Trust and Company Service Providers (TCSPs) in the UAE can capitalise on the unique attributes that a Know Your Customer (KYC) software offers. TCSPs also need to develop and implement a well-defined KYC methodology to conduct their KYC obligations prior to onboarding customers and establishing a business relationship. Conducting KYC accurately is the first step towards ensuring appropriate AML/CFT compliance.

KYC Requirements for TCSPs in UAE

In order to understand Know Your Customer (KYC) better, it’s important to understand the Customer Due Diligence (CDD) requirements as per UAE AML/CFT laws and regulations. CDD comprises several elements that are broadly classifiable into three categories: KYC, Risk Assessment, and Ongoing Monitoring.

KYC obligation is a subset of the CDD process, where the TCSP is required to collect and verify the identification documents of the prospective customers, based on which further CDD measures such as risk assessment can take place, followed by decision-making as to whether such a customer can be onboarded or not and applying risk-based due diligence measures such as enhanced, standard, or simplified customer due diligence. The selection of the stringency of due diligence measures is a deciding factor for determining the periodicity at which KYC refresh or Re-CDD is to be conducted.

KYC obligations in the UAE involve taking measures to identify and verify prospective customers in order to further carry out CRA, ongoing monitoring, and keep up with the record-keeping requirements. These KYC obligations for TCSPs in UAE are briefly discussed as follows:

The first step TCSPs must take is to collect customer information details such as:

Overall, TCSPs must be mindful while conducting KYC of natural persons and legal entities, as elements of KYC and KYB (Know Your Business) at the outset appear similar, but consist of minor variations as discussed below:

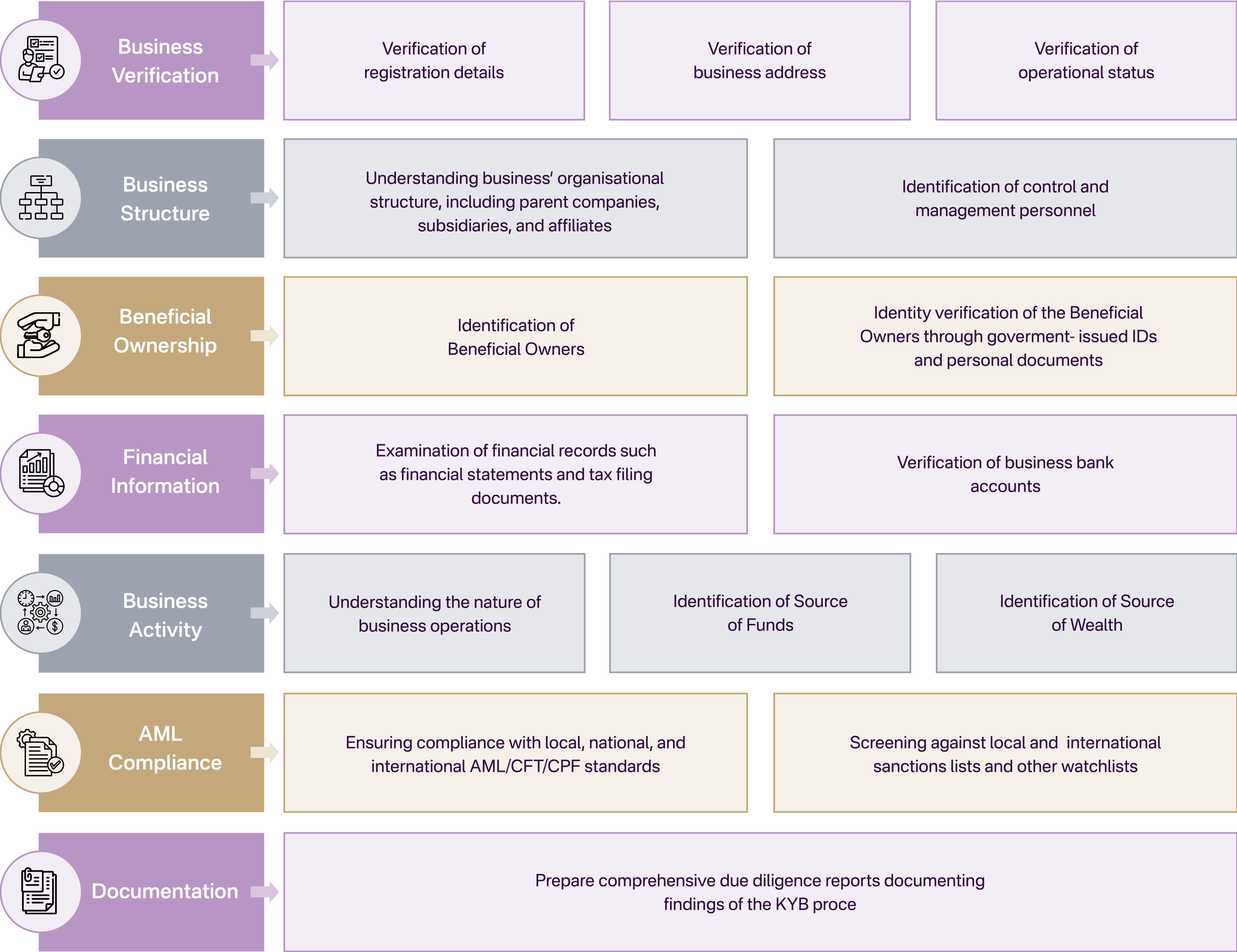

A detailed understanding of KYB for TCSPs in UAE includes core elements such as

As elaborated below:

For more information about Know Your Business requirements, refer to:

Additionally, TCSPs are required to identify and verify the ultimate beneficial owners (UBOs) of a legal entity or a legal arrangement customer. The infographic hereunder depicts the criteria for UBO identification in UAE.

The second step involves verifying the authenticity, validity, and veracity of all the information collected in the first step. Documents that help TCSPS in verifying customer information are passports, Emirates ID, national ID cards, driving licenses, utility bills, and bank account details. Copies of these documents must be collected and maintained by TCSPs.

Additionally, TCSPs also need to rule out conducting business with legal entities that, in reality, might be shell companies that are misused by ML, FT, and PF actors to further financial crime. TCSPS needs to possess basic knowledge about shell companies and understand the distinction between legitimate and illegal shell companies.

CRA involves assessing the ML, FT, and PF risk posed by each customer to the TCSP on the basis of the following factors:

Identifying, verifying, and allocating risk ratings to customers’ needs is to be done on an ongoing basis, as customer information and situations are dynamic and may change or be updated with the passage of time, rendering the information collected and verified redundant. To mitigate this, TCSPs need to conduct ongoing monitoring of business relationships to identify changes in customer details and their resultant impact on the risk rating assigned and due diligence measures deployed.

TCSPs are required to maintain records of the methodology, measures taken, database built and relied on for the purpose of KYC, KYC register, etc., for a duration of 5 years in UAE mainland. TCSPs must be mindful of the duration of record-keeping requirements in other free zones and financial free zones such as DIFC or ADGM.

Learn more about AML/CFT Record-Keeping obligations in UAE by referring to:

Risks Hides in the Quiet Corner

Where Diligence is Absent, Danger Finds Room to Grow

An effective KYC procedure and software directly results in improved quality and accuracy of CDD measures and improves the accuracy of sanctions compliance, as accurate KYC helps ensure that the customer details entered into the screening software are accurate and free from errors, resulting in improved sanctions compliance and fewer instances of erroneous screening due wrong entry of customer information collected during KYC.

Efficient KYC, usually conducted by a KYC Analyst, helps with the commencement of CRA and adequate due diligence measures, helping the TCSP’s AML compliance officer delegate tasks to the AML compliance team, such as assigning CRA to a Risk Analyst, sanctions screening to a Screening Analyst, ongoing monitoring to the Transaction Monitoring Analyst, as the situation demands. An efficient KYC process helps TCSPs accelerate their AML compliance workflow.

Customer experience relies entirely on the ease and customer-friendly self-KYC process and easy-to-understand customer onboarding procedure for the TCSP involved. An efficient eKYC software integrated with a Self-KYC functionality provides easy customer information upload, verification and enhances customer experience, putting the customer in the driver’s seat for uploading their documents and entering their information at their convenience. Refer to Enhancing Customer Experience and Ensuring KYC Compliance for detailed insights.

Even a River Needs Banks

Effective KYC Channels the Flow of Data, Decisions, of Trust

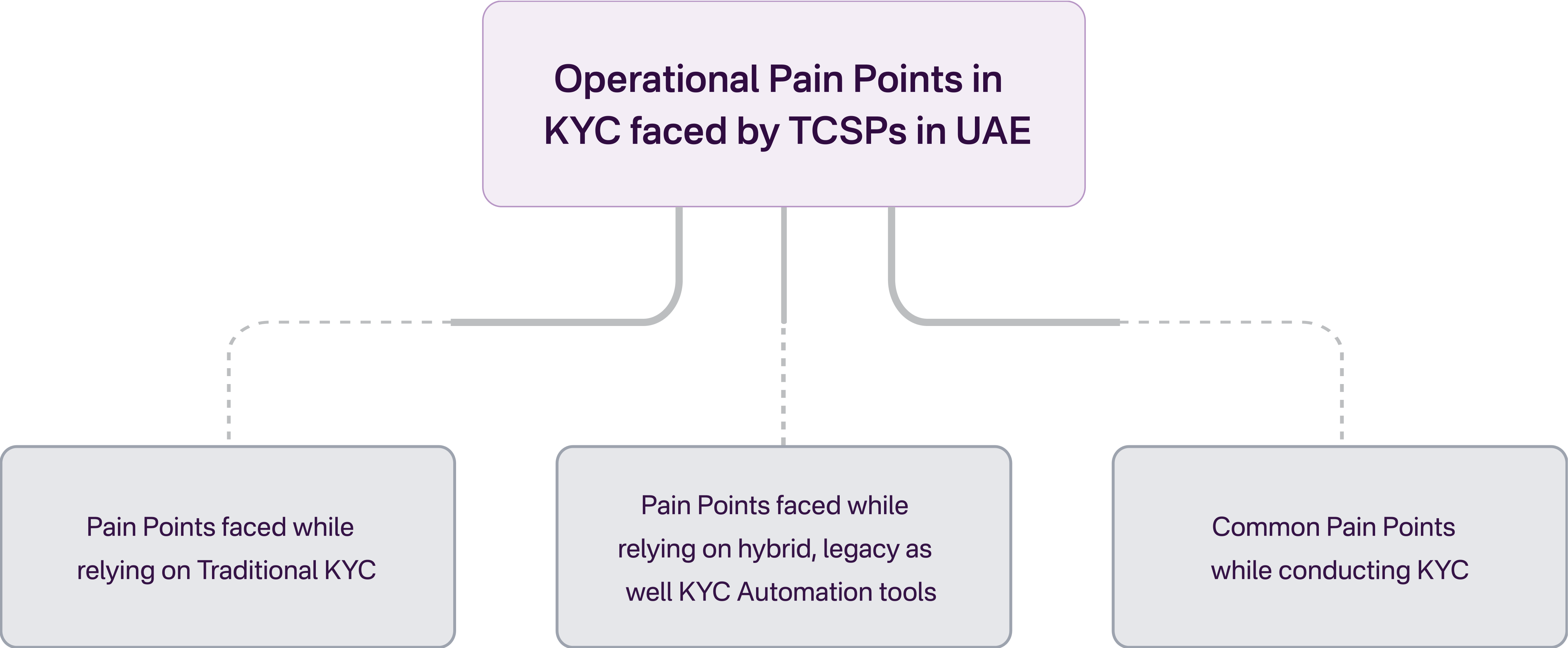

KYC process, be it manual or automated, poses multiple challenges.

These challenges can be segregated into three categories: challenges faced during manual KYC, challenges faced when using a hybrid or automated KYC tool, and some of the common pain points faced.

1. Operational pain points faced while relying on the manual KYC process, also known as the traditional KYC process, are discussed as follows:

The traditional KYC process requires TCSPS’ KYC Analyst or any other employee entrusted with KYC responsibilities to manually enter customer details into KYC forms and fill out KYC questionnaires by obtaining physical copies of customer information and government-issued identification documents. These documents need to be verified by comparing them with original government-issued identification documents and verifying the authenticity, validity, and veracity of these documents through publicly accessible government-published databases. This manual process of conducting KYC leads to the following pain points:

Since every component of KYC, right from document collection to data entry into KYC forms and client questionnaires, needs to be carried out by employees of the TCSPs manually, it ends up consuming a significant number of man-hours, thereby consuming the productivity of the team.

The identity and document verification component of KYC is susceptible to the risk of identity theft, spoofing, or impersonation. This happens when the prospective customer is not available in person for identity and document verification, and the TCSP has to carry out the verification process remotely.

With heavy reliance on the human element in repetitive tasks, particularly those such as conducting KYC, the scope of human error increases significantly. Examples of such human errors include:

Also, when human-driven processes do not have adequate checks and balances, the risk of such a process becoming prone to fraud increases drastically.

2. Operational Pain Points faced by TCSPs while relying on hybrid, legacy, as well as KYC Automation tools

While the term automation and use of KYC software may give a sense of security to a TCSP, a TCSP must be mindful of the fact that merely deploying KYC software is not equivalent to achieving adequate and accurate KYC compliance. Some of the operational issues while relying on KYC software are discussed below:

The KYC software market in UAE has a lot of options. However, the element of customisability of the KYC software to meet the unique needs of each TCSP, which is quite a diverse sector, is lacking. The lack of customisability of KYC software leads to reverse engineering of the compliance team’s strengths and capabilities to meet the needs of using a particular KYC software. This reverse engineering of the workforce to meet technology needs is not an ideal way forward for any TCSP. Rather, the KYC software should be customisable to meet the individual needs of any TCSP, based on its available and projected workforce capabilities. Customisability in KYC software must be such that it enables the TCSP using it to determine, control, and configure the number of users, access, permissions, workflows, and escalations apart from the presets and defaults given.

Read MoreWith the use of technology, the risk of Cyber-Enabled Fraud (CEF) is bound to impact KYC software and eKYC tools. Examples of emerging CEF include the abuse of deepfakes and generative AI,

which are used to commit fraud by impersonating and circumventing biometric checks by creating deepfakes of a person’s voice and video. These deepfakes are used to circumvent liveness checks to commit account takeover fraud.

Professional Money Laundering (PML) enablers or PML Organisations or Networks (PMLO/PMLN), and CEF syndicates heavily rely on emerging technology to recruit money mules and initiate social engineering techniques to commit CEF to launder illicit proceeds through various techniques, including but not limited to:

. Online trading fraud

. Employment fraud

. Online romance fraud

. Business Email Compromise (BEC) fraud

A KYC software with permeable or weak cybersecurity protocols and firewalls is prone to exposing a TCSP’s customers to the risk of being unwitting/unwilling participants in CEF or PMLN schemes.

KYC software tools do not always provide the feature and configurability to integrate with a TCSP’s other software or tools, such as Name Screening Software, Case Management Software, or any other software that a TCSP might be using already. This lack of integration capability becomes a pain point for TCSPs due to escalation and workflow overlaps, where the time and efforts of personnel get consumed in navigating multiple tools for different requirements, impacting productivity and efficiency.

Read MoreTechnology implementation, too, has its weak points. In a world where data is currency and leverage, TCSP’s customer data entered and stored onto its KYC software too is at the risk of being theft, sold, or used beyond the lawful basis for which it was procured or sought from the customer, or is used beyond the purpose for which it was obtained from the customer, and so on. Many KYC tools are built without having a proper data security framework in place and may not have hosting of the KYC software infrastructure in the UAE, which may lead to TCSP missing out on ensuring adequate compliance with the UAE’s data privacy laws. Deploying KYC software requires TCSPs to ensure that the technical and operational aspects of using KYC software do not result in a breach of data security and data privacy standards as prescribed by UAE laws and those imposed by regional supervisory authorities where they operate. Navigation through data security and privacy concerns is a pain point for most TCSPS in UAE.

Read More

AML/CFT compliance for occasional customers requires TCSPs to conduct KYC once. However, for ongoing relationships, KYC details must be periodically reviewed and updated based on assigned risk scores. Neglecting KYC refresh measures for existing relationships can lead to non-compliance with regulatory requirements.

If TCSPs miss out on regulatory updates and changes to CDD obligations, this becomes a pain point, as it would result in the TCSP following outdated methodology to conduct KYC, ultimately causing non-compliance or inadequate KYC measures.

Implementation of ongoing monitoring measures becomes tricky for TCSPs to navigate, as on many occasions, there is not enough clarity whether the business relationship is occasional or continuous in nature, and this lack of clarity about the nature of the business relationship makes implementation of ongoing monitoring measures difficult.

Implementation of KYC measures, be it manual, hybrid, or through KYC software, requires TCSPs to invest a certain portion of their earnings in AML compliance measures. The portion of funds that can be allocated for the purpose of meeting compliance obligations is limited, and the challenge lies in meeting compliance requirements with limited funds allocated for compliance.

TCSPs operating in the UAE who have clients residing in other countries seeking their services need to be mindful of ensuring that they not only ensure compliance with the UAE’s AML/CFT laws but also ensure compliance with regulatory requirements laid down by the country from which their customer belongs. Also, TCSPs having branch offices or group entities in multiple jurisdictions, developing and implementing uniform AML/CFT compliance measures, specifically pertaining to KYC implementation, is a navigational pain point.

Your KYC Tool Doesn’t Need a Tool Belt

When Your So-Called Automation Needs Constant Babysitting, Is It Really Automation

With operational pain points come the consequent impact on the business of TCSPs. Some of these immediate impact points are discussed for TCSP’s benefit to ensure that awareness of the same drives TCSPs towards ensuring robust KYC compliance.

When relying on manual, traditional, or legacy models for fulfilling of KYC obligations, customer onboarding is bound to get delayed due to involvement of human factor, i.e., the AML compliance team as its productivity is exhausted in completing time consuming repetitive tasks of filling out KYC forms and questionnaires, while maintaining KYC registers for the TCSPs.

Delayed customer onboarding, coupled with a traditional tick-box approach, results in increased compliance costs. TCSPs become unable to deploy simplified due diligence measures on customers where ML/FT, and PF risks are low. Compliance costs also increase due to poorly customised KYC forms and questionnaires, where KYC Analysts and customers end up spending time filling out materially irrelevant or insignificant information. Learn more about AML Non-Compliance: An Unaffordable Cost.

Regulatory fines and penalties are among the most obvious consequences of tick-box-based KYC measures, which are devoid of RBA and neglect KYC refresh requirements. The imposition of fines and penalties on TCSPs for non-compliance with AML/CFT regulations in the UAE not only poses an extreme cost burden but also causes reputation and business loss.

When the KYC process consumes time and delays customer onboarding timelines, AML compliance teams, particularly the KYC Analysts and Screening Analysts, are rushed into meeting deadlines and completing a set number of KYCs and screenings, each day. This hurried approach to the completion of compliance tasks further results in errors and causes the TCSP and its employees to miss out on accurately implementing risk-based CDD, where each detail and information about customers is considered carefully and weighted to derive CRA scoring. Many TCSPs, especially those having a tick-box approach towards KYC compliance, end up being inept with risk-based CDD.

When AML/CFT and CPF control measures are not deployed accurately and TCSPs are unable to alleviate pain points such as multi-jurisdictional compliance, ongoing monitoring difficulties, data privacy, and cybersecurity threats, the TCSP as an entity becomes highly prone to ML/TF, and PF risks due to either a lack of, or poor implementation of AML/CFT and CPF control measures such as Enhanced Due Diligence, Transaction Monitoring, etc.

Refer:

Your First Risk Isn’t the Client, It’s Your Process

Delayed Onboarding. Poor Risk Grading. Soaring Costs.

RapidAML simplifies TCSPs’ KYC obligations by capitalising on KYC process automation. This simplification of the KYC process takes place in 8 steps, as elaborated.

RapidAML capitalises on technological advancements and solutions such as Machine Learning and AI for automated and systematic analysis and maintenance of customer information.

RapidAML enables KYC Analysts of TCSPs to make use of its customer identification and verification facilities, which can be accessed through every customer’s individual or linked entities’ profile and through the centralised dashboard for entering their observations and findings about each customer’s details and documents uploaded for verification purposes.

RapidAML makes use of document validation or verification systems and provides an option to integrate the customer onboarding process with UAE PASS to verify its customers’ identities, and helps enhance the customer onboarding experience for the specific client base.

RapidAML, to mitigate cyber-enabled fraud (CEF) risks, facilitates 2-factor authentication (2FA) for accessing and validating customer profiles. The 2FA component makes it difficult for fraudsters and financial criminals to misuse customer information stored and entered on RapidAML platform.

RapidAML helps optimise customer onboarding requirements while ensuring that compliance requirements and legalities are taken care of. It facilitates the KYC declaration by obtaining customers’ OTP-based confirmation.

The major USP of RapidAML KYC software is the customisability component of its KYC questionnaires or templates, which helps fit every TCSP’s unique KYC requirements like a tailor-made glove. RapidAML also has a built-in variety of KYC templates from which a TCSP can choose and customise according to the nature and size of its business.

RapidAML KYC software can integrate with third-party solutions to capture information from the pre-filled KYC forms, reducing the duplication effort and saving time and costs.

RapidAML KYC software provides TCSPs with multiple channels to onboard customers, such as obtaining customer information through Self-KYC functionality, which can be accessed by customers online through the use of a mobile phone.

Learn more about KYC Automation Strategies in UAE

Refer to: Why is eKYC a Game-Changer?

RapidAML KYC software is unlike any other KYC software as it is built to incorporate UAE’s AML/CFT and TFS obligations imposed upon TCSPS, which mitigates the pain points and resultant challenges TCSPS face. The distinguishing features of RapidAML KYC software are expanded below to assist TCSPs in UAE to understand how opting for RapidAML is the answer to all their KYC problems.

Distinguishing Features that RapidAML KYC Software Offers for TCSPs in UAE

RapidAML KYC software lets a TCSP add as many users as necessary for their organisation’s use. It also works in a multi-organisation environment where KYC templates can be applied uniformly or individually across branch offices within an organisation, ultimately making KYC compliance scalable. This scalability component encourages TCSPs to focus on business expansion while RapidAML KYC software takes care of KYC obligations.

RapidAML is developed using state-of-the-art technology and provides top-class performance. Its frontend works in tandem with the backend and provides the relevant information in no time. Performance is the key factor that users consider when opting for a specific screening software, RapidAML is built for performance facilitating scaling and growth for TCSP businesses.

RapidAML KYC software’s capability to integrate with existing software or tools used by a TCSP makes its implementation and operation possible in the shortest possible timeframe. RapidAML can integrate with ERP and POS systems to automate the business processes. RapidAML KYC software's integration capability, built-in templates, and workflows help minimise overlapping of tasks and manual intervention across tools.

RapidAML KYC software’s team is not only equipped to resolve KYC software-related issues faced while using the RapidAML KYC software, but also provides valuable insights regarding components such as:

1. KYC Training and Awareness

2. KYC/KYB Software Implementation

3. KYC/KYB Questionnaire

4. KYC/KYB Policies and Procedures

5. AML/CFT/CPF Program

RapidAML KYC software helps TCSPs balance KYC compliance with enhanced customer experience through proven strategies such as:

1. Ensuring Data Privacy and Security

2. Using Self KYC Functionality

3. Conducting Adequate Reviews and Audits

4. Ensuring Timely Communication

5. Providing Adequate KYC Support and Guidance

6. Adopting a Risk-Based Approach

Learn more about Enhancing Customer Experience and Ensuring KYC Compliance.

RapidAML KYC software offers Kanban board which helps users within a TCSP, especially KYC Analysts and AML Compliance Officers navigate easily through contacts created and track case files, upcoming KYC document expiries, and check onboarding status of their prospective and existing customers on a single screen, eliminating the need to navigate through endless lists in the Contact Register as well as KYC register. This helps with a 360-degree analysis of a customer’s profile.

RapidAML KYC software comes with the functionality to tailor KYC templates and select role-wise accessibility to complete KYC checks such as document collection, verification and self-KYC verification. It facilitates selecting among different KYC questionnaires for a different range or variety of services opted for.

RapidAML KYC software enables TCSPs to download various types of reports and helps the TCSP to access and download contact lists, KYC lists for individuals and legal entities, customer account registers of active, dormant, inactive, and exited customers. These reports and registers help TCSPs with writing details for SAR/STR and other regulatory reports’ narratives whenever any suspicious element warrants regulatory reporting. This also help in re-evaluating Enterprise-Wide Risk Assessment (EWRA).

RapidAML KYC software is designed to facilitate remote customer onboarding through its Self-KYC functionality, obtaining consent and an electronic signature necessary to meet compliance requirements. Remote customer onboarding removes the need of customer being physically present or having to visit TCSP’s office premises so as to fulfil CDD obligations, making ease of doing business, a reality.

Refer to our blog for more information on Remote Customer Onboarding and ML/TF Risk Mitigation.

RapidAML KYC software facilitates document verification and authentication by relying on government-approved databases. Document verification is an immensely important component to verify a person's identity and rule out the possibility of fraudulent or counterfeit or forged document being used to fulfill CDD obligations. Document verification helps establish legitimacy of customer’s identity.

As discussed in the previous part of reporting, RapidAML KYC software makes it possible to generate and download reports in a matter of seconds. These reports can also be used to establish an audit trail, as they act as documentary evidence of KYC measures taken by a TCSP. Further, RapidAML KYC software logs each and every action performed by the user to ensure that it knows who did what and when, through user logs.

RapidAML KYC software simply requires TCSPs to have an internet connection and access to a laptop/computer to start using RapidAML KYC software, as it is cloud-based software that can be used by logging into the user account from anywhere. This eliminates the need to have on-site hardware storage and maintenance of physical records and database, simplifying the lives of users

RapidAML KYC software is built on a strong bedrock of information privacy and cybersecurity best practices. As data security and privacy protocols are embedded into the KYC software at the software design and development stage, adequate compliance with these requirements is an obvious outcome during the course of its normal use.

RapidAML KYC software helps TCSPs in the UAE to implement RBA through its KYC automation software, as it helps with risk-centric configuration of re-KYC through the risk-scoring assigned, configuring re-KYC triggers, and generating timely notifications for KYC document expiry and re-KYC. It eliminates the need to revisit customer profiles that do not require as much attention and due diligence as actual high-risk customers, where extra scrutiny is needed.

RapidAML KYC software enables TCSPs to conduct ongoing monitoring of business relationships. It identifies any material changes in customer information and upcoming KYC document expiries, which trigger alerts and notifications to TCSP’s users and the customer concerned so that necessary steps can be initiated. The illustrated use case showcases how RapidAML facilitates ongoing monitoring.

Whether You Onboard 10 or 10,000, We Don’t Blink

High Volume, High Speed, Zero Compromise

KYC excellence journey is paved with milestones in terms of strategies, remedial measures, and commitment to ensure risk-based AML/CFT compliance. The best practices for achieving KYC software implementation success are as follows:

Your KYC Software Shouldn’t Let the Criminals Blend In

Before You Onboard a Client, Onboard the Truth

KYC and KYB compliance for TCSPs in the UAE can be simplified by developing a thoroughly brainstormed KYC software implementation strategy. RapidAML’s KYC software and consulting services go hand in hand, helping TCSPs in the UAE navigate the rugged terrain of AML/CFT and CPF compliance requirements, particularly concerning KYC obligations.

Name Screening Software for TCSPs in UAE

Name Screening Software for TCSPs in Australia

Name Screening Software for TCSPs in UK

Name Screening Software for RFAs in Singapore

Name Screening Software for TCSPs in India

KYC Software for TCSPs in UAE

KYC Software for TCSPs in Australia

KYC Software for TCSPs in UK

KYC Software for RFAs in Singapore

KYC Software for TCSPs in India

CRA Software for TCSPs in UAE

CRA Software for TCSPs in Australia

CRA Software for TCSPs in UK

CRA Software for RFAs in Singapore

CRA Software for TCSPs in India

Transaction Monitoring Software for TCSPs in UAE

Transaction Monitoring Software for TCSPs in Australia

Transaction Monitoring Software for TCSPs in UK

Transaction Monitoring Software for RFAs in Singapore

Transaction Monitoring Software for TCSPs in India

EWRA Software for TCSPs in UAE

EWRA Software for TCSPs in Australia

EWRA Software for TCSPs in UK

EWRA Software for RFAs in Singapore

EWRA Software for TCSPs in India

Regulatory Reporting Software for TCSPs in UAE

Regulatory Reporting for TCSPs in Australia

Regulatory Reporting Software for TCSPs in UK

Regulatory Reporting Software for RFAs in Singapore

Regulatory Reporting Software for TCSPs in India

Case Management Software for TCSPs in UAE

Case Management for TCSPs in Australia

Case Management Software for TCSPs in UK

Case Management Software for RFAs in Singapore

Case Management Software for TCSPs in India

Solutions

Services

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Solutions

Transaction Monitoring

Regulatory Reporting

Services

AML/CFT Health Check

Industries

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

Lorem Ipsum

© RapidAML 2025

Contact Us