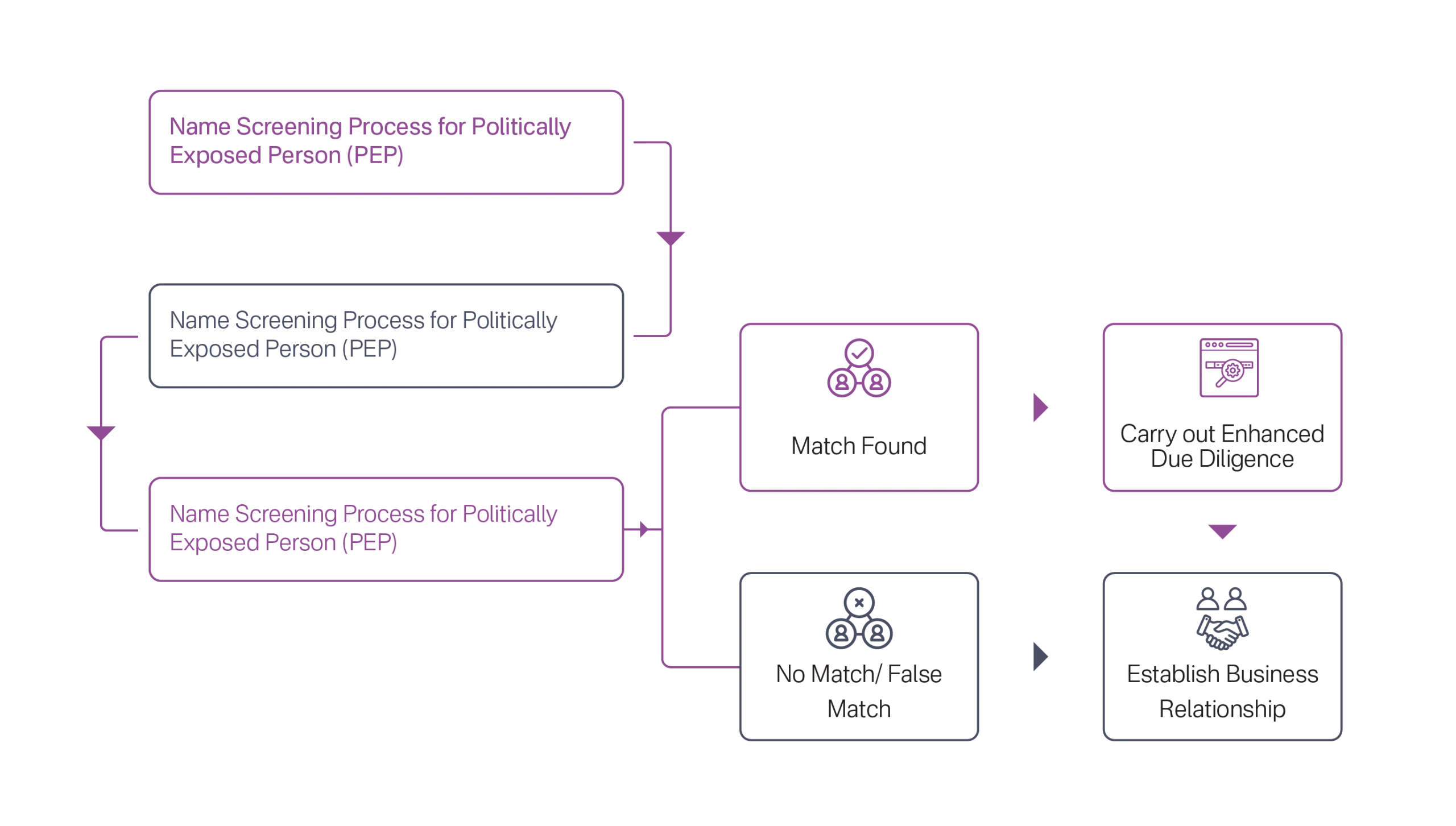

Lawyers, notaries, and other legal professionals in the UAE, particularly those engaged in activities subject to AML/CFT compliance, are required under the UAE’s AML/CFT laws and the relevant sectoral guidelines to identify Politically Exposed Persons (PEPs) and conduct thorough screening of their clients. This includes determining whether a natural person client or any Ultimate Beneficial Owners (UBOs), persons in controlling positions, or authorised signatories of a legal entity are themselves domestic or foreign PEPs, or are closely associated with one through familial, professional, or business ties. Name screening software for lawyers can help them identify the Politically Exposed Persons.

Identifying PEPs is crucial to assess the potential risk of corruption, bribery, or undue influence due to the PEP’s authoritative position. Such identification enables Lawyers, Notaries, and Other Legal Professionals to perform a risk-based Customer Risk Assessment (CRA) and assign an appropriate risk rating. Where necessary, Enhanced Due Diligence (EDD) measures must be applied in proportion to the assessed risk of money laundering, terrorist financing, or proliferation financing (ML/FT or PF).

Process: The process for PEP screening for Lawyers, Notaries, and Other Legal Professionals in UAE is illustrated here for a better understanding.

Purpose

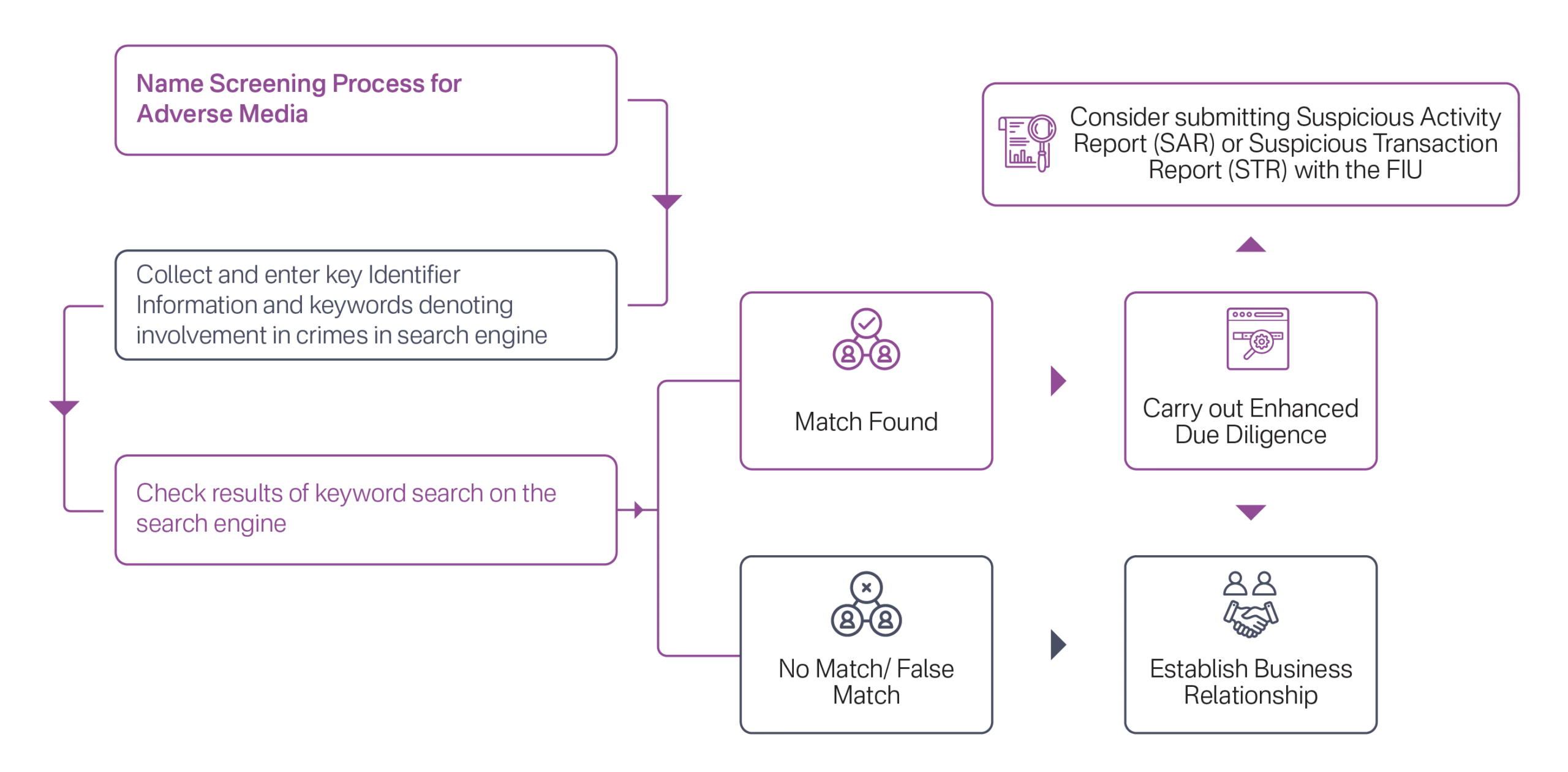

For Legal Professionals, Adverse Media Screening plays a critical role in identifying red flags that may not surface through sanctions or PEP list checks alone. The objective is to extract publicly available information about prospective or existing clients to uncover any potential involvement in money laundering, predicate offences, or other illicit activities that might otherwise go undetected through standard screening protocols.

In practical terms, Adverse Media Screening Software helps bridge the gaps left by traditional Customer Due Diligence (CDD) processes and Know Your Customer (KYC) questionnaires, which may overlook key risk indicators. It serves as an essential supplement to ensure that the Customer Risk Assessment (CRA) reflects a more realistic and comprehensive risk profile. This, in turn, informs whether Standard Due Diligence (SDD) suffices or if Enhanced Due Diligence (EDD) is necessary to meet the obligations under AML/CFT and TFS compliance frameworks.

Process: The process for Adverse Media screening is illustrated here for a better understanding.

For more insights into Adverse Media, refer to Integrating Adverse Media Screening into AML Framework: A Guide for DNFBPs and VASPs

Refer to our YouTube Videos:

For Lawyers, Notaries, and Other Legal Professionals in the UAE, effective name screening is a non-negotiable compliance requirement under AML/CFT and TFS obligations. As illustrated in the name screening process flow for legal service providers, the importance of robust name screening software and mechanisms cannot be overstated. Lawyers, notaries, and other legal professionals advising clients or acting in fiduciary capacities must ensure thorough and accurate screening of individuals and entities they engage with, considering factors such as:

1. Improved AML/CFT and Sanctions Compliance

For Legal Professionals, having a robust AML/CFT and TFS (Sanctions) Compliance Policy, along with clearly defined procedures and controls, is essential to ensuring airtight compliance. Implementing a reliable and effective name screening tool as part of these controls allows Lawyers, Notaries, and Other Legal professionals to conduct thorough due diligence, leaving no room for sanctioned individuals or entities to bypass scrutiny.

Sanctions Program: A Legal Practice Enabler

2. Improved CDD Accuracy

For Legal Professionals, the integrity and effectiveness of the screening process play a pivotal role in determining the accuracy and defensibility of Customer Due Diligence (CDD) outcomes. An aligned and error-free name screening process forms the backbone of an effective CDD framework, which typically consists of five key steps:

1. Know Your Customer

2. Name Screening

3. Customer Risk Assessment (CRA)

4. Enhanced Due Diligence (EDD)

5. Ongoing Monitoring

Among these, Name Screening is the most risk-sensitive component. It can be flawed due to factors such as:

Inaccuracies in the initial screening will skew the Customer Risk Assessment, misguide the need or extent for Enhanced Due Diligence, and ultimately misalign the periodicity and scope of Ongoing Monitoring. For Legal Professionals, this can lead not only to regulatory non-compliance but also to inadvertent facilitation of high-risk relationships. Therefore, adopting an intelligent, up-to-date, and legally defensible name screening solution is indispensable to maintaining the integrity of the entire CDD process and fulfilling professional obligations under UAE AML/CFT laws and legal sector guidance.

For Legal Professionals, errors in name screening directly impact the accuracy of Customer Due Diligence. Incorrect screening results can lead to wrong risk ratings, causing either missed Enhanced Due Diligence for high-risk clients or unnecessary checks for low-risk ones. A reliable, well-calibrated name screening process is essential to ensure accurate risk assessment, maintain compliance, and avoid regulatory issues.

3. Improved Customer Risk Assessment (CRA)

Customer Risk Assessment (CRA) follows directly after Name Screening and involves assigning a risk rating based on the screening results, along with the nature, purpose, and frequency of the business relationship and its associated ML/FT or PF risks. If the name screening is inaccurate, due to human error or an outdated or poorly calibrated tool, the resulting risk rating will be flawed. Therefore, the quality and reliability of CRA depend heavily on precise, error-free results obtained from name screening software for lawyers, notaries, and other legal practitioners.

4. Timely Regulatory Reporting Obligation of Lawyers, Notaries, and Other Legal Professionals

To ensure compliance with the TFS obligations, Lawyers, Notaries, and Other Legal Professionals need to carry out the following steps:

Regulatory Reporting Obligations for Lawyers, Notaries, and Other Legal Professionals in UAE

Additionally, if suspicious activities or transactions are detected indicating possible money laundering, terrorism financing, or proliferation financing, a Suspicious Transaction Report (STR) must be filed promptly. Ultimately, the accuracy, timeliness, and quality of Regulatory Reports are heavily dependent on the accurate and timely outcomes generated by efficient name screening.

5. Improved Customer Experience

A seamless and legally compliant customer onboarding experience is crucial and largely depends on the efficiency and clarity of the onboarding procedure. For Lawyers, Notaries, and Other Legal professionals advising on regulatory compliance, it is important to note that the ease of obtaining and verifying customer information, whether through self-KYC, eKYC, or similar mechanisms, plays a key role in shaping this experience. The integration of robust name screening software with KYC tools significantly improves data collection and verification processes. This not only enhances the customer journey but also ensures adherence to AML/CFT obligations, thereby reducing legal and compliance risks for the business.

6. Accurate and Timely Workflow Escalation

Efficient name screening plays a pivotal role in enabling immediate disambiguation of potential matches, allowing for swift and accurate escalation to the relevant KYC Analyst, AML Risk Analyst, or Compliance Officer. For Legal Professionals, this efficiency is critical as it directly supports timely decision-making within the AML compliance framework. A streamlined name screening process not only ensures adherence to regulatory expectations but also enhances the overall effectiveness and responsiveness of the compliance workflow.

Refer to our YouTube Video: How Name Screening Helps in Fighting Money Laundering and Terrorist Financing | RapidAML

Name Screening poses many challenges when it comes to implementation. Some of the commonly faced pain points are elaborated below:

1. Cost Constraints

Conducting name screening—whether manually or through automated tools—requires both trained personnel and robust screening software. Legal Professionals, particularly smaller entities, often face challenges in sustaining the resource-intensive demands of effective screening. The key lies in identifying a screening solution that is technologically competent yet economically viable, helping strike the necessary balance between fulfilling AML/CFT obligations and managing the financial implications of non-compliance.

2. Ongoing Monitoring Difficulties

Name screening of business relationships is an ongoing obligation, not a one-time compliance task. For Lawyers, Notaries, and Other Legal professionals, it is important to underscore that continuing business relationships require consistent monitoring and periodic updates of the screening status until the business relationship concludes. In particular, TFS compliance mandates daily screening of existing clients against the updated UAE Local Terrorist List and UN Sanctions Lists, which is normally done through sanctions screening software. While Lawyers, Notaries, and Other Legal professionals may understand this legal requirement in principle, challenges often arise in ensuring accurate, timely, and systematic implementation in practice.

3. False Positives and Negatives

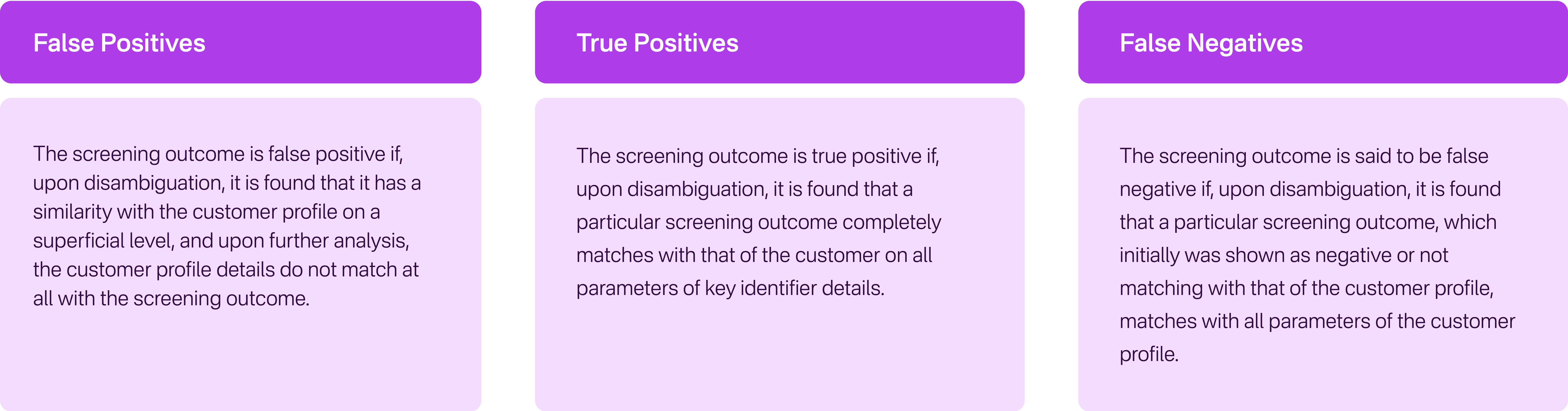

False positives occur when name screening software flags matches based on partial or superficial similarities with a prospective customer's profile, which, upon further investigation (disambiguation), are found not to correspond to any actual sanctioned or high-risk entity. In contrast, false negatives are instances where the screening system fails to detect a relevant match, and the individual or entity is incorrectly cleared. Upon disambiguation, these cases are recognised as significant oversight, representing a failure in the screening process. For Legal Professionals, both scenarios highlight the critical importance of accuracy in screening tools to ensure compliance and avoid regulatory exposure.

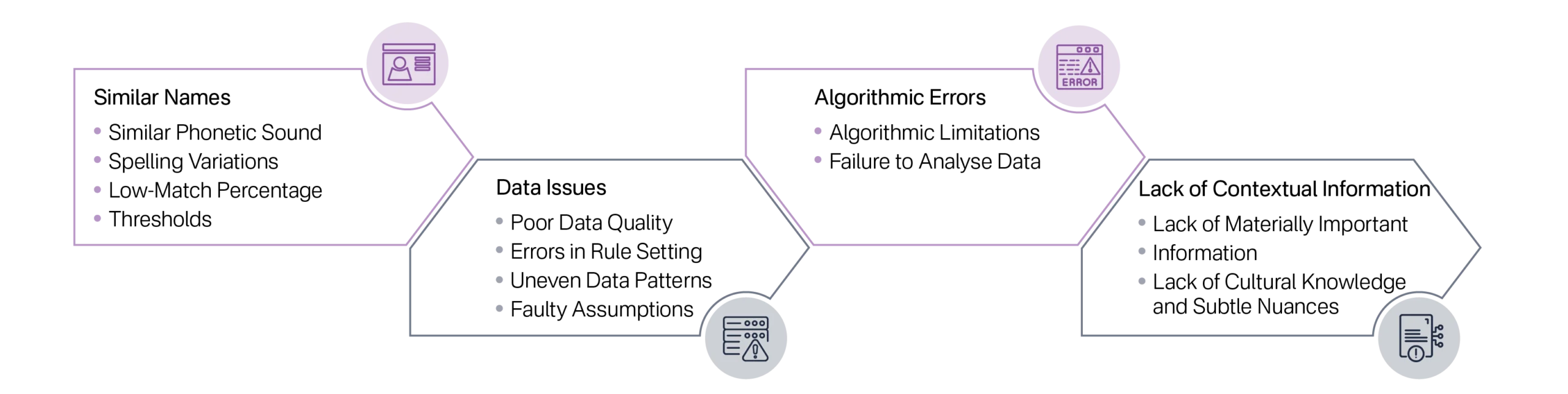

Causes of False Positives in Name Screening by Lawyers, Notaries, and Other Legal Professionals

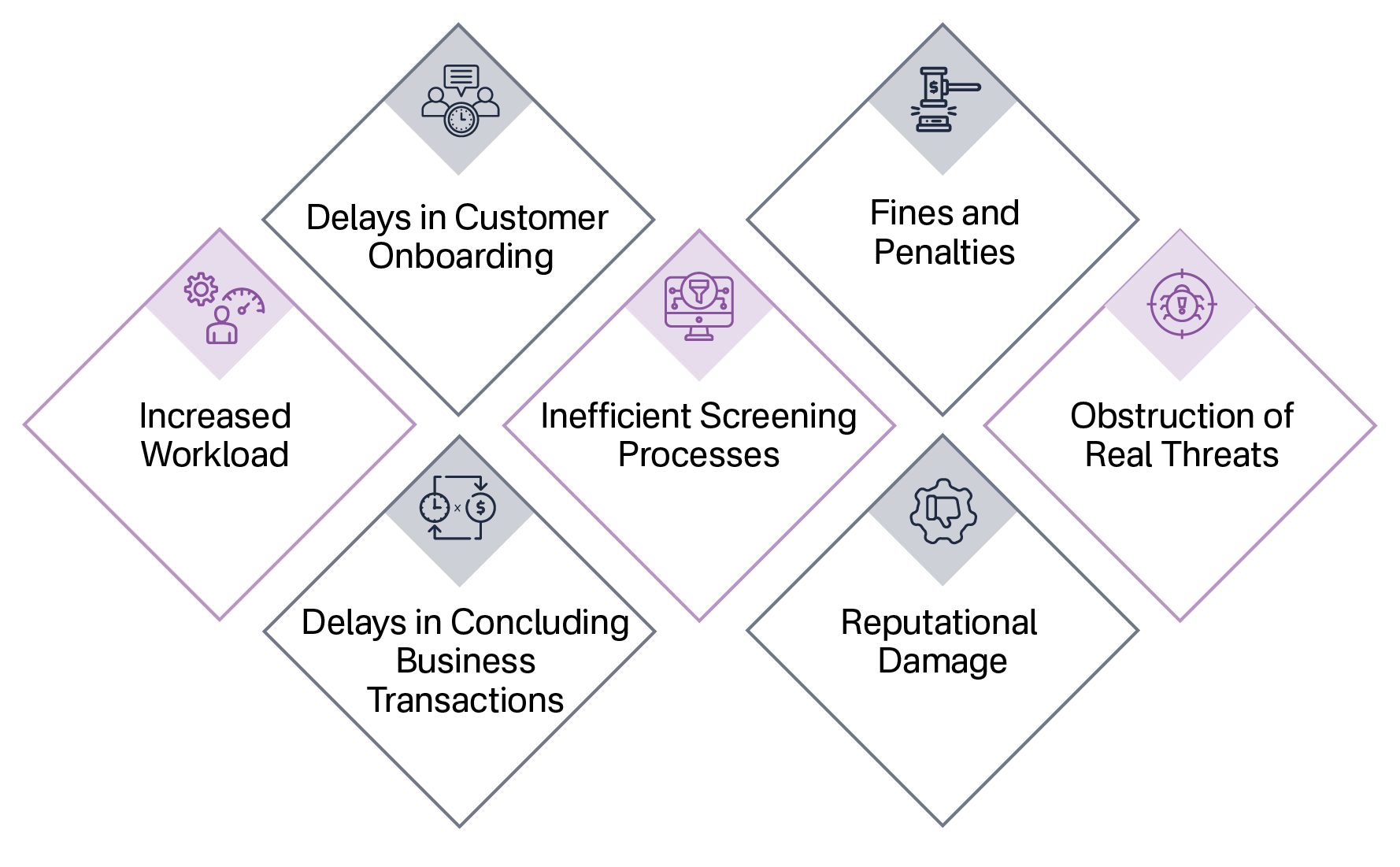

False positives strain compliance resources by forcing Screening Analysts to review irrelevant matches. This results from poorly calibrated screening tools, leading to delays, higher costs, and inefficiencies—issues that Lawyers, Notaries, and Other Legal Professionals Should address through proper tool configuration.

4. Data Quality Issues

Poor data quality, whether due to inaccuracies, inconsistencies, or improper formatting, undermines the effectiveness of name screening. When customer data is entered into flawed screening systems, the resulting matches may be unreliable, directly affecting compliance accuracy and operational efficiency. Lawyers, Notaries, and Other Legal Professionals must ensure robust data governance to support accurate screening outcomes.

5. Integration Issues

Integration challenges in name screening present significant compliance risks for Legal Professionals. These issues emerge when attempting to harmonise diverse software solutions, workflows, and processes, such as AML/CFT compliance systems, regulatory reporting tools, onboarding platforms, and CRM, while avoiding functional redundancies. Common causes include technical incompatibilities, legacy infrastructure, limited scalability, and licensing constraints. Addressing these integration complexities is essential to ensuring efficient compliance management and mitigating regulatory risks.

6. Multi-Jurisdictional Compliance

For Legal Professionals, ensuring multi-jurisdictional AML/CFT compliance presents significant challenges, especially when client services and requirements span multiple jurisdictions. It is crucial to consider various sanctions and watchlists and to ensure adherence to both local and international Targeted Financial Sanctions (TFS) obligations. Navigating these complex regulatory frameworks requires legal expertise to implement robust compliance measures and effectively manage associated legal risks.

For Legal Professionals, recognising the challenges encountered in screening processes is only the initial step, as it aids in identifying the existence of these issues. The subsequent step involves analysing the consequences arising from such challenges. Understanding these consequences is essential to grasp the severity and operational impact these challenges impose on daily compliance and risk management activities.

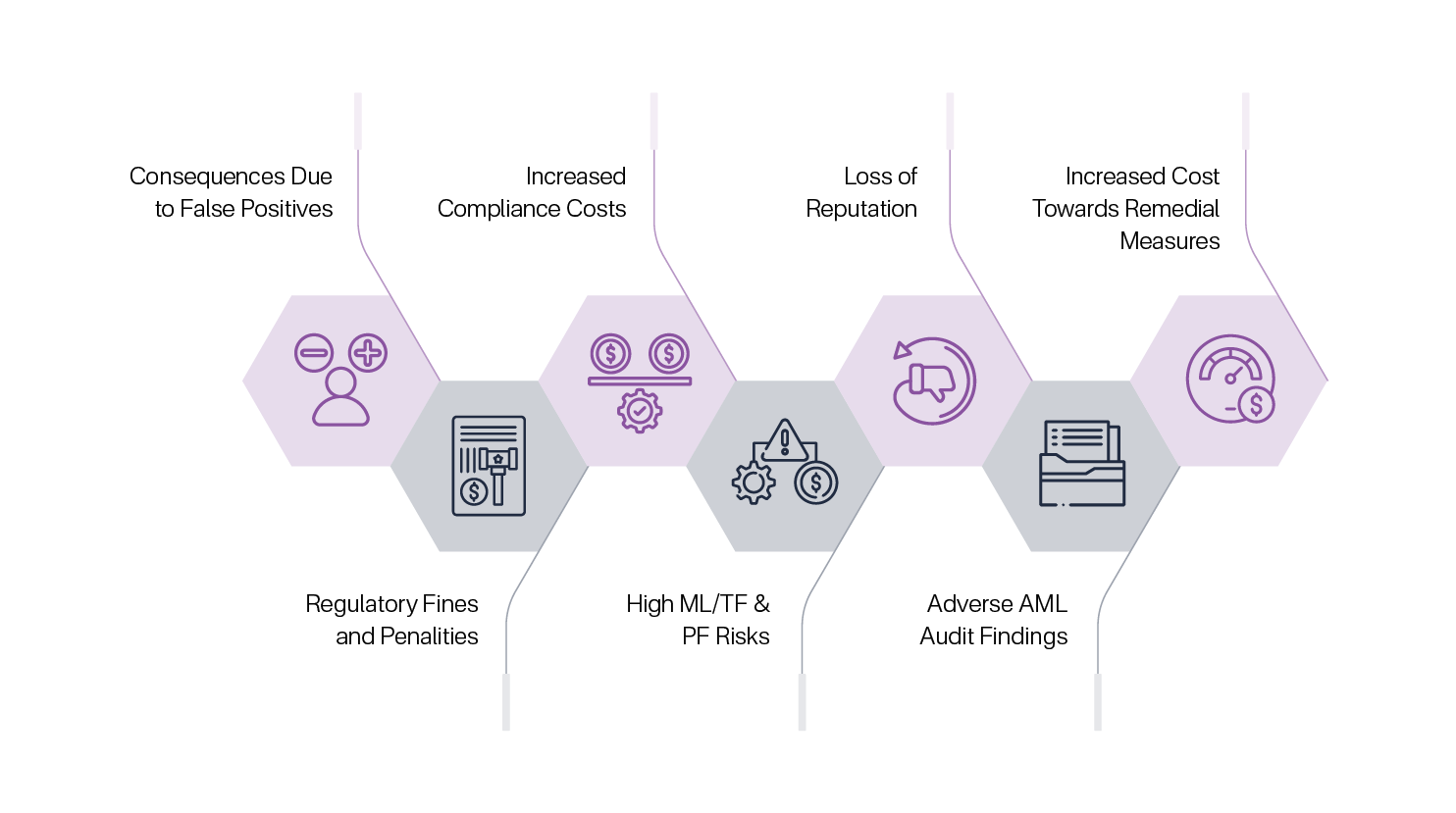

Consequences Due to False Positives

The pain point of false positives comes with its own set of resultant consequences. The Legal Professionals, dealing with a high number of false positives, must also deal with the following.

Consequences of High False Positive Rates on Lawyers, Notaries, and Other Legal professionalsduring Sanctions Screening Outcome Analysis

Regulatory Fines and Penalties

Regulatory fines and penalties are an immediate consequence of the challenges faced by law firms with multi-jurisdictional operations. When implementing group-wide AML/CFT policies and procedures, balancing AML/CFT obligations alongside data privacy and security requirements across different jurisdictions can lead to inadvertent breaches of local laws. Factors such as difficulties in ongoing monitoring and data quality issues may contribute to these breaches, ultimately resulting in fines and penalties for the firm.

Loss of Business Reputation

Any law firm encountering challenges such as cost constraints in achieving adequate AML/CFT compliance, difficulties with ongoing monitoring, or issues related to data quality and accuracy faces significant reputational risks. The imposition of even a single fine or penalty, or the mere appearance of the firm’s name in adverse media related to facilitation or involvement in illicit activities, whether intentional or not, can lead to substantial damage to the firm’s professional reputation and business standing.

High ML/TF & PF Risks

Needless to say, challenges in efficient name screening directly increase the ML/TF and PF risks beyond the levels estimated during the Enterprise-Wide Risk Assessment (EWRA), which forms the basis for determining control measures. Lawyers, Notaries, and Other Legal Professionals must consider technical implementation issues when assessing residual risk and evaluating the effectiveness of their controls.

Increased Compliance Costs

False positives and negatives, integration challenges, and multi-jurisdictional compliance complexities all contribute to increased AML/CFT and TFS compliance costs by draining the productivity of Screening Analysts. Ensuring compliance across multiple jurisdictions demands specialised expertise, which is often beyond the scope of the average AML Compliance Officer or MLRO. Hiring skilled and experienced AML Compliance Officers and MLROs with this niche knowledge comes at a significant cost for law firms. Additionally, integration issues create functional overlaps and operational blind spots, further driving up overall compliance expenses.

Adverse AML Audit Findings

When there are continuous challenges in name screening, the AML Audit’s reports and findings for law firm or practitioner’s screening compliance capabilities are bound to reflect where screening measures have gone wrong for them. Not having a robust name screening process and tools leads to negative audit findings, needing lawyers, law firms, and other legal professionals to spend time and resources on remedial measures.

Increased Costs Towards Remedial Measures

Factors such as adverse AML audit findings lead towards loss of business reputation which creates a ripple effect requiring remedial measures to eliminate screening issues. Legal professionals not investing in efficient screening processes later need to pay in terms of fines, penalties, and remedial measures.

After knowing the grievous consequences that a Lawyers, Notaries, and Other Legal professionals can face due to challenges in efficient name screening, Lawyers, Notaries, and Other Legal professionals can largely benefit and safeguard themselves against these consequences by understanding how RapidAML helps solve Lawyers, Notaries, and Other Legal professionals screening problems.

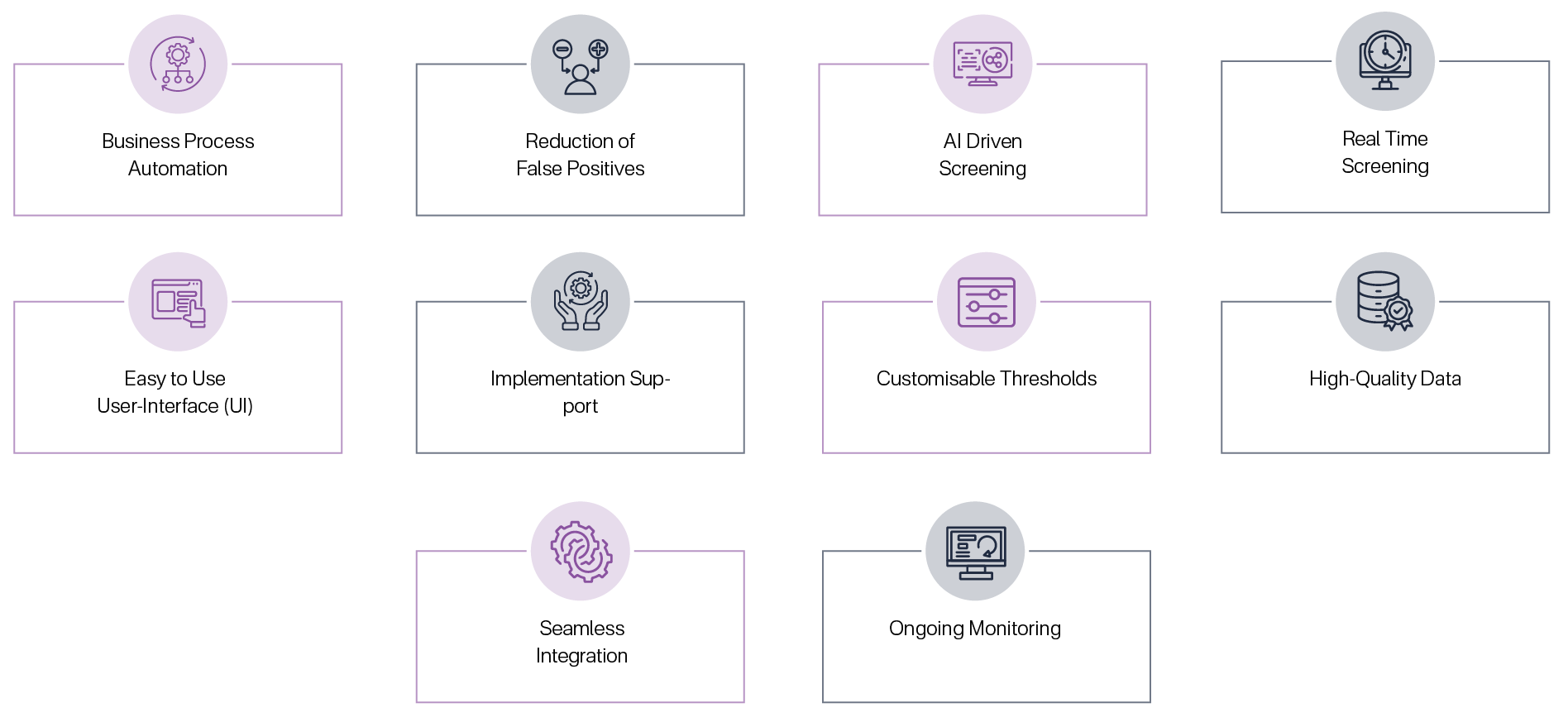

RapidAML simplifies Name Screening Obligations for Lawyers, Notaries, and Other Legal professionals in UAE through its multi-faceted capabilities, such as the following:

Business Process Automation

Business Process Automation involves automating manual processes and workflows that follow repeatable, predefined steps. In the context of AML compliance, this is especially valuable for Legal Professionals, as it helps streamline routine and time-consuming tasks, such as name screening, which requires screening one client after another. Solutions like RapidAML’s Screening Software enable Lawyers, Notaries, and Other Legal professionals to automate the name screening process for both prospective and existing clients, enhancing accuracy and efficiency in meeting AML obligations.

Real-Time Screening

Time is critical when conducting name screening in AML compliance. Outdated watchlists or sanctions lists can lead to inaccurate results, and lengthy screening processes increase the risk of overlooking potential matches. RapidAML addresses these challenges by enabling real-time screening with up-to-date lists and processing customer data instantly once all required information is provided—ensuring timely and reliable compliance outcomes for Legal Professionals.

High-Quality Data

RapidAML produces high-quality data through detailed screening results, registers, and case logs. This reliable data supports Lawyers, Notaries, and Other Legal Professionals in meeting record-keeping requirements and is seamlessly integrated with RapidAML’s document repository for quick and easy information retrieval. The accuracy and thoroughness of the data also assist AML Compliance Officers or MLROs in making well-informed decisions, minimising the risk of human error.

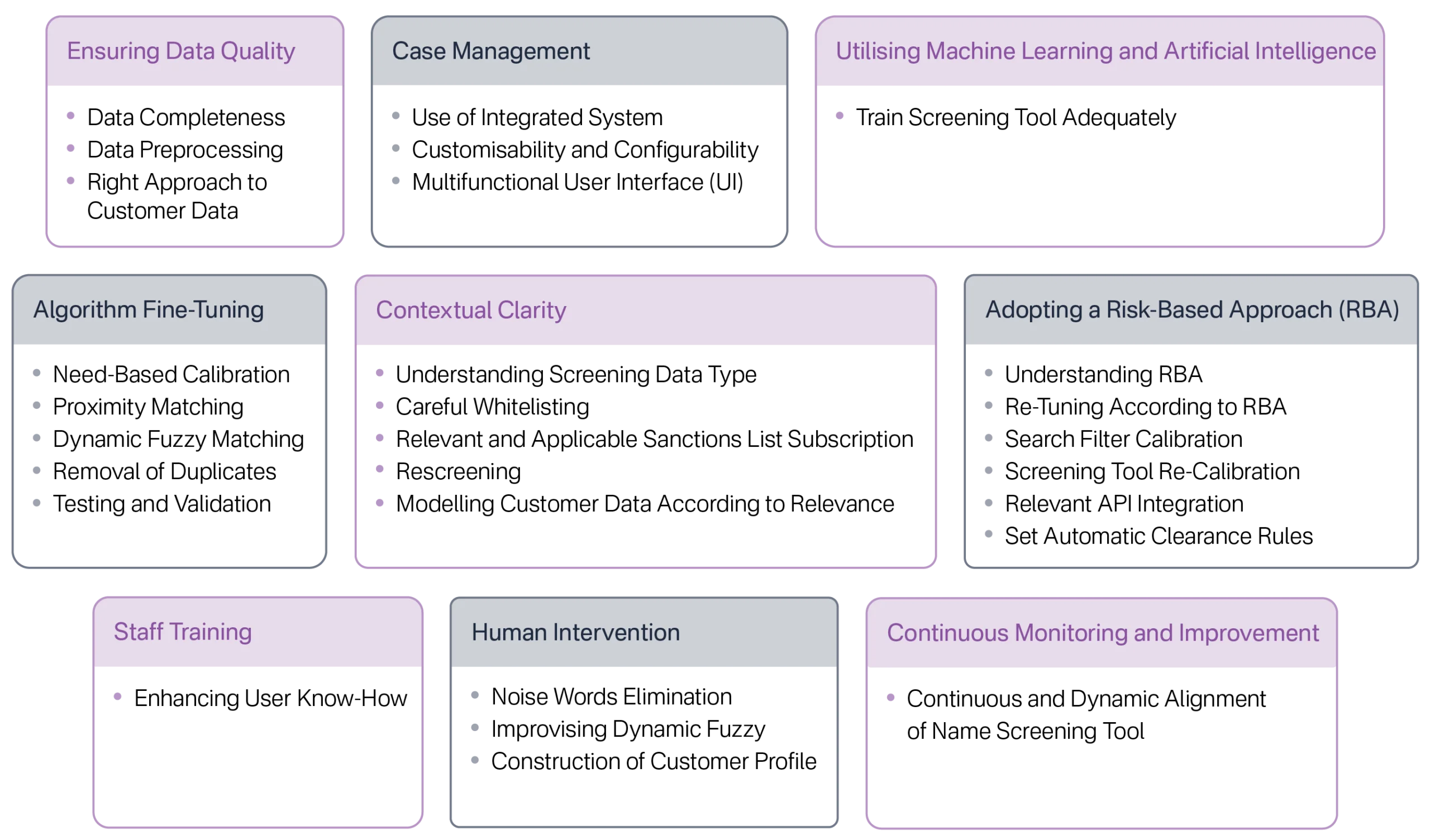

Reduction in False Positives

False positives are a significant challenge for Lawyers, Notaries, and Other Legal Professionals in the UAE when fulfilling AML compliance obligations. RapidAML effectively minimises false positives by leveraging fuzzy logic to account for language variations and phonetic similarities. Additionally, the screening software’s high degree of customisability and configurability allows Lawyers, Notaries, and Other Legal Professionals to fine-tune screening parameters, further reducing the likelihood of false positives. The infographic below outlines how RapidAML supports Lawyers, Notaries, and Other Legal Professionals in addressing this common compliance pain point.

How RapidAML Helps Lawyers, Notaries, and Other Legal Professionals Minimise False Positives

Refer to our YouTube Video: Effective Approaches to Reducing False Positives in Sanctions Screening | RapidAML

AI-Driven Screening

RapidAML’s AI-powered intelligent matching capability significantly reduces the time Lawyers, Notaries, and Other Legal Professionals spend resolving large volumes of false positives. By effectively handling name variations and phonetic similarities, name screening software streamlines the screening process and supports faster, more accurate decision-making in AML compliance workflows.

Batch Screening

Automating repetitive screening tasks alone isn’t sufficient for effective compliance. RapidAML enhances efficiency by enabling bulk name screening, allowing Lawyers, Notaries, and Other Legal Professionals to screen multiple clients simultaneously. After the bulk screening is completed, analysts can individually review and resolve each result, ensuring thorough compliance while significantly speeding up the overall screening process.

Easy-to-Use User Interface (UI)

RapidAML removes the complexity often associated with AML screening tools. Its intuitive and user-friendly interface is designed to be easy to navigate, ensuring that Lawyers, Notaries, and Other Legal Professionals and their compliance teams can conduct screenings efficiently without struggling to interpret a complicated system. This simplicity of name screening software streamlines the screening process and supports smoother AML compliance for Lawyers, Notaries, and Other Legal Professionals in the UAE.

Ongoing Monitoring

The screening aspect of AML compliance is an ongoing process, not a one-time checklist. RapidAML supports continuous monitoring by enabling Legal Professionals’ AML Compliance Officers to classify each client’s status as accepted, rejected, inactive, dormant, or exited. Based on these classifications, the system automatically carries out ongoing monitoring tailored to each client’s profile. It generates alerts or notifications whenever it detects matches, anomalies, or inconsistencies by comparing initial client data against updated information from over 700 global watchlists, PEP lists, and adverse media sources—ensuring vigilant and up-to-date AML compliance throughout the business relationship.

KANBAN Board for Task Management

The name screening process often involves multiple team members with distinct roles—from front office staff handling document collection and data entry, to screening analysts reviewing results, and ultimately the AML Compliance Officer making final determinations. RapidAML simplifies collaboration by offering a Kanban Board that provides a clear, real-time view of task assignments and progress across the team. This ensures transparency, accountability, and efficient workflow management for Legal Professionals.

Seamless Integration

Integration refers to the capability of software to seamlessly connect and interact with other systems, tools, or processes by sharing information. It ensures smooth communication and coordination between different software applications, enabling cross-functional workflows across an organisation. RapidAML’s ability to integrate with various platforms—such as client onboarding systems, customer relationship management (CRM) tools, and billing or invoicing software—helps Lawyers, Notaries, and Other Legal professionals overcome integration challenges and streamline their compliance operations.

Implementation Support

RapidAML goes beyond simply providing screening software—it offers comprehensive implementation support to ensure Lawyers, Notaries, and Other Legal Professionals are fully equipped to use the system effectively. The team provides in-depth training to personnel on how to conduct screenings, generate reports, access case registers, modify onboarding workflows, and more. The implementation process for Lawyers, Notaries, and Other Legal Professionals in the UAE is illustrated in the infographic below.

Customisable Thresholds

RapidAML offers complete customisability when it comes to setting thresholds for screening outcomes. Recognising that each legal professional’s compliance needs are unique, RapidAML allows customisation of watchlists, criteria, and result-generation thresholds to tailor the screening process precisely to their specific requirements.

Easy Disambiguation

RapidAML’s screening software streamlines the process of match resolution by automatically categorising screening results into segments such as Sanctions, Politically Exposed Persons (PEPs), and Adverse Media. This structured presentation enables Lawyers, Notaries, and Other Legal Professionals and compliance analysts to quickly assess each match and determine whether it is false, partial, or a true positive, enhancing both accuracy and efficiency in AML compliance efforts.

Document Repository

RapidAML enables Lawyers, Notaries, and Other Legal Professionals to maintain comprehensive records of client and prospect screening activities, including screening outcomes and supporting documents. These records are securely stored on the cloud and retained for the duration mandated by the relevant Supervisory Authority, helping Lawyers, Notaries, and Other Legal Professionals meet their AML record-keeping obligations with ease and reliability.

RapidAML Screening Software is not just an ordinary name screening tool; it is specifically designed to incorporate the UAE’s AML/CFT and TFS requirements relevant to Lawyers, Notaries, and Other Legal Professionals. It effectively addresses common challenges faced in compliance processes. The key features of RapidAML are detailed below to demonstrate how adopting this solution can resolve the screening challenges faced by Lawyers, Notaries, and Other Legal professionals operating in the UAE.

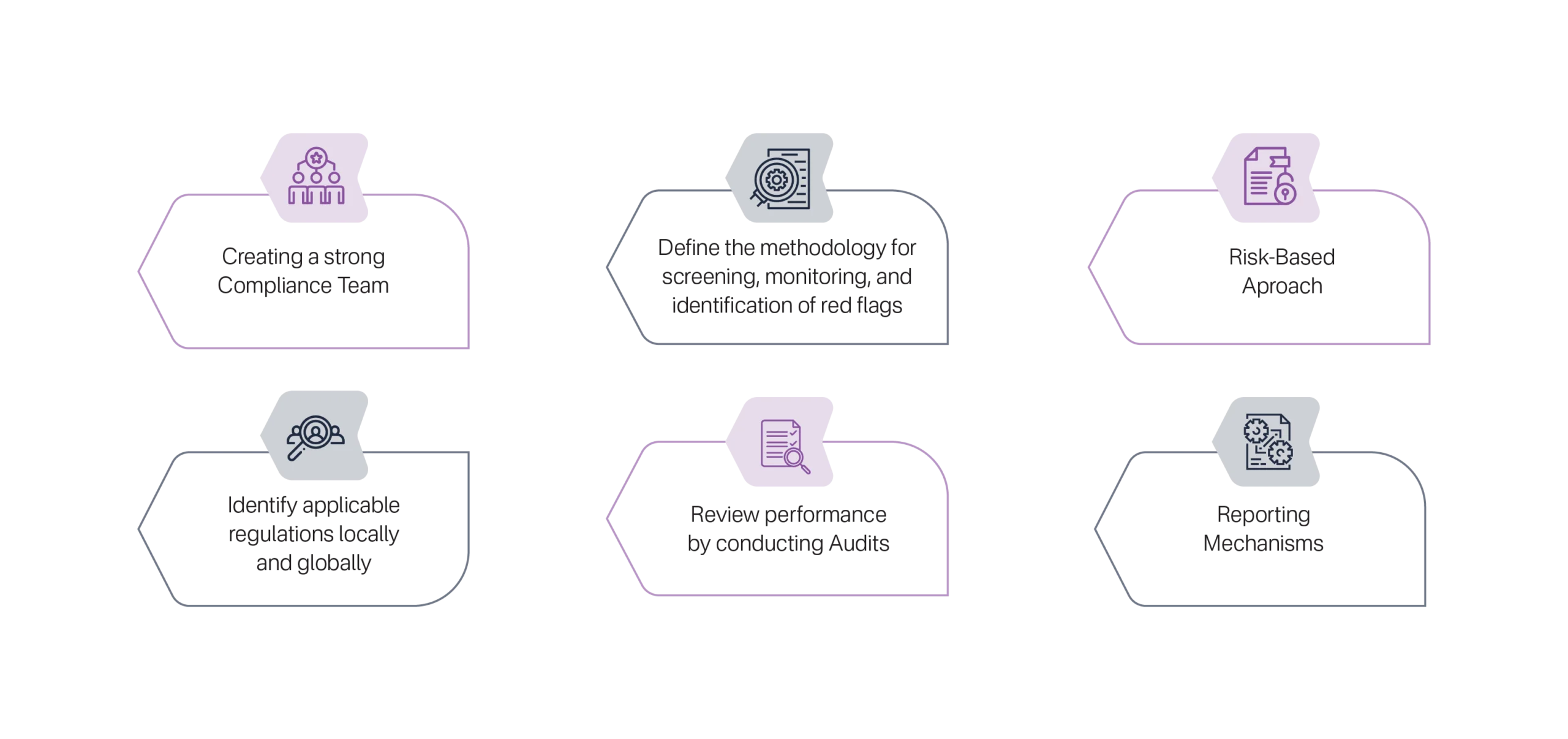

Success stories are built with strategies, course correction, and relentless effort to ensure that the Lawyers, Notaries, and Other Legal Professionals operate within regulatory compliance parameters. The best practices to attain screening software implementation success are as follows:

Screening Software Requirements Identification

Lawyers, Notaries, and Other Legal Professionals in the UAE must have a clear understanding of their screening obligations tailored to their firm’s unique risk profile, including factors such as client types, jurisdictions served, service delivery channels, and transaction volumes. In essence, the ML/FT and PF risk identification measures, particularly the choice and configuration of a screening solution, should align with the firm’s most recent Enterprise-Wide Risk Assessment (EWRA) and targeted financial sanctions (TFS) requirements. This strategic alignment not only supports regulatory compliance but also ensures that screening parameters are effectively tailored to the firm’s goals, client base, and expansion plans, ultimately enabling legal practices to stay both compliant and growth-oriented.

Identify Migration Requirements

Whether transitioning from manual processes, another name screening software, or a legacy compliance tool to RapidAML, Lawyers, Notaries, and Other Legal Professionals must carefully assess the prerequisites and data compatibility of the screening solution they intend to adopt. Understanding the specific migration requirements is crucial for preparing and formatting existing client data in a way that the new screening software can accurately process and deliver reliable, error-free results.

Failure to ensure alignment with data transfer specifications may lead to severe consequences, such as data loss, non-compliance with recordkeeping obligations, disruption to client service, and reputational damage. Moreover, improper handling of client data during migration may result in breaches of data privacy and security laws, potentially attracting regulatory scrutiny, fines, and legal penalties. Therefore, it is essential for Lawyers, Notaries, and Other Legal Professionals to select a screening solution like RapidAML that not only supports secure and seamless data migration but also prioritises data integrity, privacy, and compliance throughout the process.

Select, Test, and Fine-Tune Name Screening Software

Test-driving a name screening solution is essential for Lawyers, Notaries, and Other Legal professionals before full-scale implementation. A trial run enables firms to identify areas within the software that require custom configuration to align with their operational structure and risk appetite. For instance, legal practices must ensure that the escalation workflows, user roles, and approval hierarchies in the screening tool are calibrated to match their internal reporting lines. Without such fine-tuning, implementation can lead to operational confusion and bottlenecks.

Other key elements requiring careful adjustment include match percentage thresholds to balance between false positives and missed matches, the creation of whitelists to exclude pre-cleared entities from repeated screening alerts, and the configuration of screening rules for handling deceased persons, close versus exact matches, and regulated versus unregulated matters. It’s equally important that these parameters—such as the name of the screening software, match criteria, and custom settings—are documented and kept current in the firm’s AML/CFT policies and procedures. Doing so ensures that the screening tool forms an integrated part of the firm’s risk-based control measures and satisfies audit and regulatory expectations.

Allocate Adequate Resources

Lawyers, Notaries, and Other Legal Professionals must recognise that name screening is a mandatory compliance obligation. While compliance entails costs, these should be viewed as prudent investments that safeguard the firm from severe penalties, including hefty fines, potential license revocation, or even imprisonment of responsible individuals.

It is essential to evaluate the cost-to-benefit ratio carefully and allocate sufficient resources to acquire reliable name screening software that can be sustained over the long term without frequent switching or migration challenges. Investing in robust screening solutions is akin to administering a preventive vaccine, protecting the firm from the costly and reputational consequences of non-compliance.

Define Users and their Roles

Lawyers, Notaries, and Other Legal Professionals must develop a detailed implementation plan for screening software that aligns employee capabilities, hierarchical escalation matrices, and workflows with the proposed solution. This involves clearly defining and configuring user roles within the screening system.

Such careful mapping is critical to the successful adoption of any name screening software. Success is further enhanced through strong vendor support, where the provider thoroughly understands the firm’s needs and assists employees during the transition from pre-implementation to post-implementation workflows, addressing any gaps through targeted training and awareness programs.

Configure Alerts, Workflows, and Timelines

Lawyers, Notaries, and Other Legal Professionals must ensure they customise the functionalities and escalation pathways of their chosen name screening software to fully leverage its features and capabilities. Properly configuring alerts, notifications, and task completion timelines is essential. When combined with robust screening software, these actions enable legal teams to achieve excellence in name screening compliance.

Integrate Name Screening Software

Lawyers, Notaries, and Other Legal Professionals should maximise the integration capabilities of the name screening software they select. This reduces redundant efforts and lowers overall operational costs. Integration can be achieved with CRM, accounting, invoicing, and other AML software, such as transaction monitoring, customer risk assessment, and customer due diligence. Case management software is also a key consideration when aiming to unify multiple solutions under a single, streamlined dashboard.

Assessment of Post-Implementation Outcomes

Lawyers, Notaries, and Other Legal Professionals must continuously evaluate post-implementation outcomes to understand the factors behind the success or failure of the name screening software. This ongoing assessment ensures consistent alignment with organisational compliance goals. Any deviations may indicate screening inefficiencies, increased false positives, or excessive disambiguation workload for compliance analysts, necessitating corrective actions such as re-configuration, retraining, or considering alternative software. Moreover, this evaluation supports informed decisions on scalability, determining whether the current software can support business growth or if alternatives should be explored. Continuous viability testing is essential to maintain compliance and operational effectiveness.

Re-tune Configuration to Keep Pace with Evolving Needs

Lawyers, Notaries, and Other Legal Professionals should incorporate fine-tuning or adjusting the jurisdictions whose sanctions lists are subscribed to, as well as reconfiguring ongoing monitoring lists, into their best practices. Various factors drive the need to update screening tool configurations, including changes in regulatory requirements, business expansion, shifts in FATF grey or blacklists, and evolving sanctions regimes or diplomatic relations. It is essential to promptly reflect such changes in the screening software to maintain stringent compliance. Additionally, documenting and securing approval for these changes should be integrated into AML/CFT policy and procedure updates. This ensures adherence to procedural and compliance protocols, thereby minimising audit queries and regulatory scrutiny.

Refer to our YouTube Video: Best Practices in Sanction Screening Software Implementation | RapidAML

The Smart Way to Do It Is Here

RapidAML Makes Sure Your System Evolves with Your Firm

Name Screening for Lawyers, Notaries, and Other Legal Professionals in the UAE can be simplified by devising a well-thought-out screening solution implementation strategy. RapidAML’s solutions and consulting services go hand in hand, helping Lawyers, Notaries, and Other Legal professionals in the UAE navigate the complexities of AML/CFT and TFS compliance requirements, particularly concerning screening obligations.

Name Screening Software for TCSPs in UAE

Name Screening Software for TCSPs in Australia

Name Screening Software for TCSPs in UK

Name Screening Software for RFAs in Singapore

Name Screening Software for TCSPs in India

KYC Software for TCSPs in UAE

KYC Software for TCSPs in Australia

KYC Software for TCSPs in UK

KYC Software for RFAs in Singapore

KYC Software for TCSPs in India

CRA Software for TCSPs in UAE

CRA Software for TCSPs in Australia

CRA Software for TCSPs in UK

CRA Software for RFAs in Singapore

CRA Software for TCSPs in India

Transaction Monitoring Software for TCSPs in UAE

Transaction Monitoring Software for TCSPs in Australia

Transaction Monitoring Software for TCSPs in UK

Transaction Monitoring Software for RFAs in Singapore

Transaction Monitoring Software for TCSPs in India

EWRA Software for TCSPs in UAE

EWRA Software for TCSPs in Australia

EWRA Software for TCSPs in UK

EWRA Software for RFAs in Singapore

EWRA Software for TCSPs in India

Regulatory Reporting Software for TCSPs in UAE

Regulatory Reporting for TCSPs in Australia

Regulatory Reporting Software for TCSPs in UK

Regulatory Reporting Software for RFAs in Singapore

Regulatory Reporting Software for TCSPs in India

Case Management Software for TCSPs in UAE

Case Management for TCSPs in Australia

Case Management Software for TCSPs in UK

Case Management Software for RFAs in Singapore

Case Management Software for TCSPs in India

Solutions

Services

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Solutions

Screening

KYC

Customer Risk Assessment

Case Management

Transaction Monitoring

Regulatory Reporting

Services

Enterprise-Wide Risk Assessment

AML/CFT Health Check

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Get Started

Contact Us